NYcarbineer

Diamond Member

I know you're still smarting from my proving you a liar the other day, but really, get over it. Holding grudges is not conducive to intelligent debate.

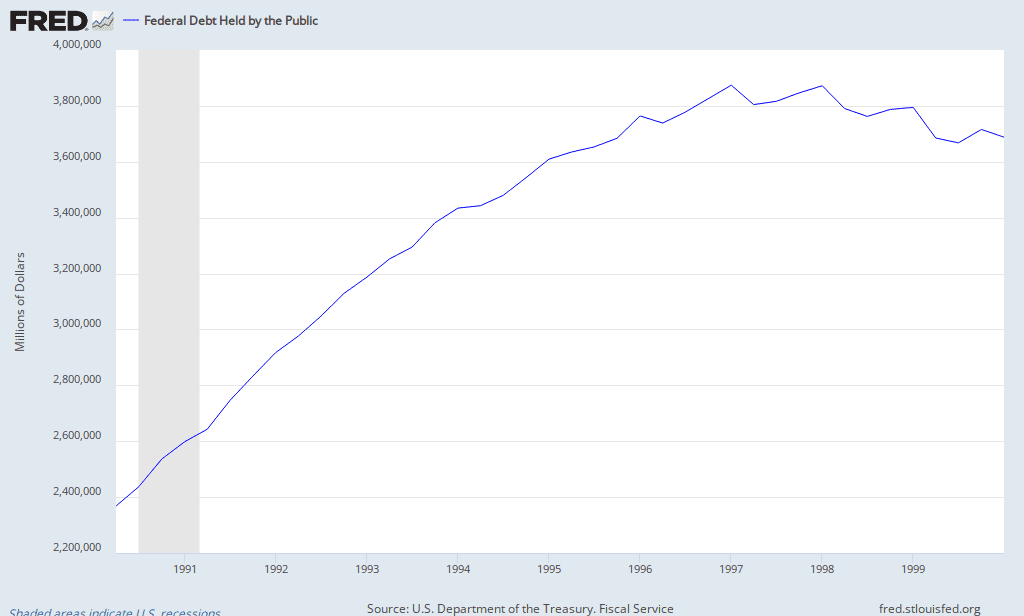

Clinton had a budget surplus for 2 or 3 budgets. Period.

Question, which I know I won't get a straight answer from you on, but I'll ask anyway, because getting you to avoid the question makes almost as good a point as getting you to answer one:

Did Clinton use budgetary methods THAT NO OTHER PRESIDENT EVER USED, before or after, in order to falsely create the appearance of several annual budget surpluses?

Barbie, now that it has been proven that both your character and your knowledge have both reached their nadir, on what possible basis would I entertain any questions from you?

Henceforth, Barbie, you will merely be relegated to the pigeon hole of comic relief/human piñata.

NYC, walk away dude you look really bad in this exchange. I dont know what went on in the other thread but you look really bad in light of all that has been said in this thread.

And yes clinton still added to the national debt every year and yes clintons budgets had a surplus.

Ah, yes, a wingnut is telling me I look bad in an exchange where the facts are on my side and the personal attacks are on the other.

Mind your own business.