JiggsCasey

VIP Member

- Jan 12, 2010

- 991

- 121

- 78

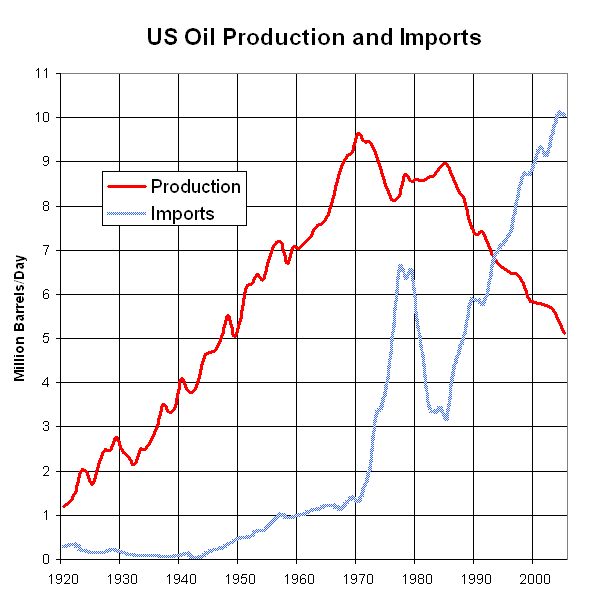

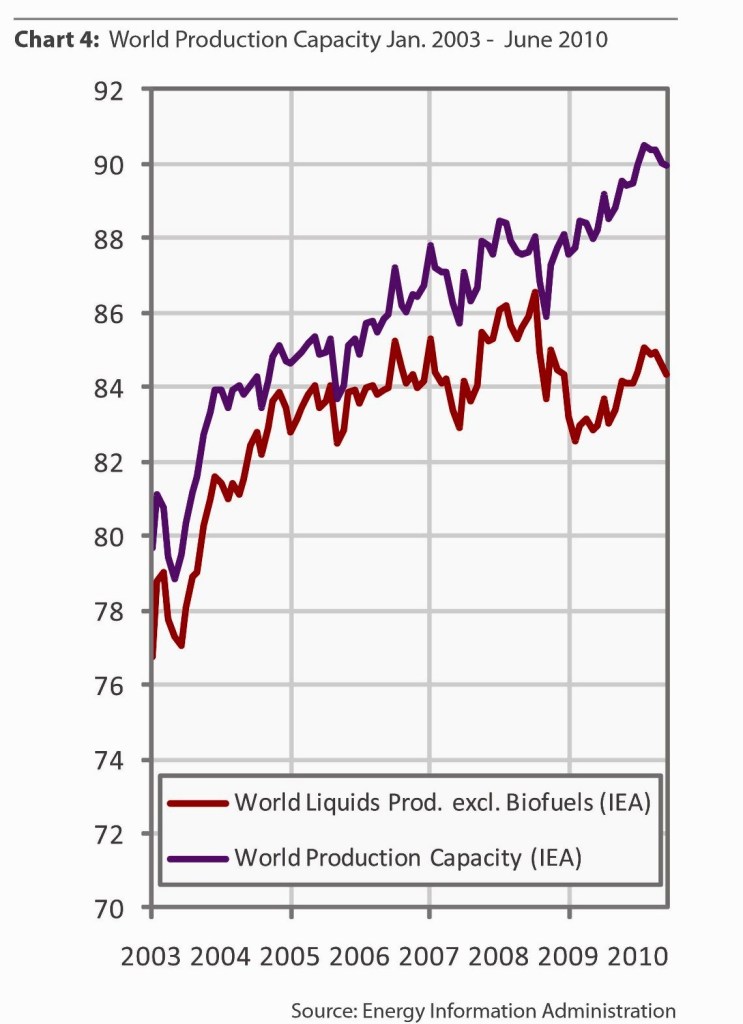

Too bad the oil markets don't agree with your doom-and-gloomery.

Actually, they do. Again, dude... I'll ask you once more.... why is the IEA, the Pentagon, the DoE, the EIA and the men in this video somehow lying? For what purpose:

[ame=http://www.youtube.com/watch?v=VUVY2qrEfd8]YouTube - ASPO.TV News: Peak Oil Reality - Production & Depletion Issues[/ame]

Perhaps you'll venture a guess at some point. You know, something a bit more convincing than punting to "it's a big conspiracy!!"