Winston

Platinum Member

Seems like they are paying their fair share to me

-Geaux

--------------------

(Bloomberg) -- Individual income taxes are the federal government’s single biggest revenue source. In fiscal year 2018, which ended Sept. 30, the individual income tax is expected to bring in roughly $1.7 trillion, or about half of all federal revenues, according to the Congressional Budget Office.

If past statistics can offer any guidance, in 2016, $1.44 trillion income taxes were paid by 140.9 million taxpayers reporting a total of $10.2 trillion in adjusted gross income, according to data recently released by the Internal Revenue Services.

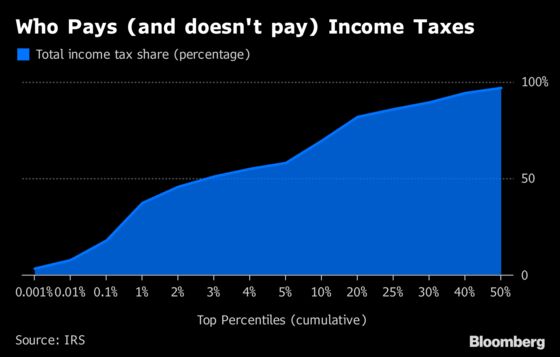

Bloomberg looked into the 2016 individual returns data in detail for some additional insights illustrated in the charts below:

- The top 1 percent paid a greater share of individual income taxes (37.3 percent) than the bottom 90 percent combined (30.5 percent).

- The top 50 percent of all taxpayers paid 97 percent of total individual income taxes.

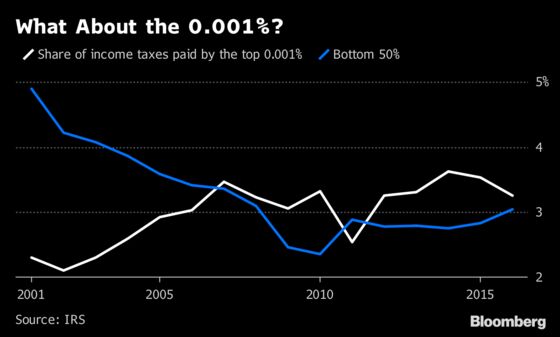

- In other words, the bottom 50 percent paid 3 percent. Which small percentile of tax payers also paid 3 percent or more? You might have guessed it. It is the top 0.001%, or about 1,400 taxpayers. That group alone paid 3.25 percent of all income taxes. In 2001, the bottom 50 percent paid nearly 5 percent whereas the top 0.001 percent of filers paid 2.3 percent of income taxes.

Top 3% of U.S. Taxpayers Paid Majority of Income Taxes in 2016

- The individual income tax system is designed to be progressive – those with higher incomes pay at higher rates. While the indentation, or the reduction in the steepness of the "progressivity" curve, is visible at the highest levels.

Yet the rich get richer...

Income gap is continuing to grow.. Trump is just increasing that..

“Income gap”

WTF...why are you so envious of your neighbor who’s done better than you? Pull your head from your ass and go get yours. Simple shit.

My college roommate received more from his trust fund every year than you will make in your lifetime. How did he go get that?