Skull Pilot

Diamond Member

- Nov 17, 2007

- 45,446

- 6,163

- 1,830

How about if the ultra rich get a nice big tax cut and you get a nice big tax increase to help make up the loss of revenue.

You good with that idea?

As to your flat, fair tax. When we all have the same amount of income THEN we can all pay the same amount of tax.

That would be "fair". You good with that idea?

You don't understand the concept of a flat tax do you?

Let me relieve you of your ignorance

If the flat tax rate was 10% then everyone would pay 10% of their income from the first dollar earned no deductions no exceptions that means no more dependent deductions, no more mortgage deductions no more charitable deductions etc everyone pays the same rate

So if you make 30K your tax bill will be 3K,

If someone makes 3 million their tax bill will be 300K

So the guy making 100 times more than you pays 100 times more tax

Get it?

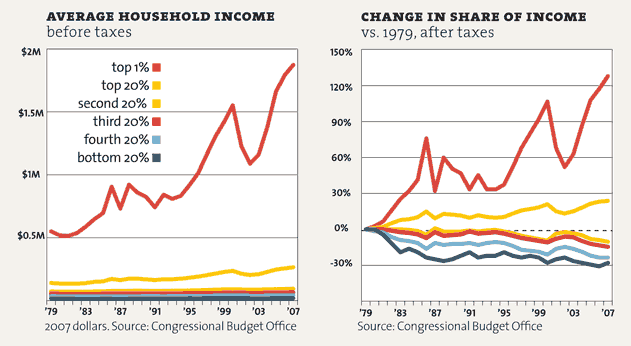

Haven't seen a flat tax proposal that doesn't result in the rich paying significantly less and the working poor paying significantly more

Calling it "fair" does not mean that it is

WHAT????? You mean that those ultra wealthy who have had the benefit of legislation, banking, schooling and inheritance arent paying the same percentage as I am?

That is so unfair. Its also unfair that my dear ole departed Dad didnt leave me a few million dollars either.

Ah well, life is just unfair. And who ever told Skull that life has to be "fair" was full of shit.

Hey Moron no one left me anything

My wife and I both come from very meager roots but just because we rose above it and didn't settle like you did you think I should be taxed at a higher rate than the people like you who did settle

Oh no skull. Somebody left you something. It was the inflated opinion of your self. Somebody left you with the opinion that you are an island. Somebody left you with the opinion that the ultra rich are somehow your better.

Some one left you the opinion that your success has no other people who contributed to it.

I could go on but why? Ive got to put a furnace in ONE of my rentals. Its cold outside.

I never said anyone was better than anyone else you see that's your opinion because you feel the need to take from those who have achieved more than you so as to make up for your failures