Sactowndog

VIP Member

- Jul 4, 2011

- 818

- 78

- 63

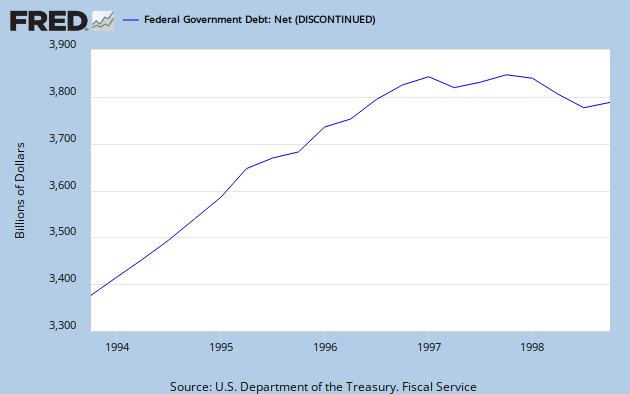

So if you care about the deficit it might be useful to look at the last time we have a balanced budget (2000) and compare it with today's budget (2010). Not suprisingly both sides are playing fast and loose with the truth...

Of course you have to adjust for the growth of the economy. The common approach is to normalize the data in terms of making it all a percentage of GDP. I have looked at budget categories as a percent of GDP and compared 2000 and 2010. Remember 2000 was also a Democratic President and Republican Congress. They compromised to balance the budget.

The biggest gaps then and now in descending order are:

Revenue's: Currently are down 5.7% as a percent of GDP compared to 2000

Top marginal tax rates are at an all time low, Capital gains rates are 5% below an all time low. Hard to make a case the wealthy are overtaxed and by historical standards they are undertaxed. The Bush tax cuts should be repealed

Defense: Currently up 1.75% as a percent of GDP compared to 2000

You can't run 3 wars and maintain troops in places of all wars past. We have a constitutional mandate to defend the country but we don't have one to defend the rest of the world. Need a real discussion here what is affordable and practicable. Let other coutries pay for their own defense.

Medicare: Currently up 1.1% as a percentage of GDP compared to 2000

Well we can thank Bush for perscription drug benefits but the Ryan plan at least trys to make a real effort to control costs. Democrats are wrong for demonizing the plan and mobilizing seniors against it. With some type of benefit floor Ryan's plan is credible and should be adopted.

Unemployment compensation: Currently up .97% of GDP compared to 2000

We need a revenue nuetral restructuring of our tax code to generate jobs. My choice, eliminate corporate income taxes, raise the capital gains tax to the level of income tax, tax net capital sent overseas. This will generate tax revenue from overseas investment and provide capital for local businesses to grow.

Health: Currently up .82% of GDP compared to 2000

You can't expand access without significant cost cuts in the system. Republicans need to stop talking about repeal and modify the system to impose significant cost reductions that were left out of the original bill. Stop playing political games and help the country.

Social Security: Currently up .70% of GDP compared to 2000

No idea what to do here. Should have been taken care of long ago. Most want back the money they put in but the money was long since given to their grandparents. Have no sense of a solution.

Enough for now. I would post links to support my points but I am not yet allowed.

Of course you have to adjust for the growth of the economy. The common approach is to normalize the data in terms of making it all a percentage of GDP. I have looked at budget categories as a percent of GDP and compared 2000 and 2010. Remember 2000 was also a Democratic President and Republican Congress. They compromised to balance the budget.

The biggest gaps then and now in descending order are:

Revenue's: Currently are down 5.7% as a percent of GDP compared to 2000

Top marginal tax rates are at an all time low, Capital gains rates are 5% below an all time low. Hard to make a case the wealthy are overtaxed and by historical standards they are undertaxed. The Bush tax cuts should be repealed

Defense: Currently up 1.75% as a percent of GDP compared to 2000

You can't run 3 wars and maintain troops in places of all wars past. We have a constitutional mandate to defend the country but we don't have one to defend the rest of the world. Need a real discussion here what is affordable and practicable. Let other coutries pay for their own defense.

Medicare: Currently up 1.1% as a percentage of GDP compared to 2000

Well we can thank Bush for perscription drug benefits but the Ryan plan at least trys to make a real effort to control costs. Democrats are wrong for demonizing the plan and mobilizing seniors against it. With some type of benefit floor Ryan's plan is credible and should be adopted.

Unemployment compensation: Currently up .97% of GDP compared to 2000

We need a revenue nuetral restructuring of our tax code to generate jobs. My choice, eliminate corporate income taxes, raise the capital gains tax to the level of income tax, tax net capital sent overseas. This will generate tax revenue from overseas investment and provide capital for local businesses to grow.

Health: Currently up .82% of GDP compared to 2000

You can't expand access without significant cost cuts in the system. Republicans need to stop talking about repeal and modify the system to impose significant cost reductions that were left out of the original bill. Stop playing political games and help the country.

Social Security: Currently up .70% of GDP compared to 2000

No idea what to do here. Should have been taken care of long ago. Most want back the money they put in but the money was long since given to their grandparents. Have no sense of a solution.

Enough for now. I would post links to support my points but I am not yet allowed.