Dot Com

Nullius in verba

- Thread starter

- #21

yeah, a full-fledged depression would have been preferable

We were in uncharted territory since the Republican repeal of Glas Steagal in the name of of Gramm Leach, Bliley

Gramm?Leach?Bliley Act - Wikipedia, the free encyclopedia

We were in uncharted territory since the Republican repeal of Glas Steagal in the name of of Gramm Leach, Bliley

Gramm?Leach?Bliley Act - Wikipedia, the free encyclopedia

ALL RepublicansIt repealed part of the GlassSteagall Act of 1933, removing barriers in the market among banking companies, securities companies and insurance companies that prohibited any one institution from acting as any combination of an investment bank, a commercial bank, and an insurance company.

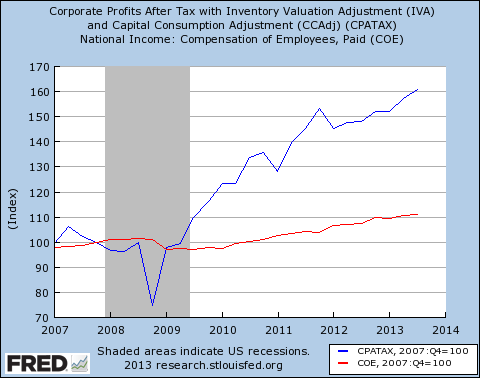

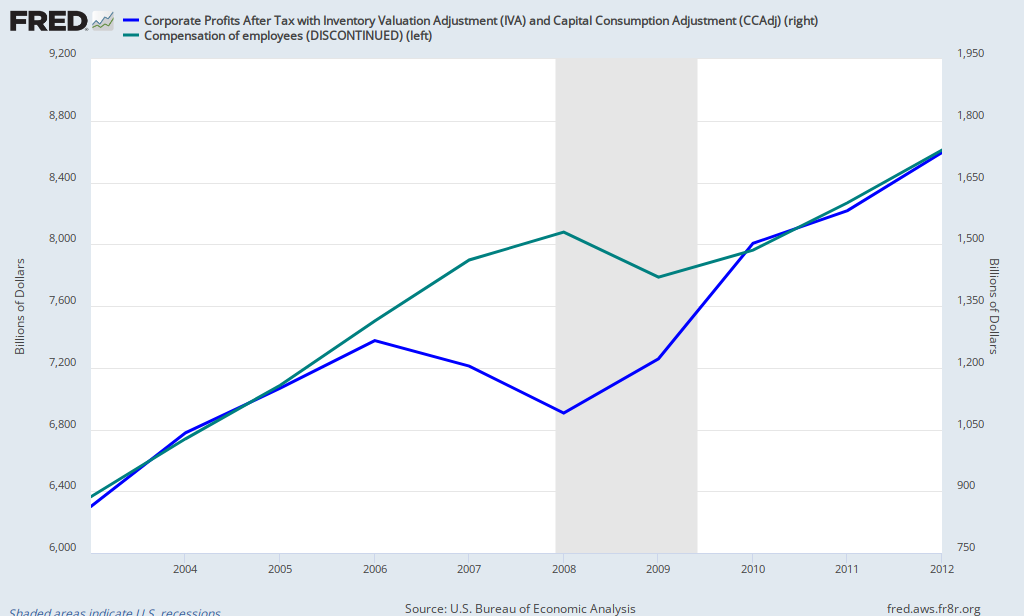

by short-sheeting their employees of course. Its the randian way.

by short-sheeting their employees of course. Its the randian way.