task0778

Diamond Member

This week the government announced that the inflation rate – as per its Consumer Price Index – has reached 7 percent, the highest it’s been since 1982. But ask any business owner and they’ll tell you that the consumer price index only tells us about the past. It isn’t the true indicator of future inflation. The future is all about the Producer Price Index (PPI), which measures the costs to make things. That index rose a whopping 9.7 percent. And – bad news, everyone – inflation is going to go a lot higher in the months to come because of this.

Why? Because there are many different materials that go into the PPI. Some are used more frequently than others. So we have to dig further. And when we unpeel the PPI and look closely at the costs of the core materials and labor used in manufacturing, farming and construction, we find that prices have risen much, much more than the reported 9.7 percent. And those prices are ultimately going to find their way to customers in the coming months. Maybe you don't believe me. So, let's go to the data.

For starters, the costs of most of the core raw chemicals that make up just about everything we use are skyrocketing and show no sign of future relief. Aluminum is used in just about all sectors of the economy, and the costs of this core material have risen 37 percent in the past year and show no sign of letting up. Tin, which is used as a protective coating and alloy for steel, has gone up 116 percent. Speaking of steel, the cost of iron and steel has shot up 87 percent.

.

.

All in all, the total costs of manufacturing have increased more than 15 percent over the past year. But it's not just the manufacturers that are suffering.

Farmers are paying almost 16 percent more to feed their animals and 92 percent more for potash, which is one of the main ingredients in fertilizer. Construction businesses are seeing enormous increases in the costs of lumber (after ups and downs, lumber costs are now up almost 19 percent this year) and concrete (almost 9 percent). In fact, the costs of all construction materials have increased 35 percent this year. Corrugated container costs, which make up packaging, have gone up 20 percent. And shipping costs are up overall a whopping 25 percent.

Let's not forget labor. Payroll company Paychex reports this week that its hundreds of thousands of customers are now paying an average wage of $30 per hour, an increase of 4.27 percent, which is the highest level since Paychex began reporting these numbers more than 10 years ago. Total compensation of all salaried and hourly employees rose more than 11 percent this year.

Doesn't this seem like a lot more than the 9.7 percent rate the government reports? It does because it is.

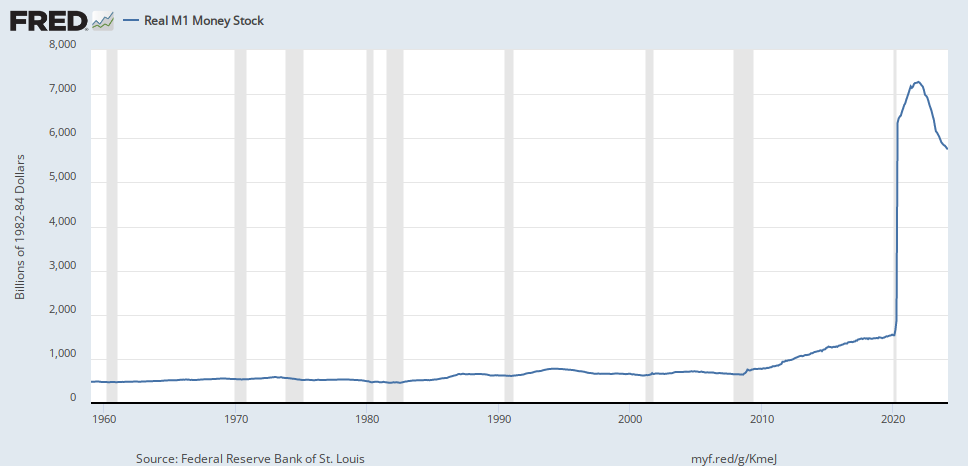

And I'm ignoring the enormous amount of cash washing around in the system thanks to the various stimulus and spending actions taken by Congress, let alone the added $4 trillion of liquidity provided by the Federal Reserve to prop up the economy during the pandemic. The Fed already plans to have anywhere from three to four interest rate hikes this year to taper down this liquidity. Will their strategy work to curtail inflation in 2022? Given its performance over the past couple of years, many business owners I know are skeptical. They have a right to be.

Gene Marks is founder of The Marks Group, a small-business consulting firm. He frequently appears on CNBC, Fox Business and MSNBC.

thehill.com

thehill.com

Gene Marks is the writer of this opinion. I have no idea of his politics, but I don't see anything too political here. He's talking about the stimulus and spending during the pandemic, which has to include Trump's last year as well as Biden's 1st. It doesn't sound too promising, does it? And there's no mention of COVID and any of it's variants. Will we see another strain/variant this year?

Why? Because there are many different materials that go into the PPI. Some are used more frequently than others. So we have to dig further. And when we unpeel the PPI and look closely at the costs of the core materials and labor used in manufacturing, farming and construction, we find that prices have risen much, much more than the reported 9.7 percent. And those prices are ultimately going to find their way to customers in the coming months. Maybe you don't believe me. So, let's go to the data.

For starters, the costs of most of the core raw chemicals that make up just about everything we use are skyrocketing and show no sign of future relief. Aluminum is used in just about all sectors of the economy, and the costs of this core material have risen 37 percent in the past year and show no sign of letting up. Tin, which is used as a protective coating and alloy for steel, has gone up 116 percent. Speaking of steel, the cost of iron and steel has shot up 87 percent.

.

.

All in all, the total costs of manufacturing have increased more than 15 percent over the past year. But it's not just the manufacturers that are suffering.

Farmers are paying almost 16 percent more to feed their animals and 92 percent more for potash, which is one of the main ingredients in fertilizer. Construction businesses are seeing enormous increases in the costs of lumber (after ups and downs, lumber costs are now up almost 19 percent this year) and concrete (almost 9 percent). In fact, the costs of all construction materials have increased 35 percent this year. Corrugated container costs, which make up packaging, have gone up 20 percent. And shipping costs are up overall a whopping 25 percent.

Let's not forget labor. Payroll company Paychex reports this week that its hundreds of thousands of customers are now paying an average wage of $30 per hour, an increase of 4.27 percent, which is the highest level since Paychex began reporting these numbers more than 10 years ago. Total compensation of all salaried and hourly employees rose more than 11 percent this year.

Doesn't this seem like a lot more than the 9.7 percent rate the government reports? It does because it is.

And I'm ignoring the enormous amount of cash washing around in the system thanks to the various stimulus and spending actions taken by Congress, let alone the added $4 trillion of liquidity provided by the Federal Reserve to prop up the economy during the pandemic. The Fed already plans to have anywhere from three to four interest rate hikes this year to taper down this liquidity. Will their strategy work to curtail inflation in 2022? Given its performance over the past couple of years, many business owners I know are skeptical. They have a right to be.

Gene Marks is founder of The Marks Group, a small-business consulting firm. He frequently appears on CNBC, Fox Business and MSNBC.

Here's why inflation numbers are about to get worse

The costs of most of the core raw chemicals that make up just about everything we use are skyrocketing and show no sign of future relief.

Gene Marks is the writer of this opinion. I have no idea of his politics, but I don't see anything too political here. He's talking about the stimulus and spending during the pandemic, which has to include Trump's last year as well as Biden's 1st. It doesn't sound too promising, does it? And there's no mention of COVID and any of it's variants. Will we see another strain/variant this year?