EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

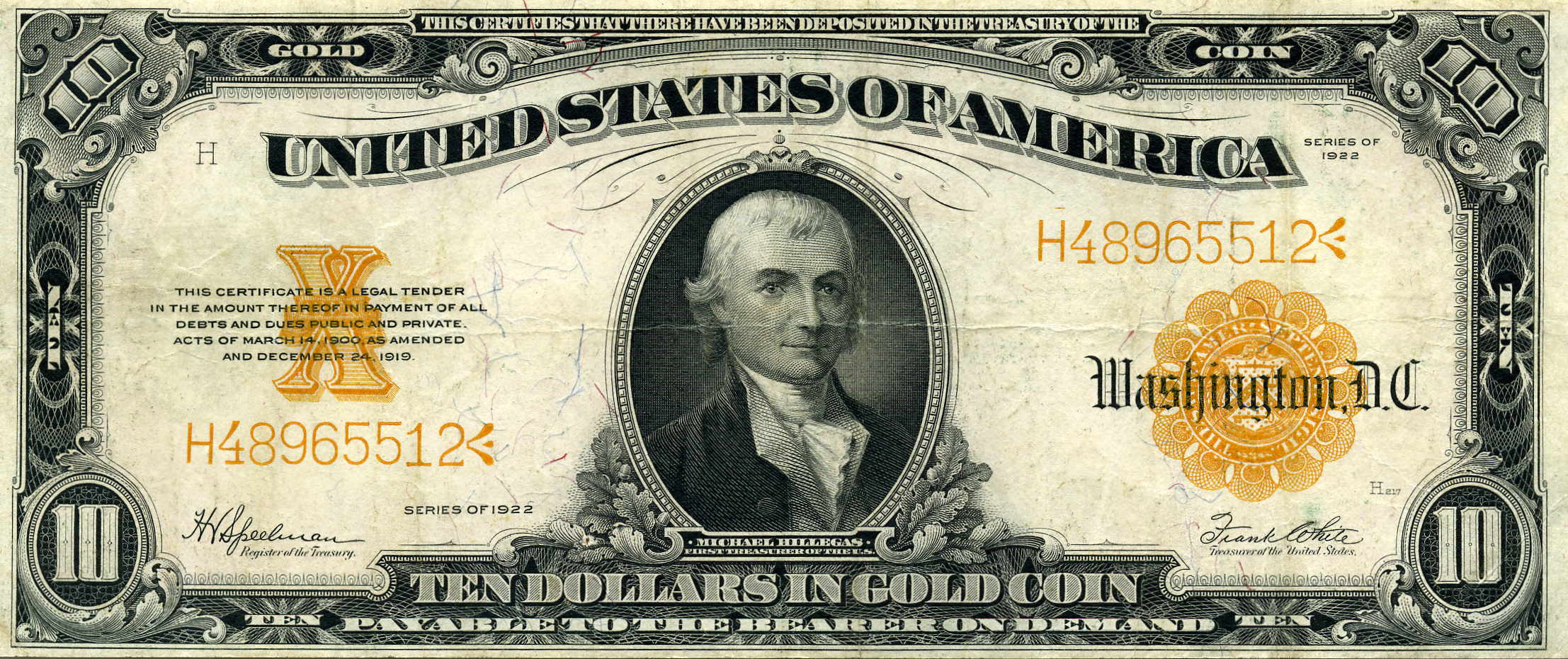

Watching the current European crisis is a great way to learn about the gold standard. The gold standard is similar to the Euro standard Europe is on.

Greece, for example, cant print Euros to pay its debts so it must spend less and earn more to get the money it needs to pay its debt. This is very healthy and realistic for a country or person or family.

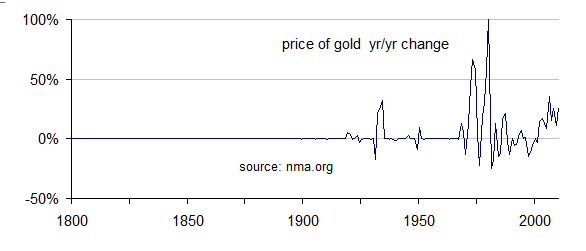

On a gold standard you cant print money either because only the amount of gold, not politicians, determines the amount of money

America is not on a gold standard or a Euro standard. We can and do print paper money at will. But, printing at will cause 4 problems

1) it rips off our creditors, who then won't trust us, since they are getting paid with devalued dollars.

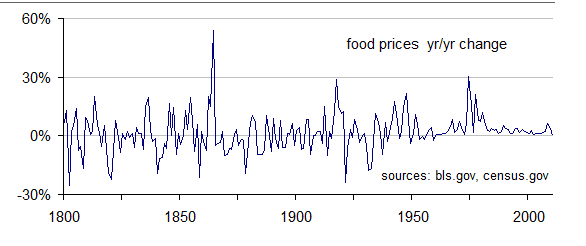

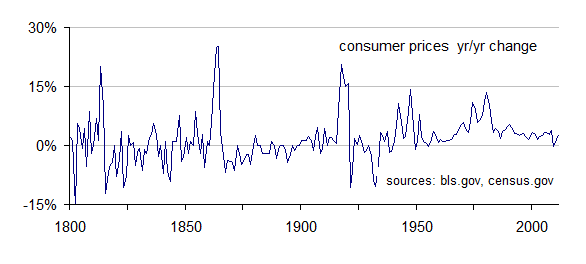

2) it rips of the American people since prices go up by the exact amount of the liberal money printed

3) it makes the economy less efficient since prices rise erratically as the new money works its way through the economy. Prices then don't reflect real costs, and thus make comparison shopping and economic efficiency impossible

4) Most importantly, there is little obvious pain so there is little incentive to discontinue the irresponsible 3rd world behavior that got us into debt in the first place.

Greece, for example, cant print Euros to pay its debts so it must spend less and earn more to get the money it needs to pay its debt. This is very healthy and realistic for a country or person or family.

On a gold standard you cant print money either because only the amount of gold, not politicians, determines the amount of money

America is not on a gold standard or a Euro standard. We can and do print paper money at will. But, printing at will cause 4 problems

1) it rips off our creditors, who then won't trust us, since they are getting paid with devalued dollars.

2) it rips of the American people since prices go up by the exact amount of the liberal money printed

3) it makes the economy less efficient since prices rise erratically as the new money works its way through the economy. Prices then don't reflect real costs, and thus make comparison shopping and economic efficiency impossible

4) Most importantly, there is little obvious pain so there is little incentive to discontinue the irresponsible 3rd world behavior that got us into debt in the first place.

Last edited: