Vanquish

Vanquisher of shills

- Aug 14, 2009

- 2,663

- 358

- 98

ooooh you used the word mathematical. omg now I have to believe you!

You're welcome to prove me wrong. I'll wait.

You never proved anything to the contrary. I would I even bother?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

ooooh you used the word mathematical. omg now I have to believe you!

You're welcome to prove me wrong. I'll wait.

ooooh you used the word mathematical. omg now I have to believe you!

You're welcome to prove me wrong. I'll wait.

You never proved anything to the contrary. I would I even bother?

Not true, sir.

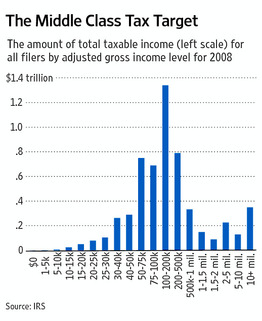

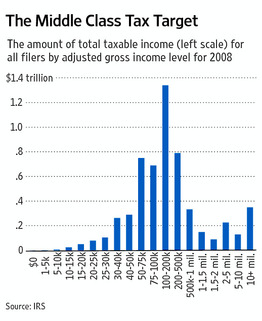

If you look at the distribution of the tax base, you'll find a chart that shows that the 75k - 200k earners are the VAST majority of the tax base - i.e. the middle class.

Again, you're wrong. Which is fairly common knowledge.

Not only that, it is the tax cut policies of the GOP that generated that 48%, policies the CON$ want to make PERMANENT.Oh so you HAVENT gone to go see the breakdown of the 48% who don't pay yet.

You're going to be in for a bit of a shock, dearie.

This is the typical wingnut assumption / argument / talking point / spin, why do you worship the 'rich' is my first question? Or why do you cry for the rich, do you really think they need your tears? Or your assist? The well to do should pay their fair share, they do fine and since they benefit most from the society that supports them and from the consumers, each of us, who are the primary support of a robust economy, they too should pay, not hide behind you wingnuts and your inane analogies which ignore reality.

"On moral grounds, then, we could argue for a flat income tax of 90 percent to return that wealth to its real owners. In the United States, even a flat tax of 70 percent would support all governmental programs (about half the total tax) and allow payment, with the remainder, of a patrimony of about $8,000 per annum per inhabitant, or $25,000 for a family of three. This would generously leave with the original recipients of the income about three times what, according to my rough guess, they had earned."UBI and the Flat Tax

As far as the super rich, they only make those enormous sums because of the state, so they are only morally entitled to an enormous sum, but not an absurd sum. The Conservative Nanny State

And why does everyone ignore the waste on military spending and three wars, one of which, Iraq, was an invasion of a sovereign nation based on spin.

The top 1% or even top 10% DO NOT pay the majority of TAXES it takes to keep this society going.

They do pay a greater share of FEDERAL INCOME taxes than the other classes, though.

Fairness doesn't have much to do with taxation, folks.

No more than fairness has much to do with incomes.

It ought not to be too confusing, in a land where the range of incomes is so vast, naturally the burden of taxation ought to reflect that, too.

Liberals believe money is theirs and they just allow you to keep a certain amount of it.

I don't know one liberal that thinks that.

I don't know one liberal that thinks that.

Seeing as the budget shortfall is 1.5 Trillion just this year alone, how much more should we tax the "evil rich" so that government can balance the books?

Can We Tax The Rich Enough To Get Out Of Debt? | Tarheel Red

If confiscating all of their money won't balance the books, then why do some say just raising their taxes would do it?First, the deficit is $1.5 trillion dollars. Can the folks who make more than $200,000 make that up? There are 4,359,936 filers who make that amount of money. Simple math says that if we take 1,500,000,000,000 and divide it by 4,359,936 we get $344,041.7. That means we would have to bill each of those people who earn more than $200,000 a year $344,042 a year. Just to break even.

Barack Obama told the nation last Wednesday that “improvements” in Medicare and hiking taxes on the wealthy would stabilize government spending and bring deficit spending to what can charitably be described as a dull roar. The Wall Street Journal does some fact checking on these claims and finds them entirely false. Even if the “rich” gets defined down to the top 10% of filers — whose average annual household income is $114,000 — the level of revenue from even a 100% tax would still not close the budget gap:

WSJ shows taxing the rich won’t cover the bill « Hot Air

See ya'll? What did I just get done posting?The top 1% have over $20 billion in wealth.We must confiscate ALL THEIR ACCUMULATED WEALTH GOING BACK 10 YEARS as well as ALL WAGES FOR SAME TIME PERIOD.

Of course, this won't make a dent in the national debt, which is a different animal entirely from the annual budget. National debt is running around 14 trillion.....

BUT.... We'll all feel better hosing "the rich."

Think of it like this...

The purpose of business is to make profit. (I'm not saying profit is bad. on the contrary, I love making profits)

To make a profit, one attempts to lower costs while maintaining (or increasing) prices.

Based on those two premises, what makes anyone think that if you give money back to companies (or the wealthy who own them) that the money will necessarily be re-invested?

Especially in today's economy...perceived as so critically bad...companies and people are going to hang on to their money...now more than ever.

This idea of the "benevolent rich" who are going to use tax cuts to hire more people is simply an assumption. In reality, the rich will do whatever makes the most profit. If it's profitable to hire more people...they will. If it's not...they wont. Furthermore, just because it could be profitable, that doesn't mean someone will decide to do it. Again, if saving seems more prudent than attempting a profit...they might just save.

Tax Cuts were part of the much-maligned stimulus...and you see where that got us.

I dont think profits are evil...I'm just realistic...people are going to hold onto their money unless they are really convinced there's profit in investing it.

Think of it like this...

The purpose of business is to make profit. (I'm not saying profit is bad. on the contrary, I love making profits)

To make a profit, one attempts to lower costs while maintaining (or increasing) prices.

Based on those two premises, what makes anyone think that if you give money back to companies (or the wealthy who own them) that the money will necessarily be re-invested?

Especially in today's economy...perceived as so critically bad...companies and people are going to hang on to their money...now more than ever.

This idea of the "benevolent rich" who are going to use tax cuts to hire more people is simply an assumption. In reality, the rich will do whatever makes the most profit. If it's profitable to hire more people...they will. If it's not...they wont. Furthermore, just because it could be profitable, that doesn't mean someone will decide to do it. Again, if saving seems more prudent than attempting a profit...they might just save.

Tax Cuts were part of the much-maligned stimulus...and you see where that got us.

I dont think profits are evil...I'm just realistic...people are going to hold onto their money unless they are really convinced there's profit in investing it.

The fact that the "job creators" had bush's taxcuts for over 8 years and CUT jobs instead of re-investing them to create or KEEP jobs shows that they have a trend of "i've got mine, screw the rest of you." as they maintain their profits and bonuses as they force the sacrificing onto their former employees who are out of a job and their current employees who have to work harder to maintain the productivity that used to be accomplished by more employees.

However, I agree that profits really aren't the problem. It's the self serving "benevolent rich" who expect everyone else to sacrifice as they feed their own greed.

How about we do BOTH?

Cut spending AND tax more. It's the only REAL solution when you finally get honest with yourself.

Just cutting back is going to get you X$. Cutting back AND raising taxes gets you X$ + maybe even X*2 or X*5.

I'm having to pay a lot of taxes this year and it sucks, but doing both is the only way our deficit AND our national debt will ever get corrected.

Why wont people accept doing BOTH as the solution??

The Left has already collectively accepted this as THE solution.

Only the RIGHT is being STUBBORNLY partisan and ideological like the radicals that they are, threatening the stability of the country along the way.

More lies.

The left doesn't want any significant cuts. That is why so many of the progressive dems voted against the budget deal.

Paul Ryan put forth a plan that would expand the tax base while at the same time cutting all tax rates. Same as what Obama's own comission came up with, though Obama rejected their ideas. It eliminates the loopholes that the large corporations are using.

Until you do this raising rates on the rich will do nothing.

Think of it like this...

The purpose of business is to make profit. (I'm not saying profit is bad. on the contrary, I love making profits)

To make a profit, one attempts to lower costs while maintaining (or increasing) prices.

Based on those two premises, what makes anyone think that if you give money back to companies (or the wealthy who own them) that the money will necessarily be re-invested?

Especially in today's economy...perceived as so critically bad...companies and people are going to hang on to their money...now more than ever.

This idea of the "benevolent rich" who are going to use tax cuts to hire more people is simply an assumption. In reality, the rich will do whatever makes the most profit. If it's profitable to hire more people...they will. If it's not...they wont. Furthermore, just because it could be profitable, that doesn't mean someone will decide to do it. Again, if saving seems more prudent than attempting a profit...they might just save.

Tax Cuts were part of the much-maligned stimulus...and you see where that got us.

I dont think profits are evil...I'm just realistic...people are going to hold onto their money unless they are really convinced there's profit in investing it.

The fact that the "job creators" had bush's taxcuts for over 8 years and CUT jobs instead of re-investing them to create or KEEP jobs shows that they have a trend of "i've got mine, screw the rest of you." as they maintain their profits and bonuses as they force the sacrificing onto their former employees who are out of a job and their current employees who have to work harder to maintain the productivity that used to be accomplished by more employees.

However, I agree that profits really aren't the problem. It's the self serving "benevolent rich" who expect everyone else to sacrifice as they feed their own greed.