DSGE

VIP Member

- Dec 24, 2011

- 1,062

- 30

- 71

...such as? That's ridiculous. There are good reasons why demand for certain goods and services should fall. There's no reason to prevent aggregate demand from falling. But there is a good reason to not let it fall.

Sorry but I don't think there is a constant of "NGDP". The number at which it should always be for maximal wellbeing given. How do you know you have the right constantat X anyway?

It's a nominal variable. It doesn't matter which constant you target. You just have to pick a target and not deviate from it. It's real variables we care about. If 1 dollar buys one can of coke and 100 yen buys one can of coke, who gives a shit? We don't care about the number, we care about how much coke we buy. The point of picking an NGDP target and not deviating from it is that we no longer have to worry about nominal variables fucking over the real economy.

Maybe the best economic outcomes come if it's the money that is constant. Or maybe not. I am saying that you are assuming.

Well I'm not assuming, I have reasons for choosing an NGDP target over a monetary aggregate target or a price level target or an inflation rate target. That's a different conversation, but I gave one reason above. Demand side recessions happen because of frictions preventing nominal variables adjusting downward. If we stop those nominal variables having to adjust downward we stop having to care about the frictions which make nominals affect reals.

So with this in mind are you saying NGDP should be constant or only increase.

Both are acceptable. The important thing is announcing the trajectory for NGDP and not deviating from it (up or down).

Either way, we are just blocking the discussion here. Let's move it somewhere else.

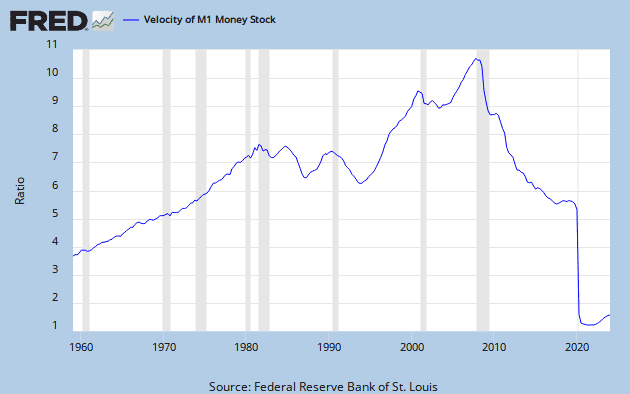

I don't think we are. A discussion about which variable the central bank should target is for another thread, but the idea that all demand side recessions are the central bank's fault is relevant because the equation of exchange can help us see that NGDP is entirely determined by monetary policy.