Sunni Man

Diamond Member

Deanie boy makes up the most mentally deranged crap. ...This is Appalachia, the center of the Republican Party.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Deanie boy makes up the most mentally deranged crap. ...This is Appalachia, the center of the Republican Party.

It's not just the fact that the gains are taxed as regular income it's the minimum required withdrawals that guarantee that retirees get every possible tax dollar squeezed out of them before they croak

And you have no idea what the taxes will be when you retire do you?

The theory of this whole scheme is you put money into an IRA or 401k tax deferred. Your investments grow using both your money and the government's money e.g. the deferred income taxes. Its assumed that when you retire and have to pay income tax on these savings your tax rate will be lower than when you were working. So I get to make money on my money, the governments money, my retirement savings grow faster, and when I retire I'll pay a lower tax rate vs paying those taxes when I was making more money working full time. Not true in 100% of cases but true for the vast majority of retirees.

It is a sucker's bet. You can pay a little now, put in a Roth, and not pay anything on the gains. Or you can pay nothing now and pay a lot later, when you have to pay taxes on the gains.

I thought government tried to curb use of the Roth? But agree with you. Pelosi freaked out on the House floor a while back, she wanted to seize ALL the deferred income tax revenue in 401k's and IRA's immediately. They hate that all that money is sitting there beyond their reach.

No she didn’t

Lib please Democrats want to seize all the money in 401k's and force people into a government run retirement system like social security. The WSJ reported on this. Here's one of their stupid schemes, end the tax breaks for 401(k)s and instead give all workers an annual $600 inflation-adjusted tax credit for retirement and force them to invest 5% of their pay into a government-run retirement account managed by the Social Security Administration. Holy crap that's dumb. They called the 401(k) "a failed experiment."

The theory of this whole scheme is you put money into an IRA or 401k tax deferred. Your investments grow using both your money and the government's money e.g. the deferred income taxes. Its assumed that when you retire and have to pay income tax on these savings your tax rate will be lower than when you were working. So I get to make money on my money, the governments money, my retirement savings grow faster, and when I retire I'll pay a lower tax rate vs paying those taxes when I was making more money working full time. Not true in 100% of cases but true for the vast majority of retirees.

It is a sucker's bet. You can pay a little now, put in a Roth, and not pay anything on the gains. Or you can pay nothing now and pay a lot later, when you have to pay taxes on the gains.

I thought government tried to curb use of the Roth? But agree with you. Pelosi freaked out on the House floor a while back, she wanted to seize ALL the deferred income tax revenue in 401k's and IRA's immediately. They hate that all that money is sitting there beyond their reach.

No she didn’t

Lib please Democrats want to seize all the money in 401k's and force people into a government run retirement system like social security. The WSJ reported on this. Here's one of their stupid schemes, end the tax breaks for 401(k)s and instead give all workers an annual $600 inflation-adjusted tax credit for retirement and force them to invest 5% of their pay into a government-run retirement account managed by the Social Security Administration. Holy crap that's dumb. They called the 401(k) "a failed experiment."

Total conservative propaganda

Why don’t you remind us about death panels and everyone being forced into Obamacare

GOVERNMENT TAKEOVER

The gains aren't taxed in a 401K. I don't know where you get that information. You never pay taxes on it unless you cash it out.

He's asking why 401k gains are not taxed at the lower capital gains rate vs federal/state income tax rate. The capital gains rate would be higher for most people this poster shouldn't look a gift horse in the mouth.

That is just ignorant as hell. The capital gains tax rate is 15%, anyone making over $38,700 is going to pay more.

Oh God the irony. A married couple who withdraw $60,000 from their 401k will owe 6% federal income tax. That's with the standard deduction. Do you know which is lower 6% or 15%?

The standard deduction also applies to capital gains dipshit. So, in your case they would pay ZERO. Which is less zero or six percent.

Dumbass

No it doesn't damn you are stupid. Short term capital gains would be 12%, long term capital gains would be 0% but only up to about $70k anything over that and you have to pay tax on the gain. Neither has anything to do with the federal income tax standard deduction. If you live in liberal California well your screwed go look up their whopping 13% capital gain tax that's on top of the federal tax.

Trump wasn't in charge of Indiana, moron.Isn't giving corporations money for nothing "free stuff"?Your error is in believing that you've been given anything in the first place.Can you even fathom how much you've benefited from other people's work at no cost? Here right here this idiot is prime example of the selfish taker mentality of the right. Take all the free stuff and give nothing back. So much was invested in you.What's wrong with it? I wasn't put on this earth to cater to other people's needs.

What free stuff?

As far as what I give back? Taxes,lots of taxes.

Thats why I was asking ...What free stuff?

Maybe I should of asked the gubermint to pay for the 20k roof they're putting on the house right now.

Carrier: Trump gave us state 'incentives' to save jobs

How did that work out?

He's asking why 401k gains are not taxed at the lower capital gains rate vs federal/state income tax rate. The capital gains rate would be higher for most people this poster shouldn't look a gift horse in the mouth.

That is just ignorant as hell. The capital gains tax rate is 15%, anyone making over $38,700 is going to pay more.

Oh God the irony. A married couple who withdraw $60,000 from their 401k will owe 6% federal income tax. That's with the standard deduction. Do you know which is lower 6% or 15%?

The standard deduction also applies to capital gains dipshit. So, in your case they would pay ZERO. Which is less zero or six percent.

Dumbass

No it doesn't damn you are stupid. Short term capital gains would be 12%, long term capital gains would be 0% but only up to about $70k anything over that and you have to pay tax on the gain. Neither has anything to do with the federal income tax standard deduction. If you live in liberal California well your screwed go look up their whopping 13% capital gain tax that's on top of the federal tax.

Please.

If my only income is Long term capital gains, can I claim deductions against it?

Yes, you can claim all allowable deductions, such as your Exemption and your Standard Deduction (or Itemized Deductions).

If my only income is Long term capital gains, can I claim deduct... - TurboTax Support

In this case the tax would be zero. So, if they had a 401K you claim the effective tax rate on that sixty grand withdrawal would be six percent. But, if they would have had long term capital gain instead the effective tax rate would be zero. And zero is less than six percent. Capital gains are almost always taxed lower than income. That is a problem, and even Ronald Reagan was opposed to such ignorance.

and

and

no one cares. all Americans are just happy that bill and the beast aren't in the white stealing from the middle classAnd repealing the tax cuts would make it ZERO PERCENT going to the workers!

That is just ignorant as hell. The capital gains tax rate is 15%, anyone making over $38,700 is going to pay more.

Oh God the irony. A married couple who withdraw $60,000 from their 401k will owe 6% federal income tax. That's with the standard deduction. Do you know which is lower 6% or 15%?

The standard deduction also applies to capital gains dipshit. So, in your case they would pay ZERO. Which is less zero or six percent.

Dumbass

No it doesn't damn you are stupid. Short term capital gains would be 12%, long term capital gains would be 0% but only up to about $70k anything over that and you have to pay tax on the gain. Neither has anything to do with the federal income tax standard deduction. If you live in liberal California well your screwed go look up their whopping 13% capital gain tax that's on top of the federal tax.

Please.

If my only income is Long term capital gains, can I claim deductions against it?

Yes, you can claim all allowable deductions, such as your Exemption and your Standard Deduction (or Itemized Deductions).

If my only income is Long term capital gains, can I claim deduct... - TurboTax Support

In this case the tax would be zero. So, if they had a 401K you claim the effective tax rate on that sixty grand withdrawal would be six percent. But, if they would have had long term capital gain instead the effective tax rate would be zero. And zero is less than six percent. Capital gains are almost always taxed lower than income. That is a problem, and even Ronald Reagan was opposed to such ignorance.

and

Oh God the irony. A married couple who withdraw $60,000 from their 401k will owe 6% federal income tax. That's with the standard deduction. Do you know which is lower 6% or 15%?

The standard deduction also applies to capital gains dipshit. So, in your case they would pay ZERO. Which is less zero or six percent.

Dumbass

No it doesn't damn you are stupid. Short term capital gains would be 12%, long term capital gains would be 0% but only up to about $70k anything over that and you have to pay tax on the gain. Neither has anything to do with the federal income tax standard deduction. If you live in liberal California well your screwed go look up their whopping 13% capital gain tax that's on top of the federal tax.

Please.

If my only income is Long term capital gains, can I claim deductions against it?

Yes, you can claim all allowable deductions, such as your Exemption and your Standard Deduction (or Itemized Deductions).

If my only income is Long term capital gains, can I claim deduct... - TurboTax Support

In this case the tax would be zero. So, if they had a 401K you claim the effective tax rate on that sixty grand withdrawal would be six percent. But, if they would have had long term capital gain instead the effective tax rate would be zero. And zero is less than six percent. Capital gains are almost always taxed lower than income. That is a problem, and even Ronald Reagan was opposed to such ignorance.

and

Typical right wing behavior. Knee jerk reaction, smart ass comment, proven totally wrong, attempt to deflect, and never, ever, under any circumstances admit you were wrong. Again, long term capital gains tax rates are almost always lower. For a married couple taxes on capital gains don't even start until $77,200. Yet if that couple were out working they would have to start paying taxes after the first $13,350.

Or you can pay taxes your whole life and hope you can live on 1200 a month when the government decides you’re old enough to retire.It's not just the fact that the gains are taxed as regular income it's the minimum required withdrawals that guarantee that retirees get every possible tax dollar squeezed out of them before they croakThe gains aren't taxed in a 401K. I don't know where you get that information. You never pay taxes on it unless you cash it out.Well they are kind of a scam

In any other investment portfolio the gains would be taxed at capital gains rates where in a 401 the gains are taxed as regular income and the government tells you how much you have to take out every year or else they hit you with a huge penalty. The goal is to squeeze every tax dollar they can out of retirees before they croak

He's asking why 401k gains are not taxed at the lower capital gains rate vs federal/state income tax rate. The capital gains rate would be higher for most people this poster shouldn't look a gift horse in the mouth.

And you have no idea what the taxes will be when you retire do you?

The theory of this whole scheme is you put money into an IRA or 401k tax deferred. Your investments grow using both your money and the government's money e.g. the deferred income taxes. Its assumed that when you retire and have to pay income tax on these savings your tax rate will be lower than when you were working. So I get to make money on my money, the governments money, my retirement savings grow faster, and when I retire I'll pay a lower tax rate vs paying those taxes when I was making more money working full time. Not true in 100% of cases but true for the vast majority of retirees.

It is a sucker's bet. You can pay a little now, put in a Roth, and not pay anything on the gains. Or you can pay nothing now and pay a lot later, when you have to pay taxes on the gains.

Deficits were decreasing under obama.That is 13% more than they got under that asshole Obama, isn't it?

Or you can pay taxes your whole life and hope you can live on 1200 a month when the government decides you’re old enough to retire.It's not just the fact that the gains are taxed as regular income it's the minimum required withdrawals that guarantee that retirees get every possible tax dollar squeezed out of them before they croakThe gains aren't taxed in a 401K. I don't know where you get that information. You never pay taxes on it unless you cash it out.

He's asking why 401k gains are not taxed at the lower capital gains rate vs federal/state income tax rate. The capital gains rate would be higher for most people this poster shouldn't look a gift horse in the mouth.

And you have no idea what the taxes will be when you retire do you?

The theory of this whole scheme is you put money into an IRA or 401k tax deferred. Your investments grow using both your money and the government's money e.g. the deferred income taxes. Its assumed that when you retire and have to pay income tax on these savings your tax rate will be lower than when you were working. So I get to make money on my money, the governments money, my retirement savings grow faster, and when I retire I'll pay a lower tax rate vs paying those taxes when I was making more money working full time. Not true in 100% of cases but true for the vast majority of retirees.

It is a sucker's bet. You can pay a little now, put in a Roth, and not pay anything on the gains. Or you can pay nothing now and pay a lot later, when you have to pay taxes on the gains.

Oh God the irony. A married couple who withdraw $60,000 from their 401k will owe 6% federal income tax. That's with the standard deduction. Do you know which is lower 6% or 15%?

The standard deduction also applies to capital gains dipshit. So, in your case they would pay ZERO. Which is less zero or six percent.

Dumbass

No it doesn't damn you are stupid. Short term capital gains would be 12%, long term capital gains would be 0% but only up to about $70k anything over that and you have to pay tax on the gain. Neither has anything to do with the federal income tax standard deduction. If you live in liberal California well your screwed go look up their whopping 13% capital gain tax that's on top of the federal tax.

Please.

If my only income is Long term capital gains, can I claim deductions against it?

Yes, you can claim all allowable deductions, such as your Exemption and your Standard Deduction (or Itemized Deductions).

If my only income is Long term capital gains, can I claim deduct... - TurboTax Support

In this case the tax would be zero. So, if they had a 401K you claim the effective tax rate on that sixty grand withdrawal would be six percent. But, if they would have had long term capital gain instead the effective tax rate would be zero. And zero is less than six percent. Capital gains are almost always taxed lower than income. That is a problem, and even Ronald Reagan was opposed to such ignorance.

and

Typical right wing behavior. Knee jerk reaction, smart ass comment, proven totally wrong, attempt to deflect, and never, ever, under any circumstances admit you were wrong. Again, long term capital gains tax rates are almost always lower. For a married couple taxes on capital gains don't even start until $77,200. Yet if that couple were out working they would have to start paying taxes after the first $13,350.

The ones complaining they aren’t getting any of the tax breaks are the ones that weren’t making enough to pay taxes anyway.The standard deduction also applies to capital gains dipshit. So, in your case they would pay ZERO. Which is less zero or six percent.

Dumbass

No it doesn't damn you are stupid. Short term capital gains would be 12%, long term capital gains would be 0% but only up to about $70k anything over that and you have to pay tax on the gain. Neither has anything to do with the federal income tax standard deduction. If you live in liberal California well your screwed go look up their whopping 13% capital gain tax that's on top of the federal tax.

Please.

If my only income is Long term capital gains, can I claim deductions against it?

Yes, you can claim all allowable deductions, such as your Exemption and your Standard Deduction (or Itemized Deductions).

If my only income is Long term capital gains, can I claim deduct... - TurboTax Support

In this case the tax would be zero. So, if they had a 401K you claim the effective tax rate on that sixty grand withdrawal would be six percent. But, if they would have had long term capital gain instead the effective tax rate would be zero. And zero is less than six percent. Capital gains are almost always taxed lower than income. That is a problem, and even Ronald Reagan was opposed to such ignorance.

and

Typical right wing behavior. Knee jerk reaction, smart ass comment, proven totally wrong, attempt to deflect, and never, ever, under any circumstances admit you were wrong. Again, long term capital gains tax rates are almost always lower. For a married couple taxes on capital gains don't even start until $77,200. Yet if that couple were out working they would have to start paying taxes after the first $13,350.

Typical Left Wing confusion.

I will be paying about $2K less in taxes this year than I would have had under the Obama rates.

If you aren't paying fewer taxes with the lower tax brackets and the higher deductions that will affect 75% of Americans then you are doing it wrong.

Go take your hate of more take home pay someplace else.

If you want to pay more taxes then just send a check to the IRS. Until then quit your bitching Moon Bat.

Republicans have increased them.Deficits were decreasing under obama.That is 13% more than they got under that asshole Obama, isn't it?

Yea Moon Bat, instead of the 1.4 trillion he was running up in his first few years it was down to a paltry .8 trillion.

Only Moon Bats would brag about that.

Not worth it when it is increasing deficits.13% is better than 0% as we saw for the past 8 years. This is a start.

"Only 13% of business' tax cuts are going to workers"Only 13% of business' tax cuts are going to workers, survey says

Tax cut scoreboard: Workers $6 billion; Shareholders $171 billion

Wow, this is one of the most expensive tax cuts in history. And at a time when corporations are doing really, really well. Why not share with the workers?

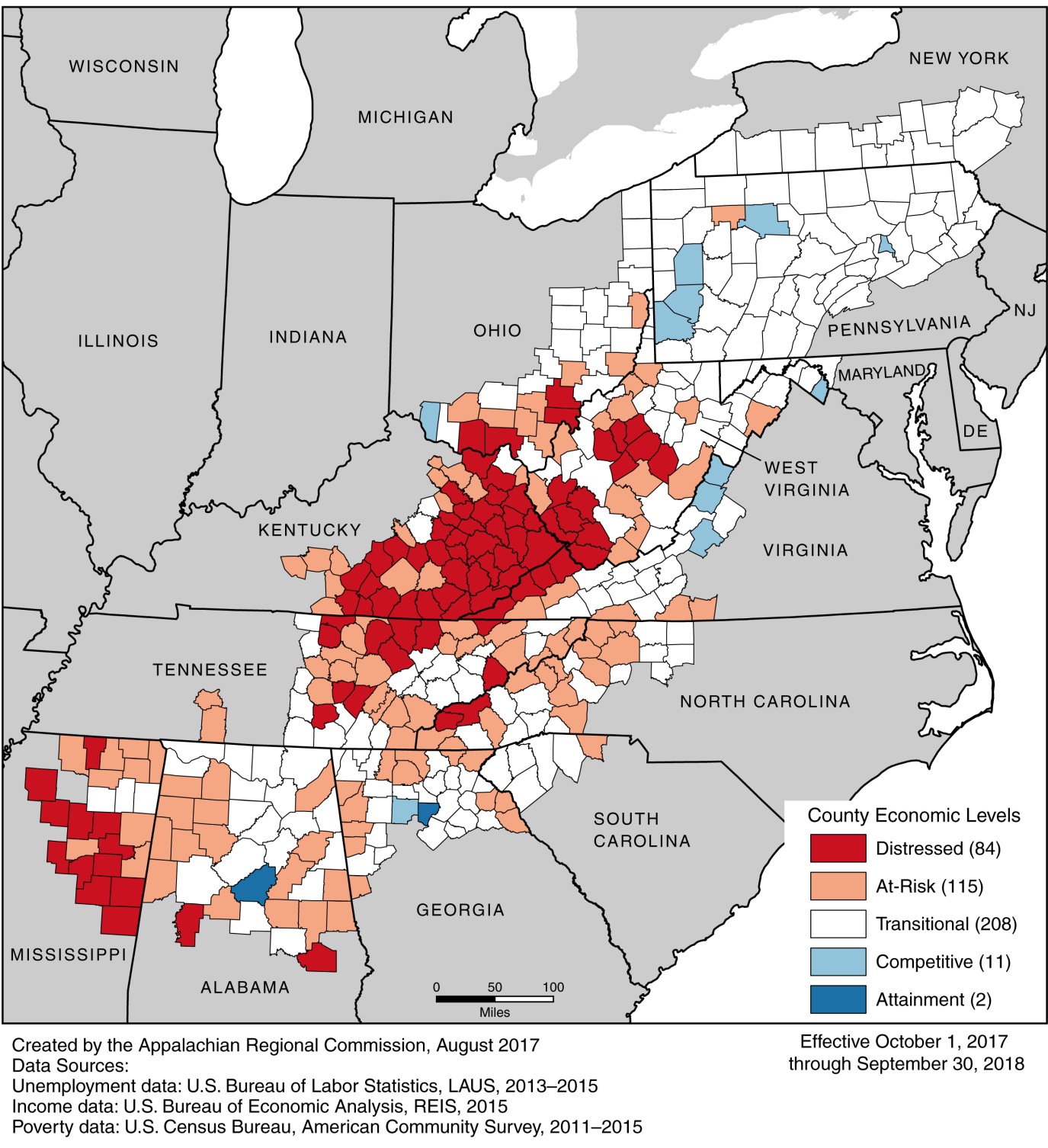

ARC: Athens County back to 'distressed' status

This is Appalachia, the center of the Republican Party. The area that has the 10 poorest counties in the United States. Those counties being more than 98% white.

Why not pass some of those tax cuts along as wage increases for whites living in the Appalachia area?

Forgot about the Obama administration's debt or are you just ignoring it ?Not worth it when it is increasing deficits.13% is better than 0% as we saw for the past 8 years. This is a start.