NYcarbineer

Diamond Member

If Bush had used the Medicare trust fund to balance the budget you would be screaming about it until hell froze over. Why does Clinton doing it get a pass?

Bush cited the surplus as justification for cutting taxes, first of all. Are all you people now of the opinion that Bush was lying????

I haven't said ANYTHING other than pointing out that Clinton did in fact have balanced budgets near the end of his presidency.

About a surplus existing at all?

Yes.

As for Clinton, he submitted a budget plan that, if carried through, would have resulted in a balanced budget in a few years. The budget never actually got balanced under Clinton because he relied on intragovernmental lending to make it look like revenues exceeded expenses.

Really? And the CBO, and the treasury, and all the other agencies that monitor the budget in one way or another went along with this mythical fudging of the numbers by Clinton?

too funny

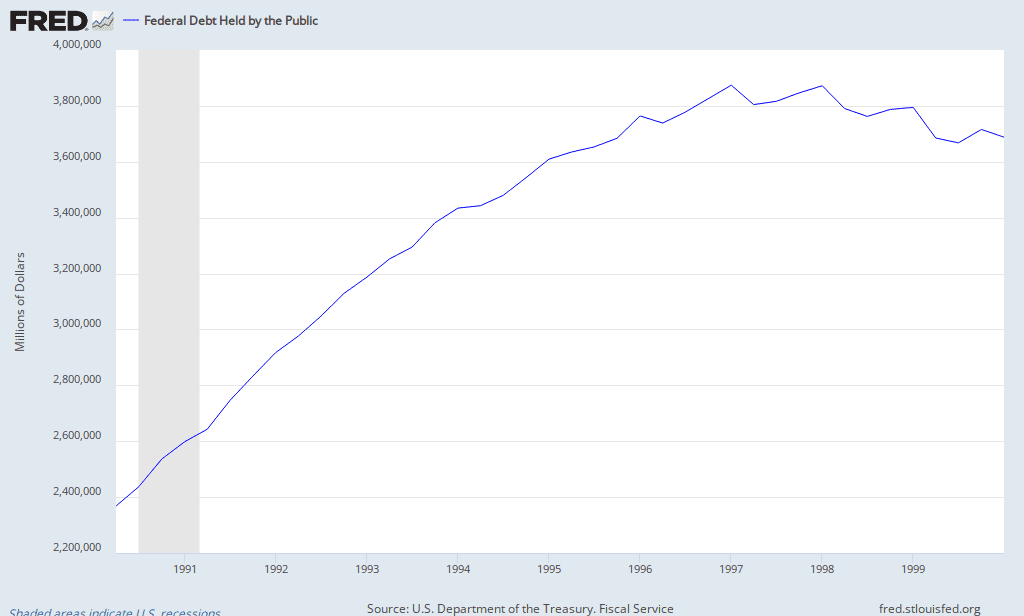

But we didn't count loans as revenues. Instead, we had a surge in payroll taxes which were used to pay down the debt. If you want to say that we didn't have a surplus if you exclude the surpluses in the trusts, I would agree with you. But a surplus is defined as revenues exceeding expenditures, which is what happened in the 90s. And extrapolating a rise in the national debt and concluding we had a deficit is incorrect. That's why you don't have conservatives with financial knowledge making this argument.

But we didn't count loans as revenues. Instead, we had a surge in payroll taxes which were used to pay down the debt. If you want to say that we didn't have a surplus if you exclude the surpluses in the trusts, I would agree with you. But a surplus is defined as revenues exceeding expenditures, which is what happened in the 90s. And extrapolating a rise in the national debt and concluding we had a deficit is incorrect. That's why you don't have conservatives with financial knowledge making this argument.