kyzr

Diamond Member

Not to interrupt the very cool bank discussion. But I'd like to pose a question,It is true no bank could handle a full bank run meltdown. However, it can calm the depositors if they are informed that the bank is well-capitalized.

I think that is what banks are doing now to hedge their interest rate risk. They are borrowing money from the Fed.

While you pointed out that the Fed charges around 4 percent, that is still cheaper than the going rate anywhere else.

What no one knows is how well hedged all these banks are against the interest rate risk. I think SVB and First Republic inform us "not at all".

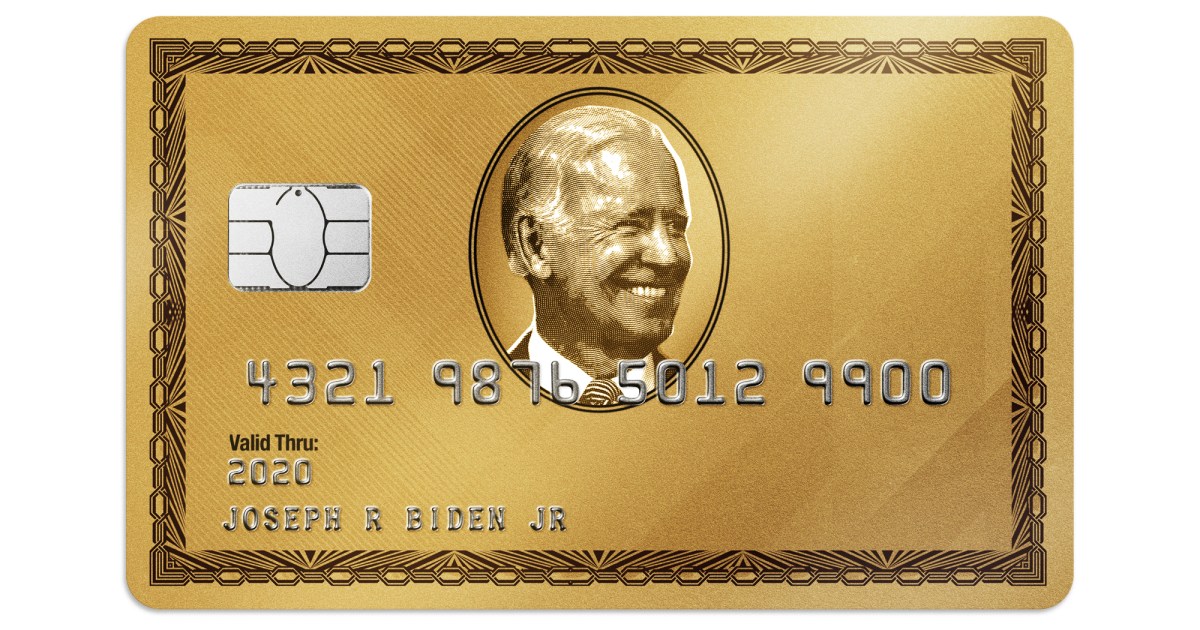

Since SVB was termed "the democrat's ATM", and FTX donated millions to democrats, does politics enter into the bank failure discussion?

If one of the failed banks was from TX, or FL, or KS I'd say politics doesn't matter.

Does politics matter? Is that why SVB got backstopped instead of let go bankrupt?