- Apr 5, 2010

- 80,319

- 32,337

- 2,300

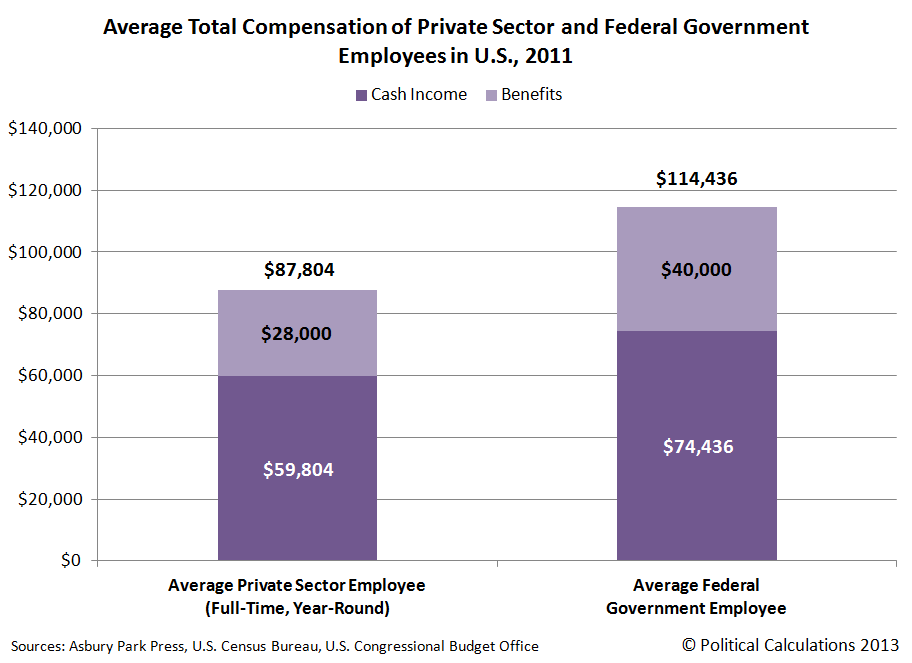

Your retirement benefits are part of your total compensation package

Workers spent a career working with an understanding that they would be paid X amount and if they stayed on the job, their retirement would be Y amount

Can't change the rules after the benefit has already been earned

People in Hell want ice water.

When the good of one group threatens the solvency of everyone else, including that group, choices must be made.

They will go running to the constitutional amendments that somehow were passed in some states that make changing pensions something out of the reach of legislators.

I cannot see how this was allowed, oh wait, I do, the unions paid off the politicians.