Soggy in NOLA

Diamond Member

- Jul 31, 2009

- 40,565

- 5,358

- 1,830

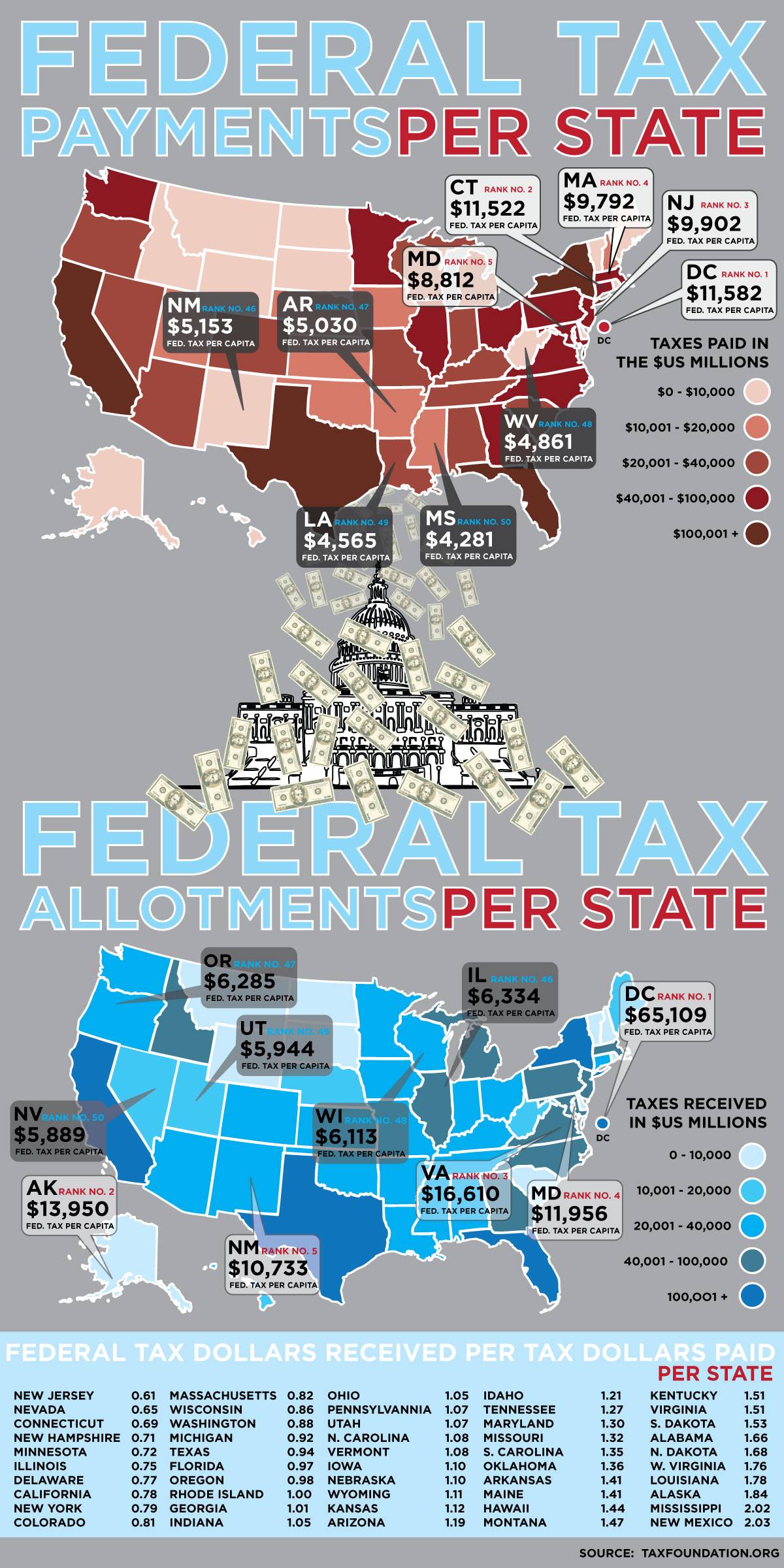

the tax money the folks in South Carolina pay will one day bail CA out for their stupidity.

Seriously?

And this has what to do with anything?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

the tax money the folks in South Carolina pay will one day bail CA out for their stupidity.

Seriously?

You guys saw this, right? This snippet is from Yahoo.com, wonder how many jobs will be lost.

.....California Governor Jerry Brown signed a bill into law Wednesday requiring online businesses to pay state sales tax, calling it a common sense idea, but Amazon and other large online retailers said they no longer see the business sense in staying in the Golden State.

Amazon and Overstock.com both announced shortly after the bill was signed that they will be closing all of their affiliate programs in California. Affiliates are small websites and businesses that sell products through sites like Amazon and receive a small commission.

The new law requires large online retailers to collect and file state sales tax on purchases made by California customers. California hopes to raise an estimated $317 million a year in new state and local government revenue through the added sales tax collections.

The State Board of Equalization has estimated there are 25,000 affiliates in California, 10,000 of which make money through an affiliation with Amazon.

Not anymore, though.

We oppose this bill because it is unconstitutional and counterproductive, Amazon said in an email to its affiliates. It is supported by big-box retailers, most of which are based outside California, that seek to harm the affiliate advertising programs of their competitors.

Overstock.com, a large Utah-based online retailer, sent a similar email to its California affiliates.

We think this law is unconstitutional, said Mark Griffin, Overstocks general counsel, in an interview with the San Jose Mercury News. We sent a final note to our California affiliates today. Its a business decision that we had to make.

I especially like the part where because Amazon left California, all the "Conservatives" give it numerous amount of attention. Meanwhile, the same thing happens in Texas with nary a peep.

Wonder why that is?

YouTube - ‪Jeopardy! Think Music, 1960s 1984-1997‬‏

Amazon To Close Distribution Center In Texas After Tax Dispute - FoxBusiness.com

I especially like the part where because Amazon left California, all the "Conservatives" give it numerous amount of attention. Meanwhile, the same thing happens in Texas with nary a peep.

Wonder why that is?

YouTube - ‪Jeopardy! Think Music, 1960s 1984-1997‬‏

Amazon To Close Distribution Center In Texas After Tax Dispute - FoxBusiness.com

I especially like the part where because Amazon left California, all the "Conservatives" give it numerous amount of attention. Meanwhile, the same thing happens in Texas with nary a peep.

Wonder why that is?

YouTube - ‪Jeopardy! Think Music, 1960s 1984-1997‬‏

Amazon To Close Distribution Center In Texas After Tax Dispute - FoxBusiness.com

I especially like the part where because Amazon left California, all the "Conservatives" give it numerous amount of attention. Meanwhile, the same thing happens in Texas with nary a peep.

Wonder why that is?

YouTube - ‪Jeopardy! Think Music, 1960s 1984-1997‬‏

Amazon To Close Distribution Center In Texas After Tax Dispute - FoxBusiness.com

Is Texas a separate country yet?

I especially like the part where because Amazon left California, all the "Conservatives" give it numerous amount of attention. Meanwhile, the same thing happens in Texas with nary a peep.

Wonder why that is?

YouTube - ‪Jeopardy! Think Music, 1960s 1984-1997‬‏

Amazon To Close Distribution Center In Texas After Tax Dispute - FoxBusiness.com

Is Texas a separate country yet?

I think successful and prosperous best describes them.. job creating, business friendly.. Kerry On.

Is Texas a separate country yet?

I think successful and prosperous best describes them.. job creating, business friendly.. Kerry On.

They want to leave the U.S. I think they should go now...instead of whining.

What's wrong with SC living?Wait til those Amazon people get a taste of SC living...

fly over country?

You guys saw this, right? This snippet is from Yahoo.com, wonder how many jobs will be lost.

.....California Governor Jerry Brown signed a bill into law Wednesday requiring online businesses to pay state sales tax, calling it a common sense idea, but Amazon and other large online retailers said they no longer see the business sense in staying in the Golden State.

Amazon and Overstock.com both announced shortly after the bill was signed that they will be closing all of their affiliate programs in California. Affiliates are small websites and businesses that sell products through sites like Amazon and receive a small commission.

The new law requires large online retailers to collect and file state sales tax on purchases made by California customers. California hopes to raise an estimated $317 million a year in new state and local government revenue through the added sales tax collections.

The State Board of Equalization has estimated there are 25,000 affiliates in California, 10,000 of which make money through an affiliation with Amazon.

Not anymore, though.

We oppose this bill because it is unconstitutional and counterproductive, Amazon said in an email to its affiliates. It is supported by big-box retailers, most of which are based outside California, that seek to harm the affiliate advertising programs of their competitors.

Overstock.com, a large Utah-based online retailer, sent a similar email to its California affiliates.

We think this law is unconstitutional, said Mark Griffin, Overstocks general counsel, in an interview with the San Jose Mercury News. We sent a final note to our California affiliates today. Its a business decision that we had to make.

What's wrong with SC living?

fly over country?

Actually Charleston is a really nice city, friendly folks, good restarurants, some fine old homes and an interesting history. Of course drving there offers a much different landscape. My wife wanted to see Savannah, GA so two years ago we flew to Jacksonville, spent a few nights on the beach on Amelia Island and drove to Savannah (Also a very charming, clean city with nice homes and an interesting history).

Then we drove to Charleston. Two lane undivided highway with speed limits that changed in each (I guess) jurisdiction we entered. And signs stating "speeders will be arrested". A two hour drive from the main highway revealed shanty's, old rusty machinary, and strip malls right out of the 1940's. I recommend anyone intersted in seeing Charleston (and I recommend the tour to Fort Sumter) fly.

What's wrong with SC living?

fly over country?

Actually Charleston is a really nice city, friendly folks, good restarurants, some fine old homes and an interesting history. Of course drving there offers a much different landscape. My wife wanted to see Savannah, GA so two years ago we flew to Jacksonville, spent a few nights on the beach on Amelia Island and drove to Savannah (Also a very charming, clean city with nice homes and an interesting history).

Then we drove to Charleston. Two lane undivided highway with speed limits that changed in each (I guess) jurisdiction we entered. And signs stating "speeders will be arrested". A two hour drive from the main highway revealed shanty's, old rusty machinary, and strip malls right out of the 1940's. I recommend anyone intersted in seeing Charleston (and I recommend the tour to Fort Sumter) fly.

It is nice down there. Different breed of Cop than the California State Trooper though. Just remember to stay Polite.

It is nice down there. Different breed of Cop than the California State Trooper though. Just remember to stay Polite. I especially like the part where because Amazon left California, all the "Conservatives" give it numerous amount of attention. Meanwhile, the same thing happens in Texas with nary a peep.

Wonder why that is?

YouTube - ‪Jeopardy! Think Music, 1960s 1984-1997‬‏

Amazon To Close Distribution Center In Texas After Tax Dispute - FoxBusiness.com

You guys saw this, right? This snippet is from Yahoo.com, wonder how many jobs will be lost.

.....California Governor Jerry Brown signed a bill into law Wednesday requiring online businesses to pay state sales tax, calling it a common sense idea, but Amazon and other large online retailers said they no longer see the business sense in staying in the Golden State.

Amazon and Overstock.com both announced shortly after the bill was signed that they will be closing all of their affiliate programs in California. Affiliates are small websites and businesses that sell products through sites like Amazon and receive a small commission.

The new law requires large online retailers to collect and file state sales tax on purchases made by California customers. California hopes to raise an estimated $317 million a year in new state and local government revenue through the added sales tax collections.

The State Board of Equalization has estimated there are 25,000 affiliates in California, 10,000 of which make money through an affiliation with Amazon.

Not anymore, though.

We oppose this bill because it is unconstitutional and counterproductive, Amazon said in an email to its affiliates. It is supported by big-box retailers, most of which are based outside California, that seek to harm the affiliate advertising programs of their competitors.

Overstock.com, a large Utah-based online retailer, sent a similar email to its California affiliates.

We think this law is unconstitutional, said Mark Griffin, Overstocks general counsel, in an interview with the San Jose Mercury News. We sent a final note to our California affiliates today. Its a business decision that we had to make.

If a company is selling thru an affiliate or subsidiary in a state then it should pay state sales tax.

Amazon seems to be cutting off it's nose to spite it's face.

fly over country?

Actually Charleston is a really nice city, friendly folks, good restarurants, some fine old homes and an interesting history. Of course drving there offers a much different landscape. My wife wanted to see Savannah, GA so two years ago we flew to Jacksonville, spent a few nights on the beach on Amelia Island and drove to Savannah (Also a very charming, clean city with nice homes and an interesting history).

Then we drove to Charleston. Two lane undivided highway with speed limits that changed in each (I guess) jurisdiction we entered. And signs stating "speeders will be arrested". A two hour drive from the main highway revealed shanty's, old rusty machinary, and strip malls right out of the 1940's. I recommend anyone intersted in seeing Charleston (and I recommend the tour to Fort Sumter) fly.

Did y'all eat at the butter queens restaurant in Savannah?

You guys saw this, right? This snippet is from Yahoo.com, wonder how many jobs will be lost.

.....California Governor Jerry Brown signed a bill into law Wednesday requiring online businesses to pay state sales tax, calling it a common sense idea, but Amazon and other large online retailers said they no longer see the business sense in staying in the Golden State.

Amazon and Overstock.com both announced shortly after the bill was signed that they will be closing all of their affiliate programs in California. Affiliates are small websites and businesses that sell products through sites like Amazon and receive a small commission.

The new law requires large online retailers to collect and file state sales tax on purchases made by California customers. California hopes to raise an estimated $317 million a year in new state and local government revenue through the added sales tax collections.

The State Board of Equalization has estimated there are 25,000 affiliates in California, 10,000 of which make money through an affiliation with Amazon.

Not anymore, though.

We oppose this bill because it is unconstitutional and counterproductive, Amazon said in an email to its affiliates. It is supported by big-box retailers, most of which are based outside California, that seek to harm the affiliate advertising programs of their competitors.

Overstock.com, a large Utah-based online retailer, sent a similar email to its California affiliates.

We think this law is unconstitutional, said Mark Griffin, Overstocks general counsel, in an interview with the San Jose Mercury News. We sent a final note to our California affiliates today. Its a business decision that we had to make.

If a company is selling thru an affiliate or subsidiary in a state then it should pay state sales tax.

Amazon seems to be cutting off it's nose to spite it's face.

You guys saw this, right? This snippet is from Yahoo.com, wonder how many jobs will be lost.

.....California Governor Jerry Brown signed a bill into law Wednesday requiring online businesses to pay state sales tax, calling it “a common sense idea,” but Amazon and other large online retailers said they no longer see the business sense in staying in the Golden State.

Amazon and Overstock.com both announced shortly after the bill was signed that they will be closing all of their affiliate programs in California. Affiliates are small websites and businesses that sell products through sites like Amazon and receive a small commission.

The new law requires large online retailers to collect and file state sales tax on purchases made by California customers. California hopes to raise an estimated $317 million a year in new state and local government revenue through the added sales tax collections.

The State Board of Equalization has estimated there are 25,000 affiliates in California, 10,000 of which make money through an affiliation with Amazon.

Not anymore, though.

“We oppose this bill because it is unconstitutional and counterproductive,” Amazon said in an email to its affiliates. “It is supported by big-box retailers, most of which are based outside California, that seek to harm the affiliate advertising programs of their competitors.”

Overstock.com, a large Utah-based online retailer, sent a similar email to its California affiliates.

“We think this law is unconstitutional,” said Mark Griffin, Overstock’s general counsel, in an interview with the San Jose Mercury News. “We sent a final note to our California affiliates today. It’s a business decision that we had to make.”

If a company is selling thru an affiliate or subsidiary in a state then it should pay state sales tax.

Amazon seems to be cutting off it's nose to spite it's face.

I don't think so, these guys are far more interested in the bottom line than in politics. They added up the costs to move vs the costs to stay and moving won out. I'm sure whatever sweetheart deal they got from SC played a part in the decision.