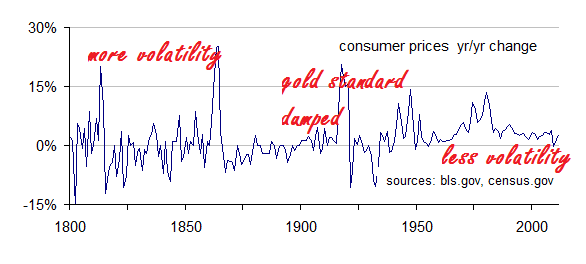

You said "90% of economic volatility would be eliminated." [with a gold standard] That is what I'm "comprehending." And it is wrong.

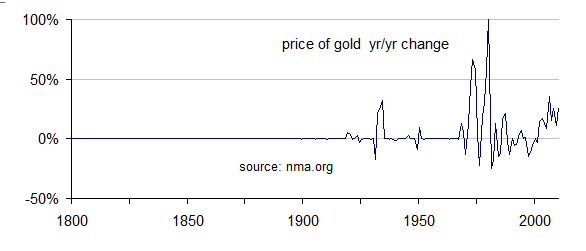

We had a gold standard for ~40 years from the 1870s onward.

you are 100% confused. Do you remember William Jennings Bryant's "cross of gold" . We did not have a true gold standard. There was huge huge controversy about it. It was the main topic in presidential election precisely because it was by no means a settled matter. Liberals openly wanted fiat inflation so farmers in debt would be better off when they had to pay back with inflated fiat currency. Read your HS history!!

Want to give up or do you want to challenge the gold standard from another era??

Go away, ideologue. You sound like a Marxist who says "We've never tried true communism."

Lame.