WillowTree

Diamond Member

- Sep 15, 2008

- 84,532

- 16,091

- 2,180

Currently the rich use the tax code to prey upon the rest of us stripping us of our earnings. Unless they ACTUALLY pay a higher percent than us, they are preying on us

They already do.

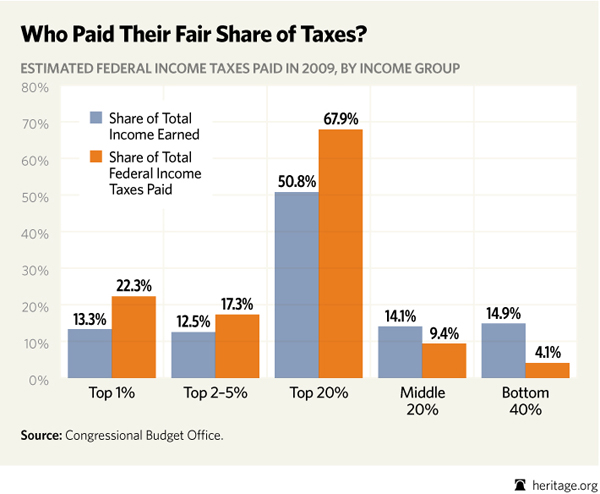

They pay a far higher percentage than you. In fact, 20% of them pay for 70% of all federal taxes.

You and your 80% are only accountable for 30%. So in reality, you're the ones preying on them.

The one's who pay ZERO federal income taxes are the predators.