usmbguest5318

Gold Member

Do research. Feed your talent. Research not only wins the war on cliche, it's the key to victory over fear and it's cousin, depression.

-- Robert McKee

-- Robert McKee

Introduction:

What makes for a good doctor, economist, accountant, psychologist, lawyer, physicist or nearly any other profession? Some things one might think important are in fact, irrelevant. For instance, one's grades in graduate, law or medical school are important while one is in school, but the instant one obtains one's professional certification, one is as good as everyone else having that certification and better than everyone who does not. The thing is that once one is "official," to stay that way, one must engage in continuing education for as long as one wants to practice in that field. What correlates best with one's being very good at one's profession is being well informed, and the way to do that is to read journals. I don’t know whether that means good professionals read more journals or reading more journals makes a better professional.

The thing is that the very same thing that make for good professionals make for good citizens. It's every bit as important for laymen to be well apprised of "what's what" with regard to the topics of the day. This is as true now as it was in the Founder's days. Jefferson had some six thousand books in his library so he could be an informed contributor to discussions that captured his interest. The Renaissance had officially passed by Jefferson's day, but he was nonetheless a "Renaissance Man." Modern citizens blessed with the freedoms of democracy must also be exactly that, and the way to do so is to supplement the reading one had to do in school -- the foundational content that we all must have mastered as kids so we can use it as adults -- by reading journal articles. There's just too much information to do it any other way.

The thing is that the very same thing that make for good professionals make for good citizens. It's every bit as important for laymen to be well apprised of "what's what" with regard to the topics of the day. This is as true now as it was in the Founder's days. Jefferson had some six thousand books in his library so he could be an informed contributor to discussions that captured his interest. The Renaissance had officially passed by Jefferson's day, but he was nonetheless a "Renaissance Man." Modern citizens blessed with the freedoms of democracy must also be exactly that, and the way to do so is to supplement the reading one had to do in school -- the foundational content that we all must have mastered as kids so we can use it as adults -- by reading journal articles. There's just too much information to do it any other way.

The Challenge:

Of course, few of us aim to match the knowledge and contextual expertise of professionals in a discipline that isn't our own career field, yet given the complexity of issues that confront us, we each have a duty to understand them well, well enough at least to make an independently arrived at and well informed decision about them. To do that one must quickly "get up to speed" without having to read two dozen text books, gain thousands of hours of experience, and so on.

It used to be that one could do that by turning on the "boob tube" and watching the news, but back then, news wasn't a commercial affair. It was what it was, but whether one liked the news didn't matter. That, of course, is no longer so, yet one must still obtain information that, regardless of what one thinks about it, one has a way to assess its rigor and quality.

In spite of the internet rapidly gaining a strong foothold as a quick source of obtaining information, reading journal articles, whether from print or electronic media, still remains the most common way of acquiring new information for most of us who give a damn about being well informed and forming sound cogently defensible points of view. Newspaper reports or novels can be read in an insouciant manner, but reading research reports and scientific articles requires concentration and meticulous approach.

These days the only places publishing information of that sort are journals. Regardless of the topic, journals are the place to go for the highest quality and most reliable information one can obtain. With more than 2.5 million new English-language scientific papers are published each year in more than 28,000 [peer-reviewed] journals, there's at least one journal for every topic one can imagine, and likely some that one cannot imagine."

Reading Journal Articles:It used to be that one could do that by turning on the "boob tube" and watching the news, but back then, news wasn't a commercial affair. It was what it was, but whether one liked the news didn't matter. That, of course, is no longer so, yet one must still obtain information that, regardless of what one thinks about it, one has a way to assess its rigor and quality.

In spite of the internet rapidly gaining a strong foothold as a quick source of obtaining information, reading journal articles, whether from print or electronic media, still remains the most common way of acquiring new information for most of us who give a damn about being well informed and forming sound cogently defensible points of view. Newspaper reports or novels can be read in an insouciant manner, but reading research reports and scientific articles requires concentration and meticulous approach.

These days the only places publishing information of that sort are journals. Regardless of the topic, journals are the place to go for the highest quality and most reliable information one can obtain. With more than 2.5 million new English-language scientific papers are published each year in more than 28,000 [peer-reviewed] journals, there's at least one journal for every topic one can imagine, and likely some that one cannot imagine."

The greatest part of a writer's time is spent in reading, in order to write: a man will turn over half a library to make one book.

-- Samuel Johnson

-- Samuel Johnson

Reading journal articles can seem daunting [1], but so long as one doesn't allow it to be it isn't, and insofar as journal reading allows one to keep abreast of progress in a given discipline and aprises one of current trends, it's immensely more productive than is reading "regular" news websites or watching news broadcasts. Even more important given the limited-time world in which many folks dwell, reading them is usually a very quick affair.

Here's what I typically do:

Several writers/researchers have offered input on how to approach journal articles. Check them out if you'd like. Most of them assume their audience is grad students, undergrads, and professionals who are reading journal articles for more than just their personal intellectual enrichment. One, however, is geared to readers who merely want high quality info so they can have a better understanding of the world in which they live.

In the methodology and/or results sections of an article, one will often enough find a lot of math and statistics presented and discussed. One need not be a mathematician to understand those sections. Overwhelmingly, researchers explain what the equations they show mean. What one (a lay reader) needs is a basic understanding of quantitative analytical methods and what be the strengths and weaknesses, thus the applicability, of them.

If one is inclined to read the methodology and detailed analytical results:

Discussion: If you read only one part of the paper, read this:

This is far and away the most important section of a journal article. It's where the author answers the research questions, explains the import of the analysis, and interprets the data. Often, the author(s) compares his/her results with those obtained in other studies, explaining in what aspects they are different or similar and reconciling, vis-a-vis the overarching relevant theory(s), the differences among them. No new data should appear under discussion and no information from other sections will generally be repeated. In addition, and perhaps most importantly for lay readers, this section discusses the various strengths and limitations/shortcomings of the study.

Conclusions:

Even though I read the conclusion first, sometimes they don't "gel" in one's mind; thus it's prudent to read it again, not only because after perusing the rest of the article, the conclusion may make sense to one, but aos to confirm whether what one had inferred initially is correct. If the conclusion had not made sense earlier, it may make sense after having perused through the entire article. Sometimes, conclusions are in the discussion section, making them harder to locate. That is what it is.

Reasons for reading journal articles:

The trick to reading journal articles is knowing (1) how journal articles are organized, (2) how to choose ones to read, and (3) how then to read them. A great thing about journal articles is that they jam-packed with high quality information and are designed for speed reading. [2] Every journal article will have an abstract and section headings, which means one doesn't need to read the whole document to consume the knowledge it delivers. Lord only knows when I last read an entire journal article; the only time I do is when I feel obliged to challenge (in fact or in my mind) the methodology.- To get up to date on the status of a given discipline.

- To obtain a solution or solution approach to a specific question.

- To learn about causations and correlations.

- To obtain detailed knowledge on specific topic.

- To discover what findings militate for/against a given view and what be the apt weight or role of the respective findings with regard to the matter under consideration.

- To obtain bibliographical information about related research and analysis.

Here's what I typically do:

- Identify an article that seems to address the topic.

- Read the abstract.

- Read the conclusion's first two and last two paragraphs.

- Read the discussion section.

- Read the introduction or quick-scan through it if it's more than five paragraphs. I do this just to make sure I understand the article's context.

- Read most of the rest of the article if it's just that "worth it." The parts I read in most instances are the rest of the introduction and the rest of the discussion and conclusion.

Several writers/researchers have offered input on how to approach journal articles. Check them out if you'd like. Most of them assume their audience is grad students, undergrads, and professionals who are reading journal articles for more than just their personal intellectual enrichment. One, however, is geared to readers who merely want high quality info so they can have a better understanding of the world in which they live.

- How to Read a Research Article

- How to (seriously) read a scientific paper

- The Non-Scientist’s Guide to Reading and Understanding a Scientific Paper

- How to Read a Scientific Research Paper

In the methodology and/or results sections of an article, one will often enough find a lot of math and statistics presented and discussed. One need not be a mathematician to understand those sections. Overwhelmingly, researchers explain what the equations they show mean. What one (a lay reader) needs is a basic understanding of quantitative analytical methods and what be the strengths and weaknesses, thus the applicability, of them.

If one is inclined to read the methodology and detailed analytical results:

- Methodology --> This section gives the technical details of how the experiments were carried out. In most of the research articles, every detail is rarely included but there is always enough information to understand how the study was carried out so that reviewers who want to can (1) replicate the study using their own data, test subjects, etc. [3] The methodology section includes descriptive information about things such as the number of subjects included in a study and their categorization, sampling methods, data point and/or test subject inclusion criteria (who can be in) and exclusion criteria (who cannot be in), and the germane dependent and independent variables in any given test procedure chosen can be derived by reading this section.

- Results --> This section provides details about the data collected and, in turn, put through the study's analytical procedures, either in the form of figures, tables and/or graphs. Usually, qualitative interpretation of data doesn't appear in this section; however, statistical analyses appear in this section.

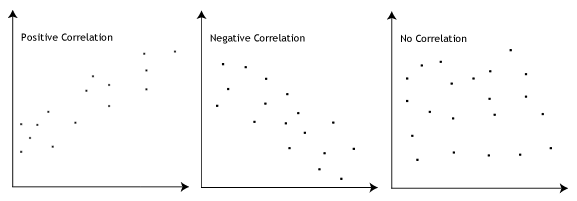

Researchers identify statistically significant and statistically insignificant results; they are required to. Readers must observe whether the researcher used an (or multiple) apt statistical test for analysis and whether the level of significance was appropriate to the nature of the study. To appreciate the choice of a statistical test, one requires an understanding of the hypothesis being tested. The list below provides a list of commonly used statistical tests. Explication of these tests is beyond the scope of this post. Suffice to say that it's not only important to know whether a difference or association is statistically significant but also to appreciate whether it is germane to the research context.- Descriptive statistics

- Mean, median, range and std. deviation

- Proportions and rates

- Tables and graphs

- Sensitivity and specificity

- Inferential statistics

- Parametric testing (quantitative)

- Z-tests -- Compare two sample means or proportions

- Student tests

- Difference between means of two data groupings

- Unpaired t-test

- Paired t-test

- Variance analysis

- Pearson correlation coefficient -- test strength of association of two variables

- Linear Regression -- Predict a variable's value based on one or more variables

- Non-parametric testing (quantitative)

- Wilcoxon -- matched data

- Mann-Whitney -- two independent groups

- Kruskal-Wallis -- compare three or more groups

- Non-parametric testing (qualitative)

- Chi-square

- McNemar

- Fisher

- Parametric testing (quantitative)

- Descriptive statistics

Discussion: If you read only one part of the paper, read this:

This is far and away the most important section of a journal article. It's where the author answers the research questions, explains the import of the analysis, and interprets the data. Often, the author(s) compares his/her results with those obtained in other studies, explaining in what aspects they are different or similar and reconciling, vis-a-vis the overarching relevant theory(s), the differences among them. No new data should appear under discussion and no information from other sections will generally be repeated. In addition, and perhaps most importantly for lay readers, this section discusses the various strengths and limitations/shortcomings of the study.

Conclusions:

Even though I read the conclusion first, sometimes they don't "gel" in one's mind; thus it's prudent to read it again, not only because after perusing the rest of the article, the conclusion may make sense to one, but aos to confirm whether what one had inferred initially is correct. If the conclusion had not made sense earlier, it may make sense after having perused through the entire article. Sometimes, conclusions are in the discussion section, making them harder to locate. That is what it is.

Conclusion:

Am I suggesting that one cease and desist with reading mainstream publications? Of course not. [4] What I'm saying is read mainstream articles and read journal content to determine whether the mainstream information and analysis one encounters holds water, as it were.

The time will come when diligent research over long periods will bring to light things which now lie hidden. A single lifetime, even though entirely devoted to the sky, would not be enough for the investigation of so vast a subject... And so this knowledge will be unfolded only through long successive ages. There will come a time when our descendants will be amazed that we did not know things that are so plain to them... Many discoveries are reserved for ages still to come, when memory of us will have been effaced.

-- Seneca, Natural Questions

Endnotes The time will come when diligent research over long periods will bring to light things which now lie hidden. A single lifetime, even though entirely devoted to the sky, would not be enough for the investigation of so vast a subject... And so this knowledge will be unfolded only through long successive ages. There will come a time when our descendants will be amazed that we did not know things that are so plain to them... Many discoveries are reserved for ages still to come, when memory of us will have been effaced.

-- Seneca, Natural Questions

The endnote content is not the topic of this post -- just as they aren't the topic of a paper -- they're merely supplementary info I opted to share:

- A tongue-in-cheek essay about the writing style of many journals and process of reading journals --> How to read a scientific paper.

Can you imagine if mainstream magazine articles were like science papers? Picture a Time cover story with 48 authors. Or a piece in The Economist that required, after every object described, a parenthetical listing of the company that produced the object and the city where that company is based. Or a People editorial about Jimmy Kimmel that could only be published following a rigorous review process by experts in the field of Jimmy Kimmel.

-- Adam Ruben - Durbin has written an excellent exposition of how journal articles are structured: How to Read a Scientific Research Paper. His target audience is medical professionals, but that doesn't matter. Journal papers are journal papers. The structure is the same.

- Few if any researchers will merely replicate a study, the exception being when there's a genuine evidence from what's given in the paper that it's author(s) faked something. Not many folks replicate studies because, well, what's the point? Everyone's well beyond high school; nobody's "checking one's addition," so to speak.

What reviewers and other researchers check/retest is the theory applied, not the specific application of it in a given paper. The reason for that is partly because doing so doesn't add to humanity's body of knowledge and partly because one doesn't get any credit for doing that which has already been done.

- For an interesting but brief look at what some leaders and principals read see: What 16 Successful People Read In The Morning. For the life of me, I don't know why I rarely see conservatives here citing content from The Economist and Financial Times, despite both having conservative editorial boards and neither being a propaganda rag....But that's a discussion topic for another thread, not this one.

- Scientific research paper, journal article, science journal, etc....they're all just different terms for the same thing: research and analysis conducted in accordance with with rigor of logical thought and analysis. Such articles exist for mathematics, social sciences, natural sciences, humanities, applied natural sciences (engineering, kinesiology, medicine, animal husbandry, etc.), and, of course, applied social science and humanities (aka business)..

Last edited: