Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Obama Spokesman Calls Newt Or Anyone Who Says They Can Lower Gas Prices Liars

- Thread starter mudwhistle

- Start date

Sealybooboo..( more like boo hoo) has an anti fossil fuel bias. That said he/she has no credibility and has no standing in the discussion.

Refining is a low margin business. Federal and state environmental as well as commercial business regulations that are specific to the petroleum industry are part of the problem.

Yes Refineries have something to do with the cost of gasoline. But thats only half the story. You only have half the story.

Why Republicans Aren’t Mentioning the Real Cause of Rising Prices at the Gas Pump

Thursday, March 15, 2012

Gas prices continue to rise, which is finally giving Republicans an issue. Mitt Romney is demanding the President open up more domestic drilling; the super PAC behind Rick Santorum just released a new ad in Louisiana blasting the President on gas prices; and the GOP is attacking the White House on the Keystone XL Pipeline.

NOTICE NO MENTION OF REFINERIES GRAMPS?

But the rise in gas prices has almost nothing to do with energy policy. It has everything to do with America’s continuing failure to adequately regulate Wall Street. But don’t hold your breath waiting for Republicans to tell the truth.

As I’ve noted before, oil supplies aren’t being squeezed. Over 80 percent of America’s energy needs are now being satisfied by domestic supplies. In fact, we’re starting to become an energy exporter. Demand for oil isn’t rising in any event. Demand is down in the U.S. compared to last year at this time, and global demand is still moderate given the economic slowdowns in Europe and China.

But Wall Street is betting on higher oil prices in the future — and that betting is causing prices to rise. The Street is laying odds that unrest in Syria will spill over into other countries or that tensions with Iran will affect the Persian Gulf, and that global demand will pick up as American consumers bounce back to life.

These bets are pushing up oil prices because Wall Street firms and other big financial players now dominate oil trading.

Financial speculators historically accounted for about 30 percent of oil contracts, producers and end users for about 70 percent. But today speculators account for 64 percent of all contracts.

Bart Chilton, a commissioner at the Commodity Futures Trading Commission — the federal agency that regulates trading in oil futures, among other commodities — warns that too few financial players control too much of the oil market. This allows them to push oil prices higher and higher — not only on the basis of their expectations about the future but also expectations about how high other speculators will drive the price.

In other words, a relatively few players with very deep pockets are placing huge bets on oil — and you’re paying.

But the GOP won't let us regulate this???

Chilton estimates that drivers of small cars like Honda Civics are paying an extra $7.30 every time they fill up because of oil speculators. That money is going into the pockets of Wall Street speculators. Drivers of larger vehicles like the Ford Explorer are paying speculators $10.41 when they fill up.

Funny, but I don’t hear Republicans rail against Wall Street speculators. Could this have anything to do with the fact that hedge funds and money managers are bankrolling the GOP?

Wall Street isn’t bankrolling Democrats nearly as much this time around because the Street is still smarting from the Dodd-Frank Wall Street reform law pushed by the Democrats, and from the president’s offhand remark in 2010 calling the denizens of the Street “fat cats.”

The Commodity Futures Trading Commission is trying to limit how much speculators can bet in oil futures — a power it was given by Dodd-Frank. It issued a rule in October, but it won’t take effect for another year.

Meanwhile, Wall Street has gone to court to stop the rule. It’s already won a stay.

As rising gas prices start wagging the election-year dog, the President should let America know what’s really causing prices to rise.

Robert Reich (Why Republicans Aren't Mentioning the Real Cause of Rising Prices at the Gas Pump)

No...You stated very clearly that the refining capacity issue was a fall back position and that drill baby drill won't work.

You are the rest of the Obama cheerleaders are not going to have the clout to save your Obamessiah from the public's perception that the Administration while not entirely responsible for expensive gas, but the failure of the Administration to put forth a definitive energy policy.

The killer for Obama is his very own hand picked Energy Secretary stating that "we have to find a way to get gas prices to the levels seen in Europe".

At this point you should know that the opinions and ten second sound bites from political candidates mean very little. They have no substance. So stop posting them. They are summarily dismissed as campaign fodder.

Earlier in this thread you stated that because "we are regulating Wall Street" is the reason for the recent rise in stock values. Now you contradict yourself. And then you try to place blame on the GOP. Look genius, your side is every bit if not more culpable. Your side controls the Senate and the White House.

So, this alleged proposal to further regulate the commodities markets...care to post a link so I can read it for myself? Or am I and the rest of the forum members supposed to take your word for it?

it is clear you are clueless on this matter. You have posted nonsense, made statements yet refused to support them with verifiable facts and have contradicted your own statements of opinion.

Your focus on commodities speculation is typical politics. "Speculator" is the latest liberal talking point bogeyman buzz term.

Do you actually believe that the only concern of oil traders is to driver the price upward?

You have taken the time to do some digging and produce quotes from on analyst. Based on that, you should know that traders do not care whether the price rises or falls. Only that they are on the correct side of the market when it moves.

GOP Attacks Obama With Gas Price Cudgel, While Media Ignores Refinery Closures

As the stock market and overall economy slowly improve, the GOP continues to blame President Obama for rising gas prices as November's election approaches. The drumbeat of the GOP message is constant: The Obama administration is at fault for limiting oil companies' access to potential domestic sources in environmentally-fragile locations.

This narrative has dominated media coverage. Yet almost totally absent from the news has been how oil companies are pinching off the supply of gasoline by shutting down refineries. Strangely, this is occurring at a time of plentiful domestic oil supplies; the United States now exports more oil than it imports.

But NPR recently broke the story by broadcasting a story about the curious chain of refinery shutdowns on the East Coast. The United Steelworkers union (USW), which represents many oil refinery workers, has also been calling attention to three shutdowns in the Philadelphia area; two other refinery have closed on the East Coast during the last two years.

"The supply of gasoline has been declining," Gheit says. "We have 700,000 barrels of refining capacity [that were shut down] in the last three months. That is almost 5 percent of U.S. gasoline production ... now offline." Why would they do that thereisnospoon?

"and never in my life have I seen so many refineries close all at once."

The oil giants have also been failing to uprgrade other refineries to handle high-sulphur oil.

While about 2,200 workers have been directly employed at the three refineries, a total of about 20,000 workers will eventually lose their jobs as a result of the three latest shutdowns, according to Lynne Hancock, spokeswoman for USW, which represents many of the workers.

"They claim they're not making money in refining, that they're making money upstream in exploration and production,"

But just like the complex and expensive process of exploring for oil, refining the oil is an essential link in the process of converting oil to gas. Given the hundreds of billions realized in profits at the end of the process, operating refineries can hardly be characterized as an unaffordable burden.

However, the oil companies are using this rationale to close more and more refineries, which means a heavier reliance on transporting oil over long distances from foreign refineries or already over-burdened U.S. operations, Hancock explains.

It also creates critical bottlenecks in the flow of oil and production of gas, driving up prices. Despite these high prices, the major companies are reducing the supply.

"Their mentality is focused on their company and not the community at large, and we think the government needs to step in. If the government regulates electricity, it should regulate gasoline production,.

The refinery closings will lead to higher prices for gas, home heating oil, and diesel fuel. Inevitably, these will translate into higher prices for virtually every commodity and service, she says. "Once gas goes up, groceries go up, clothing goes up, everything. High gas prices have a snowball effect."

What is so extrarodinary about the woefully weak mainstream media coverage of oil giants' role in rising prices is that industry is widely recognized as hugely profitable, yet nonetheless rake in enormous tax breaks from the government.

Th top five oil companies—BP, Chevron, ConocoPhillips, ExxonMobil, and Royal Dutch Shell—hauled in a record $137 billion in profits in 2011, up 75 percent from 2010. They effectively used their lobbying and campaign-contribution muscle to shield those profits from fair taxation. As the Center for American Progress notes:

For every $1 the big five spent on lobbying in D.C. last year, they effectively received $30 in subsidies disguised as tax breaks. This is equivalent to a 3,000 percent return on every dollar they invested in strong-arming Congress.

More than $1.6 million was spent on campaign contributions in 2011 from just four of the top five oil companies. And more than 90 percent of these campaign contributions were made to Republican candidates or committees.

Despite a century-long muckraking tradition that has repeatedly revealed oil barons' awesome power, major media have been utterly unwilling to expose their political influence and explain how recent refinery closures are related to the high prices Republicans are now blaming on President Obama to push him out of the White House.

Beyond the shame of being used by political operatives to distribute a powerful and thoroughly inaccurate message, news reports that privilege the myths over the facts help cement a short-sighted perspective on our energy challenges. Liberal media my ass.

Last edited:

Some people seem to think that since we have excess oil supplies within the USA, that ought to lower prices here. That is nonsense. No oil company is going to sell oil below the market value, just to make American motorists feel better. They would be violating their fiduciary duty to their shareholders, if they did such a thing.

However, America does have a huge supply of oil beneath our ground, and we should be working to produce that oil. We have enough to keep oil prices at reasonable levels for the next fifty years. We have enough to cover any attempts by foreign governments to disrupt the oil supply. We have enough to carry us through transition to reasonable and viable alternative energy sources.

Then we should stop giving them massive tax breaks.

What tax breaks? Be specific.

Th top five oil companiesBP, Chevron, ConocoPhillips, ExxonMobil, and Royal Dutch Shellhauled in a record $137 billion in profits in 2011, up 75 percent from 2010. They effectively used their lobbying and campaign-contribution muscle to shield those profits from fair taxation. As the Center for American Progress notes:

For every $1 the big five spent on lobbying in D.C. last year, they effectively received $30 in subsidies disguised as tax breaks. This is equivalent to a 3,000 percent return on every dollar they invested in strong-arming Congress.

More than $1.6 million was spent on campaign contributions in 2011 from just four of the top five oil companies. And more than 90 percent of these campaign contributions were made to Republican candidates or committees.

Mr. H.

Diamond Member

Could you go into more detail regarding the "subsidies disguised as tax breaks"?

Then we should stop giving them massive tax breaks.

What tax breaks? Be specific.

Th top five oil companiesBP, Chevron, ConocoPhillips, ExxonMobil, and Royal Dutch Shellhauled in a record $137 billion in profits in 2011, up 75 percent from 2010. They effectively used their lobbying and campaign-contribution muscle to shield those profits from fair taxation. As the Center for American Progress notes:

For every $1 the big five spent on lobbying in D.C. last year, they effectively received $30 in subsidies disguised as tax breaks. This is equivalent to a 3,000 percent return on every dollar they invested in strong-arming Congress.

More than $1.6 million was spent on campaign contributions in 2011 from just four of the top five oil companies. And more than 90 percent of these campaign contributions were made to Republican candidates or committees.

For every $1 the big five spent on lobbying in D.C. last year, they effectively received $30 in subsidies disguised as tax breaks.

Interesting claim. Still haven't seen the list of subsidies. Or the list of tax breaks.

- Thread starter

- #186

Tax breaks. You know, the "subsidies" that Obama is lyi.... talking about.

It's always amazed me how the oil business is looked upon as some get-rich quick scheme. So why aren't more people in the oil business.

Go drill a hole in the ground you fucking idiots.

Obama likes to rub elbows with the folks in Hollywood.

Their profits are up there with "Big Oil", but they're acceptable profits. They don't pollute the planet......even though many of them own their own jets and take one to go up the coast to get a burger.

NYcarbineer

Diamond Member

The Energy Department confirmed yesterday that the U.S. exported more oil-product than imported for the first time since 1949.

We have more oil than we need. Hasn't lowered prices one bit. So more refineries won't make a damn bit of difference, just like drill baby drill hasn't made a dent.

The oil companies will still charge whatever they they think they can get away with charging. And you will defend them, no?

And even if everything you say is true, you still don't seem to understand that oil speculators are causing gas prices to go up. Why do you defend them and/or deny their existance or blow off the fact that these people who don't have anything to do with drilling or refining oil are making money off high gas prices?

Now if they go too far like they did the last time they raised prices to over $4 a gallon and crash the economy again, that will force them to lower the prices, but who wants that?

As previously stated. You have no standing here because of your anti fossil fuel bias.

The Energy Dept says what the Obama admin tells it say. How do I know this? Because the top people namely the Secretary serve at the pleasure of the President.

Look honey, I understand and have knowledge of things that you can only imagine to comprehend. Do not condescend to me.

I never defended "speculators"...EVER. You made that up.

You are clueless to the workings of commodities trading. You are spewing statements that are not factual.

I will get you started on your way to recovery.

Here are factors which drive the price of commodities.

Oil and gasoline.. These are traded and prices set based on the US Dollar. In theory, the levels of supply and demand could remain neutral for a month and the price of these commodities would vary, riding on the value of the US Dollar vs other major currencies. One of the main issues which causes the price of oil and gas to rise is the falling value of the Dollar. Our federal government's spending and borrowing makes up perhaps 90% of the value of the US Dollar.

Pension and other retirement funds.....Up until 2007, on any given trading day, there was around $15billion in the oil and gasoline markets. By 2010 there was nearly THIRTY times that amount. Banks and other institutions which had pension funds and other investment and speculative index fund money tied up in securities took their money from those and placed it in commodities looking for a better return. Now, contrary to the news that is spoon fed to the public, commodities traders bet the market in BOTH directions. These are called "buys" (up) and "Puts (Down). They can force the price downward as quickly as it can be forced upward. Whatever direction will bring them the greatest return on investment ,that is where the trades go. An example of this was the precipitous drop in oil and gas futures in 2009. The US Dollar was surging and even though our economy was sagging, the other currencies were falling faster. Hence the price bottoming out at $30 per barrel and about $1.20 for one gallon of Regular..So while you are told by your people in the White House that is not their fault gas prices are high and there is nothing they can do, that's a lie. But as long as they say there is nothing that can be done it's all good for you.

The fact is the policies of the federal government forced this to happen.

Now, the refining capacity issue is very real. You just refuse to acknowledge that fact. That's fine.

You can whine and deny all you like. It doesn't change the facts. Facts that obviously you cannot bring yourself to grasp.

Refining capacity is the problem pure and simple.

We have an abundance of oil available now. We can not refine it quick enough.

So if we can not refine it what happens? The demand goes up and with increased demand theprice goes up.

Simple economics. So how does the price of gas go down if we drill it?

It doesn't. What car runs on oil?

It HAS TO BE REFINED and that is the reason gas is so high and goes higher.

Demand pure and simple as there is NO shortage of oil. There is so much of it how does the price of a commodity go down when they can not make enough of it to meet demand?

A basic understanding of economics is needed in this country. "Drill and the price goes down" is laughable. The pipeline was a good idea as that saves delivery costs but that oil IS ALREADY OUT OF THE GROUND. Obama has no business as President but the price of gas will not go down with a new President over night and drilling does not lower it. We need 3 new refineries now and the oil companies are not stepping up to lay out the capital to do it. Why should they? They make more $$ the way it is now.

Simple, basic economics.

You're dead wrong. American refineries are exporting gasoline on top of providing domestic supply.

Seawytch

Information isnt Advocacy

Interesting claim. Still haven't seen the list of subsidies. Or the list of tax breaks.

Then you aren't looking very hard.

CRS Report Describes Subsidies Explicitly For Fossil Fuels. An April 14 report by the Congressional Research Service (CRS) titled, "Energy Tax Policy: Issues in the 112th Congress," details seven federal tax breaks explicitly targeted to the oil and gas industry that cost the federal government billions of dollars.

Environmental Law Institute: Subsidies To Fossil Fuel Industry "Totaled Approximately $72 Billion" Between 2002 And 2008. Using a broader definition of subsidies to the oil and gas industry than CRS, the Environmental Law Institute found:

The federal government provided substantially larger subsidies to fossil fuels than to renewables. Subsidies to fossil fuels -- a mature, developed industry that has enjoyed government support for many years -- totaled approximately $72 billion over the study period, representing a direct cost to taxpayers.

Subsidies for renewable fuels, a relatively young and developing industry, totaled $29 billion over the same period. [Environmental Law Institute, September 2009]

The federal government provided substantially larger subsidies to fossil fuels than to renewables. Subsidies to fossil fuels -- a mature, developed industry that has enjoyed government support for many years -- totaled approximately $72 billion over the study period, representing a direct cost to taxpayers.

Subsidies for renewable fuels, a relatively young and developing industry, totaled $29 billion over the same period. [Environmental Law Institute, September 2009]

Senate Republicans Blocked Attempt To Repeal Oil And Gas Industry-Specific Subsidies.

the Senate considered a bill that would repeal many tax breaks that benefit only the oil and gas industry. Although a majority of senators voted for the bill, it was blocked by a filibuster on a near-party-line vote. The bill would have repealed tax breaks such as:

The "Deduction For Intangible Drilling And Development Costs"

The "Percentage Depletion Allowance For Oil And Gas Wells"

The "Outer Continental Shelf Deep Water And Deep Gas Royalty Relief" [S.940, 5/10/11, Senate.gov, 5/17/11]

the Senate considered a bill that would repeal many tax breaks that benefit only the oil and gas industry. Although a majority of senators voted for the bill, it was blocked by a filibuster on a near-party-line vote. The bill would have repealed tax breaks such as:

The "Deduction For Intangible Drilling And Development Costs"

The "Percentage Depletion Allowance For Oil And Gas Wells"

The "Outer Continental Shelf Deep Water And Deep Gas Royalty Relief" [S.940, 5/10/11, Senate.gov, 5/17/11]

JDzBrain

Active Member

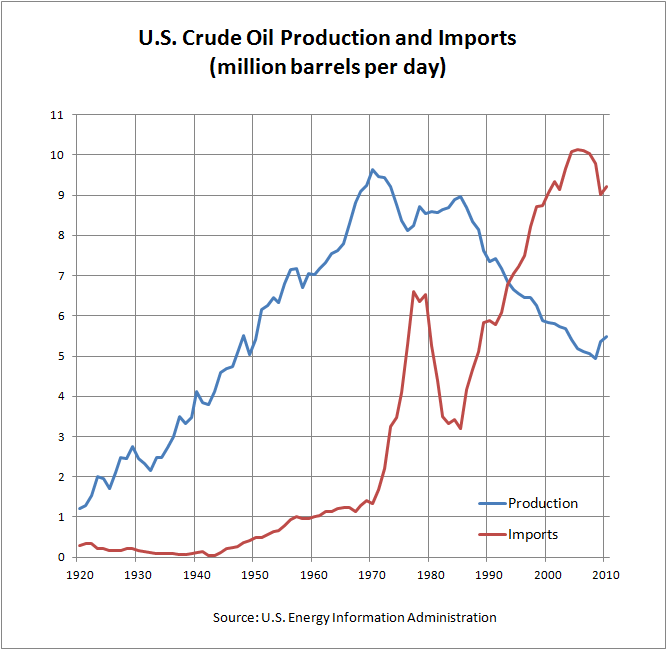

NO!!!!Is that picture true?

The one with the oli rigs?

The blue line is our (US) production over history and the red one is our imports over history!

This chart is right off Wiki, but there are dozens of other sources that ALL show the same numbers. Taking a snapshot of a short period of time and using it as proof of some point of view is typical liars figure and figures lie BULL!

Folks, you'll notice that we now import nearly twice as much oil as we produce. And here is the thing. Right now, the US strategic reserve is less than 20 million barrels from being topped off to it's historically high levels. And that was back in February...AFTER they sold off 30 barrels from the historically high levels they'd driven it up to in 2011 to "offset" the Arab Spring.

See, the very month that Obama took office, January 2009, the DOE (Department of Energy), at the direction of Obama, RESUMED purchases of crude to the strategic reserve...making the US government USING YOUR TAX DOLLARS the single largest oil speculator on the planet!

Our government is spending money STOLEN from your children's future to inflate demand and drive up the price of oil to steal the present...and the useful idiots out there are TOO STUPID to see it!

By the way the only SUBSIDY related to oil is a direct subsidy to ethanol producers the oil companies BUY their ethanol from to be blended with gas. Tax breaks are no more a subsidy to oil companies than the equipment depreciation tax credits given to every mom and pop company in this country.

If any oil company is receiving a DIRECT subsidy from the government...it's because they own an ethanol production plant...PERIOD!

If you don't like the tax code...THEN CHANGE IT FOR EVERYONE!!!!!!!

This country, our Constitution and our very founding principles are base on EQUALITY...NOT fairness. Equal protections under the law, equal rights...EQUALITY!

Dumbasses!

What tax breaks? Be specific.

Th top five oil companies—BP, Chevron, ConocoPhillips, ExxonMobil, and Royal Dutch Shell—hauled in a record $137 billion in profits in 2011, up 75 percent from 2010. They effectively used their lobbying and campaign-contribution muscle to shield those profits from fair taxation. As the Center for American Progress notes:

For every $1 the big five spent on lobbying in D.C. last year, they effectively received $30 in subsidies disguised as tax breaks. This is equivalent to a 3,000 percent return on every dollar they invested in strong-arming Congress.

More than $1.6 million was spent on campaign contributions in 2011 from just four of the top five oil companies. And more than 90 percent of these campaign contributions were made to Republican candidates or committees.

For every $1 the big five spent on lobbying in D.C. last year, they effectively received $30 in subsidies disguised as tax breaks.

Interesting claim. Still haven't seen the list of subsidies. Or the list of tax breaks.

What dopes you Republicans are. Let me sum up what I just showed you stupid.

a. Republicans say we need more refineries and Obama won't let them build anymore

b. But I just showed you that if we have 10 refineries, the oil companies shut down a couple of them so they could fuck with supply and use it to jack up the prices.

c. Republicans say we need to let them drill baby drill more but the fact is, nothing will ever be enough. Proof is that under Obama, they are drilling more than they did under Bush. This is just the oil companies wanting to gobble up all our real estate on the cheap. Republicans want to do away with the commons. Sell it all to corporations.

d. I shouldn't have to show you or Mr. T what tax breaks the oil companies get. Go find that information yourself. You two are the last two people on earth to not know about this.

e. If you can't see the oil companies are falsely jacking up the prices to help the GOP, you are brainwashed. Didn't hurt Bush in 2008 because he wasn't running for a 3rd term.

Last edited:

Is that picture true?

The one with the oli rigs?

Folks, you'll notice that we now import nearly twice as much oil as we produce. !

Why can't you acknowledge these facts?

Oil supplies arent being squeezed. Over 80 percent of Americas energy needs are now being satisfied by domestic supplies. In fact, were starting to become an energy exporter. Demand for oil isnt rising in any event. Demand is down in the U.S. compared to last year at this time, and global demand is still moderate given the economic slowdowns in Europe and China.

But Wall Street is betting on higher oil prices in the future and that betting is causing prices to rise. WallStreet is laying odds that unrest in Syria will spill over into other countries or that tensions with Iran will affect the Persian Gulf, and that global demand will pick up as American consumers bounce back to life.

These bets are pushing up oil prices because Wall Street firms and other big financial players now dominate oil trading.

Financial speculators historically accounted for about 30 percent of oil contracts, producers and end users for about 70 percent. But today speculators account for 64 percent of all contracts.

A commissioner at the Commodity Futures Trading Commission the federal agency that regulates trading in oil futures, among other commodities warns that too few financial players control too much of the oil market. BUT YOU ARE SMARTER THAN HIM? This allows them to push oil prices higher and higher not only on the basis of their expectations about the future but also expectations about how high other speculators will drive the price.

In other words, a relatively few players with very deep pockets are placing huge bets on oil and youre paying. FACT DUMMY!

Costing economy cars an extra $7.30 everytime we fill up and costing SUV's $10.41.

FACT! WHY DON'T YOU WANT TO DEAL WITH THIS DUMMY???

- Thread starter

- #192

Oil prices are going up partly because Iran's oil isn't on the open market anymore.

Mr. H.

Diamond Member

Interesting claim. Still haven't seen the list of subsidies. Or the list of tax breaks.

Then you aren't looking very hard.

CRS Report Describes Subsidies Explicitly For Fossil Fuels. An April 14 report by the Congressional Research Service (CRS) titled, "Energy Tax Policy: Issues in the 112th Congress," details seven federal tax breaks explicitly targeted to the oil and gas industry that cost the federal government billions of dollars.

Environmental Law Institute: Subsidies To Fossil Fuel Industry "Totaled Approximately $72 Billion" Between 2002 And 2008. Using a broader definition of subsidies to the oil and gas industry than CRS, the Environmental Law Institute found:

The federal government provided substantially larger subsidies to fossil fuels than to renewables. Subsidies to fossil fuels -- a mature, developed industry that has enjoyed government support for many years -- totaled approximately $72 billion over the study period, representing a direct cost to taxpayers.

Subsidies for renewable fuels, a relatively young and developing industry, totaled $29 billion over the same period. [Environmental Law Institute, September 2009]

Senate Republicans Blocked Attempt To Repeal Oil And Gas Industry-Specific Subsidies.

the Senate considered a bill that would repeal many tax breaks that benefit only the oil and gas industry. Although a majority of senators voted for the bill, it was blocked by a filibuster on a near-party-line vote. The bill would have repealed tax breaks such as:

The "Deduction For Intangible Drilling And Development Costs"

The "Percentage Depletion Allowance For Oil And Gas Wells"

The "Outer Continental Shelf Deep Water And Deep Gas Royalty Relief" [S.940, 5/10/11, Senate.gov, 5/17/11]

These are not subsidies in any way shape or form, you twit.

Interesting claim. Still haven't seen the list of subsidies. Or the list of tax breaks.

Then you aren't looking very hard.

CRS Report Describes Subsidies Explicitly For Fossil Fuels. An April 14 report by the Congressional Research Service (CRS) titled, "Energy Tax Policy: Issues in the 112th Congress," details seven federal tax breaks explicitly targeted to the oil and gas industry that cost the federal government billions of dollars.

Environmental Law Institute: Subsidies To Fossil Fuel Industry "Totaled Approximately $72 Billion" Between 2002 And 2008. Using a broader definition of subsidies to the oil and gas industry than CRS, the Environmental Law Institute found:

The federal government provided substantially larger subsidies to fossil fuels than to renewables. Subsidies to fossil fuels -- a mature, developed industry that has enjoyed government support for many years -- totaled approximately $72 billion over the study period, representing a direct cost to taxpayers.

Subsidies for renewable fuels, a relatively young and developing industry, totaled $29 billion over the same period. [Environmental Law Institute, September 2009]

Senate Republicans Blocked Attempt To Repeal Oil And Gas Industry-Specific Subsidies.

the Senate considered a bill that would repeal many tax breaks that benefit only the oil and gas industry. Although a majority of senators voted for the bill, it was blocked by a filibuster on a near-party-line vote. The bill would have repealed tax breaks such as:

The "Deduction For Intangible Drilling And Development Costs"

The "Percentage Depletion Allowance For Oil And Gas Wells"

The "Outer Continental Shelf Deep Water And Deep Gas Royalty Relief" [S.940, 5/10/11, Senate.gov, 5/17/11]

The "Deduction For Intangible Drilling And Development Costs"

How is that a subsidy?

The "Percentage Depletion Allowance For Oil And Gas Wells"

How is that a subsidy?

The "Outer Continental Shelf Deep Water And Deep Gas Royalty Relief"

Can you explain what this is?

Th top five oil companiesBP, Chevron, ConocoPhillips, ExxonMobil, and Royal Dutch Shellhauled in a record $137 billion in profits in 2011, up 75 percent from 2010. They effectively used their lobbying and campaign-contribution muscle to shield those profits from fair taxation. As the Center for American Progress notes:

For every $1 the big five spent on lobbying in D.C. last year, they effectively received $30 in subsidies disguised as tax breaks. This is equivalent to a 3,000 percent return on every dollar they invested in strong-arming Congress.

More than $1.6 million was spent on campaign contributions in 2011 from just four of the top five oil companies. And more than 90 percent of these campaign contributions were made to Republican candidates or committees.

For every $1 the big five spent on lobbying in D.C. last year, they effectively received $30 in subsidies disguised as tax breaks.

Interesting claim. Still haven't seen the list of subsidies. Or the list of tax breaks.

What dopes you Republicans are. Let me sum up what I just showed you stupid.

a. Republicans say we need more refineries and Obama won't let them build anymore

b. But I just showed you that if we have 10 refineries, the oil companies shut down a couple of them so they could fuck with supply and use it to jack up the prices.

c. Republicans say we need to let them drill baby drill more but the fact is, nothing will ever be enough. Proof is that under Obama, they are drilling more than they did under Bush. This is just the oil companies wanting to gobble up all our real estate on the cheap. Republicans want to do away with the commons. Sell it all to corporations.

d. I shouldn't have to show you or Mr. T what tax breaks the oil companies get. Go find that information yourself. You two are the last two people on earth to not know about this.

e. If you can't see the oil companies are falsely jacking up the prices to help the GOP, you are brainwashed. Didn't hurt Bush in 2008 because he wasn't running for a 3rd term.

Let me sum up what I just showed you

Wow, thanks.

Still haven't seen the list of subsidies. Or the list of tax breaks.

Mr. H.

Diamond Member

Interesting claim. Still haven't seen the list of subsidies. Or the list of tax breaks.

Then you aren't looking very hard.

CRS Report Describes Subsidies Explicitly For Fossil Fuels. An April 14 report by the Congressional Research Service (CRS) titled, "Energy Tax Policy: Issues in the 112th Congress," details seven federal tax breaks explicitly targeted to the oil and gas industry that cost the federal government billions of dollars.

Environmental Law Institute: Subsidies To Fossil Fuel Industry "Totaled Approximately $72 Billion" Between 2002 And 2008. Using a broader definition of subsidies to the oil and gas industry than CRS, the Environmental Law Institute found:

The federal government provided substantially larger subsidies to fossil fuels than to renewables. Subsidies to fossil fuels -- a mature, developed industry that has enjoyed government support for many years -- totaled approximately $72 billion over the study period, representing a direct cost to taxpayers.

Subsidies for renewable fuels, a relatively young and developing industry, totaled $29 billion over the same period. [Environmental Law Institute, September 2009]

Senate Republicans Blocked Attempt To Repeal Oil And Gas Industry-Specific Subsidies.

the Senate considered a bill that would repeal many tax breaks that benefit only the oil and gas industry. Although a majority of senators voted for the bill, it was blocked by a filibuster on a near-party-line vote. The bill would have repealed tax breaks such as:

The "Deduction For Intangible Drilling And Development Costs"

The "Percentage Depletion Allowance For Oil And Gas Wells"

The "Outer Continental Shelf Deep Water And Deep Gas Royalty Relief" [S.940, 5/10/11, Senate.gov, 5/17/11]

The "Deduction For Intangible Drilling And Development Costs"

How is that a subsidy?

The "Percentage Depletion Allowance For Oil And Gas Wells"

How is that a subsidy?

The "Outer Continental Shelf Deep Water And Deep Gas Royalty Relief"

Can you explain what this is?

a) Obama says they are.

b) Idiots believe Obama.

If the politicians had to pick between drilling oil discovered under Washington D.C. and their palatial quarters or ANWR, which would they pick?And he's 100% correct for saying that, too.Obama Spokesman Calls Newt Or Anyone Who Says They Can Lower Gas Prices Liars

Open up ANWR.

Oil would drop immediately.

So would gas.

lol!Then you aren't looking very hard.

CRS Report Describes Subsidies Explicitly For Fossil Fuels. An April 14 report by the Congressional Research Service (CRS) titled, "Energy Tax Policy: Issues in the 112th Congress," details seven federal tax breaks explicitly targeted to the oil and gas industry that cost the federal government billions of dollars.Environmental Law Institute: Subsidies To Fossil Fuel Industry "Totaled Approximately $72 Billion" Between 2002 And 2008. Using a broader definition of subsidies to the oil and gas industry than CRS, the Environmental Law Institute found:

The federal government provided substantially larger subsidies to fossil fuels than to renewables. Subsidies to fossil fuels -- a mature, developed industry that has enjoyed government support for many years -- totaled approximately $72 billion over the study period, representing a direct cost to taxpayers.

Subsidies for renewable fuels, a relatively young and developing industry, totaled $29 billion over the same period. [Environmental Law Institute, September 2009]Senate Republicans Blocked Attempt To Repeal Oil And Gas Industry-Specific Subsidies.

the Senate considered a bill that would repeal many tax breaks that benefit only the oil and gas industry. Although a majority of senators voted for the bill, it was blocked by a filibuster on a near-party-line vote. The bill would have repealed tax breaks such as:

The "Deduction For Intangible Drilling And Development Costs"

The "Percentage Depletion Allowance For Oil And Gas Wells"

The "Outer Continental Shelf Deep Water And Deep Gas Royalty Relief" [S.940, 5/10/11, Senate.gov, 5/17/11]

The "Deduction For Intangible Drilling And Development Costs"

How is that a subsidy?

The "Percentage Depletion Allowance For Oil And Gas Wells"

How is that a subsidy?

The "Outer Continental Shelf Deep Water And Deep Gas Royalty Relief"

Can you explain what this is?

a) Obama says they are.

b) Idiots believe Obama.

JDzBrain

Active Member

What dopes you Republicans are. Let me sum up what I just showed you stupid.

a. Republicans say we need more refineries and Obama won't let them build anymore

Aaaant....WRONG! Republicans say the EPA and overly burdensome regulations won't let PRIVATE ENTERPRISE WORK! Got NOTHING to do with the party...other than it's MOSTLY liberal/progressive/socialist that are working their asses off to inflict this grotesque crap on us. Obama is just the current face of the movement of stupid!

b. But I just showed you that if we have 10 refineries, the oil companies shut down a couple of them so they could fuck with supply and use it to jack up the prices.

You haven't shown any such thing. If you look at the chart I posted, you'll notice that our domestic production of CRUDE OIL started a free fall in the 70's. At the same time the push by environmentalist toward regulation of EVERYTHING connected to automobiles and oil started. While regulations have kept increasing, there has NOT been a SINGLE refinery built in the US since 1976 while there have been more than 12,000 applications filed to build!!!

At the same time as the fed has been denying applications for the VERY FEW left who can afford to build refineries...the obscene regulatory burden placed on refineries has forced all but biggest players OUT and reduced competition so your evil big five have a complete monopoly. Way to go tree huggers. And the so called shutdowns you are claiming is price control conspiracy is actually a result of aged equipment being REGULATED into obsolescence!

Our current 149 refineries have been operating at 110% of capacity....when they weren't SHUT DOWN to be retooled to meet NEW EPA regulations....since the late 70s!

c. Republicans say we need to let them drill baby drill more but the fact is, nothing will ever be enough. Proof is that under Obama, they are drilling more than they did under Bush. This is just the oil companies wanting to gobble up all our real estate on the cheap. Republicans want to do away with the commons. Sell it all to corporations.

You ARE kidding...right? First, they don't OWN the land. They get the mineral rights to what's under it. And in case you don't know it, YOU don't own the mineral rights to what under the ground your house is on...IF you actually own anything. Production has increased on PRIVATE and STATE lands that Obama has NO SAY OVER...NOT federal lands!!!

And here is a little FACT about that oil. There are a couple kinds of oil....just like coal. A high grade and low grade, high sulfur and low. Nearly ALL of this new oil is low grade and requires extraordinary refining to be usable. Extraordinary refining means higher production cost. Just a little FACT of business you might want to keep in mind.

d. I shouldn't have to show you or Mr. T what tax breaks the oil companies get. Go find that information yourself. You two are the last two people on earth to not know about this.

I shouldn't have to remind EVERYONE that when Obama calls them subsidies to oil companies it is a LIE! Tax breaks are NOT a direct subsidy like the 500 MILLION Obama gave the now defunct Solyndra. VERY different things. YOU get tax breaks. EVERY SINGLE PERSON, BUSINESS AND COMPANY IN THIS COUNTRY gets some kind of tax break. Don't like it...change thee tax code!

e. If you can't see the oil companies are falsely jacking up the prices to help the GOP, you are brainwashed. Didn't hurt Bush in 2008 because he wasn't running for a 3rd term.

Lord give me the...Let's see. George Soros...I KNOW you liberals know and love that evil son of a bitch...spent a BILLION DOLLARS speculating oil to drive up the price of gas before Obama was elected. Even went so far as to buy into the Brizilian Oil company that Obama gave 1.4 BILLION US TAX DOLLARS his first month in office.

Do you REALLY want to go there? Obama has bought more crude using YOUR TAX DOLLARS for the Strategic Petroleum Reserve at low, price controlled prices and sold it at higher prices than all US speculators combined. Our government is the biggest offender

I've got to go for now...but I'll be back to address that next post addressed at me later. This should keep you busy for a couple minutes anyway. ;~)

Wry Catcher

Diamond Member

- Banned

- #200

Fuck You America

This is what the Obama Administration is saying to anyone who says if they were president they could lower the price of gas.

Jay Carney said the administration will try to "mitigate the effects" of high gas prices, but they don't want to talk about lowering prices and he also said anyone else who says they can get prices back down is lying.

Well folks, as long as Obama is president forget about lower gas prices. He's not gonna even try to deal with it. Just get used to it. That is what they're saying. He can't do anything about it and don't ask him to lift a finger to try.

If they're talking like this during an election year imagine what's coming next year once he figures he doesn't have to answer to the voters anymore. Trust me, come next year we are really in for it.

Link

White House: Anyone who says gas could be $2.50 is lying | WTVR.com

Carney: Newt Gingrich Lying About $2.50 Gas | The Blog on Obama: White House Dossier

Newt Gingrich's $2.50 gas promise - Feb. 24, 2012

Liars they are:

10 little known

Similar threads

- Replies

- 59

- Views

- 540

- Replies

- 15

- Views

- 311

- Replies

- 32

- Views

- 622

Latest Discussions

- Replies

- 45

- Views

- 237

- Replies

- 2

- Views

- 3

Forum List

-

-

-

-

-

Political Satire 8049

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-