FA_Q2

Gold Member

I assume you mean Bush, not Obama.I agree 110%. Banks should not be allowed to take the peoples savings and play with it at the Wall Street Casino.Until we bring back something pretty damn similar to Glass Steagall, banks will continue to have outsized influence in our economy.

.

And derivatives are simply insane.

Oh it is much worse than that. It isn't a Casino.

The key word here.... LEVERAGE.

And the government gave these investment banks taxpayer dollars, virtually for free, $trillions over several decades.

What is leverage?

Well let's say you know some good properties, that are sure to turn a profit. They are all worth $100 million, potential profit is $20 million.

But you only have $1 million. If you get investors to line up with you... you have divide that $20 million between all of them, and potentially they will get more of it than you since it is their money you are risking.

But wait...

There is SUPER FEDMAN to the rescue... "we will give you taxpayer money so you don't have to get investors!!".... Yay!!! ... GO SUPER FEDMAN!!!

So you take $99 million of taxpayer dollars at 1%... you made $20 million, and only have to give the government back $990,000 in interest.

So you keep $19 million.

LET'S DO THIS AGAIN!!!

And again, and again, and again.

And that is still happening today...and while Obama was President it happened at record amounts.

.

Oh hell no.

All of this began before Bush. And really Bush, himself, had little to do with it. He knew nothing. If there was ever a manchurian President, it was Bush.

Bush would sign whatever Cheney, advisors, and the FED wanted him to because he figured they knew what they were doing.

Obama was different. I absolutely believe he knew what had happened in the past, as equally well as what happened while he was President. Including providing $70 Billion PER MONTH in taxpayer dollars for direct debt buyout including the debt holders profits, leverage money and slush money. The result was record rise and record profits for the VERY SAME PEOPLE who created the mortgage crises. Meanwhile people lost everything, they got nothing. But the people who held the mortgages got it all. Including 100% of their profits.

Obama was different. I absolutely believe he knew what had happened in the past, as equally well as what happened while he was President. Including providing $70 Billion PER MONTH in taxpayer dollars for direct debt buyout including the debt holders profits, leverage money and slush money.

Nobody used taxpayer dollars for any "direct debt buyout" under Obama.

But the people who held the mortgages got it all. Including 100% of their profits.

Banks lost hundreds of billions of dollars on crappy mortgages.

I seem to be missing the hundreds of billions that were missing in profits.

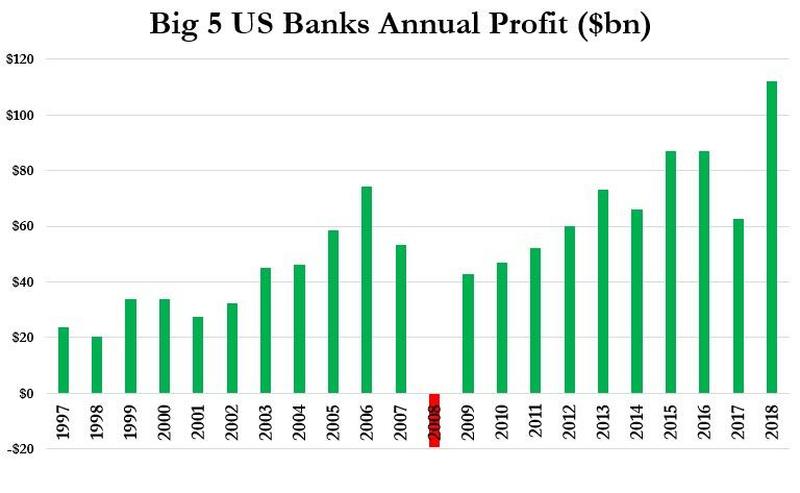

The losses in 2008 did not even take half the profits of the year before or after. Those banks that went out of burliness (like WAMU) did so because they were over leveraged in mortgages, most of them not crappy at all but rather because crappy when the entire market collapsed. Of course, JP Morgan simply bought WAMU and became even larger.