Dad2three

Gold Member

Chirp. Chirp. Chirp. Still waiting for a liberal reply, so here goes again:

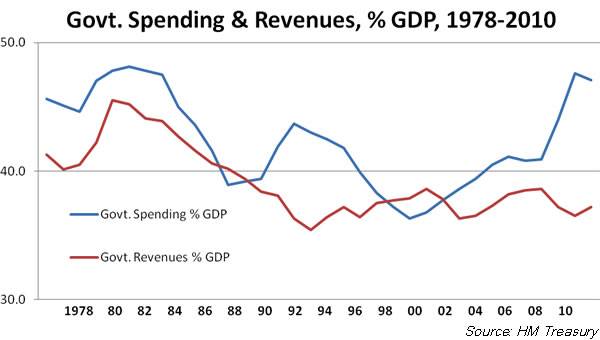

Well. . . . Okay. . . . How about we apply the revenue-as-percentage-of-GDP comparison to Obama? Guess what happens when we do that? Obama looks terrible and Bush looks even better! Why? Because under Obama’s recovery, federal revenue has been a smaller percentage of GDP than it was under Bush’s recovery!

According to Obama apologists, the Obama recovery began in 2009. Ok, let’s compare federal revenue as a percentage of GDP under Obama’s recovery vs. Bush’s recovery:

First Year: Bush 15.6% (2004) – Obama 14.6% (2009)

Second Year: Bush 16.7% (2005) – Obama 14.6% (2010)

Third Year: Bush 17.6% (2006) – Obama 15.0% (2011)

Fourth Year: Bush 17.9% (2007) – Obama 15.3% (2012)

Fifth Year: Bush 17.1% (2008) – Obama 16.7% (2013)

I threw in 2008, even though the recession began that year, since the economy was in recession for part of 2009, just to make the comparison as apples-to-apples as possible.

In fact, under Obama federal revenue has *never* been as high a percentage of GDP as it was under Bush's best year or even under his second-best year. Bush’s best percentage was 17.9% (2007), and his second best was 17.6% (2006). Obama’s best percentage was 17.5% (2014).

So, liberals, if you insist on ignoring cold hard revenue numbers and instead want to resort to phony comparisons like revenue as a percentage of GDP, then I trust you will promptly concede that Obama has been even worse than we’ve been saying and that we can ignore the substantial increase in federal revenue that has occurred under Obama. Right? Right? Hello?

You see, under Obama federal revenue has gone up even more than it did under Bush. Under Bush, revenue rose by a whopping—and until then record-setting—$480 billion in the 4 years after the 2003 tax cuts. But, in the 4 years after Obama’s recovery began, revenue rose by $660 billion. Ah, but, sorry! That doesn’t matter! Because revenue as a percentage of GDP has been less than it was under Bush! So we can ignore the revenue numbers themselves because the percentage of GDP went down! Right? Right? (Uh-oh, having second thoughts about the validity of this comparison, are we?)

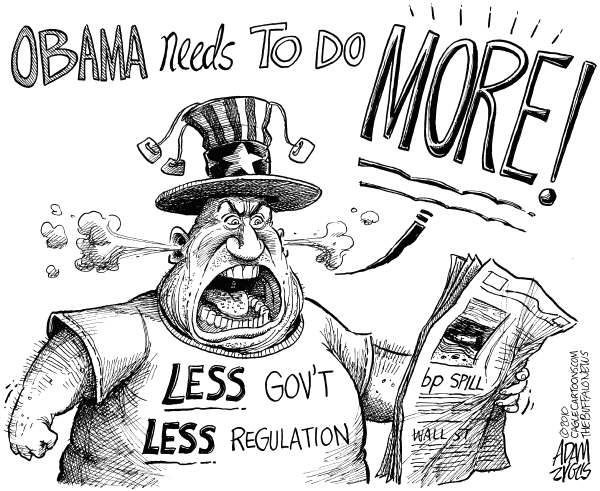

Now, of course, one could point out that this increase in revenue under Obama has been accompanied by a very weak recovery, by a record high level of U-6 unemployment (which is the real unemployment rate), by a drop in median family income, by a rise in minority unemployment, by a staggering increase in the national debt (Obama has made Bush look like a rookie in piling up debt), two quarters of negative GDP growth during a supposed "recovery" (first quarter 2014, first quarter 2015), one of the worst labor force participation rates in the modern era (and far below Bush-era levels), a huge increase in food stamps, etc., etc. That's what you get when you suck hundreds of billions of dollars out of the economy with a slew of higher taxes and piles of new burdensome regulations.

You have shifted the narrative your initial sub-premise of, "Comparing revenue to GDP is a meaningless exercise." Rather than standing up and admitting your error to everything you have been proselytizing previously, you now wish to compare two distinctly and dynamically different economic periods with different criteria! That's apples and cod fish!

Give it up. You and your supercilious argument FAILED, and shifting the subject to different parameters indicates how desperate you are to get the egg off your face!

HUH???? Did you READ my post before typing your response? If so, you must have a reading comprehension problem. I simply pointed out the consequences for Obama's economic record of using YOUR argument that we can dismiss the revenue increase that followed the 2003 tax cuts because revenue as a percentage GDP was lower than it was under Clinton. That was YOUR argument. I was just showing how meaningless that comparison is, and how dumb that argument is, since revenue has risen sharply under Obama but has been a lower percentage of GDP than it was under Bush.

As for the argument that we should start with 2001 to analyze Bush's record, how many times do I have to point out that we're talking about the Bush tax cuts and that the vast majority of those tax cuts came in 2003?

Following the 2003 tax cuts, revenue for the next 4 years rose more than it did during any 4-year period of Clinton's presidency, AND that revenue increase came with 52 consecutive months of economic growth, a rise in median family income, and a substantial reduction in the U-6 unemployment rate. Under Obama revenue has risen even more than it did under Bush, but Obama's revenue increase has come with the weakest recovery in modern history (including two quarters of negative GDP growth), a drop in median family income, and a much higher U-6 unemployment rate.

The Economic Blue Screen of Death

October 17, 2008

...Let's look at a graph I used two years ago, from work done by James Kennedy and Alan Greenspan, on the effect of mortgage equity withdrawals (MEWs) on the growth of the US economy.

Notice that in both 2001 and 2002, the US economy continued to grow on an annual basis (the "technical" recession was just a few quarters). Their work suggests that this growth was entirely due to MEWs. In fact, MEWs contributed over 3% to GDP growth in 2004 and 2005, and 2% in 2006. Without US homeowners using their homes as an ATM, the economy would have been very sluggish indeed, averaging much less than 1% for the six years of the Bush presidency. Indeed, as a side observation, without home equity withdrawals the economy would have been so bad it would have been almost impossible for Bush to have won a second term.

Now let's look at the update that James Kennedy posted last week to his numbers. While he does not have an update to the chart above, we do have the actual numbers for new mortgage equity withdrawals through the second quarter of this year. And what they show is MEWs simply withering on the vine. The engine of our GDP growth has essentially been turned off. Look at the fall in the numbers for yourself:

In 2005 there was almost $595 billion in mortgage extractions that went into some kind of consumer spending. Remember, according to the graph above, that translated into a 3% rise in GDP. In 2007, MEWs were down to $470 billion, for a boost of 2% to GDP.

The second quarter of 2008 saw an anemic $9.5 billion. At that run rate, we could see a drop-off of over 90% from 2005! Now, think what the second quarter would have been without the federal stimulus program of $150 billion. It might have looked and felt like this quarter!

The Economic Blue Screen of Death

You can duck and dodge and copy and paste all day, but you clearly have no substantive, relevant response to the following facts, facts that anyone can confirm by checking federal data sites on the federal budget and the GDP:

* Following the 2003 tax cuts, federal revenue rose for 4 years in a row, and even in the recession year of 2008 revenue was higher than it was in 2005 and 2006.

* The federal revenue growth that occurred in the 4 years that followed the 2003 tax cuts exceeded the revenue growth of any 4-year period in the Clinton years.

* The federal revenue growth that followed the 2003 tax cuts came with a sizable reduction in the U-6 unemployment rate, an increase in median family income, and 52 consecutive months of economic growth.

* Obama's federal revenue growth has exceeded Bush's, but, oddly enough, revenue as a percentage of GDP is much lower than it was under Bush. So, according to you guys, that means the revenue growth really didn't happen and/or that it shoulda/coulda/woulda been larger if other policies had been followed.

* The rise in federal revenue that has occurred under Obama has come with a drop in median family income, a sizable increase in the U-6 unemployment rate, and the weakest recovery of the modern area (a "recovery" that has included two quarters of negative GDP growth).

ANOTHER right winger who doesn't EVER get honest. Weird, almost like there's a cult or something

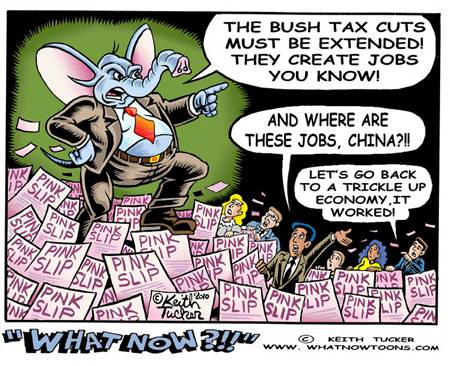

Hint you MUST start Dubya's tax revenues HIS first F/Y IF you want to ignore Dubya's great recession on Obama'a watch dumbass. I get it though, since Dubya had NOTHING until he pumped up his ponzi scheme that artificially inflated revenues although STILL WAY BELOW BJ BILL'S LAST 4 YEARS OF 19%+ GDP REVENUES, lol

Yep, you are correct though, Dubya/GOP dig WIDE and deep holes