EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

- Thread starter

- #101

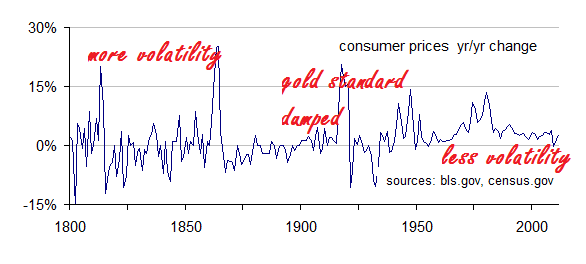

I'm not afraid to tell you why it would lead to volatility. I just have to point to history.

We all like to imagine that history supports our point of view. If you don't know why a gold standard would end volitility why not read about it or ask questions. You fool no one by evading the question.