It's not a bubble. It might be on it's way to one but it isn't one yet.

1999 was a bubble.

So no similarities you recognize between 1999 and today? That's rather bizarre.

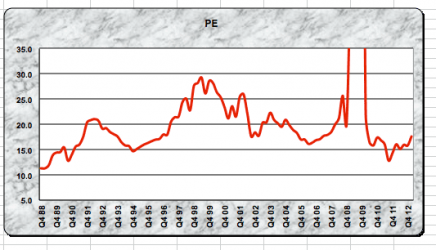

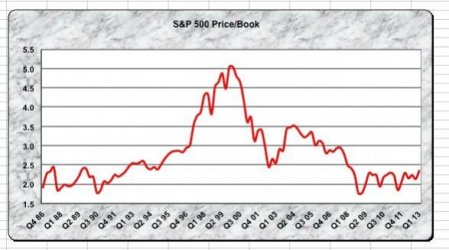

A bubble in stocks isn't when stocks go up because you don't understand why, or because of money printing, or because stocks are expensive. A bubble in stocks is when stocks make zero sense from a valuation standpoint and there is a mania. Neither exists today. The price/earnings ratio on the S&P 500 is currently about 16x, which is roughly the long-term average. During the bubble, it was as high as 30x, for large-cap growth stocks it was over 40x, and for the Nasdaq around 100x. That's a bubble.

Last edited: