Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

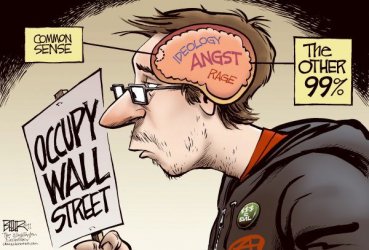

What Occupy Wall Street is mad about

- Thread starter Chris

- Start date

Someone on an internet message board is attempting to clarify their "position".

Dragon

Senior Member

- Sep 16, 2011

- 5,481

- 588

- 48

They don't want to change America. They want to take over the world.

Could in the long run be true. This is turning into a global movement. Well, it's an increasingly globalized world, so that shouldn't be too surprising.

Move to Iran

Change America for the better.

On October 15th, we will meet on the streets to initiate the global change we want. We will peacefully demonstrate, talk and organize until we make it happen.

Its time for us to unite. Its time for them to listen.

People of the world, rise up on October 15th!

They don't want to change America. They want to take over the world... for the 'change we want'.... what about those of us who don't want it?

You aren't the 99%, we are. Idiot.

Bou't time someone has the nads to say what the rest of us have been tapdancing around...

Dragon

Senior Member

- Sep 16, 2011

- 5,481

- 588

- 48

"The 99%" aren't those that agree with or approve of OWS, but rather those that are getting screwed over in this economy and by our bought-and-paid-for government for the benefit of the 1%. In that sense, most posters here if not all of them are part of the 99%.

Those who agree with or approve of OWS, according to the latest polls, are more like "the 56%." You might not be part of that.

Those who agree with or approve of OWS, according to the latest polls, are more like "the 56%." You might not be part of that.

WillowTree

Diamond Member

- Sep 15, 2008

- 84,532

- 16,091

- 2,180

CHARTS: Here's What The Wall Street Protesters Are So Angry About...

Remember when we bailed out the banks? Yes, and remember the REASON we were told we had to bail out the banks? We had to bail out the banks, we were told, so that the banks could keep lending to American businesses. Without that lending, we were told, society would collapse... Didn't the banks pay us back? And then didn't Dodd Frank come along? huh???? I think the banks are made at democrats but that's just me.

So, did the banks keep lending? Um, no. Bank lending dropped sharply, and it has yet to recover.

So, what have banks been doing since 2007 if not lending money to American companies? Lending money to America's government! By buying risk-free Treasury bonds and other government-guaranteed securities.

And, remarkably, they've also been collecting interest on money they are NOT lendingthe "excess reserves" they have at the Fed. Back in the financial crisis, the Fed decided to help bail out the banks by paying them interest on this money that they're not lending. And they're happily still collecting it. (It's AWESOME to be a bank.)

Meanwhile, of course, the banks are able to borrow money FOR FREE. Because the Fed has slashed rates to basically zero. And the banks have slashed the rates they pay on deposits to basically zero. So they can have all the money they wantfor nearly free!

When you can borrow money for nothing, and lend it back to the government risk-free for a few percentage points, you can COIN MONEY. And the banks are doing that. According to IRA, the "net interest margin" made by US banks in the first six months of this year is $211 Billion. Nice!

And that has helped produce $58 billion of profit in the first six months of the year.

And it has helped generate near-record financial sector profitswhile the rest of the country struggles with its 9% unemployment rate.

And these profits are getting back toward a record as a percentage of all corporate profits.

And those profits, of course, are AFTER the banks have paid their bankers. And it's still great to be a banker. The average banker in New York City made $361,330 in 2010. Not bad!

This average Wall Street salary was 6X the average private-sector salary (which, in turn, is actually lower than the average government salary, but that's a different issue).

And so, in conclusion, we'll end with another look at the "money shot"the one overarching reason the Wall Street protesters are so upset: Wages as a percent of the economy. Again, it's basically the lowest it has ever been.

heeee heeee hardy har har

Isn't it interesting how Chrissy takes up so much space to state absolutely zero?CHARTS: Here's What The Wall Street Protesters Are So Angry About...

Remember when we bailed out the banks? Yes, and remember the REASON we were told we had to bail out the banks? We had to bail out the banks, we were told, so that the banks could keep lending to American businesses. Without that lending, we were told, society would collapse... Didn't the banks pay us back? And then didn't Dodd Frank come along? huh???? I think the banks are made at democrats but that's just me.

So, did the banks keep lending? Um, no. Bank lending dropped sharply, and it has yet to recover.

So, what have banks been doing since 2007 if not lending money to American companies? Lending money to America's government! By buying risk-free Treasury bonds and other government-guaranteed securities.

And, remarkably, they've also been collecting interest on money they are NOT lendingthe "excess reserves" they have at the Fed. Back in the financial crisis, the Fed decided to help bail out the banks by paying them interest on this money that they're not lending. And they're happily still collecting it. (It's AWESOME to be a bank.)

Meanwhile, of course, the banks are able to borrow money FOR FREE. Because the Fed has slashed rates to basically zero. And the banks have slashed the rates they pay on deposits to basically zero. So they can have all the money they wantfor nearly free!

When you can borrow money for nothing, and lend it back to the government risk-free for a few percentage points, you can COIN MONEY. And the banks are doing that. According to IRA, the "net interest margin" made by US banks in the first six months of this year is $211 Billion. Nice!

And that has helped produce $58 billion of profit in the first six months of the year.

And it has helped generate near-record financial sector profitswhile the rest of the country struggles with its 9% unemployment rate.

And these profits are getting back toward a record as a percentage of all corporate profits.

And those profits, of course, are AFTER the banks have paid their bankers. And it's still great to be a banker. The average banker in New York City made $361,330 in 2010. Not bad!

This average Wall Street salary was 6X the average private-sector salary (which, in turn, is actually lower than the average government salary, but that's a different issue).

And so, in conclusion, we'll end with another look at the "money shot"the one overarching reason the Wall Street protesters are so upset: Wages as a percent of the economy. Again, it's basically the lowest it has ever been.

heeee heeee hardy har har

Dragon

Senior Member

- Sep 16, 2011

- 5,481

- 588

- 48

Thats what your Obama saidChange America for the better.

And his failure to keep that promise is why he's no longer "our" Obama, and why young people are now turning to street protests instead of working for his reelection.

Here's another thing to be mad about. Apparently a number of protesters went into Citibank at 555 LaGuardian in NYC and tried to close their accounts. The bank closed its doors, called the police, and had them arrested.

http://www.facebook.com/OccupyTogether/posts/179622102119358

http://www.livestream.com/globalrevolution

Last edited:

California Girl

Rookie

- Oct 8, 2009

- 50,337

- 10,058

- 0

- Banned

- #30

They don't want to change America. They want to take over the world.

Could in the long run be true. This is turning into a global movement. Well, it's an increasingly globalized world, so that shouldn't be too surprising.

Yea, a whole 1000 people turned out in London.

They had a better attendance for the riots. In fact, they had more three times that arrested for the riots. Some 'success' OWS. Idiots.

They had a better attendance for the riots. In fact, they had more three times that arrested for the riots. Some 'success' OWS. Idiots.Maybe the prior arrested had had enough pwning for one milllenium?They don't want to change America. They want to take over the world.

Could in the long run be true. This is turning into a global movement. Well, it's an increasingly globalized world, so that shouldn't be too surprising.

Yea, a whole 1000 people turned out in London.They had a better attendance for the riots. In fact, they had more three times that arrested for the riots. Some 'success' OWS. Idiots.

Dragon

Senior Member

- Sep 16, 2011

- 5,481

- 588

- 48

Yea, a whole 1000 people turned out in London.

Pretty damned good for a sympathy protest for a foreign issue set up on very short notice in London in mid October.

Photonic

Ad astra!

Thats what you're Obama saidMove to Iran

Change America for the better.

Yea, fuck it, why not.

Let's keep America in the state it's in.

It's obviously working SO WELL.

CHARTS: Here's What The Wall Street Protesters Are So Angry About...

Let's start with the obvious: Unemployment. Three years after the financial crisis, the unemployment rate is still at the highest level since the Great Depression (except for a brief blip in the early 1980s)

Corporate profits just hit another all-time high.

Corporate profits as a percent of the economy are near a record all-time high. With the exception of a brief happy period in 2007 (just before the crash), profits are higher than they've been since the 1950s. And they are VASTLY higher than they've been for most of the intervening half-century.

CEO pay is now 350X the average worker's, up from 50X from 1960-1985.

CEO pay has skyrocketed 300% since 1990. Corporate profits have doubled. Average "production worker" pay has increased 4%. The minimum wage has dropped. (All numbers adjusted for inflation).

After adjusting for inflation, average hourly earnings haven't increased in 50 years.

In short... while CEOs and shareholders have been cashing in, wages as a percent of the economy have dropped to an all-time low.

In other words, in the struggle between "labor" and "capital," capital has basically won.

Of course, life is great if you're in the top 1% of American wage earners. You're hauling in a bigger percentage of the country's total pre-tax income than you have at any time since the late 1920s. Your share of the national income, in fact, is almost 2X the long-term average!

In fact, income inequality has gotten so extreme here that the US now ranks 93rd in the world in "income equality." China's ahead of us. So is India. So is Iran.

And, by the way, few people would have a problem with inequality if the American Dream were still fully intact—if it were easy to work your way into that top 1%. But, unfortunately, social mobility in this country is also near an all-time low.

So what does all this mean in terms of net worth? Well, for starters, it means that the top 1% of Americans own 42% of the financial wealth in this country. The top 5%, meanwhile, own nearly 70%.

And remember that huge debt problem we have—with hundreds of millions of Americans indebted up to their eyeballs? Well, the top 1% doesn't have that problem. They only own 5% of the country's debt.

And then there are taxes... It's a great time to make a boatload of money in America, because taxes on the nation's highest-earners are close to the lowest they've ever been.

More to come....

Corporate profits ROSE--because companies laid off their BIGGEST expense. Employees--due to this stagnant economy. You'll note that quarter to quarter profits have been stagnant because the biggest expense for corporations is no longer a factor. Now investors are looking for REAL profit because of ACTUAL growth in sales--(which isn't happening.)

China and India are working--We're NOT.

And until Barack Obama is gone along with Obamacare and the zillions of regulations he has imposed on business--we won't get any new job growth.

Obama for 4 years now has continually threatened business with higher taxes. That's all he knows how to do. THREATEN EVERYONE. Then he shoved Obamacare down their throats.--making it even harder for them to see the daylight--on what they're future expenses are going to be. In return they have tucked in like a turtle and are waiting for the threat to leave.

If you don't believe me--then BELIEVE one of your own a DEMOCRAT and CEO

Steve Wynn--of Wynn's resort and Casino--Las Vegas Nevada--democrat and strong support of senate democrat majority leader Harry Reid.“I’m saying it bluntly, that this administration is the greatest wet blanket to business, progress and job creation in my lifetime. A lot of people don’t want to say that. They’ll say, ‘Oh God, don’t be attacking Obama.’ Well, this is Obama’s deal, and it’s Obama that’s responsible for this fear in America.”

“The guy [Obama] keeps making speeches about redistribution, and maybe ‘we ought to do something to businesses that don’t invest or hold too much money.’ We haven’t heard that kind of talk except from pure socialists.”

“Business is being hammered. The business community in this country is frightened to death of the weird political philosophy of the president of the United States. Until he’s gone, everybody’s going to be sitting on their thumbs.”

Steve Wynn's Anti-Obama Rant - Is He Right? | BNET

Last edited:

Mr.Nick

VIP Member

- May 10, 2011

- 9,604

- 719

- 83

CHARTS: Here's What The Wall Street Protesters Are So Angry About...

Let's start with the obvious: Unemployment. Three years after the financial crisis, the unemployment rate is still at the highest level since the Great Depression (except for a brief blip in the early 1980s)

Corporate profits just hit another all-time high.

Corporate profits as a percent of the economy are near a record all-time high. With the exception of a brief happy period in 2007 (just before the crash), profits are higher than they've been since the 1950s. And they are VASTLY higher than they've been for most of the intervening half-century.

CEO pay is now 350X the average worker's, up from 50X from 1960-1985.

CEO pay has skyrocketed 300% since 1990. Corporate profits have doubled. Average "production worker" pay has increased 4%. The minimum wage has dropped. (All numbers adjusted for inflation).

After adjusting for inflation, average hourly earnings haven't increased in 50 years.

In short... while CEOs and shareholders have been cashing in, wages as a percent of the economy have dropped to an all-time low.

In other words, in the struggle between "labor" and "capital," capital has basically won.

Of course, life is great if you're in the top 1% of American wage earners. You're hauling in a bigger percentage of the country's total pre-tax income than you have at any time since the late 1920s. Your share of the national income, in fact, is almost 2X the long-term average!

In fact, income inequality has gotten so extreme here that the US now ranks 93rd in the world in "income equality." China's ahead of us. So is India. So is Iran.

And, by the way, few people would have a problem with inequality if the American Dream were still fully intactif it were easy to work your way into that top 1%. But, unfortunately, social mobility in this country is also near an all-time low.

So what does all this mean in terms of net worth? Well, for starters, it means that the top 1% of Americans own 42% of the financial wealth in this country. The top 5%, meanwhile, own nearly 70%.

And remember that huge debt problem we havewith hundreds of millions of Americans indebted up to their eyeballs? Well, the top 1% doesn't have that problem. They only own 5% of the country's debt.

And then there are taxes... It's a great time to make a boatload of money in America, because taxes on the nation's highest-earners are close to the lowest they've ever been.

More to come....

If everything you say is true what is your solution??

Oh yeah - socialism - er a government dictated economy..

Its only the libertarians who are calling for an end to dictated pseudo capitalism - they want capitalism - you want socialism..

Not to mention 75% of those stupid OWS squatters are only there for the party... They don't know what the fuck is going on other than there is a huge rave..

Oh and many are being paid to be there - that has been established.

Wait until it starts snowing.

- Thread starter

- #37

Bush lowered taxes for the rich and defunded the government.

Then Wall Street ran a $516 trillion dollar derivative Ponzi scheme which destroyed the world economy.

The government then had to bail out the banks, so they would start lending again.

But because Bush defunded the government, the government had to borrow money from the banks in the form of Treasuries.

So the bankers got their tax rate cut, then stole money which the government replaced, and now the Fed is loaning them money at 0% which they are loaning back to the government and earning interest on.

Is this a great country or what?

Then Wall Street ran a $516 trillion dollar derivative Ponzi scheme which destroyed the world economy.

The government then had to bail out the banks, so they would start lending again.

But because Bush defunded the government, the government had to borrow money from the banks in the form of Treasuries.

So the bankers got their tax rate cut, then stole money which the government replaced, and now the Fed is loaning them money at 0% which they are loaning back to the government and earning interest on.

Is this a great country or what?

Teals_Of_Wonder

Rookie

- Banned

- #38

they are also angry that Heir Soros didn't provide them with those Blue Porto-Potty's and cheap toilet paper! well Thank God For Lawns, Cars, Trees, and sleeping homeless people.

- Thread starter

- #39

they are also angry that Heir Soros didn't provide them with those Blue Porto-Potty's and cheap toilet paper! well Thank God For Lawns, Cars, Trees, and sleeping homeless people.

Useless post of the year.

Nice try at changing the subject, though.

Ironically the OWS and the TPM are essantially both angry about the same problems.

They just lay the blame on different folks.

the TPM sees the government's responisiblity and seem to give the Wall Street commercial banksters a total pass.

The OWS seems to blame ALL corporations (and a select group in government) responsible.

Players from both populist organizations need to READ MORE.

They just lay the blame on different folks.

the TPM sees the government's responisiblity and seem to give the Wall Street commercial banksters a total pass.

The OWS seems to blame ALL corporations (and a select group in government) responsible.

Players from both populist organizations need to READ MORE.

Similar threads

- Replies

- 47

- Views

- 642

- Replies

- 173

- Views

- 2K

- Replies

- 263

- Views

- 3K

- Replies

- 45

- Views

- 530

- Replies

- 275

- Views

- 2K

Latest Discussions

- Replies

- 43

- Views

- 264

- Replies

- 1

- Views

- 2

- Replies

- 46

- Views

- 273

- Replies

- 62

- Views

- 286

Forum List

-

-

-

-

-

Political Satire 8037

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-