DSGE

VIP Member

- Dec 24, 2011

- 1,062

- 30

- 71

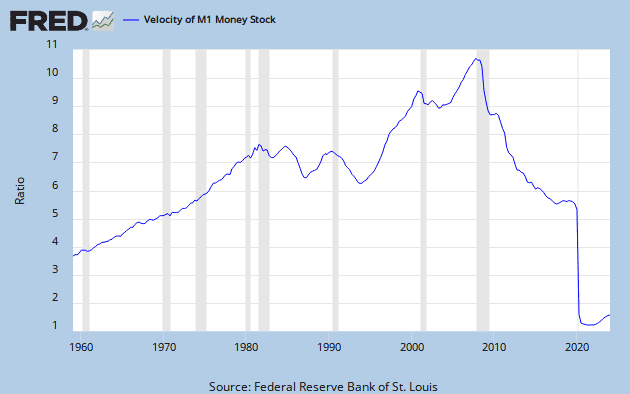

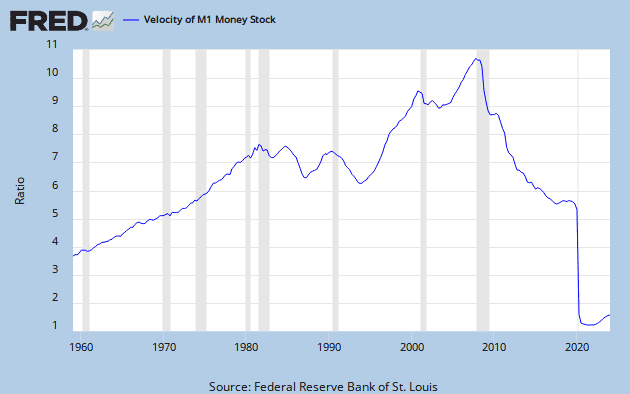

USD are employed, to "lubricate" economic transactions, about half-a-dozen times per year:

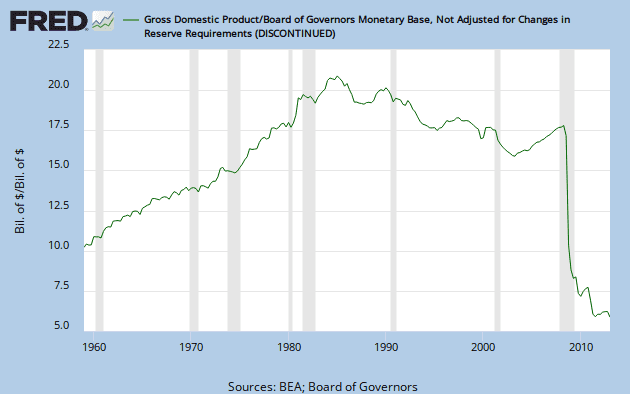

US MB ~= $2T

US GDP ~= $15T/yr.

V ~= GDP/MB ~= 8/yr.

Not sure what the point is...

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

USD are employed, to "lubricate" economic transactions, about half-a-dozen times per year:

US MB ~= $2T

US GDP ~= $15T/yr.

V ~= GDP/MB ~= 8/yr.

So the equation of exchange is just an identity. We can't get anything useful out of an identity. First off let's write it in terms of growth rates rather than levels, so MV=PY => %M + %V = %P + %Y. We have to add some rules to make it interesting. The first and most obvious being that Y returns to its natural rate in the long run, it's long run growth rate being the trend growth in productivity + trend growth in population. Say about 3%. Next we ask what measure of money we should pick for M. Friedman liked to use M2 because M2 did something cool. I can't find it now, but I recall seeing Friedman showing that the long run demand for money when money is measured as M2 is stable. So the velocity of M2 is stable, hence %V = 0. So the only things left to vary are M and P, which gives you the conclusion that inflation (%P) is everywhere and always a monetary phenomenon.

But, by all means, if anyone can tell me how M_flow increases without the requirement of credit, I'm dying to know. There is no magic here, no complicated annuity expressions. CDSs, derivatives, straddles and swaps, MBS, stock, T-bills, whatever, is just moving back and forth between savings and credit accounts. An IPO moves money from one guys savings to a companies savings in trade for a contract of repayment and dividends. That is great. But it's just another, out of a savings and into the flow. Sure, some company makes a business loan which increases their savings that then pays for intermediate capital equipment that then creates a new product stream for Q. But, that loan gets paid back and it doens't permanently increase M_flow.

So the equation of exchange is just an identity. We can't get anything useful out of an identity. First off let's write it in terms of growth rates rather than levels, so MV=PY => %M + %V = %P + %Y. We have to add some rules to make it interesting. The first and most obvious being that Y returns to its natural rate in the long run, it's long run growth rate being the trend growth in productivity + trend growth in population. Say about 3%. Next we ask what measure of money we should pick for M. Friedman liked to use M2 because M2 did something cool. I can't find it now, but I recall seeing Friedman showing that the long run demand for money when money is measured as M2 is stable. So the velocity of M2 is stable, hence %V = 0. So the only things left to vary are M and P, which gives you the conclusion that inflation (%P) is everywhere and always a monetary phenomenon.

I'm a tad confused by the embolden statement above.

More than a tad confused , really. Perhaps I don't understand the meaning of it.

It seems to suggest that the demand (velocity?) for M2 is by nature stable?

Why would that be?

Is the demand for cash or it's close equivalents truly STABLE, after say, a massive natural disaster>

I don't think so.

Perhaps I'm entirely missing the point here, but it seems to me that the demand for cash can change due to events outside the world of monetary manipulation by a central bank.

What am I missing here?

(i do not have access to a drawing program)...massive infusion of goldhow M_flow increases without the requirement of credit... out of a savings and into the flow.

...All that FREE GOLD

...The inflation of the M supply

trying to learn ?Not sure what the point is...

Money-Velocity (V) is the ratio of a Money-flow (GDP) [$/time] to a Money-stock (M) [$]

Money-Velocity resembles GDP-per-capita, representing "GDP per spendable dollar", i.e. "how much of National Income was 'lubricated' by each spendable dollar'

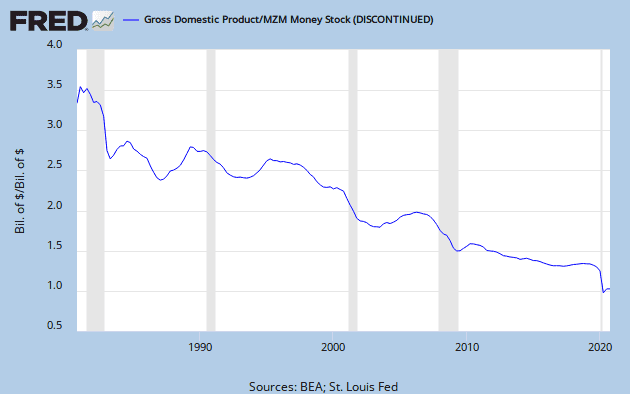

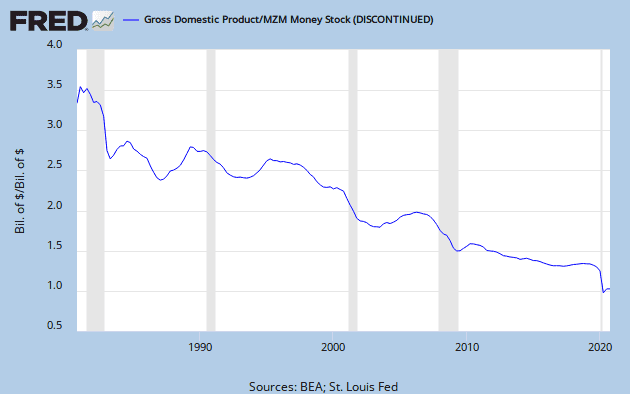

naively, the most seemingly-reasonable Money-Velocity is VZM = GDP / MZM, i.e. "GDP per demandable dollar of 'zero maturity'", simplistically including cash + demand Deposits (physical Money + cyber Money):

MZM embodies both physical & cyber Money, which 'lubricates' transactions, in our mixed physical & cyber economy. Decreasing VZM implies that the total supply of physico-cyber "cyborg" Money has expanded even faster than GDP, so that individual "cyborg Dollars" are "working half as hard" to "lubricate" National Income / Expenditures. At present, "cyborg Dollars" generate $1.50 of GDP per quarter, i.e. are involved in one-and-a-half transactions per season (approximately once per 10 weeks).

to my mind, focusing on "economic entities" (F,D x p,c,G), and the Money-flows from-and-to them (Fp --> Dc), makes more sense, than focusing on the specific "things" transacted (Consumer goods, Capital goods).

sometimes, Y+M=C+I+G+X focuses on the "who" (e.g. G,X); other times focuses on the "what" (C,I); such seems inconsistent. Cp. Vasily Leontief's "input-output" theory of economics

if "economic agents" who accumulate Money (Revenues > Expenses) generally "save" into the banking system; then what happens when banks themselves are Profitable ?? do banks "save" earnings into themselves ??

(i do not have access to a drawing program)...massive infusion of goldhow M_flow increases without the requirement of

credit... out of a savings and into the flow.

...All that FREE GOLD

...The inflation of the M supply

The EoX describes Money-flows [$/yr.]; accumulated aggregate Savings is a Money-stock [$]. The former describes

the "blood-sugar-flow" through the economy; the latter resembles "fat-stores". Denoting dynamic "flows" with

single-brackets [], and denoting static "stocks" with double-square-brackets [[]], circulating Money, can be

de-circulated, as Savings; ergo the rate of Savings (S) equals the time-rate-of-change (d/dt) of the stock

of accumulated Savings (MS):

[[MS]] <-----------> [MV = PQ = GDP = C + S + T]Savings stock does not enter the "stream of spending". But Savings stock can be re-circulated; ergo

dMS/dt = S

"de-Savings" (re-circulation of squirreled-away Money) is a means of "self-financing" an increase in "flowing"

Money (reaching under the mattress for stashed cash), without use of Credit (borrowing from banks) ?

The Spanish acquisition, of large amounts of specie, economically resembles to "finding buried treasure" (somebody

else's accumulated Savings stock), and then "de-Saving" (spending) the same.

But, by all means, if anyone can tell me how M_flow increases without the requirement of credit, I'm dying to know. There is no magic here, no complicated annuity expressions. CDSs, derivatives, straddles and swaps, MBS, stock, T-bills, whatever, is just moving back and forth between savings and credit accounts. An IPO moves money from one guys savings to a companies savings in trade for a contract of repayment and dividends. That is great. But it's just another, out of a savings and into the flow. Sure, some company makes a business loan which increases their savings that then pays for intermediate capital equipment that then creates a new product stream for Q. But, that loan gets paid back and it doens't permanently increase M_flow.

SPAIN's economy post the discover and rape of the AmerIndians, might be a good example of that phemonema, no?

No expansion of credit (with fiat dollars) was necessary for Spain to undergo a massive inflationary period of the Money supply, true?

In fact, didn't that massive infusion of gold (coupled with Spain deciding to become the defender of Christendom) cause Spain's internal economy to go into centuries of decline?

All that FREE GOLD that the Spainish elite classes got, caused Spain to stop being a truly productive nation.

The inflation of the M supply crushed the working classes, and the overreach of the Spainish foreign policies eventually caused the state to go bankrupt, too.

What this really show us is that on a MACRO level FREE money is NOT really free. Free money, in this case, free gold, acted like an amphetimine on the natural economy. It produced nothing of lasting worth.

It fostered a LOT of useless economic activity, but it also caused a gradual reduction in national production.

So the equation of exchange is just an identity. We can't get anything useful out of an identity. First off let's write it in terms of growth rates rather than levels, so MV=PY => %M + %V = %P + %Y. We have to add some rules to make it interesting. The first and most obvious being that Y returns to its natural rate in the long run, it's long run growth rate being the trend growth in productivity + trend growth in population. Say about 3%. Next we ask what measure of money we should pick for M. Friedman liked to use M2 because M2 did something cool. I can't find it now, but I recall seeing Friedman showing that the long run demand for money when money is measured as M2 is stable. So the velocity of M2 is stable, hence %V = 0. So the only things left to vary are M and P, which gives you the conclusion that inflation (%P) is everywhere and always a monetary phenomenon.

I'm a tad confused by the embolden statement above.

More than a tad confused , really. Perhaps I don't understand the meaning of it.

It seems to suggest that the demand (velocity?) for M2 is by nature stable?

Why would that be?

Is the demand for cash or it's close equivalents truly STABLE, after say, a massive natural disaster>

I don't think so.

Perhaps I'm entirely missing the point here, but it seems to me that the demand for cash can change due to events outside the world of monetary manipulation by a central bank.

What am I missing here?

if the Money-supply is constant, then all the gains, made by profiting economic entities, must match losses, incurred by other unprofiting economic entities; every positive cash-flow must offset other negative cash-flows...the old days when you could dig up gold, take it to the state mint, and coin new money... [Today] "money is created endogenously through the fractional reserve banking system as new loans stimulate growth". the simple anwser is that money is created through debt and maintained through the constant renewal of debt

if the Money-supply is constant, then all the gains, made by profiting economic entities, must match losses, incurred by other unprofiting economic entities; every positive cash-flow must offset other negative cash-flows...the old days when you could dig up gold, take it to the state mint, and coin new money... [Today] "money is created endogenously through the fractional reserve banking system as new loans stimulate growth". the simple anwser is that money is created through debt and maintained through the constant renewal of debt

according to Wikipedia, M2 includes all forms of "Money" included in M1, plus longer-term savings Deposits. If so, then any transfer of "Money" affecting M1 automatically affects M2 in the same way. You may be employing the word "M1" to mean "checking Deposits", and "M2" to mean "saving Deposits". Technically, one would need to define "dM1 = M1-M0 = checking Deposits", and "dM2 = M2-M1 = savings Deposits".M2 is increased by my savings while M1 is decreased. Yet, someone else then borrows against it to increase M1 again.