You Dishonest Sour Grapes tramp.

This is HUGE for Israel and everyone knows it.

It's so huge your wasting all your time back in your home-by-insemination Saudi Arabia posting here.

and you are now Unwittingly admitting you LIED.

NG was NOT "Falling".

In fact it was up even before the recent Cold Weather snap.

ALL Your posts are LIES.

You are a Sick and Pathological LIAR.

You didn't answer this from page one either LIAR:

I am and O&G investor and I understand the dynamics better than you and just explained them above.

You are just getting hearsay whispered in your ear while some 80 yr old Sheik is porking you.

`

You sure have a filthy mouth.

Israel is faced with several challenges.. They have to increase the size of their navy, protect the installations and work out how to get their gas to market.

And they have to hope that there is NOT so much natural gas available that the price is depressed.

I posted an excellent link for you to read.

So you move on to a NEW Point, never admitting you were Caught LYING AGAIN! !

Everything you type is a Pathological Lie.

You couldn't answer my knowledgable post even with all that time in the Saudi ex-pat life.

WTF is the matter with you?

Get help.

You really have some problem.

There are several factors that will influence this windfall.

Israeli gas find remains bottled up

By: Matthew Bryza

Posted: 01/21/2014 2:53 PM |

For Israel, the discovery in 2010 of a vast natural gas field off its coast was like hitting the jackpot. The future energy development offered the country unprecedented economic security.

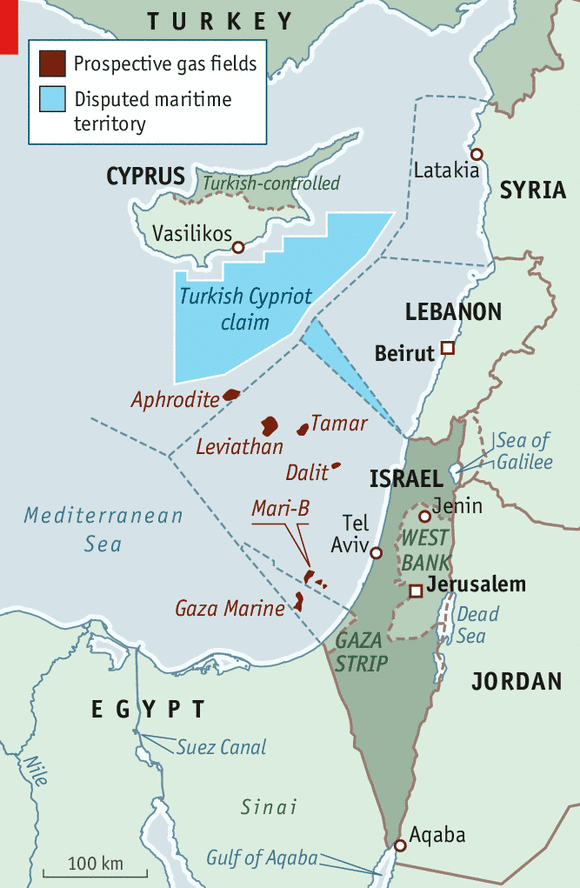

Now, the business plans for the Leviathan site are advanced enough that Israel and its neighbours must address the toughest question about the project: how to export the gas.

The Leviathan fields estimated 510 billion cubic meters of gas, coupled with continuing production at the nearby Tamar site, are expected to fuel Israels electricity generation, water desalinization and a new generation of energy-intensive industries. Exporting the gas beyond Israel would offer still greater economic benefits.

The finds also have the potential to lead to breakthroughs in disputes that have long poisoned relationships between Turkey on one side, and Israel and Cyprus, which also has potential gas reserves in its waters, on the other. Getting to a resolution wont be easy, but with the right approach and support from the U.S. and the European Union, it is possible.

Exports in the form of liquefied natural gas would maximize Israels options, providing access to the worlds highest gas prices, currently in East Asia. Unfortunately, building a liquefaction plant on Israeli territory appears politically impossible, given concerns about environmental and physical security.

The obvious alternative would be to build an LNG terminal off Israels coast, avoiding such domestic hurdles. But this would limit the geopolitical advantages to Israel of collaborating with other countries on gas exports. It may become a flashpoint if the neighbours of Israel and Cyprus have no stake in the new energy resources, further entrenching regional disputes.

Aware of the costs and benefits, Israels government is planning to build a short pipeline to Jordan, a project that could help to stabilize the Jewish states lone Arab partner and supply Palestinians in the West Bank. The Leviathan fields developers said Jan. 5 that they had signed a deal to sell 4.5 billion cubic meters of gas to Palestine Power Generation Co. over 20 years.

Full development of the field, however, will require larger exports than Jordan or the Palestinian territories can absorb (the combined annual gas consumption of Israel and Jordan is only about six billion cubic meters). One possibility would be to pipe the gas from Leviathan to a proposed LNG terminal on Jordans Red Sea coast. Similarly, Israeli gas could be piped to Egypts underused LNG terminals on the Mediterranean.

But locating such a critical Israeli asset in Jordan or Egypt is politically infeasible for all three countries. So the Israeli government is looking at two other export options: an LNG terminal in Cyprus or an underwater pipeline to Turkey.

The first option looks politically easier. With the deterioration and rupture of its partnership with Turkey, Israel has improved relations with Cyprus in the last three years. Cyprus has had no diplomatic relations with Turkey since 1974, when Turkish troops seized the northern third of the island after a military coup.

For the Cypriot government, an LNG terminal at Vasilikos on the islands southern shore is an urgent priority, providing revenue and jobs to mitigate the countrys financial crisis and creating the eastern Mediterraneans natural gas hub.

The project, however, requires large amounts of Israeli gas, because the biggest Cypriot field discovered so far, Aphrodite, is too small to justify commercial development of a $4.5 billion to $6 billion terminal. In the time it takes to find enough gas and finance construction, new volumes of liquefied natural gas from Australia, East Africa and the U.S. may have flooded global markets, depressing prices.

Israel might agree to use a Cypriot terminal, yet no country has ever exported its natural gas from an LNG terminal on another countrys territory, making this prospect unlikely.

Another option might involve two stages: First, private companies construct a 470 kilometre pipeline to Turkey, which would be much cheaper and give Israel more control (disclosure: I am on the board of Turcas Energy Group AS, which is proposing such a pipeline); second, some of the pipelines early revenue, coupled with excess gas from Leviathan, would be used to enable financing of the Cypriot terminal.

Commercially, this dual-export option appears feasible; it enjoys support from the lead companies developing both the Leviathan and Aphrodite fields, the U.S. company Noble Energy Inc. and Israels Delek Group Ltd.

Again, however, the hurdles are formidable. A subsea pipeline from Leviathan to Turkey must cross the Cypriot continental shelf, which, for practical purposes, requires permission from the Cypriot government. Such permission is inconceivable today. Meanwhile, normalization of Israel-Turkey relations also remains stalled.

These obstacles could fade in coming months as the prize of a deal on energy helps speed that process. Both Cyprus and Turkey are working to restart talks on a Cyprus settlement under the auspices of the United Nations.

Although this has been tried before, Cypriot leaders increasingly (if privately) recognize the economic imperative of a pipeline to Turkey. At the same time, Turkish officials have quietly suggested that restoration of full relations with Israel could occur in tandem with an agreement to build an Israel-Turkey natural gas pipeline.

Achieving these breakthroughs and integrating them into an agreement among Israel, Cyprus and Turkey to develop these two projects in tandem will require intricate diplomatic choreography.

The U.S. can play a role, as it did in the late 1990s, when it helped Azerbaijan, Georgia and Turkey open a new corridor for oil and gas pipelines. This time, however, the U.S. is sitting back, waiting for Turkish Prime Minister Recep Tayyip Erdogan to soften his hostility toward Israel.

Building an Israel-Turkey pipeline connected to a Cyprus LNG terminal offers strategic opportunities that transcend economics, including a chance for Israel and Turkey to restore their strategic partnership. It would also push Turkey to reach an agreement on the Cyprus question, removing a 40-year irritant in relations with Europe and re-energizing Turkeys flagging efforts to join the EU. The U.S., working with the EU, should help to shape this future.

Israeli gas find remains bottled up - Winnipeg Free Press