Ed,

I did not know that you believed yourself to be an economic scholar. Let me help you to reassess. You are an economics idiot.

In any basic econ class that goes into micro economics, you will find that price is not determined by cost but by supply and demand. For a number of reasons that would be too complex for you to understand (though quite simple for everyone else). Cost only determines profit margin of the product. If you are stupid enough to price your product based on cost, your competitors will indeed take you out, over time.

Of course, that is in a case of perfect competition, or the Market System. Of course, if you are GE, or Exxon, then you can price as you are able based on the elasticity of supply (again, I would explain this to you, but probably well beyond your simple mind).

And no, I never wondered about comparative prices between cars and apples. If you are wondering about that yourself, you should probably be committed. To the rest of us, the issue is obvious.

So, what you believe is that we should cover tax costs for corporations. And I asked you for examples of where that had been done. Obviously, you failed to find any.

Let me know when you need your next econ lesson. Hopefully, someone else will do it next time, Schooling idiots is boring.

Supply is also a function of cost. If it costs less, then there will be more supply, all else considered. Ed is right about that.

Ed is not right that all taxes are passed along towards consumers. Some are, some are not. It depends on price elasticity. If prices are less elastic, more will be passed on to consumers. If prices are more elastic, the cost is born more so by shareholders. However, taxes will decrease supply since it increases costs. Eventually, the return on capital will recalibrate to its opportunity cost, and if the relative opportunity cost increases, capital will leave and supply will as well. If all taxes were passed on to the consumer, then corporations would never fight a tax increase, since it could merely be passed on to consumers. This, obviously, is not the case.

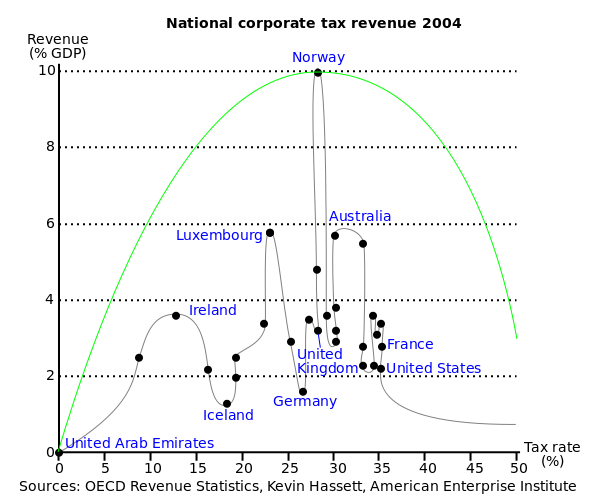

The Laffer curve is, for the most part, bullshit as it applies to income taxes in the US, except maybe at very high levels. But the empirical evidence is that cutting corporate taxes does increase total tax revenues since it increases economic activity. We should be cutting corporate income taxes in America and eliminating tax deductions, including many of the nonsense offshore tax-sheltering gimmicks companies use to shelter income.

Welfare? What a ******* joke!

Welfare? What a ******* joke!