Sorry Mike but....on factual grounds you may win this arguement. You will also win this arguement on moral grounds. But you will never win this arguement under the current conditions of politics/tax code in this country. As long as a large % of the adult population in the US pays 0 or less federal tax, they have no inclination to fight against overtaxing. The politicians have purposely set it up this way so as they have a group to pander to in elections. We both know this, and so does every lefty on this board, and good luck beating your head against the wall trying to get them to admit it; although I do appreciate your using facts in an attempt to try and get them to do so!

As the wise say...........a 10% rise in taxes on 100 dollars is 10 bucks. A 10% rise on zero taxes is still zero. Nothing from nothing means nothing to them financially, so how we gonna win that arguement on any political grounds?

he wins neither argument. and the people who pay no taxes CAN'T pay taxes because they don't have sufficient earnings or they are exempt (e.g., social security recipients or those in the military).

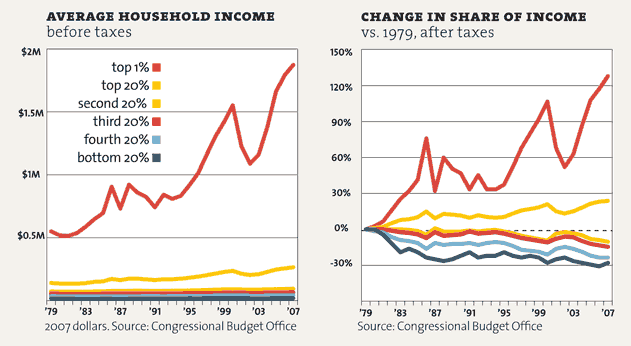

when people say the rich pay no taxes, they mean PROPORTIONATE TO THEIR EARNINGS.

I pay a certain percentage of income in taxes. someone who makes millions should pay the same percentage.

and multinational corporations like exxon mobile pay almost nothing.... or nothing at all.

and if someone earns their money from dividends, they should be taxed at the same rate as someone who earns the same amount as a W-2 employee or independent contractor

You have a problem with the tax code. The top percentage is around 39% on wages and salaries and raising the tax rate on dividends would stop investors from putting money in the stock market. That would not be good for the economy.