- May 20, 2009

- 144,615

- 67,094

- 2,330

Communist nations must be the worlds most caring, amiright?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

How about you actually post something that proves your claims instead of just making accusations based on a know biased web site.

Why is GOP going after Social Security - CNN.com

Republicans planning stealth attack on Social Security Democrats fear - The Washington Post

Benefits for disabled persons were added to Social Security in 1956 under President Eisenhower. By 1967, Social Security Disability Insurance (SSDI) benefits were extended to dependents of disabled persons, and to widowers of disabled persons, when the disabled person was qualified for collecting Social Security Disability Insurance benefits.

When Was Disability Insurance Added To Social Security - 2015

The program has been expanded beyond sustainability, that's been proven time and again by it having to be propped up so often. You don't think there is a need to find a long term solution?

The long term solution is not cutting benefits. A long term solution has been proposed by Bernie Sanders.

Sanders Issues New Report Documenting Republican Effort to Cut Social Security

Tuesday, February 10, 2015

WASHINGTON, Feb. 10 – Sen. Bernie Sanders (I-Vt.), the ranking member of the Senate Budget Committee, said that he would fight Republican attempts to cut Social Security and today issued a report detailing the importance of Social Security and how attempts to cut it are unnecessary.

“Republicans are manufacturing a phony crisis in Social Security in order to cut the earned benefits of millions of the most vulnerable people in this country,” Sanders said. “The American people won’t let them get away with it.”

“At a time when millions of Americans with disabilities and senior citizens are struggling to pay for food, medicine and heat, we should expand, not cut, Social Security,” Sanders added.

National senior organizations representing more than 60 million older Americans –including the AARP, the National Committee to Preserve Social Security and Medicare, the Alliance for Retired Americans and others – are opposed to Republican attempts to block a reallocation of Social Security retirement funds into the Social Security disability fund. Such a reallocation has happened 11 times since the 1960’s and was embraced by Presidents Johnson, Ford, Carter, Reagan and Clinton. President Barack Obama recently asked Congress to do it again this year.

But last month, House Republicans passed a rule to make reallocation more difficult and now the Senate may be poised to attempt the same thing, Sanders warned.

This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years.

“If Republicans are serious about extending the solvency of Social Security beyond 2033, I hope they will join me in scrapping the cap that allows multi-millionaires to pay a much smaller percentage of their income into Social Security than the middle class,” Sanders said.

According to the chief actuary of the Social Security Administration, applying the Social Security payroll tax on income above $250,000 would extend the solvency of Social Security until 2060. Sanders is working on legislation to do just that.

The Sanders’ report also explains how the Social Security disability program is affected by trends in the economy and the increase in income inequality. The report also notes that the American disability insurance system is actually less generous and more rigorous than programs in other countries. Finally, the report shows that many Americans rely on the program to buy food and other essentials and offers some anecdotes from people in Vermont and elsewhere.

Tomorrow, Sanders will speak in favor of reallocation to preserve Social Security for nearly 11 million disabled Americans and their children when the GOP-controlled committee convenes a hearing to review the disability program. The report can be found here.

How about you actually post something that proves your claims instead of just making accusations based on a know biased web site.

Why is GOP going after Social Security - CNN.com

Republicans planning stealth attack on Social Security Democrats fear - The Washington Post

Benefits for disabled persons were added to Social Security in 1956 under President Eisenhower. By 1967, Social Security Disability Insurance (SSDI) benefits were extended to dependents of disabled persons, and to widowers of disabled persons, when the disabled person was qualified for collecting Social Security Disability Insurance benefits.

When Was Disability Insurance Added To Social Security - 2015

The program has been expanded beyond sustainability, that's been proven time and again by it having to be propped up so often. You don't think there is a need to find a long term solution?

The long term solution is not cutting benefits. A long term solution has been proposed by Bernie Sanders.

Sanders Issues New Report Documenting Republican Effort to Cut Social Security

Tuesday, February 10, 2015

WASHINGTON, Feb. 10 – Sen. Bernie Sanders (I-Vt.), the ranking member of the Senate Budget Committee, said that he would fight Republican attempts to cut Social Security and today issued a report detailing the importance of Social Security and how attempts to cut it are unnecessary.

“Republicans are manufacturing a phony crisis in Social Security in order to cut the earned benefits of millions of the most vulnerable people in this country,” Sanders said. “The American people won’t let them get away with it.”

“At a time when millions of Americans with disabilities and senior citizens are struggling to pay for food, medicine and heat, we should expand, not cut, Social Security,” Sanders added.

National senior organizations representing more than 60 million older Americans –including the AARP, the National Committee to Preserve Social Security and Medicare, the Alliance for Retired Americans and others – are opposed to Republican attempts to block a reallocation of Social Security retirement funds into the Social Security disability fund. Such a reallocation has happened 11 times since the 1960’s and was embraced by Presidents Johnson, Ford, Carter, Reagan and Clinton. President Barack Obama recently asked Congress to do it again this year.

But last month, House Republicans passed a rule to make reallocation more difficult and now the Senate may be poised to attempt the same thing, Sanders warned.

This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years.

“If Republicans are serious about extending the solvency of Social Security beyond 2033, I hope they will join me in scrapping the cap that allows multi-millionaires to pay a much smaller percentage of their income into Social Security than the middle class,” Sanders said.

According to the chief actuary of the Social Security Administration, applying the Social Security payroll tax on income above $250,000 would extend the solvency of Social Security until 2060. Sanders is working on legislation to do just that.

The Sanders’ report also explains how the Social Security disability program is affected by trends in the economy and the increase in income inequality. The report also notes that the American disability insurance system is actually less generous and more rigorous than programs in other countries. Finally, the report shows that many Americans rely on the program to buy food and other essentials and offers some anecdotes from people in Vermont and elsewhere.

Tomorrow, Sanders will speak in favor of reallocation to preserve Social Security for nearly 11 million disabled Americans and their children when the GOP-controlled committee convenes a hearing to review the disability program. The report can be found here.

Disability insurance entitlement explodes under Obama - Baltimore Sun

Yes I did read the study and I did notice that Obama did not write the rules but he streamlined the approval process and loosened the rules to allow anyone with a hangnail to qualify. He also allocated more taxpayer money to hire more people to hand out more taxpayer money, a common Obama practice. The above article cites the numbers you can't argue with.

What else you got?

We just went through this with Mitten Romney 47% BULLSHIT...

We don't have a 'gargantuan welfare state'. America's safety net is below almost every other industrialized country in every measure. America more closely resembles the likes of Mexico than a modern First World industrialized nation.

We heard the ignorant rant of Mitt Romney and his 47%...

If there is a citizenry on this planet that does NOT have an entitlement mentality, it is the American people. American workers receive less benefits, paid leave, health care and take less vacation time than any other people. American workers take pride in the quality of their work and their work ethic.

What Romney said is a gross insult and reveals a dangerous mindset. He reeks of contempt for middle class working people and the poor.

Who are the 47%?

Federal budget and Census data show that, in 2010, 91 percent of the benefit dollars from entitlement and other mandatory programs went to the elderly (people 65 and over), the seriously disabled, and members of working households. People who are neither elderly nor disabled and do not live in a working household received only 9 percent of the benefits.

Moreover, the vast bulk of that 9 percent goes for medical care, unemployment insurance benefits (which individuals must have a significant work history to receive), Social Security survivor benefits for the children and spouses of deceased workers, and Social Security benefits for retirees between ages 62 and 64. Seven out of the 9 percentage points go for one of these four purposes.

80 percent of the workforce has seen their wages decline in real terms over the last quarter-century, and the average household has seen 40 percent of its wealth disappear during the Great Recession. Through it all, families never asked for a handout from anyone, especially Washington. They were left to go on their own, working harder, squeezing nickels, and taking care of themselves. But their economic boats have been taking on water for years, and now the crisis has swamped millions of middle class families. ref ref

"Labor is the United States. The men and women, who with their minds, their hearts and hands, create the wealth that is shared in this countrythey are America."

President Dwight D. Eisenhower

Federal Spending by the Numbers 2014 Government Spending Trends in Graphics Tables

The bull here is strictly from people like this poster. Almost 70 percent of the us budget is entitlements and income support, that comes to two trillion dollars in one year which is probably more than the next 20 countries combined spend on such things. Just like Mexico eh? Well I guess that is why all the Mexicans are trying to get into this country. You can't argue with people who will not acknowledge the facts. Yes we do have a gargantuan welfare state to the tune of over two trillion dollars. Wake the f up.

Social Security and Medicare have added ZERO dollars to the national debt...

Medicare and Social Security -- not defense -- are driving debt says Marco Rubio PolitiFact Florida

Once again your claims are disproved. Really it is absolutely ludicrous to claim that social security and Medicare are not and will not add to the debt. Your are part of the problem.

And as I have posted many months ago when this same discussion came up the reality in my town is this. A woman who is a drunk is getting disability for being a drunk, a man who is a drug addict is getting disability for being a drug addict, a fat woman is getting disability for being fat, and a twenty year old boy/man who fathered a baby is getting disability because he doesn't deal well with other people. If you think people like this with self created problems should crowd out people with true suffering and real,physical pain then it is obvious you are not part of the solution

TOTAL bullshit. Social Security and Medicare are PAID FOR. As a matter of FACT, if those programs ever do add to the debt, the benefits MUST be cut BY LAW!

Social Security and the federal budget

Social Security operates independently from the rest of the federal government, with dedicated funding sources and long-term commitments that are not subject to the annual budget process. This makes benefits more secure, since the amount spent each year on Social Security benefits is not limited to what Congress appropriates but is instead based on a benefit formula.9 Though Congress can rewrite the law to change this formula—as it did in 1983 in the form of a gradual increase in the normal retirement age10—it has been reluctant to cut benefits for older workers and retirees who would have the greatest difficulty adjusting to cuts.

The fact that Social Security benefits are an entitlement that workers earn through a lifetime of contributions does not make them an open-ended liability for taxpayers. To the contrary, the Social Security Administration is prohibited from borrowing, so if it does not have enough money to pay promised benefits in full, it will be forced to cut benefits. This could happen in 2037 when the trust fund is projected to run out, though it is much more likely that Congress will act to shore up the system’s finances before then.

It is important to understand that, because Social Security is prohibited from borrowing, it must balance its long-term budget. As Social Security Chief Actuary Stephen Goss succinctly put it: “Trust Funds enforce long-term budget neutrality. Total spending to date cannot exceed income to date” (Goss 2010). Social Security can run a short-run deficit only if it has previously run surpluses. Thus, when it is drawing down trust fund assets to pay for the Baby Boomer retirement, it will be contributing to the unified budget deficit, a measure that includes Social Security. But over time, Social Security cannot add to the federal deficit.

How about you actually post something that proves your claims instead of just making accusations based on a know biased web site.

Why is GOP going after Social Security - CNN.com

Republicans planning stealth attack on Social Security Democrats fear - The Washington Post

Benefits for disabled persons were added to Social Security in 1956 under President Eisenhower. By 1967, Social Security Disability Insurance (SSDI) benefits were extended to dependents of disabled persons, and to widowers of disabled persons, when the disabled person was qualified for collecting Social Security Disability Insurance benefits.

When Was Disability Insurance Added To Social Security - 2015

The program has been expanded beyond sustainability, that's been proven time and again by it having to be propped up so often. You don't think there is a need to find a long term solution?

The long term solution is not cutting benefits. A long term solution has been proposed by Bernie Sanders.

Sanders Issues New Report Documenting Republican Effort to Cut Social Security

Tuesday, February 10, 2015

WASHINGTON, Feb. 10 – Sen. Bernie Sanders (I-Vt.), the ranking member of the Senate Budget Committee, said that he would fight Republican attempts to cut Social Security and today issued a report detailing the importance of Social Security and how attempts to cut it are unnecessary.

“Republicans are manufacturing a phony crisis in Social Security in order to cut the earned benefits of millions of the most vulnerable people in this country,” Sanders said. “The American people won’t let them get away with it.”

“At a time when millions of Americans with disabilities and senior citizens are struggling to pay for food, medicine and heat, we should expand, not cut, Social Security,” Sanders added.

National senior organizations representing more than 60 million older Americans –including the AARP, the National Committee to Preserve Social Security and Medicare, the Alliance for Retired Americans and others – are opposed to Republican attempts to block a reallocation of Social Security retirement funds into the Social Security disability fund. Such a reallocation has happened 11 times since the 1960’s and was embraced by Presidents Johnson, Ford, Carter, Reagan and Clinton. President Barack Obama recently asked Congress to do it again this year.

But last month, House Republicans passed a rule to make reallocation more difficult and now the Senate may be poised to attempt the same thing, Sanders warned.

This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years.

“If Republicans are serious about extending the solvency of Social Security beyond 2033, I hope they will join me in scrapping the cap that allows multi-millionaires to pay a much smaller percentage of their income into Social Security than the middle class,” Sanders said.

According to the chief actuary of the Social Security Administration, applying the Social Security payroll tax on income above $250,000 would extend the solvency of Social Security until 2060. Sanders is working on legislation to do just that.

The Sanders’ report also explains how the Social Security disability program is affected by trends in the economy and the increase in income inequality. The report also notes that the American disability insurance system is actually less generous and more rigorous than programs in other countries. Finally, the report shows that many Americans rely on the program to buy food and other essentials and offers some anecdotes from people in Vermont and elsewhere.

Tomorrow, Sanders will speak in favor of reallocation to preserve Social Security for nearly 11 million disabled Americans and their children when the GOP-controlled committee convenes a hearing to review the disability program. The report can be found here.How about you actually post something that proves your claims instead of just making accusations based on a know biased web site.

Why is GOP going after Social Security - CNN.com

Republicans planning stealth attack on Social Security Democrats fear - The Washington Post

Benefits for disabled persons were added to Social Security in 1956 under President Eisenhower. By 1967, Social Security Disability Insurance (SSDI) benefits were extended to dependents of disabled persons, and to widowers of disabled persons, when the disabled person was qualified for collecting Social Security Disability Insurance benefits.

When Was Disability Insurance Added To Social Security - 2015

The program has been expanded beyond sustainability, that's been proven time and again by it having to be propped up so often. You don't think there is a need to find a long term solution?

The long term solution is not cutting benefits. A long term solution has been proposed by Bernie Sanders.

Sanders Issues New Report Documenting Republican Effort to Cut Social Security

Tuesday, February 10, 2015

WASHINGTON, Feb. 10 – Sen. Bernie Sanders (I-Vt.), the ranking member of the Senate Budget Committee, said that he would fight Republican attempts to cut Social Security and today issued a report detailing the importance of Social Security and how attempts to cut it are unnecessary.

“Republicans are manufacturing a phony crisis in Social Security in order to cut the earned benefits of millions of the most vulnerable people in this country,” Sanders said. “The American people won’t let them get away with it.”

“At a time when millions of Americans with disabilities and senior citizens are struggling to pay for food, medicine and heat, we should expand, not cut, Social Security,” Sanders added.

National senior organizations representing more than 60 million older Americans –including the AARP, the National Committee to Preserve Social Security and Medicare, the Alliance for Retired Americans and others – are opposed to Republican attempts to block a reallocation of Social Security retirement funds into the Social Security disability fund. Such a reallocation has happened 11 times since the 1960’s and was embraced by Presidents Johnson, Ford, Carter, Reagan and Clinton. President Barack Obama recently asked Congress to do it again this year.

But last month, House Republicans passed a rule to make reallocation more difficult and now the Senate may be poised to attempt the same thing, Sanders warned.

This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years.

“If Republicans are serious about extending the solvency of Social Security beyond 2033, I hope they will join me in scrapping the cap that allows multi-millionaires to pay a much smaller percentage of their income into Social Security than the middle class,” Sanders said.

According to the chief actuary of the Social Security Administration, applying the Social Security payroll tax on income above $250,000 would extend the solvency of Social Security until 2060. Sanders is working on legislation to do just that.

The Sanders’ report also explains how the Social Security disability program is affected by trends in the economy and the increase in income inequality. The report also notes that the American disability insurance system is actually less generous and more rigorous than programs in other countries. Finally, the report shows that many Americans rely on the program to buy food and other essentials and offers some anecdotes from people in Vermont and elsewhere.

Tomorrow, Sanders will speak in favor of reallocation to preserve Social Security for nearly 11 million disabled Americans and their children when the GOP-controlled committee convenes a hearing to review the disability program. The report can be found here.

From your post above:

"This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years."

Sanders is a liar, how do I know, if the disability insurance had a surplus it wouldn't need propping up. You can throw out your propaganda all day, that won't change the facts.

We just went through this with Mitten Romney 47% BULLSHIT...

We don't have a 'gargantuan welfare state'. America's safety net is below almost every other industrialized country in every measure. America more closely resembles the likes of Mexico than a modern First World industrialized nation.

We heard the ignorant rant of Mitt Romney and his 47%...

If there is a citizenry on this planet that does NOT have an entitlement mentality, it is the American people. American workers receive less benefits, paid leave, health care and take less vacation time than any other people. American workers take pride in the quality of their work and their work ethic.

What Romney said is a gross insult and reveals a dangerous mindset. He reeks of contempt for middle class working people and the poor.

Who are the 47%?

Federal budget and Census data show that, in 2010, 91 percent of the benefit dollars from entitlement and other mandatory programs went to the elderly (people 65 and over), the seriously disabled, and members of working households. People who are neither elderly nor disabled and do not live in a working household received only 9 percent of the benefits.

Moreover, the vast bulk of that 9 percent goes for medical care, unemployment insurance benefits (which individuals must have a significant work history to receive), Social Security survivor benefits for the children and spouses of deceased workers, and Social Security benefits for retirees between ages 62 and 64. Seven out of the 9 percentage points go for one of these four purposes.

80 percent of the workforce has seen their wages decline in real terms over the last quarter-century, and the average household has seen 40 percent of its wealth disappear during the Great Recession. Through it all, families never asked for a handout from anyone, especially Washington. They were left to go on their own, working harder, squeezing nickels, and taking care of themselves. But their economic boats have been taking on water for years, and now the crisis has swamped millions of middle class families. ref ref

"Labor is the United States. The men and women, who with their minds, their hearts and hands, create the wealth that is shared in this countrythey are America."

President Dwight D. Eisenhower

Federal Spending by the Numbers 2014 Government Spending Trends in Graphics Tables

The bull here is strictly from people like this poster. Almost 70 percent of the us budget is entitlements and income support, that comes to two trillion dollars in one year which is probably more than the next 20 countries combined spend on such things. Just like Mexico eh? Well I guess that is why all the Mexicans are trying to get into this country. You can't argue with people who will not acknowledge the facts. Yes we do have a gargantuan welfare state to the tune of over two trillion dollars. Wake the f up.

Social Security and Medicare have added ZERO dollars to the national debt...

Medicare and Social Security -- not defense -- are driving debt says Marco Rubio PolitiFact Florida

Once again your claims are disproved. Really it is absolutely ludicrous to claim that social security and Medicare are not and will not add to the debt. Your are part of the problem.

And as I have posted many months ago when this same discussion came up the reality in my town is this. A woman who is a drunk is getting disability for being a drunk, a man who is a drug addict is getting disability for being a drug addict, a fat woman is getting disability for being fat, and a twenty year old boy/man who fathered a baby is getting disability because he doesn't deal well with other people. If you think people like this with self created problems should crowd out people with true suffering and real,physical pain then it is obvious you are not part of the solution

TOTAL bullshit. Social Security and Medicare are PAID FOR. As a matter of FACT, if those programs ever do add to the debt, the benefits MUST be cut BY LAW!

Social Security and the federal budget

Social Security operates independently from the rest of the federal government, with dedicated funding sources and long-term commitments that are not subject to the annual budget process. This makes benefits more secure, since the amount spent each year on Social Security benefits is not limited to what Congress appropriates but is instead based on a benefit formula.9 Though Congress can rewrite the law to change this formula—as it did in 1983 in the form of a gradual increase in the normal retirement age10—it has been reluctant to cut benefits for older workers and retirees who would have the greatest difficulty adjusting to cuts.

The fact that Social Security benefits are an entitlement that workers earn through a lifetime of contributions does not make them an open-ended liability for taxpayers. To the contrary, the Social Security Administration is prohibited from borrowing, so if it does not have enough money to pay promised benefits in full, it will be forced to cut benefits. This could happen in 2037 when the trust fund is projected to run out, though it is much more likely that Congress will act to shore up the system’s finances before then.

It is important to understand that, because Social Security is prohibited from borrowing, it must balance its long-term budget. As Social Security Chief Actuary Stephen Goss succinctly put it: “Trust Funds enforce long-term budget neutrality. Total spending to date cannot exceed income to date” (Goss 2010). Social Security can run a short-run deficit only if it has previously run surpluses. Thus, when it is drawing down trust fund assets to pay for the Baby Boomer retirement, it will be contributing to the unified budget deficit, a measure that includes Social Security. But over time, Social Security cannot add to the federal deficit.

What Happened to the 2.6 Trillion Social Security Trust Fund - Forbes

Well B wouldn't it be wonderful if your fantasy was reality. Apparently you don't understand how the process has been working believing naively that everything is fine. You are apparently ignorant of the real state of affairs and absolutely don't care to learn what the real state of affairs is if it goes against your orthodoxy. Debating you is easy except that it goes in one ear and out the other and we go through the same exercise a few weeks from now. So we can follow your intellectual train wreck and continue to see the decline of America or we could face the truth and try and solve problems. You always have the ability to change.

How about you actually post something that proves your claims instead of just making accusations based on a know biased web site.

Why is GOP going after Social Security - CNN.com

Republicans planning stealth attack on Social Security Democrats fear - The Washington Post

Benefits for disabled persons were added to Social Security in 1956 under President Eisenhower. By 1967, Social Security Disability Insurance (SSDI) benefits were extended to dependents of disabled persons, and to widowers of disabled persons, when the disabled person was qualified for collecting Social Security Disability Insurance benefits.

When Was Disability Insurance Added To Social Security - 2015

The program has been expanded beyond sustainability, that's been proven time and again by it having to be propped up so often. You don't think there is a need to find a long term solution?

The long term solution is not cutting benefits. A long term solution has been proposed by Bernie Sanders.

Sanders Issues New Report Documenting Republican Effort to Cut Social Security

Tuesday, February 10, 2015

WASHINGTON, Feb. 10 – Sen. Bernie Sanders (I-Vt.), the ranking member of the Senate Budget Committee, said that he would fight Republican attempts to cut Social Security and today issued a report detailing the importance of Social Security and how attempts to cut it are unnecessary.

“Republicans are manufacturing a phony crisis in Social Security in order to cut the earned benefits of millions of the most vulnerable people in this country,” Sanders said. “The American people won’t let them get away with it.”

“At a time when millions of Americans with disabilities and senior citizens are struggling to pay for food, medicine and heat, we should expand, not cut, Social Security,” Sanders added.

National senior organizations representing more than 60 million older Americans –including the AARP, the National Committee to Preserve Social Security and Medicare, the Alliance for Retired Americans and others – are opposed to Republican attempts to block a reallocation of Social Security retirement funds into the Social Security disability fund. Such a reallocation has happened 11 times since the 1960’s and was embraced by Presidents Johnson, Ford, Carter, Reagan and Clinton. President Barack Obama recently asked Congress to do it again this year.

But last month, House Republicans passed a rule to make reallocation more difficult and now the Senate may be poised to attempt the same thing, Sanders warned.

This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years.

“If Republicans are serious about extending the solvency of Social Security beyond 2033, I hope they will join me in scrapping the cap that allows multi-millionaires to pay a much smaller percentage of their income into Social Security than the middle class,” Sanders said.

According to the chief actuary of the Social Security Administration, applying the Social Security payroll tax on income above $250,000 would extend the solvency of Social Security until 2060. Sanders is working on legislation to do just that.

The Sanders’ report also explains how the Social Security disability program is affected by trends in the economy and the increase in income inequality. The report also notes that the American disability insurance system is actually less generous and more rigorous than programs in other countries. Finally, the report shows that many Americans rely on the program to buy food and other essentials and offers some anecdotes from people in Vermont and elsewhere.

Tomorrow, Sanders will speak in favor of reallocation to preserve Social Security for nearly 11 million disabled Americans and their children when the GOP-controlled committee convenes a hearing to review the disability program. The report can be found here.How about you actually post something that proves your claims instead of just making accusations based on a know biased web site.

Why is GOP going after Social Security - CNN.com

Republicans planning stealth attack on Social Security Democrats fear - The Washington Post

Benefits for disabled persons were added to Social Security in 1956 under President Eisenhower. By 1967, Social Security Disability Insurance (SSDI) benefits were extended to dependents of disabled persons, and to widowers of disabled persons, when the disabled person was qualified for collecting Social Security Disability Insurance benefits.

When Was Disability Insurance Added To Social Security - 2015

The program has been expanded beyond sustainability, that's been proven time and again by it having to be propped up so often. You don't think there is a need to find a long term solution?

The long term solution is not cutting benefits. A long term solution has been proposed by Bernie Sanders.

Sanders Issues New Report Documenting Republican Effort to Cut Social Security

Tuesday, February 10, 2015

WASHINGTON, Feb. 10 – Sen. Bernie Sanders (I-Vt.), the ranking member of the Senate Budget Committee, said that he would fight Republican attempts to cut Social Security and today issued a report detailing the importance of Social Security and how attempts to cut it are unnecessary.

“Republicans are manufacturing a phony crisis in Social Security in order to cut the earned benefits of millions of the most vulnerable people in this country,” Sanders said. “The American people won’t let them get away with it.”

“At a time when millions of Americans with disabilities and senior citizens are struggling to pay for food, medicine and heat, we should expand, not cut, Social Security,” Sanders added.

National senior organizations representing more than 60 million older Americans –including the AARP, the National Committee to Preserve Social Security and Medicare, the Alliance for Retired Americans and others – are opposed to Republican attempts to block a reallocation of Social Security retirement funds into the Social Security disability fund. Such a reallocation has happened 11 times since the 1960’s and was embraced by Presidents Johnson, Ford, Carter, Reagan and Clinton. President Barack Obama recently asked Congress to do it again this year.

But last month, House Republicans passed a rule to make reallocation more difficult and now the Senate may be poised to attempt the same thing, Sanders warned.

This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years.

“If Republicans are serious about extending the solvency of Social Security beyond 2033, I hope they will join me in scrapping the cap that allows multi-millionaires to pay a much smaller percentage of their income into Social Security than the middle class,” Sanders said.

According to the chief actuary of the Social Security Administration, applying the Social Security payroll tax on income above $250,000 would extend the solvency of Social Security until 2060. Sanders is working on legislation to do just that.

The Sanders’ report also explains how the Social Security disability program is affected by trends in the economy and the increase in income inequality. The report also notes that the American disability insurance system is actually less generous and more rigorous than programs in other countries. Finally, the report shows that many Americans rely on the program to buy food and other essentials and offers some anecdotes from people in Vermont and elsewhere.

Tomorrow, Sanders will speak in favor of reallocation to preserve Social Security for nearly 11 million disabled Americans and their children when the GOP-controlled committee convenes a hearing to review the disability program. The report can be found here.

From your post above:

"This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years."

Sanders is a liar, how do I know, if the disability insurance had a surplus it wouldn't need propping up. You can throw out your propaganda all day, that won't change the facts.

If SSI EVER has to borrow a penny, it MUST cut benefits, BY LAW. It ONLY need to be reformed so the surplus is not exhausted. What is the driver? We face a large number of Americans who will reach retirement age soon. WHY? Because the New Deal and Democrats created such a robust middle class and they procreated at a very high rate.

We just went through this with Mitten Romney 47% BULLSHIT...

We don't have a 'gargantuan welfare state'. America's safety net is below almost every other industrialized country in every measure. America more closely resembles the likes of Mexico than a modern First World industrialized nation.

We heard the ignorant rant of Mitt Romney and his 47%...

If there is a citizenry on this planet that does NOT have an entitlement mentality, it is the American people. American workers receive less benefits, paid leave, health care and take less vacation time than any other people. American workers take pride in the quality of their work and their work ethic.

What Romney said is a gross insult and reveals a dangerous mindset. He reeks of contempt for middle class working people and the poor.

Who are the 47%?

Federal budget and Census data show that, in 2010, 91 percent of the benefit dollars from entitlement and other mandatory programs went to the elderly (people 65 and over), the seriously disabled, and members of working households. People who are neither elderly nor disabled and do not live in a working household received only 9 percent of the benefits.

Moreover, the vast bulk of that 9 percent goes for medical care, unemployment insurance benefits (which individuals must have a significant work history to receive), Social Security survivor benefits for the children and spouses of deceased workers, and Social Security benefits for retirees between ages 62 and 64. Seven out of the 9 percentage points go for one of these four purposes.

80 percent of the workforce has seen their wages decline in real terms over the last quarter-century, and the average household has seen 40 percent of its wealth disappear during the Great Recession. Through it all, families never asked for a handout from anyone, especially Washington. They were left to go on their own, working harder, squeezing nickels, and taking care of themselves. But their economic boats have been taking on water for years, and now the crisis has swamped millions of middle class families. ref ref

"Labor is the United States. The men and women, who with their minds, their hearts and hands, create the wealth that is shared in this countrythey are America."

President Dwight D. Eisenhower

Federal Spending by the Numbers 2014 Government Spending Trends in Graphics Tables

The bull here is strictly from people like this poster. Almost 70 percent of the us budget is entitlements and income support, that comes to two trillion dollars in one year which is probably more than the next 20 countries combined spend on such things. Just like Mexico eh? Well I guess that is why all the Mexicans are trying to get into this country. You can't argue with people who will not acknowledge the facts. Yes we do have a gargantuan welfare state to the tune of over two trillion dollars. Wake the f up.

Social Security and Medicare have added ZERO dollars to the national debt...

How about you actually post something that proves your claims instead of just making accusations based on a know biased web site.

Why is GOP going after Social Security - CNN.com

Republicans planning stealth attack on Social Security Democrats fear - The Washington Post

Benefits for disabled persons were added to Social Security in 1956 under President Eisenhower. By 1967, Social Security Disability Insurance (SSDI) benefits were extended to dependents of disabled persons, and to widowers of disabled persons, when the disabled person was qualified for collecting Social Security Disability Insurance benefits.

When Was Disability Insurance Added To Social Security - 2015

The program has been expanded beyond sustainability, that's been proven time and again by it having to be propped up so often. You don't think there is a need to find a long term solution?

The long term solution is not cutting benefits. A long term solution has been proposed by Bernie Sanders.

Sanders Issues New Report Documenting Republican Effort to Cut Social Security

Tuesday, February 10, 2015

WASHINGTON, Feb. 10 – Sen. Bernie Sanders (I-Vt.), the ranking member of the Senate Budget Committee, said that he would fight Republican attempts to cut Social Security and today issued a report detailing the importance of Social Security and how attempts to cut it are unnecessary.

“Republicans are manufacturing a phony crisis in Social Security in order to cut the earned benefits of millions of the most vulnerable people in this country,” Sanders said. “The American people won’t let them get away with it.”

“At a time when millions of Americans with disabilities and senior citizens are struggling to pay for food, medicine and heat, we should expand, not cut, Social Security,” Sanders added.

National senior organizations representing more than 60 million older Americans –including the AARP, the National Committee to Preserve Social Security and Medicare, the Alliance for Retired Americans and others – are opposed to Republican attempts to block a reallocation of Social Security retirement funds into the Social Security disability fund. Such a reallocation has happened 11 times since the 1960’s and was embraced by Presidents Johnson, Ford, Carter, Reagan and Clinton. President Barack Obama recently asked Congress to do it again this year.

But last month, House Republicans passed a rule to make reallocation more difficult and now the Senate may be poised to attempt the same thing, Sanders warned.

This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years.

“If Republicans are serious about extending the solvency of Social Security beyond 2033, I hope they will join me in scrapping the cap that allows multi-millionaires to pay a much smaller percentage of their income into Social Security than the middle class,” Sanders said.

According to the chief actuary of the Social Security Administration, applying the Social Security payroll tax on income above $250,000 would extend the solvency of Social Security until 2060. Sanders is working on legislation to do just that.

The Sanders’ report also explains how the Social Security disability program is affected by trends in the economy and the increase in income inequality. The report also notes that the American disability insurance system is actually less generous and more rigorous than programs in other countries. Finally, the report shows that many Americans rely on the program to buy food and other essentials and offers some anecdotes from people in Vermont and elsewhere.

Tomorrow, Sanders will speak in favor of reallocation to preserve Social Security for nearly 11 million disabled Americans and their children when the GOP-controlled committee convenes a hearing to review the disability program. The report can be found here.How about you actually post something that proves your claims instead of just making accusations based on a know biased web site.

Why is GOP going after Social Security - CNN.com

Republicans planning stealth attack on Social Security Democrats fear - The Washington Post

Benefits for disabled persons were added to Social Security in 1956 under President Eisenhower. By 1967, Social Security Disability Insurance (SSDI) benefits were extended to dependents of disabled persons, and to widowers of disabled persons, when the disabled person was qualified for collecting Social Security Disability Insurance benefits.

When Was Disability Insurance Added To Social Security - 2015

The program has been expanded beyond sustainability, that's been proven time and again by it having to be propped up so often. You don't think there is a need to find a long term solution?

The long term solution is not cutting benefits. A long term solution has been proposed by Bernie Sanders.

Sanders Issues New Report Documenting Republican Effort to Cut Social Security

Tuesday, February 10, 2015

WASHINGTON, Feb. 10 – Sen. Bernie Sanders (I-Vt.), the ranking member of the Senate Budget Committee, said that he would fight Republican attempts to cut Social Security and today issued a report detailing the importance of Social Security and how attempts to cut it are unnecessary.

“Republicans are manufacturing a phony crisis in Social Security in order to cut the earned benefits of millions of the most vulnerable people in this country,” Sanders said. “The American people won’t let them get away with it.”

“At a time when millions of Americans with disabilities and senior citizens are struggling to pay for food, medicine and heat, we should expand, not cut, Social Security,” Sanders added.

National senior organizations representing more than 60 million older Americans –including the AARP, the National Committee to Preserve Social Security and Medicare, the Alliance for Retired Americans and others – are opposed to Republican attempts to block a reallocation of Social Security retirement funds into the Social Security disability fund. Such a reallocation has happened 11 times since the 1960’s and was embraced by Presidents Johnson, Ford, Carter, Reagan and Clinton. President Barack Obama recently asked Congress to do it again this year.

But last month, House Republicans passed a rule to make reallocation more difficult and now the Senate may be poised to attempt the same thing, Sanders warned.

This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years.

“If Republicans are serious about extending the solvency of Social Security beyond 2033, I hope they will join me in scrapping the cap that allows multi-millionaires to pay a much smaller percentage of their income into Social Security than the middle class,” Sanders said.

According to the chief actuary of the Social Security Administration, applying the Social Security payroll tax on income above $250,000 would extend the solvency of Social Security until 2060. Sanders is working on legislation to do just that.

The Sanders’ report also explains how the Social Security disability program is affected by trends in the economy and the increase in income inequality. The report also notes that the American disability insurance system is actually less generous and more rigorous than programs in other countries. Finally, the report shows that many Americans rely on the program to buy food and other essentials and offers some anecdotes from people in Vermont and elsewhere.

Tomorrow, Sanders will speak in favor of reallocation to preserve Social Security for nearly 11 million disabled Americans and their children when the GOP-controlled committee convenes a hearing to review the disability program. The report can be found here.

From your post above:

"This despite the fact that the combined Social Security retirement and disability insurance trust funds have a $2.8 trillion surplus and can pay every benefit owed to every eligible American for the next 18 years."

Sanders is a liar, how do I know, if the disability insurance had a surplus it wouldn't need propping up. You can throw out your propaganda all day, that won't change the facts.

If SSI EVER has to borrow a penny, it MUST cut benefits, BY LAW. It ONLY need to be reformed so the surplus is not exhausted. What is the driver? We face a large number of Americans who will reach retirement age soon. WHY? Because the New Deal and Democrats created such a robust middle class and they procreated at a very high rate.

if you say they say that.....lets see someone saying that.....Welfare was never meant to be a lifestyle or career, it's designed to be a stepping stone for those that are able to work. The left uses it to get votes and a tool for fear mongeringWelfare was never meant to be a lifestyle or career, it's designed to be a stepping stone for those that are able to work. The left uses it to get votes and a tool for fear mongering

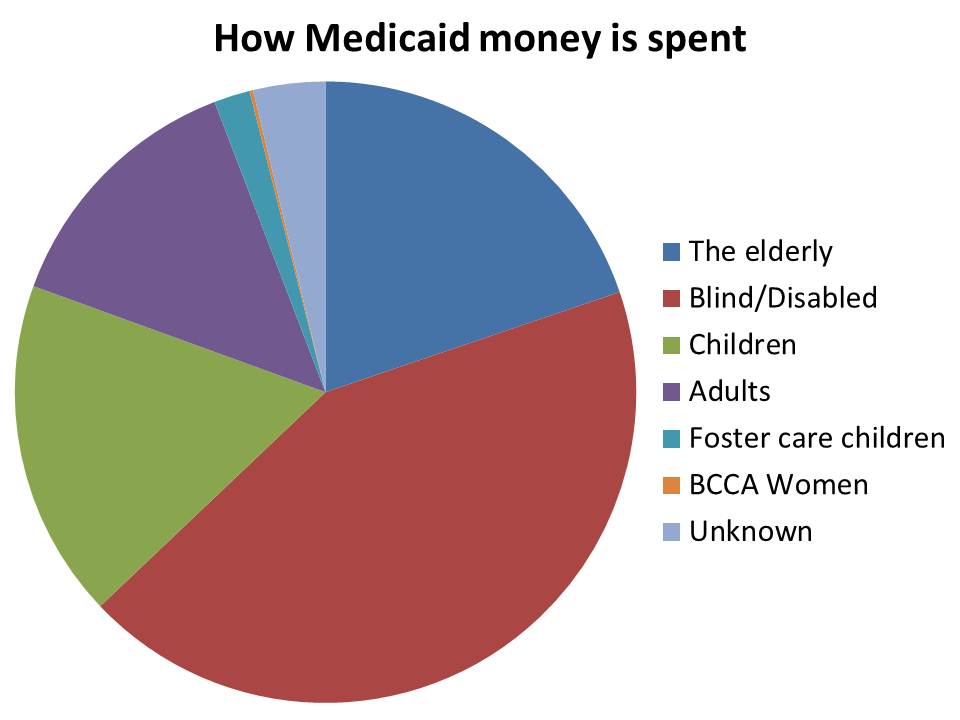

That adults is a pretty big piece of the pie, let's start looking at them, see how long they've been on welfare and why

Disabled vets make up a large percentage but RWs say they don't deserve help any more than children do.

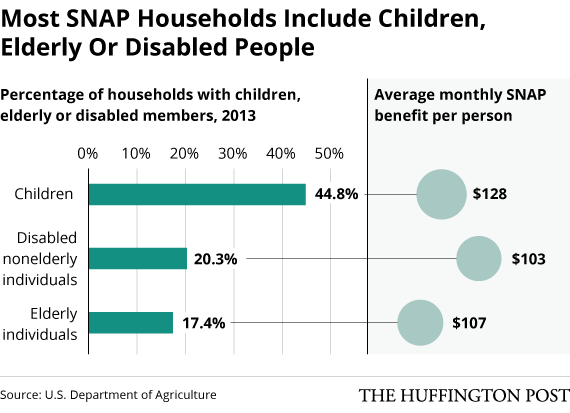

We all know that taking care of children, the disabled and the elderly is more than just feeding them. Those that take care of two of the three know how much a hundred dollars of food stamps means.

All this GOP ranting about food stamps. Do they believe children, the disabled and the elderly don't deserve help? Do Republicans think they should just quietly go away?

We just went through this with Mitten Romney 47% BULLSHIT...

We don't have a 'gargantuan welfare state'. America's safety net is below almost every other industrialized country in every measure. America more closely resembles the likes of Mexico than a modern First World industrialized nation.

We heard the ignorant rant of Mitt Romney and his 47%...

If there is a citizenry on this planet that does NOT have an entitlement mentality, it is the American people. American workers receive less benefits, paid leave, health care and take less vacation time than any other people. American workers take pride in the quality of their work and their work ethic.

What Romney said is a gross insult and reveals a dangerous mindset. He reeks of contempt for middle class working people and the poor.

Who are the 47%?

Federal budget and Census data show that, in 2010, 91 percent of the benefit dollars from entitlement and other mandatory programs went to the elderly (people 65 and over), the seriously disabled, and members of working households. People who are neither elderly nor disabled and do not live in a working household received only 9 percent of the benefits.

Moreover, the vast bulk of that 9 percent goes for medical care, unemployment insurance benefits (which individuals must have a significant work history to receive), Social Security survivor benefits for the children and spouses of deceased workers, and Social Security benefits for retirees between ages 62 and 64. Seven out of the 9 percentage points go for one of these four purposes.

80 percent of the workforce has seen their wages decline in real terms over the last quarter-century, and the average household has seen 40 percent of its wealth disappear during the Great Recession. Through it all, families never asked for a handout from anyone, especially Washington. They were left to go on their own, working harder, squeezing nickels, and taking care of themselves. But their economic boats have been taking on water for years, and now the crisis has swamped millions of middle class families. ref ref

"Labor is the United States. The men and women, who with their minds, their hearts and hands, create the wealth that is shared in this countrythey are America."

President Dwight D. Eisenhower

Federal Spending by the Numbers 2014 Government Spending Trends in Graphics Tables

The bull here is strictly from people like this poster. Almost 70 percent of the us budget is entitlements and income support, that comes to two trillion dollars in one year which is probably more than the next 20 countries combined spend on such things. Just like Mexico eh? Well I guess that is why all the Mexicans are trying to get into this country. You can't argue with people who will not acknowledge the facts. Yes we do have a gargantuan welfare state to the tune of over two trillion dollars. Wake the f up.

Social Security and Medicare have added ZERO dollars to the national debt...

Of course they have. You don't believe that nonsense about the "Trust Fund," do you?

We just went through this with Mitten Romney 47% BULLSHIT...

We don't have a 'gargantuan welfare state'. America's safety net is below almost every other industrialized country in every measure. America more closely resembles the likes of Mexico than a modern First World industrialized nation.

We heard the ignorant rant of Mitt Romney and his 47%...

If there is a citizenry on this planet that does NOT have an entitlement mentality, it is the American people. American workers receive less benefits, paid leave, health care and take less vacation time than any other people. American workers take pride in the quality of their work and their work ethic.

What Romney said is a gross insult and reveals a dangerous mindset. He reeks of contempt for middle class working people and the poor.

Who are the 47%?

Federal budget and Census data show that, in 2010, 91 percent of the benefit dollars from entitlement and other mandatory programs went to the elderly (people 65 and over), the seriously disabled, and members of working households. People who are neither elderly nor disabled and do not live in a working household received only 9 percent of the benefits.

Moreover, the vast bulk of that 9 percent goes for medical care, unemployment insurance benefits (which individuals must have a significant work history to receive), Social Security survivor benefits for the children and spouses of deceased workers, and Social Security benefits for retirees between ages 62 and 64. Seven out of the 9 percentage points go for one of these four purposes.

80 percent of the workforce has seen their wages decline in real terms over the last quarter-century, and the average household has seen 40 percent of its wealth disappear during the Great Recession. Through it all, families never asked for a handout from anyone, especially Washington. They were left to go on their own, working harder, squeezing nickels, and taking care of themselves. But their economic boats have been taking on water for years, and now the crisis has swamped millions of middle class families. ref ref

"Labor is the United States. The men and women, who with their minds, their hearts and hands, create the wealth that is shared in this countrythey are America."

President Dwight D. Eisenhower

Federal Spending by the Numbers 2014 Government Spending Trends in Graphics Tables

The bull here is strictly from people like this poster. Almost 70 percent of the us budget is entitlements and income support, that comes to two trillion dollars in one year which is probably more than the next 20 countries combined spend on such things. Just like Mexico eh? Well I guess that is why all the Mexicans are trying to get into this country. You can't argue with people who will not acknowledge the facts. Yes we do have a gargantuan welfare state to the tune of over two trillion dollars. Wake the f up.

Social Security and Medicare have added ZERO dollars to the national debt...

Of course they have. You don't believe that nonsense about the "Trust Fund," do you?

I believe in facts, not myths and propaganda from right wing social Darwinists who are try to take down the safety net.

Social Security: Fears vs. Facts

What Social Security critics keep getting wrong

Myth #2: The Social Security trust fund assets are worthless.

Any surplus payroll taxes not used for current benefits are used to purchase special-issue, interest-paying Treasury bonds. In other words, the surplus in the Social Security trust fund has been loaned to the federal government for its general use — the reserve of $2.6 trillion is not a heap of cash sitting in a vault. These bonds are backed by the full faith and credit of the federal government, just as they are for other Treasury bondholders. However, Treasury will soon need to pay back these bonds. This will put pressure on the federal budget, according to Social Security's board of trustees. Even without any changes, Social Security can continue paying full benefits through 2033. After that, the revenue from payroll taxes will still cover about 75 percent of promised benefits.

What evidence?

The evidence that the Paul Ryan budgets in the news in past years intended for 60% of the cuts to come from programs for low income Americans.

What evidence?

The evidence that the Paul Ryan budgets in the news in past years intended for 60% of the cuts to come from programs for low income Americans.

Are they cuts or are they merely less than desired increases?

And really we need to address the requirements for going on the dole and the indisputable fact that it has been made easier and easier to suck on the taxpayer tit

The wealthier receive more in housing subsidies, mostly coming from the mortgage interest deduction,

than the poorer receive in housing subsidies.

What evidence?

The evidence that the Paul Ryan budgets in the news in past years intended for 60% of the cuts to come from programs for low income Americans.

Are they cuts or are they merely less than desired increases?

And really we need to address the requirements for going on the dole and the indisputable fact that it has been made easier and easier to suck on the taxpayer tit

It's not hard to look at a household income and figure out whether or not they can afford something like health insurance coverage;

if they can't, then you have to make the choice, either give them taxpayer funded help, or let them sink or swim without it.

What evidence?

The evidence that the Paul Ryan budgets in the news in past years intended for 60% of the cuts to come from programs for low income Americans.

Are they cuts or are they merely less than desired increases?

And really we need to address the requirements for going on the dole and the indisputable fact that it has been made easier and easier to suck on the taxpayer tit