Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Volcker rule strengthened thangod 12/9/13

- Thread starter Dot Com

- Start date

Kimura

VIP Member

Expect this as my response to you going forward. Nothing else needs to be said. You're fuckin' drunk on central planning stupidity.

TakeAStepBack

Gold Member

- Mar 29, 2011

- 13,935

- 1,742

- 245

TakeAStepBack

Gold Member

- Mar 29, 2011

- 13,935

- 1,742

- 245

Lick my wounds?

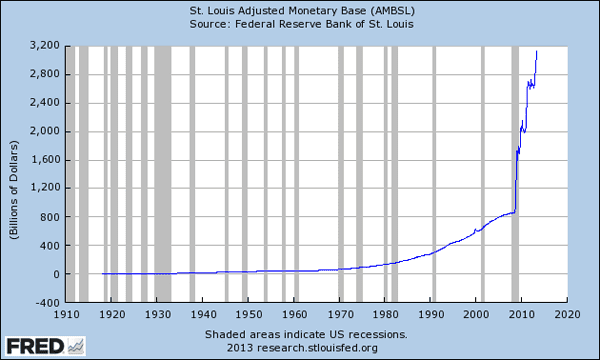

You do not even know what you're talking about. Neither does Kinura. He believes the fed can increase its balance sheet indefintely and also that the federal reserves QE efforts havent resulted in any change to supply. Here is a clue for him. This one will completely go over your head, Dot.

What is the moneatary base? I'll leave good ol' Kimura to come out again with some repeater and play make believe that when the federal reserve creates credits to buy assets from banks, it does, in fact, change the monetary base. High powered changes the supply of demand deposits through loan-making.

Now, before our resident Kimura comes in to say "but the federal reserve makes it so that banks can not lend out these reserves." But, they can later and our resident Kimura here says that it's no problem. Because the federal reserve can continue to buy endlessly and increase its balance sheet to say, oh, who cares? 200 trillion even. It doesn't matter. But it actually does matter. And I am sure our resident Kimura knows that and why it is important. But does not like to address such things when the agenda is to say that QE is simply an asset swap and that additional bank reserves aren't lent out or turned into currency.

Of coure, this misses the essential point I've brought up and even after so, we continue to play "repeater". As if i need our resident Kurmit to explain monetary affairs to me.

its fuckin' boring. And there are no wounds to be licked or tended to.

And lastly, Dot, I'm not the moron who though the Volcker rule meant increased capital reserve requirements.

You do not even know what you're talking about. Neither does Kinura. He believes the fed can increase its balance sheet indefintely and also that the federal reserves QE efforts havent resulted in any change to supply. Here is a clue for him. This one will completely go over your head, Dot.

What is the moneatary base? I'll leave good ol' Kimura to come out again with some repeater and play make believe that when the federal reserve creates credits to buy assets from banks, it does, in fact, change the monetary base. High powered changes the supply of demand deposits through loan-making.

Now, before our resident Kimura comes in to say "but the federal reserve makes it so that banks can not lend out these reserves." But, they can later and our resident Kimura here says that it's no problem. Because the federal reserve can continue to buy endlessly and increase its balance sheet to say, oh, who cares? 200 trillion even. It doesn't matter. But it actually does matter. And I am sure our resident Kimura knows that and why it is important. But does not like to address such things when the agenda is to say that QE is simply an asset swap and that additional bank reserves aren't lent out or turned into currency.

Of coure, this misses the essential point I've brought up and even after so, we continue to play "repeater". As if i need our resident Kurmit to explain monetary affairs to me.

its fuckin' boring. And there are no wounds to be licked or tended to.

And lastly, Dot, I'm not the moron who though the Volcker rule meant increased capital reserve requirements.

Last edited:

Kimura

VIP Member

Lick my wounds?

You do not even know what you're talking about. Neither does Kinura. He believes the fed can increase its balance sheet indefintely and also that the federal reserves QE efforts havent resulted in any change to supply. Here is a clue for him. This one will completely go over your head, Dot.

What is the moneatary base? I'll leave good ol' Kimura to come out again with some repeater and play make believe that when the federal reserve creates credits to buy assets from banks, it does, in fact, change the monetary base. High powered changes the supply of demand deposits through loan-making.

Now, before our resident Kimura comes in to say "but the federal reserve makes it so that banks can not lend out these reserves." But, they can later and our resident Kimura here says that it's no problem. Because the federal reserve can continue to buy endlessly and increase its balance sheet to say, oh, who cares? 200 trillion even. It doesn't matter. But it actually does matter. And I am sure our resident Kimura knows that and why it is important. But does not like to address such things when the agenda is to say that QE is simply an asset swap and that additional bank reserves aren't lent out or turned into currency.

Of coure, this misses the essential point I've brought up and even after so, we continue to play "repeater". As if i need our resident Kurmit to explain monetary affairs to me.

its fuckin' boring. And there are no wounds to be licked or tended to.

And lastly, Dot, I'm not the moron who though the Volcker rule meant increased capital reserve requirements.

The QUANTITY of BASE $$$$ has NOTHING to do with banks lending. An increase in the quantity of total reserves doesn't result in increased lending. All it does is affect price which translates into a lower fed funds rate.

An increase in reserves isn't automatic, but has to be done by the FED to set the target rate. Reserves have to be supplied by the FED, they don't trickle into or out of the banking system on a whim.

Central banks cannot control the supply of $$$$, all they can do is control interest rates.

Last edited:

this is my first post

this is the same as glass stegall. the stupidity of grahm leach was that glass stegal protected the economy for 60 years from another collaspe. when clinton signed grahm leach there were congressmen predicting a collaspe in ten years. they were wrong, it happened in eight.

unbelievable, keep commercial banking and investment banking separate

this is the same as glass stegall. the stupidity of grahm leach was that glass stegal protected the economy for 60 years from another collaspe. when clinton signed grahm leach there were congressmen predicting a collaspe in ten years. they were wrong, it happened in eight.

unbelievable, keep commercial banking and investment banking separate

^ ummm..... maybe in Randianworld higher reserve capital req'ts are a bad thing.

Forcing them to keep adequete reserves to cover their zany bets is a good thing in grown-up world.

Except when it comes to Government spending

??? How do you reconcile that???

??? How do you reconcile that???Similar threads

Latest Discussions

- Replies

- 127

- Views

- 486

- Replies

- 4

- Views

- 5

- Replies

- 110

- Views

- 362

Forum List

-

-

-

-

-

Political Satire 8040

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-

Take some time off to lick your wounds.

Take some time off to lick your wounds.

You should see my thread on what Ryan just did

You should see my thread on what Ryan just did  "Compromised" on the budget

"Compromised" on the budget