can you provide any proof that oil dropped $112 during the Bush administration?It took less than a year for oil production to begin after the OCS ban was lifted. That was barely enough time for the speculators to sell off all the oil they were hording in "floating storage" before the new supply came on line. Selling all that oil caused the price to drop $112 from $147 to $35 .this is all speculation. the article clearly stated the following:

"If we were to drill today, realistically speaking, we should not expect a barrel of oil coming out of this new resource for three years, maybe even five years, so let's not kid ourselves," said Fadel Gheit, oil and gas analyst with Oppenheimer & Co. Equity Capital Markets Division.

this is the reason the price of oil fell. speculator thought there would be more oil instantly, not because actual supplies increased. if you were to end oil speculation, oil would actually drop dramatically.

If you would read, I posted it back here in this thread.

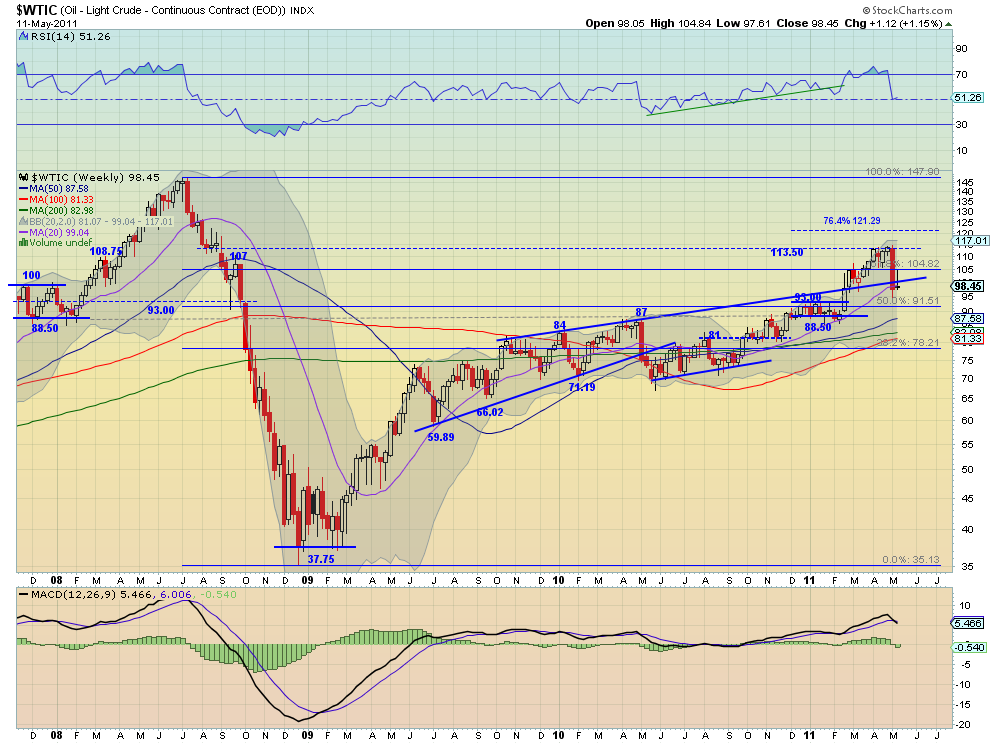

Here is another chart. High of $147.90 to Low of $35.13 = $112.77

Last edited: