Your say so isn't good enough. Provide some data.

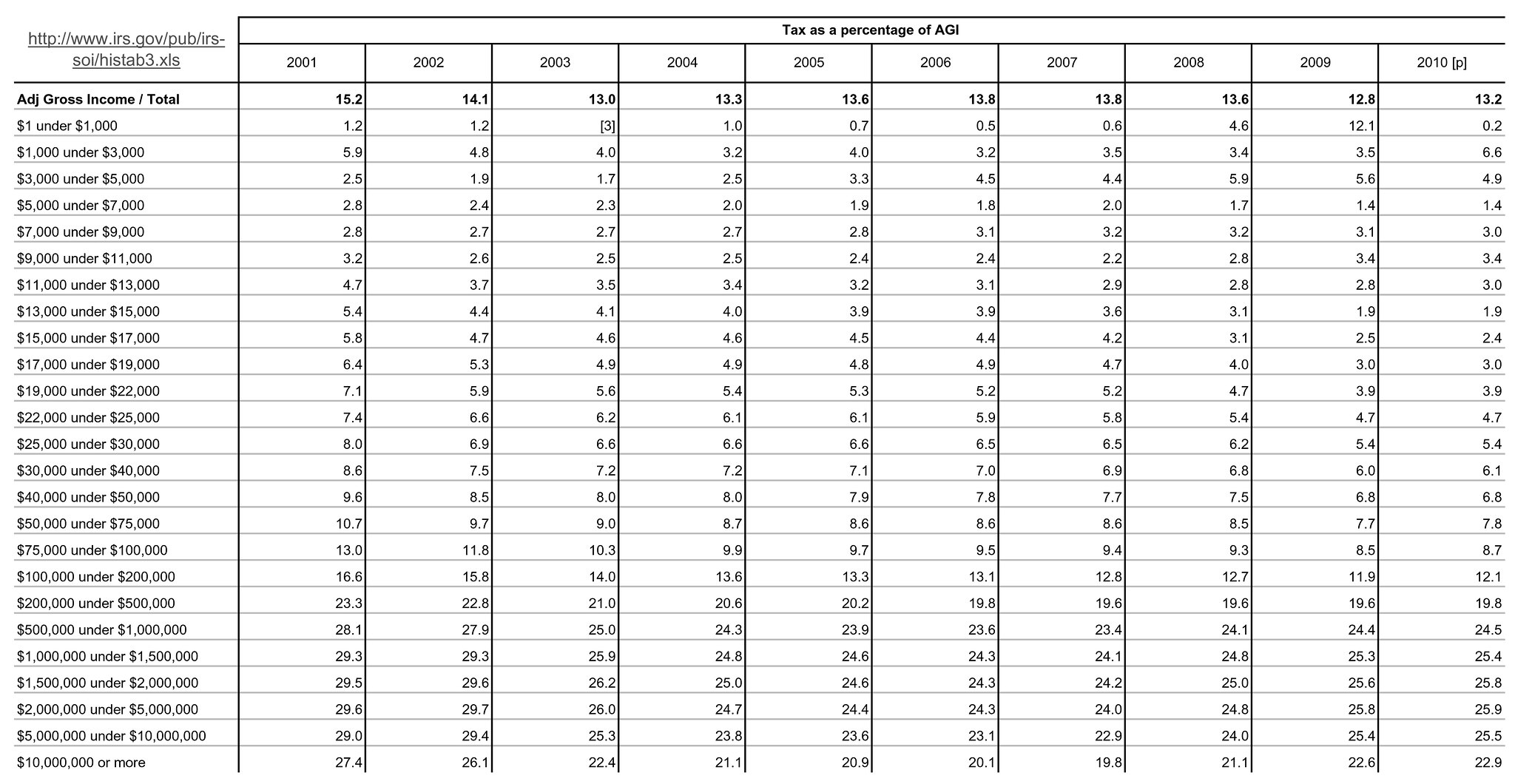

Through income tax alone the middle class pays the highest effective tax rate. When you add in payroll taxes the middle class gets completely screwed. Income tax facts from the IRS: From 2001 to 2007 the people with the highest income got the biggest percentage cuts in their actual tax payments. The middle class had to subsidize the rich even more than before. In 2007 once you start making $2 million a year your effective tax rates go down & you are being subsidized. Workers making $200K were paying higher effective income tax rates than billionaires. That is before adding in payroll taxes that make the rates even worse.

No matter. The top 10% of all earners pay 40% of the federal tax burden. The top 25% pay well over 70% of the federal tax burden.

The problem is not revenue. The problem is SPENDING...There is too much of it.

The fact that a measly $85 bln of a total continuing resolution( remember, there is no federal budget right now) of over $3 trillion caused such a ruckus. There is just far too much dependency on government.

The other fact ignored is there were NO CUTS in the sequester. Only reductions in increases. Which the libs call a "cut"...

No, you guys get plenty. Your side needs to figure out good stewardship of the people's money before you can ask for more.

I warned you in this post "If you post something stupid like the rich pay the majority of this countries tax then you are clearly to retarded to understand tax subsidies & how they unleveled the playing field."

You have clearly demonstrated you are to retarded to understand subsidies or tax codes!

You are clueless as to how the tax code made all the capital, investment & wealth flow to the rich because their lower effective tax rate & exemption from payroll tax generated greater return on investment than others could.

You are clueless as to how the tax code made all the capital, investment & wealth flow to the rich because their lower effective tax rate & exemption from payroll tax generated greater return on investment than others could.  You don't have the mental capacity to understand.

You don't have the mental capacity to understand.I never asked for more revenue, only less from the upper middle class in order to stop the $2 million & above income from paying lower rates than us who are subsidizing them.

Last edited: