HenryFortune

Rookie

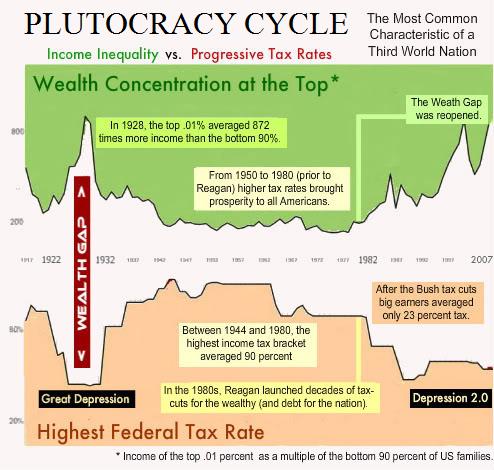

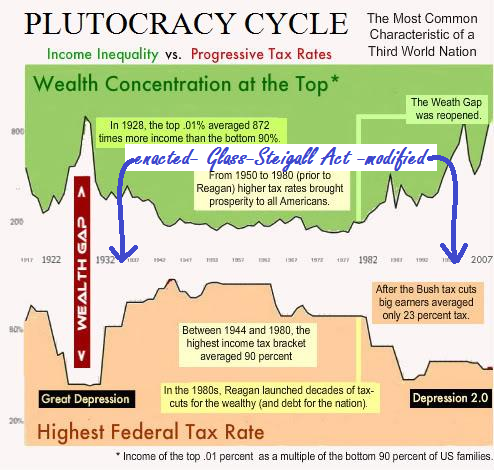

So far no one has pointed out the fact that the wealth gap shown in the graph directly corresponds to the existence of the Glass-Steigall Act.

Oh gawd, not another one that believes wealth is a finite pile of cash from which we all must draw.

Honestly, other than pure jealousy, why would you care if the wealthiest Americans (a group in constant flux) increased their wealth over time...even if it was to a greater extent than Americans around median income levels (also a group in flux)?

Do you think that if one guy makes himself rich, another man must therefore go with less?

You have much to learn grasshopper...

I've noticed you people have a habit of making assumptions based on next to no evidence, so this doesn't surprise me. No, I do not believe that wealth is a finite pile of cash, nor am I jealous if anyone, wealthy or otherwise, increases their wealth over time (or even all at once, like with the lottery). The beef I have is primarily with the banking industry, which not only uses their wealth to buy and control Congress and change the laws to their advantage, but then use the absence of safeguards and regulations (which they created by doing things such as eliminating the Glass-Steigall Act) to gamble with billions of dollars of other peoples money on the stock market, lose it all, and then ask the tax payers to cover their bets. This is exactly what they did in the 1920s, and it led to the Great Depression. And now that theyre virtually unregulated, theyre doing it again, and the next time they have a meltdown its going to be too big for the government to fix. The problem with JUST ABOUT EVERYBODY is that you wont believe this until you see it, but by then it will be too late.