ColonelAngus

Diamond Member

- Feb 25, 2015

- 59,609

- 64,835

- 3,615

- Thread starter

- #161

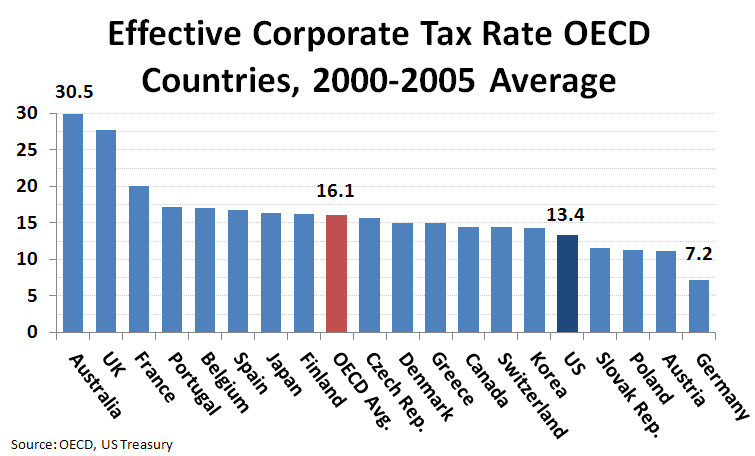

The income tax rate that you've quoted doesn't take into account the deductions that are typical. As for updated information, here's a chart that shows it's only gone down since 2000-2005. Also, despite all those concessions, the employment rate hasn't improved.

For some odd reason, people simply don't realize the difference between marginal and effective tax rates. One would think after Mitt Romney released his taxes that people would understand that difference, but, sure as God made little green apples, many appear not to.

Simply put, if one's marginal tax rate is, say 25% and one's deductions and exemptions allow one to actually pay tax such that one's effective rate is 15%, with no change other than a reduction in one's marginal tax rate from 25% to 15%, one will pay the same sum of money in taxes.

OT:

That chart may be among the best one's I've seen recently that illustrates the lie that is one of the main supply siders' mantras: cutting corporate taxes increases job growth.

15% across the board, no deductions. That's what I would like to see for all Federal Income tax.