Within the CARES Act 880 pages there appears to be a $454 billion slush fund designed to kill Wall Street's two main legitimate functions: price discovery and prudent capital allocation.

The Fed Is Killing the Two Main Functions of Wall Street: Price Discovery and Prudent Capital Allocation

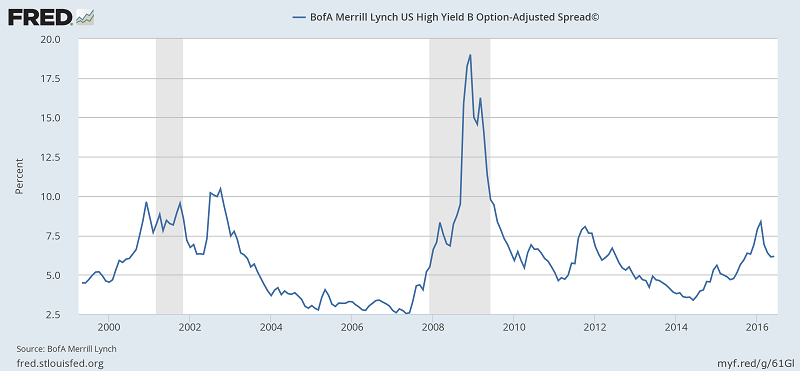

"On Thursday, knowing that a three-day Easter weekend was coming and the attention of the public would be elsewhere, the Federal Reserve announced that it would allow two of its emergency lending programs to begin buying junk bonds.

"Those are bonds with less than an investment-grade credit rating, meaning they have a greater likelihood of defaulting.

"The Fed is not simply accepting junk bonds as collateral for loans, it will actually be buying junk bonds — potentially hundreds of billions of dollars of them."

The Fed Is Killing the Two Main Functions of Wall Street: Price Discovery and Prudent Capital Allocation

"On Thursday, knowing that a three-day Easter weekend was coming and the attention of the public would be elsewhere, the Federal Reserve announced that it would allow two of its emergency lending programs to begin buying junk bonds.

"Those are bonds with less than an investment-grade credit rating, meaning they have a greater likelihood of defaulting.

"The Fed is not simply accepting junk bonds as collateral for loans, it will actually be buying junk bonds — potentially hundreds of billions of dollars of them."