Truthmatters

Diamond Member

- May 10, 2007

- 80,182

- 2,273

- 1,283

- Banned

- #21

Nobody sells anything unless there is a buyer.

we are a consumer driven system

we are a consumer driven system

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Nobody sells anything unless there is a buyer.

we are a consumer driven system

Wow. Just wow.

For starters, the economy sucked before Reagan. That was sort of a big reason he got elected.

Second, "supply side" policy targets the supply of items. The theory is if you make it profitable for people to produce and innovate then they will do that. If you punish them for doing that, they won't. And that is the case, demonstrably so. This has nothing to do with globalization.

But let's consider globalization. We have not seen the kind of inflation we saw in the 1970s since that time. In fact, inflation has been low for the last 20 years. Why? Globalization. Reduced costs. Increased efficiency. We have outsourced low skill manufacturing and insourced high skilled design, marketing, finance, and other functions. The US has been a net beneficiary of globalization, which is why unemployment was very low until the recent turn in the economic cycle. Few were complaining about globalization in 2005 when the UE rate was 5%.

We could erect tariffs and build everything here and it would cost double what it does now. Is that really what we want, destroying our export business in the process? I think not.

The 50's and 60's were pure economic growth. The 70's economy was fi8ne. GDP stiill grew. The perception that the economy was bad was a myth brought on by two Oil Embargos.

See how the GDP and average income diverge when the embargos happened and though GDP continued to rise, average incomes did not.

Now consider what effect that had on tax revenue.

Wow. Just wow.

For starters, the economy sucked before Reagan. That was sort of a big reason he got elected.

Second, "supply side" policy targets the supply of items. The theory is if you make it profitable for people to produce and innovate then they will do that. If you punish them for doing that, they won't. And that is the case, demonstrably so. This has nothing to do with globalization.

But let's consider globalization. We have not seen the kind of inflation we saw in the 1970s since that time. In fact, inflation has been low for the last 20 years. Why? Globalization. Reduced costs. Increased efficiency. We have outsourced low skill manufacturing and insourced high skilled design, marketing, finance, and other functions. The US has been a net beneficiary of globalization, which is why unemployment was very low until the recent turn in the economic cycle. Few were complaining about globalization in 2005 when the UE rate was 5%.

We could erect tariffs and build everything here and it would cost double what it does now. Is that really what we want, destroying our export business in the process? I think not.

The 50's and 60's were pure economic growth. The 70's economy was fi8ne. GDP stiill grew. The perception that the economy was bad was a myth brought on by two Oil Embargos.

See how the GDP and average income diverge when the embargos happened and though GDP continued to rise, average incomes did not.

Now consider what effect that had on tax revenue.

By the 70s we had massive inflation and high unemployment. Stagflation, which no economist had predicted. We saw the destruction of the steel and auto industries due to competition from the Japanese. Even Carter talked about a "malaise". It is historically inaccurate to say the 70s were fine and point to one or two measures. They were not fine. Reagan ran on the "misery" index and won. There was too much taxation, the code was too complex, and too much regulation.

ALready in Carter's time we saw deregulation in: brokerage commissions, telephone rates, airline rates, trucking rates, railroad rates, and probably a couple more. Every one of them brought prices down in those industries. There was still high inflation and very high interest rates were necessary to bring them down. Supply side theory played a part in that because inflation is caused by "too many dollars chasing too few goods." So supply side focused on the goods, and how to encourage more of them.

It was incredibly successful. And will be again.

The Western nations' central banks decided to sharply cut interest rates to encourage growth, deciding that inflation was a secondary concern. Although this was the orthodox macroeconomic prescription at the time, the resulting stagflation surprised economists and central bankers, and the policy is now considered by some to have deepened and lengthened the adverse effects of the embargo.http://en.wikipedia.org/wiki/1973_oil_crisis#Macroeconomic_effects

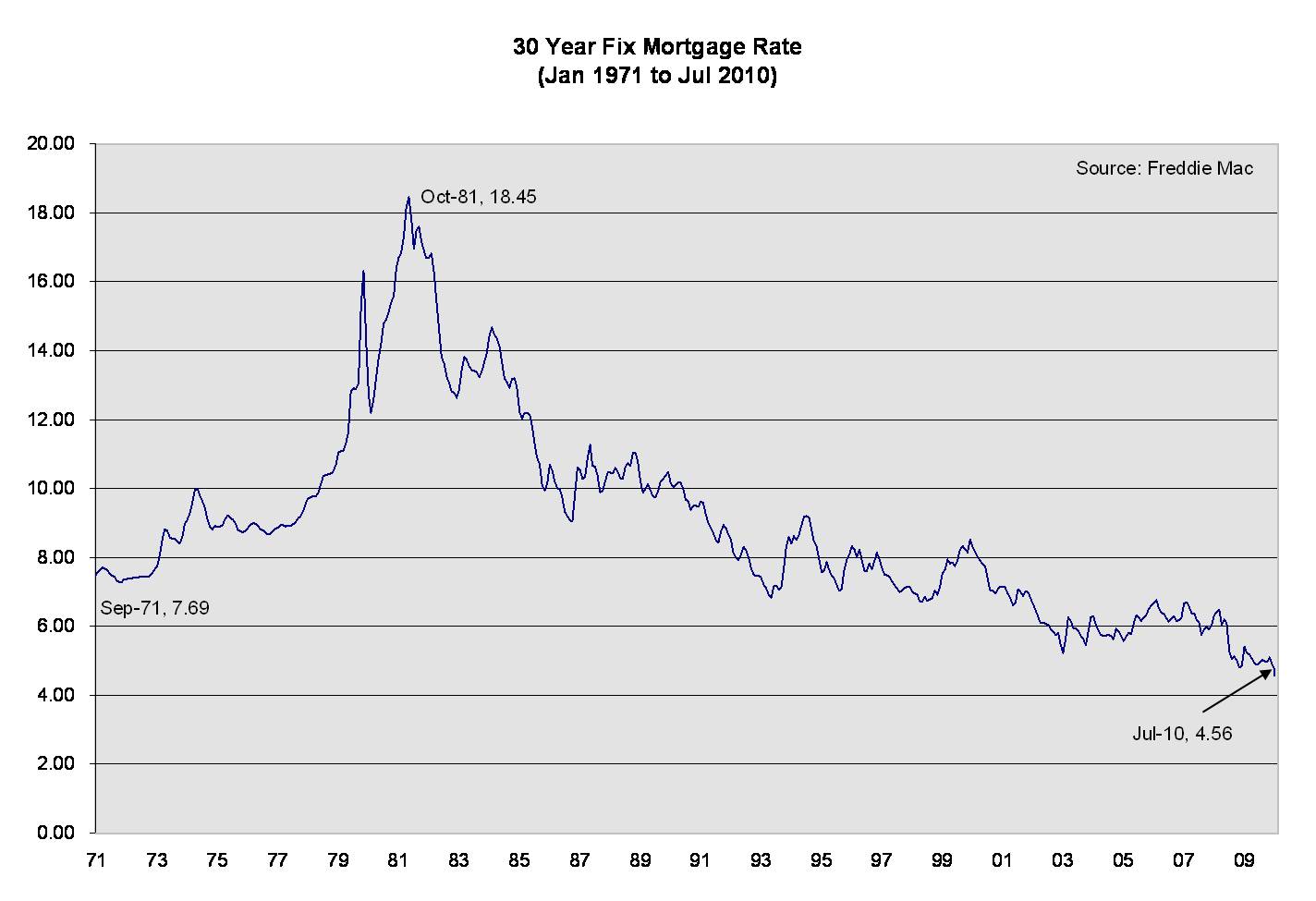

I see your own chart shows rates in the double digits under Carter. Remember the "Misery Index", which was the inflation rate plus the unemployment rate? Yes, it was high.

Or do you think that Carter really won the 1980 election and everyone else has it wrong?

I see your own chart shows rates in the double digits under Carter. Remember the "Misery Index", which was the inflation rate plus the unemployment rate? Yes, it was high.

Or do you think that Carter really won the 1980 election and everyone else has it wrong?

Carter lost. He lost big. And he should have lost. The Iran Hostage crisis proved he was weak.

But to blame him for TWO oil embargos that slowed the economies of the ENTIRE western world is dishonest.

And back to the original point, its a GLOBAL economy. Without barriers in place to keep investment within our borders, the vast majority of jobs created by supply side economics will be outside of our borders.

I see your own chart shows rates in the double digits under Carter. Remember the "Misery Index", which was the inflation rate plus the unemployment rate? Yes, it was high.

Or do you think that Carter really won the 1980 election and everyone else has it wrong?

Carter lost. He lost big. And he should have lost. The Iran Hostage crisis proved he was weak.

But to blame him for TWO oil embargos that slowed the economies of the ENTIRE western world is dishonest.

And back to the original point, its a GLOBAL economy. Without barriers in place to keep investment within our borders, the vast majority of jobs created by supply side economics will be outside of our borders.

So your thesis is that the Iran crisis was responsible for Carter's loss? Not stagflation. Not the Soviet invasion of Afghanistan and his absurd claim the Russians lied. Not his failure on almost every front. But a hostage crisis. OK.

Other countries experienced oil embargoes. Other countries did not experience the massive inflation we did.

So Reagan's policies, along with the deregulation that was already working its way through the system, along with Volker's strong anti inflation stance drove down inflation and interest rates, which turned into a 30 year trend. We'll see what the next 2 years does.

As to your point about the global economy, do you think that trade is a zero sum proposition, where only one side gains in a transation and the other loses?

Carter lost. He lost big. And he should have lost. The Iran Hostage crisis proved he was weak.

But to blame him for TWO oil embargos that slowed the economies of the ENTIRE western world is dishonest.

And back to the original point, its a GLOBAL economy. Without barriers in place to keep investment within our borders, the vast majority of jobs created by supply side economics will be outside of our borders.

So your thesis is that the Iran crisis was responsible for Carter's loss? Not stagflation. Not the Soviet invasion of Afghanistan and his absurd claim the Russians lied. Not his failure on almost every front. But a hostage crisis. OK.

Other countries experienced oil embargoes. Other countries did not experience the massive inflation we did.

So Reagan's policies, along with the deregulation that was already working its way through the system, along with Volker's strong anti inflation stance drove down inflation and interest rates, which turned into a 30 year trend. We'll see what the next 2 years does.

As to your point about the global economy, do you think that trade is a zero sum proposition, where only one side gains in a transation and the other loses?

I think that there is no way that any amount of tax incentive can compete with 20 cents an hour labor vs 20 dollar an hour labor.

I think this is another case of ignoring the real issue, and shouting at a straw man to keep the status quo.

It's really about why Keynsian economics doesn't work. We've used that model for the last, I dunno, 30-50 years and look where it's gotten us. But instead of debating why we should change that to something like the Austrian model, we endlessly debate trickledown, and supply side issues. Let's look at the core of the matter first, the economic model.

Edited

Let's start with your assertion that Keynesian economics have been in play for the last 30-50 years. You've completely ignored Milton Friedman with that statement and his effect on our economic policy. Prior to Friedmans influence on President Reagan, this country enjoyed its most prosperous 30 years. And that was when Keynesian economics were in play unfettered.

And you support the Austrian model? What model is that exactly?

As one of the fundamental principles of the Austria school is that all models are flawed and only logical thought based on illogical human action. According to that theory all test ability and mathematical modeling are impossible.

Basically, the Austrian school holds to the theory of Fuck it, we don't know, there's no way to know, let's try this.

Yeah, let's do that.

Austrian School economists argue that they are a flawed, unreliable, and insufficient means of analyzing economic behavior and evaluating economic theories. Instead, they advocate deriving economic theory logically from basic principles of human action, a study called praxeology. Furthermore, whereas experimental research and natural experiments are often used in mainstream economics, Austrians generally hold that testability in economics and precise mathematical modeling of an economic market are virtually impossible. They argue that modeling a market relies on human actors who cannot be placed in a lab setting without altering their would-be actions.

So your thesis is that the Iran crisis was responsible for Carter's loss? Not stagflation. Not the Soviet invasion of Afghanistan and his absurd claim the Russians lied. Not his failure on almost every front. But a hostage crisis. OK.

Other countries experienced oil embargoes. Other countries did not experience the massive inflation we did.

So Reagan's policies, along with the deregulation that was already working its way through the system, along with Volker's strong anti inflation stance drove down inflation and interest rates, which turned into a 30 year trend. We'll see what the next 2 years does.

As to your point about the global economy, do you think that trade is a zero sum proposition, where only one side gains in a transation and the other loses?

I think that there is no way that any amount of tax incentive can compete with 20 cents an hour labor vs 20 dollar an hour labor.

You already posted the proof that I am correct. Your chart clearly shows UE rising, along with interest rates.

Does the term "unit labor cost" mean anything to you?

And again, do you think trade is a zero sum proposition?

Not much of a debate. I pose a question and prove points and you simply ignore the questions and reiterate what you've already said.I think that there is no way that any amount of tax incentive can compete with 20 cents an hour labor vs 20 dollar an hour labor.

You already posted the proof that I am correct. Your chart clearly shows UE rising, along with interest rates.

Does the term "unit labor cost" mean anything to you?

And again, do you think trade is a zero sum proposition?

And you have clearly ignored my answer to your assertion that you are proven correct by the facts I posted.

I think this is another case of ignoring the real issue, and shouting at a straw man to keep the status quo.

It's really about why Keynsian economics doesn't work. We've used that model for the last, I dunno, 30-50 years and look where it's gotten us. But instead of debating why we should change that to something like the Austrian model, we endlessly debate trickledown, and supply side issues. Let's look at the core of the matter first, the economic model.

Edited

Let's start with your assertion that Keynesian economics have been in play for the last 30-50 years. You've completely ignored Milton Friedman with that statement and his effect on our economic policy. Prior to Friedmans influence on President Reagan, this country enjoyed its most prosperous 30 years. And that was when Keynesian economics were in play unfettered.

And you support the Austrian model? What model is that exactly?

As one of the fundamental principles of the Austria school is that all models are flawed and only logical thought based on illogical human action. According to that theory all test ability and mathematical modeling are impossible.

Basically, the Austrian school holds to the theory of Fuck it, we don't know, there's no way to know, let's try this.

Yeah, let's do that.

My point about the difference between the two schools of thought. You clearly like the Keynsian model as you state that "Without barriers to keep businesses here..." shows that you are for forcing them to do what you want, instead of incentivizing them. Folks don't like to do things at the point of a gun.

Austrian econ doesn't just throw it to the wind, they in fact argue why modeling, etc is inefficient:

Austrian School economists argue that they are a flawed, unreliable, and insufficient means of analyzing economic behavior and evaluating economic theories. Instead, they advocate deriving economic theory logically from basic principles of human action, a study called praxeology. Furthermore, whereas experimental research and natural experiments are often used in mainstream economics, Austrians generally hold that testability in economics and precise mathematical modeling of an economic market are virtually impossible. They argue that modeling a market relies on human actors who cannot be placed in a lab setting without altering their would-be actions.

Austrian School - Wikipedia, the free encyclopedia

So it still comes down to wanting centralized management, or letting people make their own decisions. I will argue that SOME regulation (smart regulation) is needed, but that over regulation coupled with the centralized management that yes, even happened under Reagan, is the cause of where we are today.

The government needs to shepard the economy, not try to run it. Amtrak anyone?

Not much of a debate. I pose a question and prove points and you simply ignore the questions and reiterate what you've already said.You already posted the proof that I am correct. Your chart clearly shows UE rising, along with interest rates.

Does the term "unit labor cost" mean anything to you?

And again, do you think trade is a zero sum proposition?

And you have clearly ignored my answer to your assertion that you are proven correct by the facts I posted.

Bye.

This explains my POV very well. It also explains why Obama's plan is so poor.

The invisible depression is here - financial crisis - MSN Money