dilloduck

Diamond Member

Soak the rich.

How ?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

Soak the rich.

How ?

By raising taxes on those making over $250,000 per year, just as Obama has suggested. Reagan and Bush's tax cuts for the rich have left us deeply in debt and increased the wide gap between the rich and the rest of us.

Time for the rich to pay up.

Do you actually think you would benefit from it ?

JR

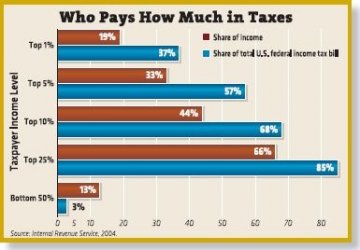

how much the top 1% pay of our income tax, which is about 1 trillion of income tax collected in a year in total, is only a little more than a THIRD of our annual budget spending of nearing 3 TRILLION.....

AND what these people pay of our total income tax is NOT important and has NOTHING to do with what i was saying above....you missed my point entirely....

IT is what these people can earn and make a year because of the laws, and regulations, and oversight of the markets or lack there of, and because of tax laws put in place for them, and bankruptcy laws put in place for them, and bailouts for them, and free leases of our land to them, and eminent domain now, being used for them, and offshore tax breaks put in to law for them and on and on and on and on jr.....

THOSE THINGS have made them wealthier....much more so than the average jo living on edge...those things are layed out in their favor to continue to prosper....while in many cases, reducing our share of the pie.....shoot, even when the wealthiest fail, we still bail them out.

the wealth the wealthiest have gained ...came thru hard work for some i am certain....BUT what our government has GIVEN THEM has MORE THAN COMPENSATED for their income tax share.....

i guess we will have to agree to disagree at this point!

care

We have a $9 trillion dollar National Debt thanks to Reagan and Bush. It has to be paid for somehow. Obama's plan is a good one.

Don't think so, the war on poverty, has made the rich, richer and the poor, poorer.

Not really.

Oh sure it keeps some people in the social services working, but basically we've done such a botched job of dealing with the root causes of poverty that it has actually made things worse.

While I am deeply commited to creating a fair and just society, a LOT of the complaints made by our fellow conservatives have been SPOT ON.

Now many of their complaints are in fact no longer valid as we've changed the whole welfare sytem so much, and apparently few of them realize that, but their complaint that we will get MORE of what we FUND is spot on.

For years we enabled poverty without REALLY enabling the poor to get the hell out of that trap.

And now that we're busy making the middle class poor, so that our rich can be rich rich richer!we really don't have the time or resources to deal with the poor.

If the welfare system has changed so much, why hasn't the number of people in poverty changed dramatically?

We need to reinstill personal responsibility into America. We need to give people a helping hand, not a handout.

By the way did you ever refute any of the facts or figures in my previous post? If not you would have to agree that massive handouts isn't what this country needs at this point and time.

Fact: Mccain's tax plan gives more money back to the people who actually pay federal income taxes. While a large portion of Obama's tax plan consists of handouts for people who pay no federal income taxes.

We have a $9 trillion dollar National Debt thanks to Reagan and Bush. It has to be paid for somehow. Obama's plan is a good one.

Corporate welfare is the problem not helping a few poor people.

I can tell by your tone that you have never been poor and have no idea what it is like. Championing the rich and powerful is what Republicans like you do. That is why you are so evil.

Bush borrowed $700 billion dollars from the Chinese to finance the occupation of Iraq. Now Iraq is costing us $10 billion dollars a month.

BS...the bailout not only helps out corporate america, its main purpose remember was to help out the people on Main Street.

I have been poor dumbass, that shows how much you know. I am by no means rich now, I provide for my family and for myself. Income redistribution strips a free market of personal responsibility and incentatives. Income redistribution creates a mass of people dependent on the government.

no, it won't. The corporations will just move overseas. This is a global economy now. The corporations don't have to take any bullshit from Obamalama. Same with the rich. They have options. Wonder what Obalamalams's backup plan is?

God, are you stupid.

Corporations are already moving overseas. One of the reasons they are is because employers in other countries don't have to pay for healthcare. Toyota just located a plant in Canada for that reason.

and you are even stupider.. expect more to move if Obamalama is President. No corp. no job no job no money no money no rich. what's yer backup plan?

Obama's plan is excellent.

Get out of Iraq, universal healthcare, and American energy independence.......this is exactly what we should be doing.

Go Obama!