CrusaderFrank

Diamond Member

- May 20, 2009

- 153,305

- 78,586

- 2,645

As currently enacted, Social Security is a graveyard of capital. The fund, a joke since the government has been "borrowing" against the fund for decades, is solely invest in a special class of US Treasury. The only uses of the fund are to pay benefits and administrative expenses, which currently run .7% and can probably reduced at least in half.

The fund is projected to go insolvent in 2035. The bigger problem is this:

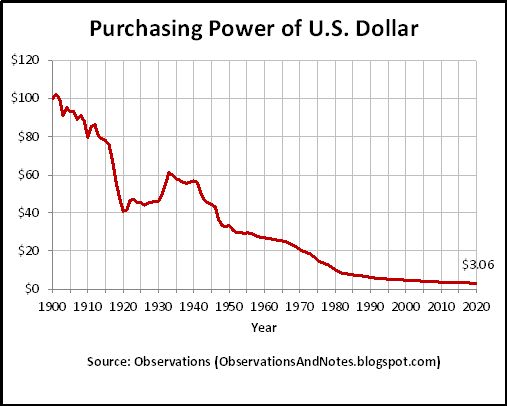

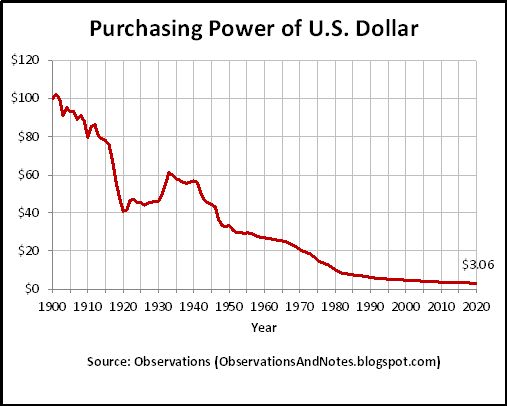

Left as is, the purchasing power is GUARANTEED to continue to decline.

In order to address both the looming insolvency and the continued decline of purchasing power, I propose that for the next 80 months, 1% of the "Trust Fund" be converted into an S&P index fund. At the end of 80 months the fund will be 80% US equities and 20% US debt.

Sure the stock market has ups and down over the year, but OVERALL THE TREND IS UP.

The fund is projected to go insolvent in 2035. The bigger problem is this:

Left as is, the purchasing power is GUARANTEED to continue to decline.

In order to address both the looming insolvency and the continued decline of purchasing power, I propose that for the next 80 months, 1% of the "Trust Fund" be converted into an S&P index fund. At the end of 80 months the fund will be 80% US equities and 20% US debt.

Sure the stock market has ups and down over the year, but OVERALL THE TREND IS UP.