Exactly right, so we can agree to disagree, but IMHO I have more AARP voters wanting to save SS & Medicare than you have for letting them go bankrupt.I oppose paying for the spending that you demand. It's as simple as that.Who cares about the tax rates in a bunch of socialist kleptocracies? Why should we screw ourselves just because they did?Look at the tax rates in post #214, the US tax rates are low compared to other 1st world countries.Anyone who believes 47% is low needs to have his head examined.You chose Denmark as the metric to verify that the graph is accurate. The graph is accurate.ok, lets use Denmark as the metric:A leftwing think tank? Not credible. Furthermore, the graph is in terms of taxes against GDP. Income is less than per capita GDP, so their tax rates are considerably higher than the percentages listed in the chart. Denmark is more like 60%See post #172 asked and answeredI don't see any link, asshole.You've already posted this worthless propaganda chart. Without attribution it can't be believed.Take a look at these two graphs and tell me who is squealing. Its not the rich paying for the poor, its paying fair taxes. :But dude... you are the pig man. This is what you people don't grasp.Let the pigs squeal, SS needs to be fixed.Only a moron would claim that increased taxes are not "pain."The COVID-19 pandemic borrowing will make SS & Medicare less solvent.

Which party will raise taxes to save SS & Medicare for future generations?

The Future of America’s Entitlements: What You Need to Know About the Medicare and Social Security Trustees Reports - AAF

The Social Security and Medicare Trustees issued their annual reports detailing the financial state of America’s two largest entitlement programs.www.americanactionforum.org

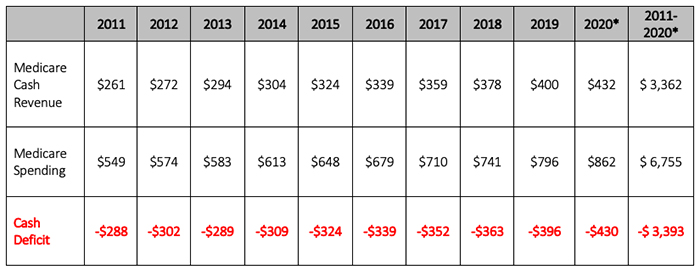

- Medicare’s Annual Cash Shortfall in 2019 was $396 billion;

- Payroll taxes would have to increase more than 15 percent to pay for Medicare Part A in 2019; and

- Over the next 75 years, Social Security will owe $16.8 trillion more than it is projected to take in.

You are implying that it is even possible to "pay for it".

With or without Covid-19, with or without the economic down turn, whether Democrats or Republicans are in office....

You can't pay for socialism. It never works. Never. Not one time in all human history, has taking from group A, to pay for group B, worked.

If Social Security and Medicare were possible to have working, then we would never have the concept of a Ponzi scheme, because both of those are ponzi schemes.

In the end, my guess is that health care in the US will end up run by the government, and thus will end up declining in quality to meet the ability of the government to pay.

Social Security will equally need to be cut to the ability of the government to pay. The way they will do this, is by cutting the retirement age, meaning raise the retirement age to 75 or something.

Now there are a few alternatives that the nation could go down, that will be absolutely devastating.

One is a drastic increase in taxes, which will cause capital flight and economic decline. That would be much like what we saw in Greece.

The other option is that government just keeps spending, until they destroy themselves. Again, much like Greece.

Given the recent rise of incompetence, like AOC who is exceedingly popular, even after saying things as utterly mindless as she's going to "spend" the money from a tax cut on schools and health care.....

I see the Greece result as more and more a real possibility.

There is no way to "pay" for Social Security and Medicare/Medicaid. These programs, were never, and are not, sustainable. We have only been able to out-grow our spending thus far, but that can't continue forever.

You want 75 year-old truck drivers on the road? You want 75 year-old roofers working on your house? You want a 75 year-old nurse assisting your doctor?

You really have not thought this through, have you?

What I want, doesn't matter. What you want, doesn't matter either.

Facts don't care what either of us think. Math doesn't care what we want.

Do you want to be this guy in Greece, with no money, living in poverty, because the government simply does not have any money?

Because that's our future if we keep pushing Social Security. There is zero difference between how Social Security works, and how the Greek Pension system worked.

If you keep doing the same thing, you'll get the same result.

You talk about math and don't provide any. Here are several real SS "fixes". Show me where they are wrong.

https://www.fool.com/retirement/2018/05/21/how-warren-buffett-thinks-we-should-fix-social-sec.aspx

https://money.usnews.com/money/blogs/planning-to-retire/2014/11/14/5-potential-social-security-fixes

https://www.aarp.org/work/social-security/info-05-2012/future-of-social-security-proposals.html

So let's use your links for example.

Finally, gradually raising the full retirement age to 68 would take care of 16% of the funding gap.

Right, I said openly that we would have to raise the retirement age.

Raising the Social Security payroll tax rate from 6.2% to 7.2% over a 20-year period would generate 52% of the shortfall.

Again, Germany has an 18% pension tax, and they are saying they need to increase it. So if 18% now in Germany isn't enough, why do you think 7.2% would be enough?

Eliminating the taxable earnings cap over a 10-year period would fix 74% of the long-term financing gap all by itself.

No, I don't think so. All you have to do is look at the 1970s. In the 1970s, we have a 70% rate on the top marginal income tax rates.

Did we have endless amounts of money for everything we wanted? Or did we have deficits? We had deficits. So if 70% tax rates didn't fix anything the 1970s, would would this fix social security?

Again.... if any of those proposals could work.... why hasn't any country anywhere in the world today, done all those things and had it work?

All those things can help.... Sure you delay the crash with all those things. Certainly. But it does not fix anything. We know that because as I said, Germany has a much higher pension tax, and they still need to raise the tax rate. Germany has a lower pension payout, and they still need more taxes.

You can't show me a single country, that doesn't have a pension crisis, unless they don't have a pension system.

For example, Singapore does not have a pension crisis. And the reason why is very simple. Singapore has a private system. People pay into a private account, that is invested in their own assets, that they own in their private account.

It's impossible to have a crisis, because people get out of their retirement account, what they paid into their retirement account.

That's also pretty good, because the government can't take it away by arbitrarily increasing the retirement age, thus denying you the money you paid into retirement.

Now I will say that Means-testing could in theory work.

But you'll never get that passed. Guaranteed. Because the moment you pass means testing, you blow apart the entire mythology that Social Security is a retirement system you pay-in and pay-out of.

The moment you tell people "Yes you paid into Social Security your entire life, but you have too much wealth, so you don't get anything from it".... you will have massive revolt across the country. No politician of either party will survive trying to implement means testing.

Ok, so I think we agree that SS is fixable and is NOT a ponzi scheme.

1. We agree on raising the full retirement age 1-year from 67 to 68 is not a big deal and gets 16% of the problem.

2. Raising the SS tax rate from 6.2% to 7.2% gets 52% of the shortfall, so that's 68% of the needed fix, no biggie.

3. Eliminate the earnings cap over 10-years gains 74%, so we're at 142% of the fix. QED SS Fixed.

The actuaries proved BY MATH that SS is fixable without much controversy or pain, so why don't the DC coxuckers fix it already!!

You are the pig. You are the one who is going to squeal.

Again, name one country anywhere, that has the rich paying for the poor? No such country exists.

It's the poor and middle class that pay tax. You the pig. That's you buddy! When you say "Someone has to pay for this, let the pigs squeal!".... that's you! You are the one who is going to pay the tax.

Why do you think Denmark has a 200% tax on cars? Who do you think paid that tax? The lower and middle class. You. Those like you in Denmark paid that tax.

Why do you think Germany has a 19% sales tax? Who do you think is paying that? You! Those like you! The lower and middle class!

There is not one single country in this world, where the rich pay for the poor. Not one.

You want Social Security and Medicare? fine... but just realize, that's your taxes that are going to go up. You are the one who is going to squeal. You are the one who is going to pay $8/gallon of gas.... that's how much the price of a gasoline in the UK was. (likely lower now given the crash of oil prices).

Why were Brits paying $8 in gas? Taxes. To pay for health care and pensions.

You the pig. You are.

View attachment 329711

View attachment 329712

You can squeal all you want, but the tax man cometh. Bills need to be paid and the top US incomes need to pony up.

Denmark Personal Income Tax Rate | 1995-2018 Data | 2019-2020 Forecast | Historical (about 55% AS PER DENMARK)

List of countries by tax rates - Wikipedia (accurate)

Countries With the Highest Single and Family Income Tax Rates (also accurate)

View attachment 329843

So you believe a 55% tax rate is reasonable?

That means that the US personal tax rate compared to EU countries is very low at 47%.

I suggested a 7% bump for the top rate up to about 54% along with adding a "Fed Sales Tax" to cover the Deficit and help keep SS & Medicare solvent.

OK, so you prefer your ridiculous "spending cuts" that no party would support over actually paying for what you spend, or keep the $30T Nation Debt going skyward until the US turns into Greece and can't borrow anymore with $1T interest payments forever? Stupid options.

Well... they'll still go bankrupt, whether they vote for it or not. You can't fix math, by voting.

Voting that 2 + 2 = 22, does not work. You can't vote math to bend to what you want it to be.