But WE, US citizens, don't want them to leave their money overseas. WE want them to bring that money here and create jobs here. How do we get what we want? By giving them what they want in order to get them to bring their money here.Then they leave that money overseas. It's their choice.And if they don't wish to bring the money back to the US because the taxes are too high for them to do it?I didn't say they shouldn't. What I did say is that they should pay the taxes on profit they wish to bring back into the U.S., per current U.S. tax laws.It's not about teaching them a lesson. It's about paying taxes. If they bring their money back here, they pay the taxes on that money. No one else gets a break on their taxes where they can avoid paying much of the taxes they owe. Neither should anyone doing business overseas.Well you're sure teaching those rich people a lesson. In the mean time they just keep the money over seas. You're showing them though, keep up the good work.

Just a thought though. Maybe you're paying too much or too little in taxes? I mean if you think you deserve 50% or whatever amount of their money to go to the government how much of yours should go there? Are you willing to match what they pay?

Why shouldn't an American company build and sell their products in a foreign country?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What should be done, if anything, to bring home $5 trillion held overseas by American businesses?

- Thread starter ColonelAngus

- Start date

Faun

Diamond Member

- Nov 14, 2011

- 126,711

- 98,397

- 3,635

Umm... there are plenty of "we citizens" who want the current laws enforced. You don't speak for all Americans. As far as them bringing their money back to create jobs, history is not on your side. This was allowed before under that ruse and it failed miserably. And why would you want to get be tax breaks to some of the wealthier folks in America while we're running a $1.4 trillion deficit and while you can't get a tax break?But WE, US citizens, don't want them to leave their money overseas. WE want them to bring that money here and create jobs here. How do we get what we want? By giving them what they want in order to get them to bring their money here.Then they leave that money overseas. It's their choice.And if they don't wish to bring the money back to the US because the taxes are too high for them to do it?I didn't say they shouldn't. What I did say is that they should pay the taxes on profit they wish to bring back into the U.S., per current U.S. tax laws.It's not about teaching them a lesson. It's about paying taxes. If they bring their money back here, they pay the taxes on that money. No one else gets a break on their taxes where they can avoid paying much of the taxes they owe. Neither should anyone doing business overseas.

Why shouldn't an American company build and sell their products in a foreign country?

You apply pressure. As I said before, pretty much every country that has become a tax haven relies upon US defense and in many cases infrastructure support. It shouldn't be too difficult to get them to cooperate.How do you freeze an account in a foreign bank?Maybe I misinterpreted your statement. The idea is not to freeze US accounts but to freeze foreign accounts owned by corporations. That way they would still have working capital. There would almost certainly come a time when the capital held abroad would be needed and that is when tax money would have to be paid.Please explain your idea... It sounds like you are suggesting that the US government freeze American bank accounts for anybody that has money in an offshore account until they transfer those funds into an American account and pay taxes on it. Is that what you are saying? Hows all this supposed to work?Freeze the accounts until the corporations agree to pay what they should have to begin with.It would be nice to have some of that money come back home.

It's been shown many, many times that the US does not have the highest taxes in the world. The corporate propaganda mills would like you to believe that so they can get people to allow them to pay less.That is the down side of being a consumer economy. In the grand scheme of things we produce jack shit that only other rich nations can really afford to even think about purchasing. It's like the animals that go extinct are the ones who over specialize, and that's our economy. If a company can invest in a more "balanced" economy it behooves them. Thus when we market the US to get that offshore cash we need to be mindful of the "risk factors" and offer a little more incentive than say other countries with more "stable" markets could get away with - in direct opposition to that however, we not only have a very off kilter market, but we also have the highest taxes in the world - this is not a winning combination...

I think that genie is already out of the bottle. Might as well get some benefit out of it.So you want our intelligence agencies to get in the business of tracking the wealth of our citizens and to also force banks from other countries to disclose the financial information of their clients. Do you care at all about privacy? Do you recognize the potential problems that could arise from a government as big and intrusive as you propose?I'm confident that if our intelligence agencies don't already know who has what where, they could find out. It would also require some cooperation from the countries where the money is held and that might need to be coerced in some way. That probably wouldn't be too difficult either because those nations require defense and possibly infrastructure support from the US.How exactly does that work? For example, how does the government know how many accounts you have and how much money is in each account? How is it all regulated and enforced?Yes, that's the idea.Please explain your idea... It sounds like you are suggesting that the US government freeze American bank accounts for anybody that has money in an offshore account until they transfer those funds into an American account and pay taxes on it. Is that what you are saying? Hows all this supposed to work?Freeze the accounts until the corporations agree to pay what they should have to begin with.

JFC, if they've parked the money overseas, they haven't paid the 20%. No wonder morons like you think the US has the highest tax rate in the world.No, it's not double tax. Bringing their money here means they are taxed here the rate based on their tax bracket minus any taxes already paid elsewhere.

So the company in Faunland pays Faunland's 20% corporate tax rate on their $100.00 of net profit leaving $80.00. They bring that $80.00 into the U.S. and pay a 38.9% corporate tax rate for the privilege of bringing that $80.00 into the states. That's an additional $31.12 in taxes. Eighty dollars minus $31.12 leaves them with $48.88 net profit after the money comes in the states?

Why would they do such a thing?

If that were true, it wouldn't be considered a trade deficit.What lost revenue? That's money that's overseas right now.should we end the drug war for two years to compensate for lost revenue?Two-year tax amnesty.

.

Mac you know that other countries have money in US too... The Saudis alone have 1 trillion in US....

5 Trillion abroad is not that much...

Yes, well, people who yarp about trade deficits and "money going overseas" tend to miss the part where the people overseas exporting and selling items in the US then take that money and invest it in US financial securities, which balances out pretty nicely against the so-called "trade deficit".

ColonelAngus

Diamond Member

- Feb 25, 2015

- 59,600

- 64,815

- 3,615

- Thread starter

- #148

It's been shown many, many times that the US does not have the highest taxes in the world. The corporate propaganda mills would like you to believe that so they can get people to allow them to pay less.That is the down side of being a consumer economy. In the grand scheme of things we produce jack shit that only other rich nations can really afford to even think about purchasing. It's like the animals that go extinct are the ones who over specialize, and that's our economy. If a company can invest in a more "balanced" economy it behooves them. Thus when we market the US to get that offshore cash we need to be mindful of the "risk factors" and offer a little more incentive than say other countries with more "stable" markets could get away with - in direct opposition to that however, we not only have a very off kilter market, but we also have the highest taxes in the world - this is not a winning combination...

US corporate tax rate is too high.

It's been shown many, many times that the US does not have the highest taxes in the world. The corporate propaganda mills would like you to believe that so they can get people to allow them to pay less.That is the down side of being a consumer economy. In the grand scheme of things we produce jack shit that only other rich nations can really afford to even think about purchasing. It's like the animals that go extinct are the ones who over specialize, and that's our economy. If a company can invest in a more "balanced" economy it behooves them. Thus when we market the US to get that offshore cash we need to be mindful of the "risk factors" and offer a little more incentive than say other countries with more "stable" markets could get away with - in direct opposition to that however, we not only have a very off kilter market, but we also have the highest taxes in the world - this is not a winning combination...

US corporate tax rate is too high.

What would you recommend, going full third-world?

Cecilie1200

Diamond Member

If that were true, it wouldn't be considered a trade deficit.What lost revenue? That's money that's overseas right now.should we end the drug war for two years to compensate for lost revenue?Two-year tax amnesty.

.

Mac you know that other countries have money in US too... The Saudis alone have 1 trillion in US....

5 Trillion abroad is not that much...

Yes, well, people who yarp about trade deficits and "money going overseas" tend to miss the part where the people overseas exporting and selling items in the US then take that money and invest it in US financial securities, which balances out pretty nicely against the so-called "trade deficit".

Yes, because inaccurate titles are NEVER applied to things by people with flawed understanding of them.

ColonelAngus

Diamond Member

- Feb 25, 2015

- 59,600

- 64,815

- 3,615

- Thread starter

- #151

It's been shown many, many times that the US does not have the highest taxes in the world. The corporate propaganda mills would like you to believe that so they can get people to allow them to pay less.That is the down side of being a consumer economy. In the grand scheme of things we produce jack shit that only other rich nations can really afford to even think about purchasing. It's like the animals that go extinct are the ones who over specialize, and that's our economy. If a company can invest in a more "balanced" economy it behooves them. Thus when we market the US to get that offshore cash we need to be mindful of the "risk factors" and offer a little more incentive than say other countries with more "stable" markets could get away with - in direct opposition to that however, we not only have a very off kilter market, but we also have the highest taxes in the world - this is not a winning combination...

US corporate tax rate is too high.

What would you recommend, going full third-world?

I'd like to see 15%.

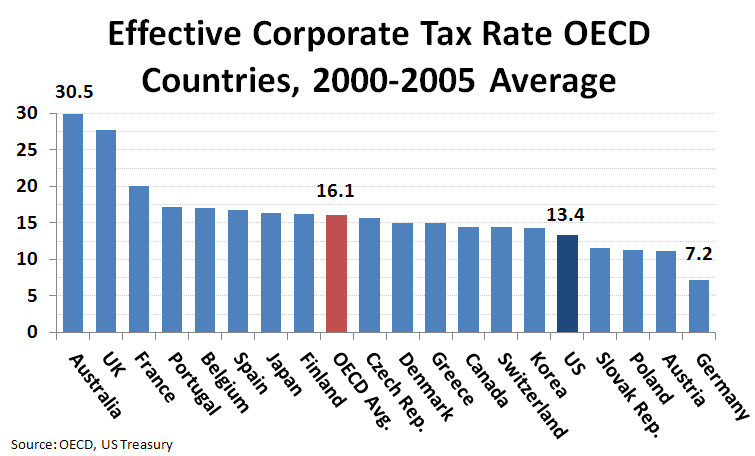

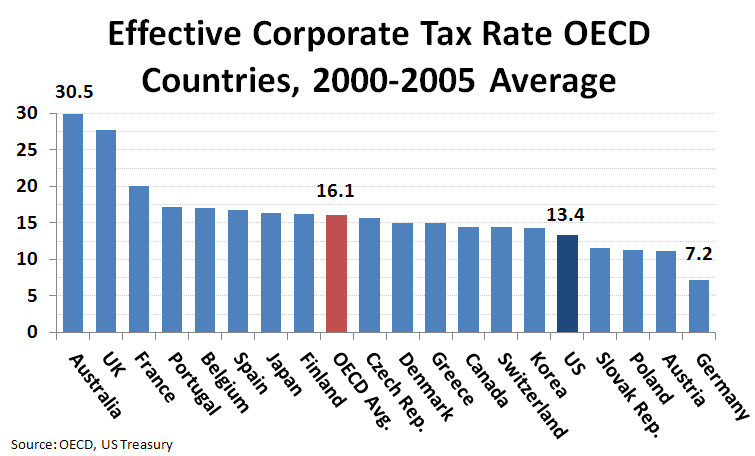

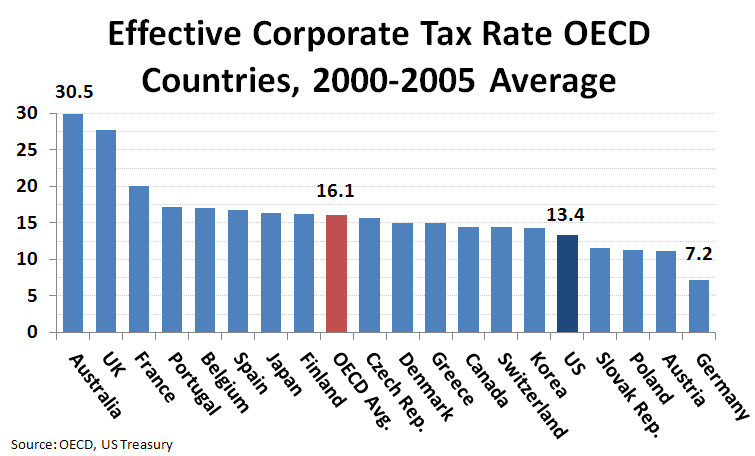

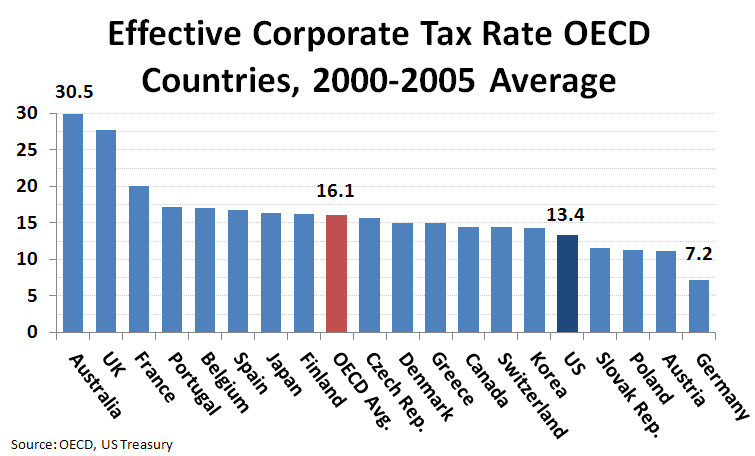

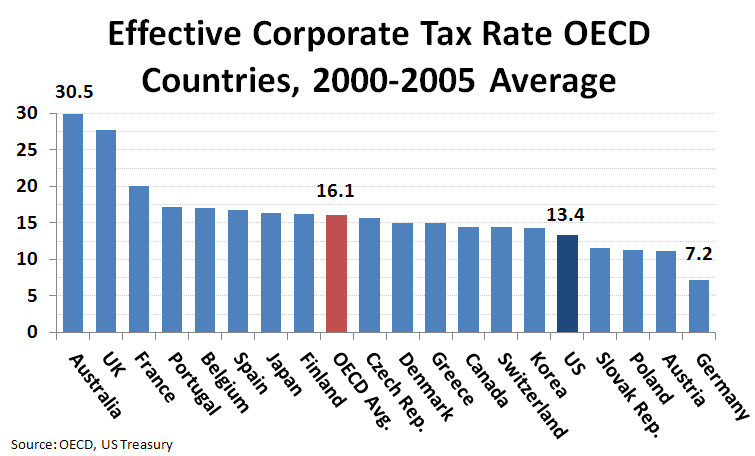

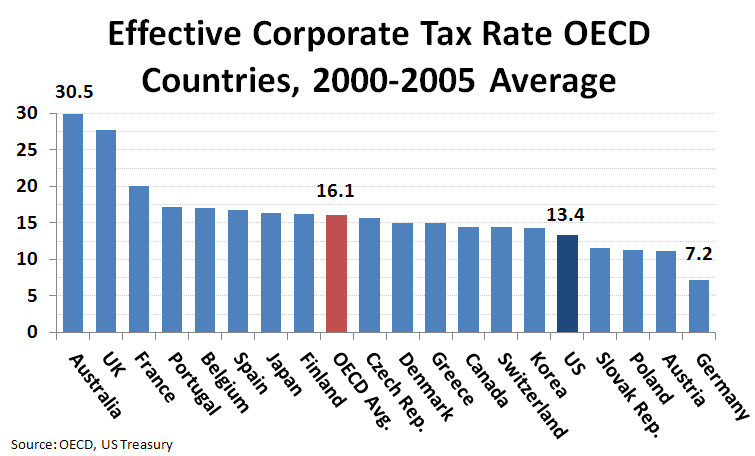

Fresh data. 2000-2005?

In 2014 the United States had the third highest general top marginal corporate income tax rate in the world at 39.1 percent (consisting of the 35% federal rate plus a combined state rate), exceeded only by Chad and the United Arab Emirates.

usmbguest5318

Gold Member

It's not about teaching them a lesson. It's about paying taxes. If they bring their money back here, they pay the taxes on that money. No one else gets a break on their taxes where they can avoid paying much of the taxes they owe. Neither should anyone doing business overseas.Well you're sure teaching those rich people a lesson. In the mean time they just keep the money over seas. You're showing them though, keep up the good work.Nope, that plan is working as designed. Want your money here? Pay your taxes on it. Why should they be allowed to avoid paying tax on their income but others, like myself, cannot?That's what they're doing now so obviously your tax the shit out of them plan isn't working to get more investment here. I don't worry about trivial things like if someone makes more than me. I also think the entire tax system is a joke. We need a flat tax if you want it to be fair to everyone equally.

Just a thought though. Maybe you're paying too much or too little in taxes? I mean if you think you deserve 50% or whatever amount of their money to go to the government how much of yours should go there? Are you willing to match what they pay?

Why shouldn't an American company build and sell their products in a foreign country?

I didn't say they shouldn't. What I did say is that they should pay the taxes on profit they wish to bring back into the U.S., per current U.S. tax laws.

What?...Are you seriously suggesting that taxes should be assessed and paid on wished for events rather than actual events? (the relevant event being earning money in the U.S. or earning it elsewhere and bringing it to the U.S.) If so, I'm fairly certain that under such a model, everyone will wish to earn nothing.

The income tax rate that you've quoted doesn't take into account the deductions that are typical. As for updated information, here's a chart that shows it's only gone down since 2000-2005. Also, despite all those concessions, the employment rate hasn't improved.It's been shown many, many times that the US does not have the highest taxes in the world. The corporate propaganda mills would like you to believe that so they can get people to allow them to pay less.That is the down side of being a consumer economy. In the grand scheme of things we produce jack shit that only other rich nations can really afford to even think about purchasing. It's like the animals that go extinct are the ones who over specialize, and that's our economy. If a company can invest in a more "balanced" economy it behooves them. Thus when we market the US to get that offshore cash we need to be mindful of the "risk factors" and offer a little more incentive than say other countries with more "stable" markets could get away with - in direct opposition to that however, we not only have a very off kilter market, but we also have the highest taxes in the world - this is not a winning combination...

US corporate tax rate is too high.

What would you recommend, going full third-world?

I'd like to see 15%.

Fresh data. 2000-2005?

In 2014 the United States had the third highest general top marginal corporate income tax rate in the world at 39.1 percent (consisting of the 35% federal rate plus a combined state rate), exceeded only by Chad and the United Arab Emirates.

ColonelAngus

Diamond Member

- Feb 25, 2015

- 59,600

- 64,815

- 3,615

- Thread starter

- #154

The income tax rate that you've quoted doesn't take into account the deductions that are typical. As for updated information, here's a chart that shows it's only gone down since 2000-2005. Also, despite all those concessions, the employment rate hasn't improved.It's been shown many, many times that the US does not have the highest taxes in the world. The corporate propaganda mills would like you to believe that so they can get people to allow them to pay less.That is the down side of being a consumer economy. In the grand scheme of things we produce jack shit that only other rich nations can really afford to even think about purchasing. It's like the animals that go extinct are the ones who over specialize, and that's our economy. If a company can invest in a more "balanced" economy it behooves them. Thus when we market the US to get that offshore cash we need to be mindful of the "risk factors" and offer a little more incentive than say other countries with more "stable" markets could get away with - in direct opposition to that however, we not only have a very off kilter market, but we also have the highest taxes in the world - this is not a winning combination...

US corporate tax rate is too high.

What would you recommend, going full third-world?

I'd like to see 15%.

Fresh data. 2000-2005?

In 2014 the United States had the third highest general top marginal corporate income tax rate in the world at 39.1 percent (consisting of the 35% federal rate plus a combined state rate), exceeded only by Chad and the United Arab Emirates.

For regular income tax purposes, a system of graduated marginal tax rates is applied to all taxable income, including capital gains. Through 2015, the marginal tax rates on a corporation's taxable income are as follows:

Taxable income ($) Tax rate

0 to 50,000 - 15%

50,000 to 75,000 - $7,500 + 25% Of the amount over 50,000

75,000 to 100,000 - $13,750 + 34% Of the amount over 75,000

100,000 to 335,000 - $22,250 + 39% Of the amount over 100,000

335,000 to 10,000,000 - $113,900 + 34% Of the amount over 335,000

10,000,000 to 15,000,000 - $3,400,000 + 35% Of the amount over 10,000,000

15,000,000 to 18,333,333 - $5,150,000 + 38% Of the amount over 15,000,000

18,333,333 and up 35%

I'd like to see 15% across the board.

Would that provide enough revenue to keep the government providing the services that are required?The income tax rate that you've quoted doesn't take into account the deductions that are typical. As for updated information, here's a chart that shows it's only gone down since 2000-2005. Also, despite all those concessions, the employment rate hasn't improved.It's been shown many, many times that the US does not have the highest taxes in the world. The corporate propaganda mills would like you to believe that so they can get people to allow them to pay less.

US corporate tax rate is too high.

What would you recommend, going full third-world?

I'd like to see 15%.

Fresh data. 2000-2005?

In 2014 the United States had the third highest general top marginal corporate income tax rate in the world at 39.1 percent (consisting of the 35% federal rate plus a combined state rate), exceeded only by Chad and the United Arab Emirates.

For regular income tax purposes, a system of graduated marginal tax rates is applied to all taxable income, including capital gains. Through 2015, the marginal tax rates on a corporation's taxable income are as follows:

Taxable income ($) Tax rate

0 to 50,000 - 15%

50,000 to 75,000 - $7,500 + 25% Of the amount over 50,000

75,000 to 100,000 - $13,750 + 34% Of the amount over 75,000

100,000 to 335,000 - $22,250 + 39% Of the amount over 100,000

335,000 to 10,000,000 - $113,900 + 34% Of the amount over 335,000

10,000,000 to 15,000,000 - $3,400,000 + 35% Of the amount over 10,000,000

15,000,000 to 18,333,333 - $5,150,000 + 38% Of the amount over 15,000,000

18,333,333 and up 35%

I'd like to see 15% across the board.

Faun

Diamond Member

- Nov 14, 2011

- 126,711

- 98,397

- 3,635

You have that backwards. The actual event which is taxable is bringing their money back into the US. That's what I'm saying they should pay taxes on.It's not about teaching them a lesson. It's about paying taxes. If they bring their money back here, they pay the taxes on that money. No one else gets a break on their taxes where they can avoid paying much of the taxes they owe. Neither should anyone doing business overseas.Well you're sure teaching those rich people a lesson. In the mean time they just keep the money over seas. You're showing them though, keep up the good work.Nope, that plan is working as designed. Want your money here? Pay your taxes on it. Why should they be allowed to avoid paying tax on their income but others, like myself, cannot?That's what they're doing now so obviously your tax the shit out of them plan isn't working to get more investment here. I don't worry about trivial things like if someone makes more than me. I also think the entire tax system is a joke. We need a flat tax if you want it to be fair to everyone equally.

Just a thought though. Maybe you're paying too much or too little in taxes? I mean if you think you deserve 50% or whatever amount of their money to go to the government how much of yours should go there? Are you willing to match what they pay?

Why shouldn't an American company build and sell their products in a foreign country?I didn't say they shouldn't. What I did say is that they should pay the taxes on profit they wish to bring back into the U.S., per current U.S. tax laws.

What?...Are you seriously suggesting that taxes should be assessed and paid on wished for events rather than actual events? (the relevant event being earning money in the U.S. or earning it elsewhere and bringing it to the U.S.) If so, I'm fairly certain that under such a model, everyone will wish to earn nothing.

usmbguest5318

Gold Member

The income tax rate that you've quoted doesn't take into account the deductions that are typical. As for updated information, here's a chart that shows it's only gone down since 2000-2005. Also, despite all those concessions, the employment rate hasn't improved.

For some odd reason, people simply don't realize the difference between marginal and effective tax rates. One would think after Mitt Romney released his taxes that people would understand that difference, but, sure as God made little green apples, many appear not to.

Simply put, if one's marginal tax rate is, say 25% and one's deductions and exemptions allow one to actually pay tax such that one's effective rate is 15%, with no change other than a reduction in one's marginal tax rate from 25% to 15%, one will pay the same sum of money in taxes.

OT:

That chart may be among the best one's I've seen recently that illustrates the lie that is one of the main supply siders' mantras: cutting corporate taxes increases job growth.

ColonelAngus

Diamond Member

- Feb 25, 2015

- 59,600

- 64,815

- 3,615

- Thread starter

- #158

Would that provide enough revenue to keep the government providing the services that are required?The income tax rate that you've quoted doesn't take into account the deductions that are typical. As for updated information, here's a chart that shows it's only gone down since 2000-2005. Also, despite all those concessions, the employment rate hasn't improved.US corporate tax rate is too high.

What would you recommend, going full third-world?

I'd like to see 15%.

Fresh data. 2000-2005?

In 2014 the United States had the third highest general top marginal corporate income tax rate in the world at 39.1 percent (consisting of the 35% federal rate plus a combined state rate), exceeded only by Chad and the United Arab Emirates.

For regular income tax purposes, a system of graduated marginal tax rates is applied to all taxable income, including capital gains. Through 2015, the marginal tax rates on a corporation's taxable income are as follows:

Taxable income ($) Tax rate

0 to 50,000 - 15%

50,000 to 75,000 - $7,500 + 25% Of the amount over 50,000

75,000 to 100,000 - $13,750 + 34% Of the amount over 75,000

100,000 to 335,000 - $22,250 + 39% Of the amount over 100,000

335,000 to 10,000,000 - $113,900 + 34% Of the amount over 335,000

10,000,000 to 15,000,000 - $3,400,000 + 35% Of the amount over 10,000,000

15,000,000 to 18,333,333 - $5,150,000 + 38% Of the amount over 15,000,000

18,333,333 and up 35%

I'd like to see 15% across the board.

Revenues will go up for many companies that currently seek tax shelters.

If the rate was a flat 15%, there would be no need to shelter. It would also allow companies to reinvest in people and expand capacities.

35% of $0 = $0

15% of $1 = 15 cents.

I think you're referring to yourself here. You've apparently confused merchandise balance with trade balance.If that were true, it wouldn't be considered a trade deficit.What lost revenue? That's money that's overseas right now.should we end the drug war for two years to compensate for lost revenue?

.

Mac you know that other countries have money in US too... The Saudis alone have 1 trillion in US....

5 Trillion abroad is not that much...

Yes, well, people who yarp about trade deficits and "money going overseas" tend to miss the part where the people overseas exporting and selling items in the US then take that money and invest it in US financial securities, which balances out pretty nicely against the so-called "trade deficit".

Yes, because inaccurate titles are NEVER applied to things by people with flawed understanding of them.

Although less general than trade balance, which includes both goods and services, the "merchandise balance", which includes only goods and not services, is sometime used because of better data availability.

Trade balance: a key concept in Economics

usmbguest5318

Gold Member

It's not about teaching them a lesson. It's about paying taxes. If they bring their money back here, they pay the taxes on that money. No one else gets a break on their taxes where they can avoid paying much of the taxes they owe. Neither should anyone doing business overseas.Well you're sure teaching those rich people a lesson. In the mean time they just keep the money over seas. You're showing them though, keep up the good work.Nope, that plan is working as designed. Want your money here? Pay your taxes on it. Why should they be allowed to avoid paying tax on their income but others, like myself, cannot?

Just a thought though. Maybe you're paying too much or too little in taxes? I mean if you think you deserve 50% or whatever amount of their money to go to the government how much of yours should go there? Are you willing to match what they pay?

Why shouldn't an American company build and sell their products in a foreign country?

What?...Are you seriously suggesting that taxes should be assessed and paid on wished for events rather than actual events? (the relevant event being earning money in the U.S. or earning it elsewhere and bringing it to the U.S.) If so, I'm fairly certain that under such a model, everyone will wish to earn nothing.

You have that backwards. The actual event which is taxable is bringing their money back into the US. That's what I'm saying they should pay taxes on.

I don't have what you proposed backwards at all. Wishing to bring money, earnings, to the U.S. and actually bringing them to the U.S. are not the same things.

I didn't say they shouldn't. What I did say is that they should pay the taxes on profit they wish to bring back into the U.S., per current U.S. tax laws.

Similar threads

- Replies

- 173

- Views

- 1K

- Replies

- 2

- Views

- 186

- Replies

- 5

- Views

- 199

- Replies

- 85

- Views

- 915

- Replies

- 99

- Views

- 870

New Topics

-

RIP Sly Stone. An iconic artist who rejected Racial animus.

- Started by MarathonMike

- Replies: 2

-

South Korea close to $6 billion tank deal with Poland in June, Yonhap reports

- Started by 1srelluc

- Replies: 0

-

-

Zone1 The statement “The Jews” is weird and against history

- Started by Andrew_Jackson_FTW

- Replies: 0