Marion Morrison

Diamond Member

- Feb 10, 2017

- 59,298

- 16,868

- 2,190

- Banned

- #21

PS: The Bushes are dickheads.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

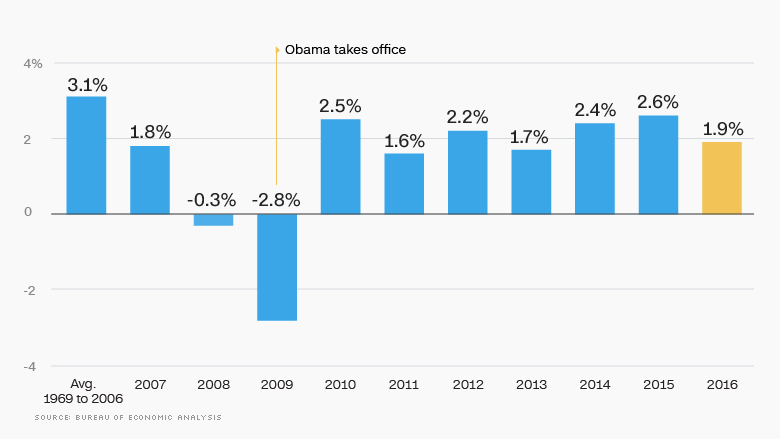

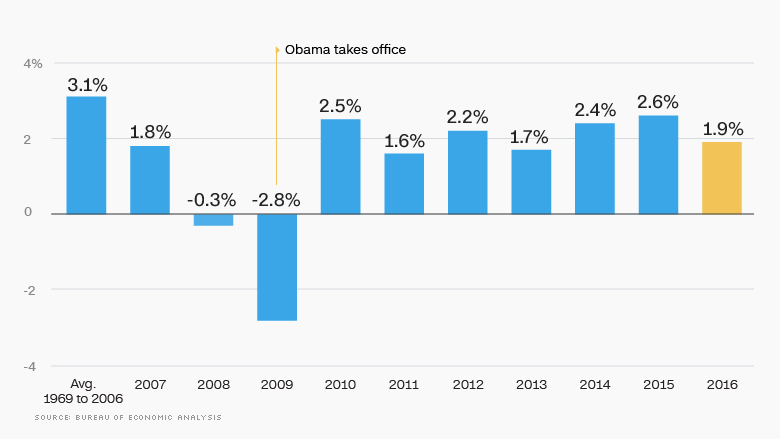

Keep in mind Barry Hussein didn't crack 3% GDP in all of his eight years.

Global CEO optimism under Trump is north of 53%, that's the first time its ever been above 50%, ever. The best Obama did was 33%. US small business owners also the most optimistic they have ever been, ever, in decades, since they even started polling them.

Link?

www.google.com

Link?

Crybaby before the fact sez what?

Keep in mind Barry Hussein didn't crack 3% GDP in all of his eight years.

Global CEO optimism under Trump is north of 53%, that's the first time its ever been above 50%, ever. The best Obama did was 33%. US small business owners also the most optimistic they have ever been, ever, in decades, since they even started polling them.

Link?

www.google.com

Just as I thought...you made it up. You are full of shit.

So noted.

Have a nice day....liar.

Keep in mind Barry Hussein didn't crack 3% GDP in all of his eight years.

Global CEO optimism under Trump is north of 53%, that's the first time its ever been above 50%, ever. The best Obama did was 33%. US small business owners also the most optimistic they have ever been, ever, in decades, since they even started polling them.

Link?

www.google.com

Just as I thought...you made it up. You are full of shit.

So noted.

Have a nice day....liar.

This will sting OP tomorrow like a bee, maybe a yellowjacket, because it will be recurring:

Ouch, I like that you rub salt in the left's wounds

Keep in mind Barry Hussein didn't crack 3% GDP in all of his eight years.

Global CEO optimism under Trump is north of 53%, that's the first time its ever been above 50%, ever. The best Obama did was 33%. US small business owners also the most optimistic they have ever been, ever, in decades, since they even started polling them.

Link?

www.google.com

Just as I thought...you made it up.

Another Trumpbot loser.

So noted.

Off to my ignore list for you.

Have a nice day.

This will sting OP tomorrow like a bee, maybe a yellowjacket, because it will be recurring:

Ouch, I like that you rub salt in the left's wounds

I rub salt in my own wounds, if necessary. It draws the infection out.

'Tomorrow, the US Department of Commerce will report its advance estimate of 2Q GDP which will be the long-awaited evidence that “Trumponomics” is working. The current estimates for the initial print run the gamut from 3.9% to over 5% annualized growth. Regardless of the actual number, the White House spokesman will be quick to take credit for success in turning America’s economy around.

...

Secondly, while the print will undoubtedly be a strong one, and not unexpected following a weak Q1 growth rate, the question is whether it is sustainable? A recent note from Goldman Sachs suggests some caution:

“An unusually large number of one-off factors appear to have boosted 2Q GDP, many of which are directly related to escalating trade concerns. As companies and countries race to secure supplies that may become expensive later on, exports have surged and inventories have swelled. If these trends are one-time adjustments (and our economists believe they are), the ‘payback’ in 2H could be significant. Enjoy the 2Q GDP number, which may be the last best print for a while.”

This is likely correct. As 2018 has seen a steady increase in trade tensions, and trade actions, between the US and its trading partners, we have already begun to see some of the negative impacts from those actions. Just this past week Boeing ($BA), General Motors ($GM) and Whirlpool ($WHR) all had disappointing reports with comments directly related to the negative impact of tariffs on their results. They are surely not going to be the last as the US has slapped tariffs on washing machines and solar panels in January, on steel and aluminum in March, and on US$34 billion of goods from China on July 6. Now, the administration is talking about another 25% tariff on close to $200 billion in foreign-made automobiles later this year.

Morgan Stanley also made very similar comments in their recent analysis about the unusually large number of one-off factors which appear to have boosted 2Q GDP, most of which are directly related to escalating trade concerns.

“As companies and countries race to secure supplies that may become expensive later on, exports have surged and inventories have swelled. If these trends are one-time adjustments (and our economists believe they are), the ‘payback’ in 2H could be significant. Enjoy the 2Q GDP number, which may be the last best print for a while.

The ‘stockpiling’ in exports could be responsible for 1.5 percentage points of our 4.7% 2Q GDP estimate. ‘Stockpiling’ also appears to be at work for US companies, albeit to a more limited extent. The inventory build in 2Q is tracking at +US$38 billion, versus a +US$10 billion rate in the prior two quarters. And what’s more interesting is the areas where those inventories are building, which have material overlaps with trade: electrical goods, machinery equipment, motor vehicles and parts.”

In other words, the contribution to Q2 GDP from inventories alone would be roughly 2.2%, or roughly 50%, of the total increase. Such would be the single biggest combined contribution since 4Q11 when the U.S. was restocking auto inventories following the tsunami-related shutdown of Japan.

These one-off adjustments are unsustainable and simply represent the pull-forward of demand that will be given back over the subsequent quarters. Following the economic reboot in Q4 of 2011, as Japan’s manufacturing came back online, the next five quarters averaged just 1.6%.'

The Mirage That Will Be Q2 GDP

In other words...the Q2 2018 GDP Growth will almost certainly be big when the initial numbers are released tomorrow.

BUT...as much as half of that GDP growth could be due to increases in inventories due to Trump's tariffs/the trade war fears.

Conclusion? Tomorrow's numbers will probably be a one off. The economy will probably go back to growing at it's tepid pace by year end - since it has since Trump took over AND since 2009.

Once again...I am neither Dem nor Rep.

'Tomorrow, the US Department of Commerce will report its advance estimate of 2Q GDP which will be the long-awaited evidence that “Trumponomics” is working. The current estimates for the initial print run the gamut from 3.9% to over 5% annualized growth. Regardless of the actual number, the White House spokesman will be quick to take credit for success in turning America’s economy around.

...

Secondly, while the print will undoubtedly be a strong one, and not unexpected following a weak Q1 growth rate, the question is whether it is sustainable? A recent note from Goldman Sachs suggests some caution:

“An unusually large number of one-off factors appear to have boosted 2Q GDP, many of which are directly related to escalating trade concerns. As companies and countries race to secure supplies that may become expensive later on, exports have surged and inventories have swelled. If these trends are one-time adjustments (and our economists believe they are), the ‘payback’ in 2H could be significant. Enjoy the 2Q GDP number, which may be the last best print for a while.”

This is likely correct. As 2018 has seen a steady increase in trade tensions, and trade actions, between the US and its trading partners, we have already begun to see some of the negative impacts from those actions. Just this past week Boeing ($BA), General Motors ($GM) and Whirlpool ($WHR) all had disappointing reports with comments directly related to the negative impact of tariffs on their results. They are surely not going to be the last as the US has slapped tariffs on washing machines and solar panels in January, on steel and aluminum in March, and on US$34 billion of goods from China on July 6. Now, the administration is talking about another 25% tariff on close to $200 billion in foreign-made automobiles later this year.

Morgan Stanley also made very similar comments in their recent analysis about the unusually large number of one-off factors which appear to have boosted 2Q GDP, most of which are directly related to escalating trade concerns.

“As companies and countries race to secure supplies that may become expensive later on, exports have surged and inventories have swelled. If these trends are one-time adjustments (and our economists believe they are), the ‘payback’ in 2H could be significant. Enjoy the 2Q GDP number, which may be the last best print for a while.

The ‘stockpiling’ in exports could be responsible for 1.5 percentage points of our 4.7% 2Q GDP estimate. ‘Stockpiling’ also appears to be at work for US companies, albeit to a more limited extent. The inventory build in 2Q is tracking at +US$38 billion, versus a +US$10 billion rate in the prior two quarters. And what’s more interesting is the areas where those inventories are building, which have material overlaps with trade: electrical goods, machinery equipment, motor vehicles and parts.”

In other words, the contribution to Q2 GDP from inventories alone would be roughly 2.2%, or roughly 50%, of the total increase. Such would be the single biggest combined contribution since 4Q11 when the U.S. was restocking auto inventories following the tsunami-related shutdown of Japan.

These one-off adjustments are unsustainable and simply represent the pull-forward of demand that will be given back over the subsequent quarters. Following the economic reboot in Q4 of 2011, as Japan’s manufacturing came back online, the next five quarters averaged just 1.6%.'

The Mirage That Will Be Q2 GDP

In other words...the Q2 2018 GDP Growth will almost certainly be big when the initial numbers are released tomorrow.

BUT...as much as half of that GDP growth could be due to increases in inventories due to Trump's tariffs/the trade war fears.

Conclusion? Tomorrow's numbers will probably be a one off. The economy will probably go back to growing at it's tepid pace by year end - since it has since Trump took over AND since 2009.

Once again...I am neither Dem nor Rep.

So the snowflakes are so afraid of the pending GDP report, after Trump has already delivered the best economy in decades, that they have to launch pre-emptive emotional rants and attacks to try to discredit it before it is even released...

BWUHAHAHAHAHA....

'Tomorrow, the US Department of Commerce will report its advance estimate of 2Q GDP which will be the long-awaited evidence that “Trumponomics” is working. The current estimates for the initial print run the gamut from 3.9% to over 5% annualized growth. Regardless of the actual number, the White House spokesman will be quick to take credit for success in turning America’s economy around.

...

Secondly, while the print will undoubtedly be a strong one, and not unexpected following a weak Q1 growth rate, the question is whether it is sustainable? A recent note from Goldman Sachs suggests some caution:

“An unusually large number of one-off factors appear to have boosted 2Q GDP, many of which are directly related to escalating trade concerns. As companies and countries race to secure supplies that may become expensive later on, exports have surged and inventories have swelled. If these trends are one-time adjustments (and our economists believe they are), the ‘payback’ in 2H could be significant. Enjoy the 2Q GDP number, which may be the last best print for a while.”

This is likely correct. As 2018 has seen a steady increase in trade tensions, and trade actions, between the US and its trading partners, we have already begun to see some of the negative impacts from those actions. Just this past week Boeing ($BA), General Motors ($GM) and Whirlpool ($WHR) all had disappointing reports with comments directly related to the negative impact of tariffs on their results. They are surely not going to be the last as the US has slapped tariffs on washing machines and solar panels in January, on steel and aluminum in March, and on US$34 billion of goods from China on July 6. Now, the administration is talking about another 25% tariff on close to $200 billion in foreign-made automobiles later this year.

Morgan Stanley also made very similar comments in their recent analysis about the unusually large number of one-off factors which appear to have boosted 2Q GDP, most of which are directly related to escalating trade concerns.

“As companies and countries race to secure supplies that may become expensive later on, exports have surged and inventories have swelled. If these trends are one-time adjustments (and our economists believe they are), the ‘payback’ in 2H could be significant. Enjoy the 2Q GDP number, which may be the last best print for a while.

The ‘stockpiling’ in exports could be responsible for 1.5 percentage points of our 4.7% 2Q GDP estimate. ‘Stockpiling’ also appears to be at work for US companies, albeit to a more limited extent. The inventory build in 2Q is tracking at +US$38 billion, versus a +US$10 billion rate in the prior two quarters. And what’s more interesting is the areas where those inventories are building, which have material overlaps with trade: electrical goods, machinery equipment, motor vehicles and parts.”

In other words, the contribution to Q2 GDP from inventories alone would be roughly 2.2%, or roughly 50%, of the total increase. Such would be the single biggest combined contribution since 4Q11 when the U.S. was restocking auto inventories following the tsunami-related shutdown of Japan.

These one-off adjustments are unsustainable and simply represent the pull-forward of demand that will be given back over the subsequent quarters. Following the economic reboot in Q4 of 2011, as Japan’s manufacturing came back online, the next five quarters averaged just 1.6%.'

The Mirage That Will Be Q2 GDP

In other words...the Q2 2018 GDP Growth will almost certainly be big when the initial numbers are released tomorrow.

BUT...as much as half of that GDP growth could be due to increases in inventories due to Trump's tariffs/the trade war fears.

Conclusion? Tomorrow's numbers will probably be a one off. The economy will probably go back to growing at it's tepid pace by year end - since it has since Trump took over AND since 2009.

Once again...I am neither Dem nor Rep.

So the snowflakes are so afraid of the pending GDP report, after Trump has already delivered the best economy in decades, that they have to launch pre-emptive emotional rants and attacks to try to discredit it before it is even released...

BWUHAHAHAHAHA....

That's exactly why Trump fired Yellen and gave the chair to Powell. The Trump tax cuts boosted the stock market but they tempered the stock market bubble by increasing the fed's interest rate.Just a guess here, but, he might be concerned that too many increases in one year will slow down the economy. I mean, that's what increases do.And to those of you who think that economy is growing strongly now? Then why was Trump SOO worried because the Fed is threatening to raise rates?

Trump worries that Fed will raise rates two more times this year, White House official says

Simple.

If the economy was strong...he would not care much. But since the economy still desperately needs low interest rates...he is VERY worried.

And well he should be.

Under the Obama administration when the rate was near zero for 8 years, just the mention of an increase would drive the market down several hundred points.

Keep in mind Barry Hussein didn't crack 3% GDP in all of his eight years.

Neither has Trump so far. And the only time Bush did was when his real estate bubble pushed it north of 3%.Keep in mind Barry Hussein didn't crack 3% GDP in all of his eight years.

LOLGDP is 4.1 today, snowflake! Suck it! Obama's highest was 2.6.

GDP boom: It sure looks like Trumponomics is doing what Obamanomics couldn’t

Winning!