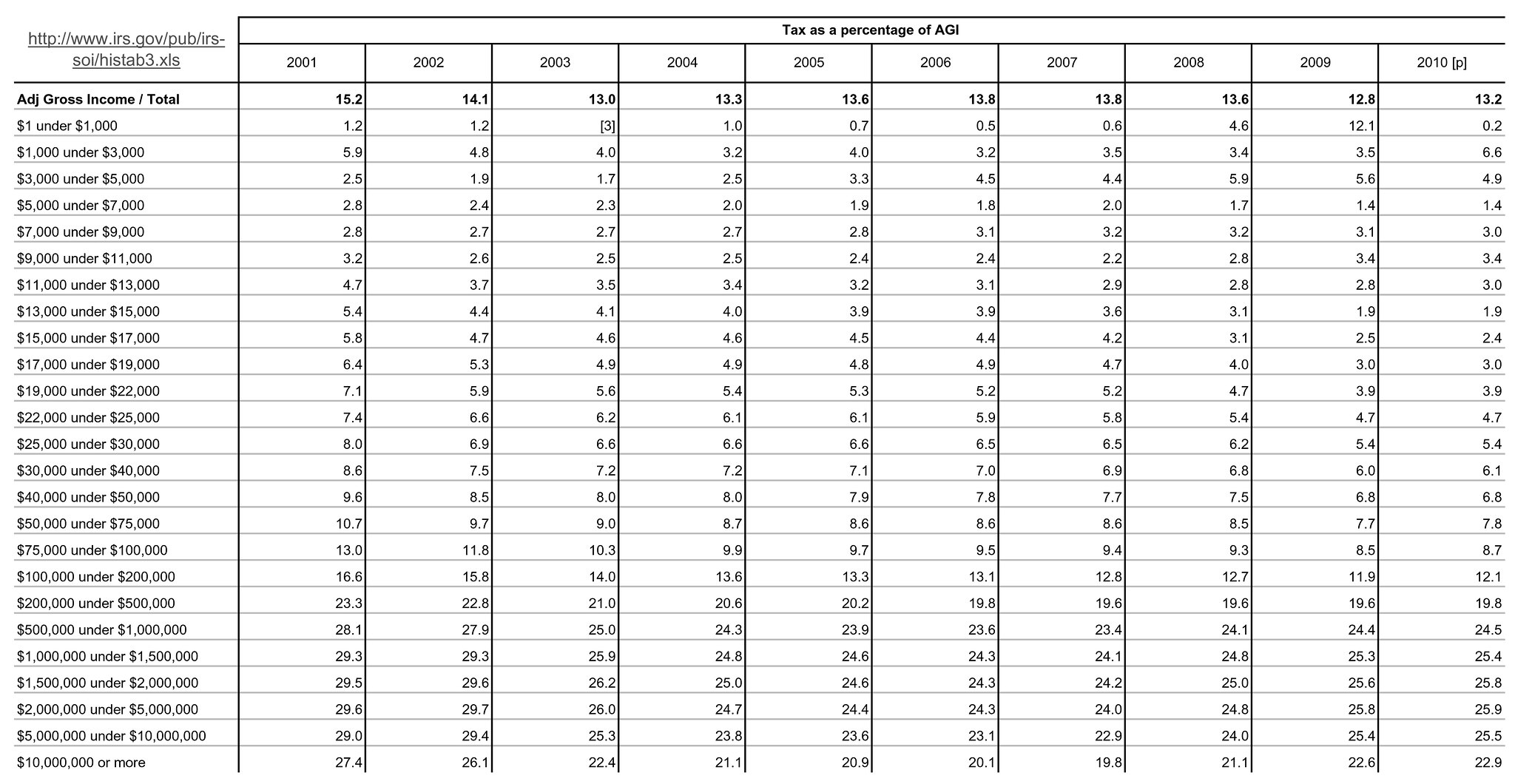

Most of your life has been one long tax cut:

The effective federal income tax rate for all Americans (average) has fallen from 11% in 1979 to about 7.2% (2009).

Historical Average Federal Tax Rates for All Households

Average is NOT all Americans.

Producers are indexed as the tax code IS INDEXED.

When one was taxed on $12,000 a year in 1973 to compensate for inflation that income is not $36,000 a year.

And they pay more taxes NOW on the 36K which bought the same amount of things NOW as it did in 1973 for 12K which was taxed FAR LESS than the 36K NOW.

There should be a point you are trying to make. What is it? That incomes have risen since 1973? Yes they have. And that items are more expensive today than in 1973? Yes they are.

And seeing as how income taxes are applied as a percentage of income, then yes, I pay more dollars in taxes today than I did in 1973.

What was your point? Do you have a "way back machine"?

Because of inflation $36K buys NOW what 12K bought in 1973.

The effective tax rate for what you paid taxes on in 1973 was FAR LESS than what one pays taxes now on 36K.

That is called INDEXING.

A word Democrats run from like monkeys on fire.

What someone paid taxes on when they had a middle income of 12K in 1973 is FAR LESS than what they pay now on 36K of income.

I made that point in the other post.