- Sep 19, 2011

- 28,466

- 10,042

- 900

- Thread starter

- #41

Why is it so hard to understand that TAX cuts INCREASES tax revenues?

It's not hard to understand, and equally not hard to reject as mindless BULLSHIT.

Liberals pay taxes, Economists pay taxes and guess what, nobody LIKES to pay taxes, so if there was some to pay less while government would collect more EVERYONE would be for it.

But like most free lunches that are too good to be true,self financingrevenue increasing tax rate reductions from current tax rates is simply NOT TRUE, as economists left right and center will assure you.

Even rightwinger like Laffer himself, after whom the Laffer Curve is named would not say that Bush's tax cuts self-financed (never mind INCREASED revenues)

Tax Cuts Don't Boost Revenues

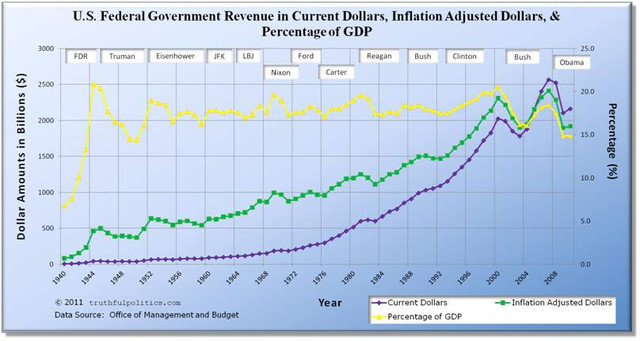

Explain this then!

Note: The events that occurred COST federal money NO question! YET in spite of that greater expenditures REVENUES increased in 2005,6,7 and would have in 2008 IF THIS event hadn't of occurred. And by the way TARP has been REPAID all $800 Billion!

The 9/18/2008 Economic Terrorist Attack:

On Thursday (Sept 18), at 11 in the morning the Federal Reserve noticed a tremendous draw-down of money market accounts in the U.S.,

to the tune of $550 billion was being drawn out in the matter of an hour or two.

The Treasury opened up its window to help and pumped a $105 billion in the system and quickly realized that they could not stem the tide.

We were having an electronic run on the banks.

They decided to close the operation, close down the money accounts and announce a guarantee of $250,000 per account so there wouldn't be further panic out there. If they had not done that, their estimation was that by 2pm that afternoon, $5.5 trillion would have been drawn out of the money market system of the U.S., would have collapsed the entire economy of the U.S., and within 24 hours the world economy would have collapsed. It would have been the end of our economic system and our political system as we know it...

http://seekingalpha.com/article/119619-how-the-world-almost-came-to-an-end-on-september-18-2008