he was blocked 17 times by dems in congress when he tried to get oversight on Fannie Freddy ! hell the CDC even called him a racist !No one has ever shown that repeal of G/S led to anything.Well, the important parts of Glass-Steagall were repealed in 1999, so -15 years.

If it took 85 years, the Dims would still find a way to blame it on Republicans.

Absolutely true, it was a Dubya/EXECUTIVE BRANCH oversight failure as Dubya cheered on the Banksters in ANOTHER GOP raid on the working classes

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

If GOP takes Senate, how long until 2nd Great Depression?

- Thread starter hazlnut

- Start date

ShaklesOfBigGov

Restore the Republic

Here is a transcript of how the Democrats handled oversight of Fannie and Freddie, and their efforts to stonewall any investigation into the two giants. Where WAS the concern over mortgage loans and it's impact on the economy by Democrats? Was their any effort made to conduct an investigation, or would Democrats simply blow it off by saying "there is no financial crisis to be found"?

September 1999With pressure from the Clinton Administration, Fannie Mae eased credit requirements on loans it would purchase from lenders, making it easier for banks to lend to borrowers unqualified for conventional loans. Raines explained that "there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market," reported the New York Times.

With this action, Fannie Mae put itself at substantial risk in the event of an economic downturn. "From the perspective of many people, including me, this is another thrift industry growing up around us," warned Peter Wallison. "If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry." The danger was known.

March 2000

Rep. Richard Baker (R-Louisiana) proposed a bill to reform Fannie and Freddie's oversight in a House Subcommittee on Capital Markets.

Rep. Frank (D-Massachusetts) dismissed the idea, saying concerns about the two were "overblown" and that there was "no federal liability there whatsoever."

June 2000

Rep. Marge Roukema (R-New Jersey): "very few banks or S&Ls could, even in this day and age, even now, meet the stress-testing requirements which Fannie and Freddie are required to meet."

Rep. Carolyn Maloney (D-New York) regarding the Treasury Department line of credit: "It is really symbolic, it is obsolete, it has never been used." "Would you explain why it would be important to repeal something that seems to be of little use?"

Smith: "as long as the pipeline is there, it is like it is very expandable. . . . It is only $2 billion today. It could be $200 billion tomorrow."

Because of Democrat obfuscation, Smith's "tomorrow" arrived in 2008 when Treasury Secretary Henry Paulson put Fannie and Freddie into conservatorship.

February 2003

OFHEO reports that "although investors perceive an implicit Federal guarantee of [GSE] obligations . . . the government has provided no explicit legal backing for them," warning that unexpected problems at a GSE could immediately spread into financial sectors beyond the housing market, according to a White House release.

June 2003

Freddie Mac reported it had understated its profits by $6.9 billion. OFHEO director Armando Falcon Jr. requested that the White House audit Fannie Mae.

July 2003

Sens. Chuck Hagel (R-Nebraska), Elizabeth Dole (R-North Carolina) and John Sununu (R-New Hampshire) introduced legislation to address Regulation of Fannie Mae and Freddie Mac. The bill was blocked by Democrats.

September 2003

In an interview with Ron Insana for CNN Money, Rep. Baker warned, "I have concerns that if appropriate resources aren't allocated for internal risk management, the consequences will be far more severe than just a real estate slowdown. The losses would fall quickly through the capital these companies have and down to shareholders and taxpayers.These companies have some of the lowest capital margins of any financial institution in the nation, yet, at the same time, they are two of the largest. The concern is that if something doesn't work out the way they predict, the American taxpayer could be called on to pay off the debt in some sort of bailout."

Rep. Barney Frank (D-Massachusetts): "These two entities - Fannie Mae and Freddie Mac - are not facing any kind of financial crisis. . . . The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing."

October 2003

Fannie Mae discloses $1.2 billion accounting error.

November 2003

Council of the Economic Advisers Chairman Greg Mankiw warned, "The enormous size of the mortgage-backed securities market means that any problems at the GSEs matter for the financial system as a whole. This risk is a systemic issue also because the debt obligations of the housing GSEs are widely held by other financial institutions. The importance of GSE debt in the portfolios of other financial entities means that even a small mistake in GSE risk management could have ripple effects throughout the financial system," from a White House release.

February 2004

Mankiw cautions Congress to "not take [the financial market's] strength for granted." Again, the call from the Administration was to reduce this risk by "ensuring that the housing GSEs are overseen by an effective regulator," says a White House release.

OFHEO reported that Fannie Mae and CEO Raines had manipulated its accounting to overstate its profits. Congress and the Bush administration sought strong new regulation and authority to put the GSEs under conservatorship if necessary. As the Washington Post reports, Fannie Mae and Freddie Mac responded by orchestrating a major campaign "by traditional allies including real estate agents, home builders and mortgage lenders. Fannie Mae ran radio and television ads ahead of a key Senate committee meeting, depicting a Latino couple who fretted that if the bill passed, mortgage rates would go up."Again, GSE pressure prevailed.

October 2004

In a subcommittee testimony, Democrats vehemently reject regulation of Fannie Mae in the face of dire warning of a Fannie Mae oversight report. A few of them, Black Caucus members in particular, are very angry at the OFHEO Director as they attempt to defend Fannie Mae and protect their CRA extortion racket.

Rep. Maxine Waters (D-California): "Through nearly a dozen hearings where, frankly, we were trying to fix something that wasn't broke."

Rep. Maxine Waters (D-California): "Mr. Chairman, we do not have a crisis at Freddie Mac, and particularly at Fannie Mae, under the outstanding leadership of Mr. Frank Raines."

Rep. Ed Royce (R-California): "In addition to our important oversight role in this committee, I hope that we will move swiftly to create a new regulatory structure for Fannie Mae, for Freddie Mac, and the federal home loan banks."

Rep. Lacy Clay (D-Missouri): "This hearing is about the political lynching of Franklin Raines."

Rep. Ed Royce (R-California): "There is a very simple solution. Congress must create a new regulator with powers at least equal to those of other financial regulators, such as the OCC or Federal Reserve."

Rep. Barney Frank (D-Massachusetts): "Uh, I, this, you, you, you seem to me saying, Well, these are in areas which could raise safety and soundness problems.' I don't see anything in your report that raises safety and soundness problems."

Rep. Maxine Waters (D-California): "Under the outstanding leadership of Mr. Frank Raines, everything in the 1992 Act has worked just fine. In fact, the GSEs have exceeded their housing goals. What we need to do today is to focus on the regulator, and this must be done in a manner so as not to impede their affordable housing mission, a mission that has seen innovation flourish from desktop underwriting to 100% loans."

Rep. Don Manzullo (R-Illinois): "Mr. Raines, 1.1 million bonus and a $526,000 salary. Jamie Gorelick, $779,000 bonus on a salary of 567,000. This is, what you state on page eleven is nothing less than staggering."

Rep. Don Manzullo (R-Illinois): "The 1998 earnings per share number turned out to be $3.23 and 9 mills, a result that Fannie Mae met the EPS maximum payout goal right down to the penny."

Rep. Don Manzullo (R-Illinois): "Fannie Mae understood the rules and simply chose not to follow them that if Fannie Mae had followed the practices, there wouldn't have been a bonus that year."

"The bill prohibited the GSEs from holding portfolios, and gave their regulator prudential authority (such as setting capital requirements) roughly equivalent to a bank regulator. In light of the current financial crisis, this bill was probably the most important piece of financial regulation before Congress in 2005 and 2006," reports the Wall Street Journal.

Greenspan testified that the size of GSE portfolios "poses a risk to the global financial system. It would be difficult, if not impossible, to bail out the lenders [GSEs] . . . should one get into financial trouble." He added, "If we fail to strengthen GSE regulation, we increase the possibility of insolvency and crisis . . . We put at risk our ability to preserve safe and sound financial markets in the United States, a key ingredient of support for homeownership."

Greenspan warned that if the GSEs "continue to grow, continue to have the low capital that they have, continue to engage in the dynamic hedging of their portfolios, which they need to do for interest rate risk aversion, they potentially create ever-growing potential systemic risk down the road . . . We are placing the total financial system of the future at a substantial risk."

Bloomberg writes, "If that bill had become law, then the world today would be different. . . .But the bill didn't become law, for a simple reason: Democrats opposed it on a party-line vote in the committee, signaling that this would be a partisan issue. Republicans, tied in knots by the tight Democratic opposition, couldn't even get the Senate to vote on the matter. That such a reckless political stand could have been taken by the Democrats was obscene even then."

April 2007

In "A Nightmare Grows Darker," the New York Times writes that the "democratization of credit" is "turning the American dream of homeownership into a nightmare for many borrowers." The "newfangled mortgage loans" called "affordability loans" "represent 60 percent of foreclosures."

2007-2008

The housing bubble began to burst, bad mortgages began to default, and finally the Fannie Mae and Freddie Mac portfolios were revealed to be what they were, in collapse. And the testimony is evident as to why. As Wallison noted, "Fannie and Freddie were, I would say, the poster children for corporate welfare."

Archived-Articles: Why the Mortgage Crisis Happened

The Presidents Working Groups March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

A Two reasons, greed and Bush's regulators let them

Bushs documented policies and statements in timeframe leading up to the start of the Bush Mortgage Bubble include (but not limited to)

Wanting 5.5 million more minority homeowners

Tells congress there is nothing wrong with GSEs

Pledging to use federal policy to increase home ownership

Routinely taking credit for the housing market

Forcing GSEs to buy more low income home loans by raising their Housing Goals

Lowering Invesntment banks capital requirements, Net Capital rule

Reversing the Clinton rule that restricted GSEs purchases of subprime loans

Lowering down payment requirements to 0%

Forcing GSEs to spend an additional $440 billion in the secondary markets

Giving away 40,000 free down payments

PREEMPTING ALL STATE LAWS AGAINST PREDATORY LENDING

But the biggest policy was regulators not enforcing lending standards.

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

BARNEY? lol

Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?

Please tell me you have enough basic common sense to know that banks are in the business of supplying loans that are paid back through interest, and not simply throwing it all away on those who have no way or intention of paying them back. That's the reason why individuals carry things like "credit scores" and a "credit history" for banks to research and use to determine the difference between a secure loan and a bad investment.

These really SHOULD already be just very basic knowledge tools for anyone who has ever inquired about a loan before.

You do know (let's say) the difference between a fixed loan and an arm? I really begin to wonder about you when you give a reply like this.

"Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?"

LOL

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

Yes, you have given that propaganda line once before and I answered it already. Are you just slow, or are you only capable of throwing out the same 3 or 4 responses?

As I said earlier and do please try to follow as you are beginning to bore me with our lack of knowledge.

The Community Reinvestment Act (CRA) forces banks to make loans in poor communities, loans that banks may otherwise reject as financially unsound. Under the CRA, banks must convince a set of bureaucracies that they are not engaging in discrimination, a charge that the act encourages any CRA-recognized community group to bring forward. Otherwise, any merger or expansion the banks attempt will likely be denied. But what counts as discrimination?

According to one enforcement agency, "discrimination exists when a lender's underwriting policies contain arbitrary or outdated criteria that effectively disqualify many urban or lower-income minority applicants." Note that these "arbitrary or outdated criteria" include most of the essentials of responsible lending: income level, income verification, credit history and savings history--the very factors lenders are now being criticized for ignoring.

Now let's see if you can follow the discussion and bring out a response with your own words instead of the usual cut and paste of 3 or 4 responses. You are only proving my argument going in circles and you really do bore me. I'd rather engage in a more intellectual discussions that moves the conversation forward. You just want to talk in circles with the same crap over and over and over and over again.

If we should take a giant leap backwards and put the party of greed and excess back in charge cutting social programs while going hog wild on spending on corporate subsidies, tax breaks, defense contracts, and Federal Salaries and benefits -- the income gap will quickly grow to pre-Depression levels and when people have no money to spend in a Consumer Driven Economy -- the country will fall apart pretty fast.

And while the ship is sinking, the scumbags at Fox will blame Obama.

We're already there. You're just blind with your head in the sand. 100 million out of work, record numbers on welfare, staggering debt, fed pumping wall street with 85 billion a month................ Keep your head in the sand. Ignorance is bliss.

Contumacious

Radical Freedom

If we should take a giant leap backwards and put the party of greed and excess back in charge cutting social programs while going hog wild on spending on corporate subsidies, tax breaks, defense contracts, and Federal Salaries and benefits -- the income gap will quickly grow to pre-Depression levels and when people have no money to spend in a Consumer Driven Economy -- the country will fall apart pretty fast.

And while the ship is sinking, the scumbags at Fox will blame Obama.

First Depression/bankruptcy caused by the Progressive wing of the democrats and Republicans;

the Second depression occurred in 2008 during the Bush II administration but he was not a "conservative" as that word meant before 1935 - Bush II was a "compassionate conservative" meaning just another welfare/warfare state politician

.

Dad2three

Gold Member

Testimony from Treasury Secretary John Snow to the REPUBLICAN CONGRESS concerning the 'regulation’ of the GSE’s Septemberr 2003

Mr. Frank: ...Are we in a crisis now with these entities?

Secretary Snow. No, that is a fair characterization, Congressman Frank, of our position. We are not putting this proposal before you because of some concern over some imminent danger to the financial system for housing; far from it.

- THE TREASURY DEPARTMENT'S VIEWS ON THE REGULATION OF GOVERNMENT SPONSORED ENTERPRISES

Yep, he said "far from it" If you read the testimony, you'd see he reiterated that position.

Bush's working group said it "was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007". Now what would 'trigger a dramatic weakening' and prevent Bush's regulators from enforcing them? Why Bush and his policies, that's who.

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

So you want to use a very small snip-it of a speech, which quite possibly be taken out of context from the overall questioning and interrogation concerning Fannie and Freddie, to say Congressman Frank was playing IGNORANT of what was going on with these government agencies? After all, it was only his job to know what was going on with Fannie and Freddie.

It became obvious through the detailed dated transcripts I provided (all public record), as the Congressional inquiry went forward under the Bush administration, that the Democrats were against more government oversight and accountability concerning Fannie and Freddie. They showed no concern for what was going on, and Maxine Waters herself said that these two agencies were in great hands "under the fantastic leadership of Mr Reigns".

No urgency, no real concern for further inquiry and more government oversight from Democrats.

RIGHT,

NOT that the Dems who said that about F/F BEFORE DUBYA HOSED THEM MEANS ANYTHING RIGHT? CONTEXT? All those OUT OF CONTEXT quotes? Were about F/F ACCOUNTING scandals of 2003-2004 dummy, BEFORE Dubya's home ownership society HOSED F/F!!!

After all the GOP LOVE regulations and regulators and the Dems hated it right? lol

Pretty boilerplate conservative, always blubbering excuses about how conservatives aren't responsible for the complete and utter failure of their policies

How George Bush and the Private Mortgage Market Created The Perfect Storm

MBS are packages of mortgages (sort of like mutual funds) that are bought and sold on in the stock market. They are mortgages bought from private companies and bundled into packages by huge trading firms (you know the ones we bailed out) and sold on the stock exchange.

In 1997 the GSEs owned about 12% of the total market share of these securities. In 2001 the GSEs owned about 15% of the total market share of these securities. In 2008 this percentage had grown dramatically to 40%.

In intervening years it was much more. President Bush directed his HUD director to pressure the GSEs into buying massive amounts these MBS on the open market. This created huge market for these securities and encouraged more and more risky private sector mortgages so they could be bought, bundled and sold on the open market largely to Fannie and Freddie.

As the Washington Post article states,

But by 2004, when HUD next revised the goals, Freddie and Fannie’s purchases of subprime-backed securities had risen tenfold. Foreclosure rates also were rising.

That year, President Bush’s HUD ratcheted up the main affordable-housing goal over the next four years, from 50 percent to 56 percent. John C. Weicher, then an assistant HUD secretary, said the institutions lagged behind even the private market and “must do more.”

For Wall Street, high profits could be made from securities backed by subprime loans. Fannie and Freddie targeted the least-risky loans. Still, their purchases provided more cash for a larger subprime market.

“That was a huge, huge mistake,” said Patricia McCoy, who teaches securities law at the University of Connecticut. “That just pumped more capital into a very unregulated market that has turned out to be a disaster.”[xvii]

How did the GSE’s accomplish this? As the article further states:

In 2003, the two bought $81 billion in subprime securities. In 2004, they purchased $175 billion — 44 percent of the market. In 2005, they bought $169 billion, or 33 percent. In 2006, they cut back to $90 billion, or 20 percent. Generally, Freddie purchased more than Fannie and relied more heavily on the securities to meet goals.

“The market knew we needed those loans,” said Sharon McHale, a spokeswoman for Freddie Mac. The higher goals “forced us to go into that market to serve the targeted populations that HUD wanted us to serve,” she said.

But because Fannie and Freddie were buying mortgage-backed securities rather than the actual subprime loans, their involvement came too late to require stiffer standards from lenders.

Fannie and Freddie “made no progress in civilizing the market,” said Sandra Fostek, a senior regulator at HUD.

William C. Apgar Jr., who was an assistant HUD secretary under Clinton, said he regrets allowing the companies to count subprime securities as affordable.

“It was a mistake,” he said. “In hindsight, I would have done it differently.”

Conclusion: Even though Fannie, Freddie and FHA had much less to do with new loans in the Bush administration they bought huge amounts of MBS in those years to meet President Bush’s 56% housing requirement.

Additionally, the President encouraged the GSEs to “focus” their “core housing mission” “with respect to low-income Americans and first-time homebuyers” in the following statement from the White House,

The Administration strongly believes that the housing GSEs should be focused on their core housing mission, particularly with respect to low-income Americans and first-time homebuyers. Instead, provisions of H.R. 1461 that expand mortgage purchasing authority would lessen the housing GSEs’ commitment to low-income homebuyers.[xix]

Conclusion: President Bush had directed HUD to require the GSEs to meet the 56% low income housing requirement. This pressured the GSEs to buy massive MBS. This created a massive market for junk mortgages.

How George Bush and the Private Mortgage Market Created The Perfect Storm Musings

George Bush, proud parent of the mortgage crisis

2004 nomination acceptance speech, Bush said:

Another priority for a new term is to build an ownership society, because ownership brings security and dignity and independence.

Thanks to our policies, home ownership in America is at an all- time high.

Tonight we set a new goal: 7 million more affordable homes in the next 10 years, so more American families will be able to open the door and say, "Welcome to my home."

That wasn't just verbiage, it was policy. Indeed, after the catastrophic job losses of his first term, expanding home ownership was the one bright spot Team Rove could point to in an otherwise dismal picture. Expanding home ownership by any means necessary was Bush administration policy until roughly Spring of 2008.

Dad2three

Gold Member

Testimony from Treasury Secretary John Snow to the REPUBLICAN CONGRESS concerning the 'regulation’ of the GSE’s Septemberr 2003

Mr. Frank: ...Are we in a crisis now with these entities?

Secretary Snow. No, that is a fair characterization, Congressman Frank, of our position. We are not putting this proposal before you because of some concern over some imminent danger to the financial system for housing; far from it.

- THE TREASURY DEPARTMENT'S VIEWS ON THE REGULATION OF GOVERNMENT SPONSORED ENTERPRISES

Yep, he said "far from it" If you read the testimony, you'd see he reiterated that position.

Bush's working group said it "was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007". Now what would 'trigger a dramatic weakening' and prevent Bush's regulators from enforcing them? Why Bush and his policies, that's who.

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

So you want to use a very small snip-it of a speech, which quite possibly be taken out of context from the overall questioning and interrogation concerning Fannie and Freddie, to say Congressman Frank was playing IGNORANT of what was going on with these government agencies? After all, it was only his job to know what was going on with Fannie and Freddie.

It became obvious through the detailed dated transcripts I provided (all public record), as the Congressional inquiry went forward under the Bush administration, that the Democrats were against more government oversight and accountability concerning Fannie and Freddie. They showed no concern for what was going on, and Maxine Waters herself said that these two agencies were in great hands "under the fantastic leadership of Mr Reigns".

No urgency, no real concern for further inquiry and more government oversight from Democrats.

Bush forced Freddie and Fannie to purchase more low income home loans, $440 billion in MBSs and then reversed the Clinton rule that actually reigned in Freddie and Fannie

Strong opposition by the Bush administration forced a top Republican congressman to delay a vote on a bill that would create a new regulator for mortgage giants Fannie Mae and Freddie Mac.

Oxley pulls Fannie, Freddie bill under heat from Bush - MarketWatch

Despite what appeared to be a broad consensus on GSE regulatory reform, efforts quickly stalled. A legislative markup scheduled for October 8, 2003, in the House of Representatives was halted because the Bush administration withdrew its support for the bill,

STATEMENT OF ADMINISTRATION POLICY

The Administration strongly believes that the housing GSEs should be focused on their core housing mission, particularly with respect to low-income Americans and first-time homebuyers. Instead, provisions of H.R. 1461 that expand mortgage purchasing authority would lessen the housing GSEs' commitment to low-income homebuyers.

George W. Bush: Statement of Administration Policy: H.R. 1461 - Federal Housing Finance Reform Act of 2005

Yes, he said he was against it because it "would lessen the housing GSEs' commitment to low-income homebuyers"

The critics have forgotten that the House passed a GSE reform bill in 2005 that could well have prevented the current crisis, says Mr Oxley(R), now vice-chairman of Nasdaq.”

“What did we get from the White House? We got a one-finger salute.”

Dad2three

Gold Member

I would say I hope this is a joke but I know you're this stupid. So when the Dems took over the Senate in 2006 it only took them a year and a half to create "the great recession." Right Lazynutz?If we should take a giant leap backwards and put the party of greed and excess back in charge cutting social programs while going hog wild on spending on corporate subsidies, tax breaks, defense contracts, and Federal Salaries and benefits -- the income gap will quickly grow to pre-Depression levels and when people have no money to spend in a Consumer Driven Economy -- the country will fall apart pretty fast.

And while the ship is sinking, the scumbags at Fox will blame Obama.

You meant 2007? NOW name the bill they passed that changed Dubya/GOP policies? lol

Right-wingers Want To Erase How George Bush's "Homeowner Society" Helped Cause The Economic Collapse

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

Dad2three

Gold Member

he was blocked 17 times by dems in congress when he tried to get oversight on Fannie Freddy ! hell the CDC even called him a racist !No one has ever shown that repeal of G/S led to anything.Well, the important parts of Glass-Steagall were repealed in 1999, so -15 years.

If it took 85 years, the Dims would still find a way to blame it on Republicans.

Absolutely true, it was a Dubya/EXECUTIVE BRANCH oversight failure as Dubya cheered on the Banksters in ANOTHER GOP raid on the working classes

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

Got it, you LIE

Name the 17 times the Demsd blocked him? GOP had the House 2001-2007 ANYTHING could pass the House, AND finally in 2005 A BI PARTISAN BILL, HR 1461 PASSED, GUESS WHAT? DUBYA OPPOSED IT, LOL

NAME the bills the Dems blocked in the GOP controlled Senate please? lol

STATEMENT OF ADMINISTRATION POLICY

The Administration strongly believes that the housing GSEs should be focused on their core housing mission, particularly with respect to low-income Americans and first-time homebuyers. Instead, provisions of H.R. 1461 that expand mortgage purchasing authority would lessen the housing GSEs' commitment to low-income homebuyers.

George W. Bush: Statement of Administration Policy: H.R. 1461 - Federal Housing Finance Reform Act of 2005

Yes, he said he was against it because it "would lessen the housing GSEs' commitment to low-income homebuyers". And here's what the House Republican Mike Oxley, Chairman of the House Financial Services committee said

“Instead, the Ohio Republican who headed the House financial services committee until his retirement after mid-term elections last year, blames the mess on ideologues within the White House as well as Alan Greenspan, former chairman of the Federal Reserve.

The critics have forgotten that the House passed a GSE reform bill in 2005 that could well have prevented the current crisis, says Mr Oxley, now vice-chairman of Nasdaq.”

“What did we get from the White House? We got a one-finger salute.”

Oxley was Chairman of the House Financial Services committee and sponsor of the only reform bill to pass any chamber of the republican controlled congress

WE KNOW HOW THE DEMS HATE REGULATIONS AND REGULATORS, AND THE GOP LOVE THEM RIGHT? lol

Dad2three

Gold Member

Here is a transcript of how the Democrats handled oversight of Fannie and Freddie, and their efforts to stonewall any investigation into the two giants. Where WAS the concern over mortgage loans and it's impact on the economy by Democrats? Was their any effort made to conduct an investigation, or would Democrats simply blow it off by saying "there is no financial crisis to be found"?

September 1999With pressure from the Clinton Administration, Fannie Mae eased credit requirements on loans it would purchase from lenders, making it easier for banks to lend to borrowers unqualified for conventional loans. Raines explained that "there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market," reported the New York Times.

With this action, Fannie Mae put itself at substantial risk in the event of an economic downturn. "From the perspective of many people, including me, this is another thrift industry growing up around us," warned Peter Wallison. "If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry." The danger was known.

March 2000

Rep. Richard Baker (R-Louisiana) proposed a bill to reform Fannie and Freddie's oversight in a House Subcommittee on Capital Markets.

Rep. Frank (D-Massachusetts) dismissed the idea, saying concerns about the two were "overblown" and that there was "no federal liability there whatsoever."

June 2000

Rep. Marge Roukema (R-New Jersey): "very few banks or S&Ls could, even in this day and age, even now, meet the stress-testing requirements which Fannie and Freddie are required to meet."

Rep. Carolyn Maloney (D-New York) regarding the Treasury Department line of credit: "It is really symbolic, it is obsolete, it has never been used." "Would you explain why it would be important to repeal something that seems to be of little use?"

Smith: "as long as the pipeline is there, it is like it is very expandable. . . . It is only $2 billion today. It could be $200 billion tomorrow."

Because of Democrat obfuscation, Smith's "tomorrow" arrived in 2008 when Treasury Secretary Henry Paulson put Fannie and Freddie into conservatorship.

February 2003

OFHEO reports that "although investors perceive an implicit Federal guarantee of [GSE] obligations . . . the government has provided no explicit legal backing for them," warning that unexpected problems at a GSE could immediately spread into financial sectors beyond the housing market, according to a White House release.

June 2003

Freddie Mac reported it had understated its profits by $6.9 billion. OFHEO director Armando Falcon Jr. requested that the White House audit Fannie Mae.

July 2003

Sens. Chuck Hagel (R-Nebraska), Elizabeth Dole (R-North Carolina) and John Sununu (R-New Hampshire) introduced legislation to address Regulation of Fannie Mae and Freddie Mac. The bill was blocked by Democrats.

September 2003

In an interview with Ron Insana for CNN Money, Rep. Baker warned, "I have concerns that if appropriate resources aren't allocated for internal risk management, the consequences will be far more severe than just a real estate slowdown. The losses would fall quickly through the capital these companies have and down to shareholders and taxpayers.These companies have some of the lowest capital margins of any financial institution in the nation, yet, at the same time, they are two of the largest. The concern is that if something doesn't work out the way they predict, the American taxpayer could be called on to pay off the debt in some sort of bailout."

Rep. Barney Frank (D-Massachusetts): "These two entities - Fannie Mae and Freddie Mac - are not facing any kind of financial crisis. . . . The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing."

October 2003

Fannie Mae discloses $1.2 billion accounting error.

November 2003

Council of the Economic Advisers Chairman Greg Mankiw warned, "The enormous size of the mortgage-backed securities market means that any problems at the GSEs matter for the financial system as a whole. This risk is a systemic issue also because the debt obligations of the housing GSEs are widely held by other financial institutions. The importance of GSE debt in the portfolios of other financial entities means that even a small mistake in GSE risk management could have ripple effects throughout the financial system," from a White House release.

February 2004

Mankiw cautions Congress to "not take [the financial market's] strength for granted." Again, the call from the Administration was to reduce this risk by "ensuring that the housing GSEs are overseen by an effective regulator," says a White House release.

OFHEO reported that Fannie Mae and CEO Raines had manipulated its accounting to overstate its profits. Congress and the Bush administration sought strong new regulation and authority to put the GSEs under conservatorship if necessary. As the Washington Post reports, Fannie Mae and Freddie Mac responded by orchestrating a major campaign "by traditional allies including real estate agents, home builders and mortgage lenders. Fannie Mae ran radio and television ads ahead of a key Senate committee meeting, depicting a Latino couple who fretted that if the bill passed, mortgage rates would go up."Again, GSE pressure prevailed.

October 2004

In a subcommittee testimony, Democrats vehemently reject regulation of Fannie Mae in the face of dire warning of a Fannie Mae oversight report. A few of them, Black Caucus members in particular, are very angry at the OFHEO Director as they attempt to defend Fannie Mae and protect their CRA extortion racket.

Rep. Maxine Waters (D-California): "Through nearly a dozen hearings where, frankly, we were trying to fix something that wasn't broke."

Rep. Maxine Waters (D-California): "Mr. Chairman, we do not have a crisis at Freddie Mac, and particularly at Fannie Mae, under the outstanding leadership of Mr. Frank Raines."

Rep. Ed Royce (R-California): "In addition to our important oversight role in this committee, I hope that we will move swiftly to create a new regulatory structure for Fannie Mae, for Freddie Mac, and the federal home loan banks."

Rep. Lacy Clay (D-Missouri): "This hearing is about the political lynching of Franklin Raines."

Rep. Ed Royce (R-California): "There is a very simple solution. Congress must create a new regulator with powers at least equal to those of other financial regulators, such as the OCC or Federal Reserve."

Rep. Barney Frank (D-Massachusetts): "Uh, I, this, you, you, you seem to me saying, Well, these are in areas which could raise safety and soundness problems.' I don't see anything in your report that raises safety and soundness problems."

Rep. Maxine Waters (D-California): "Under the outstanding leadership of Mr. Frank Raines, everything in the 1992 Act has worked just fine. In fact, the GSEs have exceeded their housing goals. What we need to do today is to focus on the regulator, and this must be done in a manner so as not to impede their affordable housing mission, a mission that has seen innovation flourish from desktop underwriting to 100% loans."

Rep. Don Manzullo (R-Illinois): "Mr. Raines, 1.1 million bonus and a $526,000 salary. Jamie Gorelick, $779,000 bonus on a salary of 567,000. This is, what you state on page eleven is nothing less than staggering."

Rep. Don Manzullo (R-Illinois): "The 1998 earnings per share number turned out to be $3.23 and 9 mills, a result that Fannie Mae met the EPS maximum payout goal right down to the penny."

Rep. Don Manzullo (R-Illinois): "Fannie Mae understood the rules and simply chose not to follow them that if Fannie Mae had followed the practices, there wouldn't have been a bonus that year."

"The bill prohibited the GSEs from holding portfolios, and gave their regulator prudential authority (such as setting capital requirements) roughly equivalent to a bank regulator. In light of the current financial crisis, this bill was probably the most important piece of financial regulation before Congress in 2005 and 2006," reports the Wall Street Journal.

Greenspan testified that the size of GSE portfolios "poses a risk to the global financial system. It would be difficult, if not impossible, to bail out the lenders [GSEs] . . . should one get into financial trouble." He added, "If we fail to strengthen GSE regulation, we increase the possibility of insolvency and crisis . . . We put at risk our ability to preserve safe and sound financial markets in the United States, a key ingredient of support for homeownership."

Greenspan warned that if the GSEs "continue to grow, continue to have the low capital that they have, continue to engage in the dynamic hedging of their portfolios, which they need to do for interest rate risk aversion, they potentially create ever-growing potential systemic risk down the road . . . We are placing the total financial system of the future at a substantial risk."

Bloomberg writes, "If that bill had become law, then the world today would be different. . . .But the bill didn't become law, for a simple reason: Democrats opposed it on a party-line vote in the committee, signaling that this would be a partisan issue. Republicans, tied in knots by the tight Democratic opposition, couldn't even get the Senate to vote on the matter. That such a reckless political stand could have been taken by the Democrats was obscene even then."

April 2007

In "A Nightmare Grows Darker," the New York Times writes that the "democratization of credit" is "turning the American dream of homeownership into a nightmare for many borrowers." The "newfangled mortgage loans" called "affordability loans" "represent 60 percent of foreclosures."

2007-2008

The housing bubble began to burst, bad mortgages began to default, and finally the Fannie Mae and Freddie Mac portfolios were revealed to be what they were, in collapse. And the testimony is evident as to why. As Wallison noted, "Fannie and Freddie were, I would say, the poster children for corporate welfare."

Archived-Articles: Why the Mortgage Crisis Happened

The Presidents Working Groups March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

A Two reasons, greed and Bush's regulators let them

Bushs documented policies and statements in timeframe leading up to the start of the Bush Mortgage Bubble include (but not limited to)

Wanting 5.5 million more minority homeowners

Tells congress there is nothing wrong with GSEs

Pledging to use federal policy to increase home ownership

Routinely taking credit for the housing market

Forcing GSEs to buy more low income home loans by raising their Housing Goals

Lowering Invesntment banks capital requirements, Net Capital rule

Reversing the Clinton rule that restricted GSEs purchases of subprime loans

Lowering down payment requirements to 0%

Forcing GSEs to spend an additional $440 billion in the secondary markets

Giving away 40,000 free down payments

PREEMPTING ALL STATE LAWS AGAINST PREDATORY LENDING

But the biggest policy was regulators not enforcing lending standards.

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

BARNEY? lol

Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?

Please tell me you have enough basic common sense to know that banks are in the business of supplying loans that are paid back through interest, and not simply throwing it all away on those who have no way or intention of paying them back. That's the reason why individuals carry things like "credit scores" and a "credit history" for banks to research and use to determine the difference between a secure loan and a bad investment.

These really SHOULD already be just very basic knowledge tools for anyone who has ever inquired about a loan before.

You do know (let's say) the difference between a fixed loan and an arm? I really begin to wonder about you when you give a reply like this.

"Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?"

LOL

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

Yes, you have given that propaganda line once before and I answered it already. Are you just slow, or are you only capable of throwing out the same 3 or 4 responses?

As I said earlier and do please try to follow as you are beginning to bore me with our lack of knowledge.

The Community Reinvestment Act (CRA) forces banks to make loans in poor communities, loans that banks may otherwise reject as financially unsound. Under the CRA, banks must convince a set of bureaucracies that they are not engaging in discrimination, a charge that the act encourages any CRA-recognized community group to bring forward. Otherwise, any merger or expansion the banks attempt will likely be denied. But what counts as discrimination?

According to one enforcement agency, "discrimination exists when a lender's underwriting policies contain arbitrary or outdated criteria that effectively disqualify many urban or lower-income minority applicants." Note that these "arbitrary or outdated criteria" include most of the essentials of responsible lending: income level, income verification, credit history and savings history--the very factors lenders are now being criticized for ignoring.

Now let's see if you can follow the discussion and bring out a response with your own words instead of the usual cut and paste of 3 or 4 responses. You are only proving my argument going in circles and you really do bore me. I'd rather engage in a more intellectual discussions that moves the conversation forward. You just want to talk in circles with the same crap over and over and over and over again.

I'LL MAKE IT EASY EVEN FOR A DOPE LIKE YOU BUBBA

THE BANKSTERS CREATED A WORLD WIDE CREDIT BUBBLE AND BUST. That's why they lobbied for 30+ years to deregulate.

The historical "originate and hold" mortgage model was replaced with the "originate and distribute" model. Incentives were such that you could get paid just to originate and sell the mortgages down the pipeline, passing the risk along. The big investment banks simply connected the investors to the originators, helped by the AAA ratings.

NO THINKING PERSON THINKS FANNIE/FREDDIE AROUND FOR 70 YEARS OR THE CRA AROUND FOR 30+ YEARS CAUSED THE MORTGAGE CRISIS, BUT IT WAS DUBYA/GOP WHO LOOKED THE OTHER WAY AS THEY CHEERED ON THE BANKSTERS

It is clear to anyone who has studied the financial crisis of 2008 that the private sector’s drive for short-term profit was behind it.

More than 84 percent of the sub-prime mortgages in 2006 were issued by private lending. These private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year. Out of the top 25 subprime lenders in 2006, only one was subject to the usual mortgage laws and regulations.

The nonbank underwriters made more than 12 million subprime mortgages with a value of nearly $2 trillion. The lenders who made these were exempt from federal regulations.

Lest We Forget Why We Had A Financial Crisis - Forbes

Dad2three

Gold Member

Here is a transcript of how the Democrats handled oversight of Fannie and Freddie, and their efforts to stonewall any investigation into the two giants. Where WAS the concern over mortgage loans and it's impact on the economy by Democrats? Was their any effort made to conduct an investigation, or would Democrats simply blow it off by saying "there is no financial crisis to be found"?

September 1999With pressure from the Clinton Administration, Fannie Mae eased credit requirements on loans it would purchase from lenders, making it easier for banks to lend to borrowers unqualified for conventional loans. Raines explained that "there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market," reported the New York Times.

With this action, Fannie Mae put itself at substantial risk in the event of an economic downturn. "From the perspective of many people, including me, this is another thrift industry growing up around us," warned Peter Wallison. "If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry." The danger was known.

March 2000

Rep. Richard Baker (R-Louisiana) proposed a bill to reform Fannie and Freddie's oversight in a House Subcommittee on Capital Markets.

Rep. Frank (D-Massachusetts) dismissed the idea, saying concerns about the two were "overblown" and that there was "no federal liability there whatsoever."

June 2000

Rep. Marge Roukema (R-New Jersey): "very few banks or S&Ls could, even in this day and age, even now, meet the stress-testing requirements which Fannie and Freddie are required to meet."

Rep. Carolyn Maloney (D-New York) regarding the Treasury Department line of credit: "It is really symbolic, it is obsolete, it has never been used." "Would you explain why it would be important to repeal something that seems to be of little use?"

Smith: "as long as the pipeline is there, it is like it is very expandable. . . . It is only $2 billion today. It could be $200 billion tomorrow."

Because of Democrat obfuscation, Smith's "tomorrow" arrived in 2008 when Treasury Secretary Henry Paulson put Fannie and Freddie into conservatorship.

February 2003

OFHEO reports that "although investors perceive an implicit Federal guarantee of [GSE] obligations . . . the government has provided no explicit legal backing for them," warning that unexpected problems at a GSE could immediately spread into financial sectors beyond the housing market, according to a White House release.

June 2003

Freddie Mac reported it had understated its profits by $6.9 billion. OFHEO director Armando Falcon Jr. requested that the White House audit Fannie Mae.

July 2003

Sens. Chuck Hagel (R-Nebraska), Elizabeth Dole (R-North Carolina) and John Sununu (R-New Hampshire) introduced legislation to address Regulation of Fannie Mae and Freddie Mac. The bill was blocked by Democrats.

September 2003

In an interview with Ron Insana for CNN Money, Rep. Baker warned, "I have concerns that if appropriate resources aren't allocated for internal risk management, the consequences will be far more severe than just a real estate slowdown. The losses would fall quickly through the capital these companies have and down to shareholders and taxpayers.These companies have some of the lowest capital margins of any financial institution in the nation, yet, at the same time, they are two of the largest. The concern is that if something doesn't work out the way they predict, the American taxpayer could be called on to pay off the debt in some sort of bailout."

Rep. Barney Frank (D-Massachusetts): "These two entities - Fannie Mae and Freddie Mac - are not facing any kind of financial crisis. . . . The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing."

October 2003

Fannie Mae discloses $1.2 billion accounting error.

November 2003

Council of the Economic Advisers Chairman Greg Mankiw warned, "The enormous size of the mortgage-backed securities market means that any problems at the GSEs matter for the financial system as a whole. This risk is a systemic issue also because the debt obligations of the housing GSEs are widely held by other financial institutions. The importance of GSE debt in the portfolios of other financial entities means that even a small mistake in GSE risk management could have ripple effects throughout the financial system," from a White House release.

February 2004

Mankiw cautions Congress to "not take [the financial market's] strength for granted." Again, the call from the Administration was to reduce this risk by "ensuring that the housing GSEs are overseen by an effective regulator," says a White House release.

OFHEO reported that Fannie Mae and CEO Raines had manipulated its accounting to overstate its profits. Congress and the Bush administration sought strong new regulation and authority to put the GSEs under conservatorship if necessary. As the Washington Post reports, Fannie Mae and Freddie Mac responded by orchestrating a major campaign "by traditional allies including real estate agents, home builders and mortgage lenders. Fannie Mae ran radio and television ads ahead of a key Senate committee meeting, depicting a Latino couple who fretted that if the bill passed, mortgage rates would go up."Again, GSE pressure prevailed.

October 2004

In a subcommittee testimony, Democrats vehemently reject regulation of Fannie Mae in the face of dire warning of a Fannie Mae oversight report. A few of them, Black Caucus members in particular, are very angry at the OFHEO Director as they attempt to defend Fannie Mae and protect their CRA extortion racket.

Rep. Maxine Waters (D-California): "Through nearly a dozen hearings where, frankly, we were trying to fix something that wasn't broke."

Rep. Maxine Waters (D-California): "Mr. Chairman, we do not have a crisis at Freddie Mac, and particularly at Fannie Mae, under the outstanding leadership of Mr. Frank Raines."

Rep. Ed Royce (R-California): "In addition to our important oversight role in this committee, I hope that we will move swiftly to create a new regulatory structure for Fannie Mae, for Freddie Mac, and the federal home loan banks."

Rep. Lacy Clay (D-Missouri): "This hearing is about the political lynching of Franklin Raines."

Rep. Ed Royce (R-California): "There is a very simple solution. Congress must create a new regulator with powers at least equal to those of other financial regulators, such as the OCC or Federal Reserve."

Rep. Barney Frank (D-Massachusetts): "Uh, I, this, you, you, you seem to me saying, Well, these are in areas which could raise safety and soundness problems.' I don't see anything in your report that raises safety and soundness problems."

Rep. Maxine Waters (D-California): "Under the outstanding leadership of Mr. Frank Raines, everything in the 1992 Act has worked just fine. In fact, the GSEs have exceeded their housing goals. What we need to do today is to focus on the regulator, and this must be done in a manner so as not to impede their affordable housing mission, a mission that has seen innovation flourish from desktop underwriting to 100% loans."

Rep. Don Manzullo (R-Illinois): "Mr. Raines, 1.1 million bonus and a $526,000 salary. Jamie Gorelick, $779,000 bonus on a salary of 567,000. This is, what you state on page eleven is nothing less than staggering."

Rep. Don Manzullo (R-Illinois): "The 1998 earnings per share number turned out to be $3.23 and 9 mills, a result that Fannie Mae met the EPS maximum payout goal right down to the penny."

Rep. Don Manzullo (R-Illinois): "Fannie Mae understood the rules and simply chose not to follow them that if Fannie Mae had followed the practices, there wouldn't have been a bonus that year."

"The bill prohibited the GSEs from holding portfolios, and gave their regulator prudential authority (such as setting capital requirements) roughly equivalent to a bank regulator. In light of the current financial crisis, this bill was probably the most important piece of financial regulation before Congress in 2005 and 2006," reports the Wall Street Journal.

Greenspan testified that the size of GSE portfolios "poses a risk to the global financial system. It would be difficult, if not impossible, to bail out the lenders [GSEs] . . . should one get into financial trouble." He added, "If we fail to strengthen GSE regulation, we increase the possibility of insolvency and crisis . . . We put at risk our ability to preserve safe and sound financial markets in the United States, a key ingredient of support for homeownership."

Greenspan warned that if the GSEs "continue to grow, continue to have the low capital that they have, continue to engage in the dynamic hedging of their portfolios, which they need to do for interest rate risk aversion, they potentially create ever-growing potential systemic risk down the road . . . We are placing the total financial system of the future at a substantial risk."

Bloomberg writes, "If that bill had become law, then the world today would be different. . . .But the bill didn't become law, for a simple reason: Democrats opposed it on a party-line vote in the committee, signaling that this would be a partisan issue. Republicans, tied in knots by the tight Democratic opposition, couldn't even get the Senate to vote on the matter. That such a reckless political stand could have been taken by the Democrats was obscene even then."

April 2007

In "A Nightmare Grows Darker," the New York Times writes that the "democratization of credit" is "turning the American dream of homeownership into a nightmare for many borrowers." The "newfangled mortgage loans" called "affordability loans" "represent 60 percent of foreclosures."

2007-2008

The housing bubble began to burst, bad mortgages began to default, and finally the Fannie Mae and Freddie Mac portfolios were revealed to be what they were, in collapse. And the testimony is evident as to why. As Wallison noted, "Fannie and Freddie were, I would say, the poster children for corporate welfare."

Archived-Articles: Why the Mortgage Crisis Happened

The Presidents Working Groups March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

A Two reasons, greed and Bush's regulators let them

Bushs documented policies and statements in timeframe leading up to the start of the Bush Mortgage Bubble include (but not limited to)

Wanting 5.5 million more minority homeowners

Tells congress there is nothing wrong with GSEs

Pledging to use federal policy to increase home ownership

Routinely taking credit for the housing market

Forcing GSEs to buy more low income home loans by raising their Housing Goals

Lowering Invesntment banks capital requirements, Net Capital rule

Reversing the Clinton rule that restricted GSEs purchases of subprime loans

Lowering down payment requirements to 0%

Forcing GSEs to spend an additional $440 billion in the secondary markets

Giving away 40,000 free down payments

PREEMPTING ALL STATE LAWS AGAINST PREDATORY LENDING

But the biggest policy was regulators not enforcing lending standards.

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

BARNEY? lol

Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?

Please tell me you have enough basic common sense to know that banks are in the business of supplying loans that are paid back through interest, and not simply throwing it all away on those who have no way or intention of paying them back. That's the reason why individuals carry things like "credit scores" and a "credit history" for banks to research and use to determine the difference between a secure loan and a bad investment.

These really SHOULD already be just very basic knowledge tools for anyone who has ever inquired about a loan before.

You do know (let's say) the difference between a fixed loan and an arm? I really begin to wonder about you when you give a reply like this.

"Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?"

LOL

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

Yes, you have given that propaganda line once before and I answered it already. Are you just slow, or are you only capable of throwing out the same 3 or 4 responses?

As I said earlier and do please try to follow as you are beginning to bore me with our lack of knowledge.

The Community Reinvestment Act (CRA) forces banks to make loans in poor communities, loans that banks may otherwise reject as financially unsound. Under the CRA, banks must convince a set of bureaucracies that they are not engaging in discrimination, a charge that the act encourages any CRA-recognized community group to bring forward. Otherwise, any merger or expansion the banks attempt will likely be denied. But what counts as discrimination?

According to one enforcement agency, "discrimination exists when a lender's underwriting policies contain arbitrary or outdated criteria that effectively disqualify many urban or lower-income minority applicants." Note that these "arbitrary or outdated criteria" include most of the essentials of responsible lending: income level, income verification, credit history and savings history--the very factors lenders are now being criticized for ignoring.

Now let's see if you can follow the discussion and bring out a response with your own words instead of the usual cut and paste of 3 or 4 responses. You are only proving my argument going in circles and you really do bore me. I'd rather engage in a more intellectual discussions that moves the conversation forward. You just want to talk in circles with the same crap over and over and over and over again.

Q When did the Bush Mortgage Bubble start?

A The general timeframe is it started late 2004.

From Bushs Presidents Working Group on Financial Markets October 2008

The Presidents Working Groups March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.

Q Did the Community Reinvestment Act under Carter/Clinton caused it?

A "Since 1995 there has been essentially no change in the basic CRA rules or enforcement process that can be reasonably linked to the subprime lending activity. This fact weakens the link between the CRA and the current crisis since the crisis is rooted in poor performance of mortgage loans made between 2004 and 2007. "

http://www.federalreserve.gov/newsevents/speech/20081203_analysis.pdf

Q Why is it commonly called the subprime bubble ?

A Because the Bush Mortgage Bubble coincided with the explosive growth of Subprime mortgage and politics. Also the subprime MBS market was the first to collapse in late 2006. In 2003, 10 % of all mortgages were subprime. In 2006, 40 % were subprime. This is a 300 % increase in subprime lending. (and notice it coincides with the dates of the Bush Mortgage bubble that Bush and the Fed said)

Some 80 percent of outstanding U.S. mortgages are prime, while 14 percent are subprime and 6 percent fall into the near-prime category. These numbers, however, mask the explosive growth of nonprime mortgages. Subprime and near-prime loans shot up from 9 percent of newly originated securitized mortgages in 2001 to 40 percent in 2006

https://www.dallasfed.org/assets/documents/research/eclett/2007/el0711.pdf

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

Examining the big lie: How the facts of the economic crisis stack up

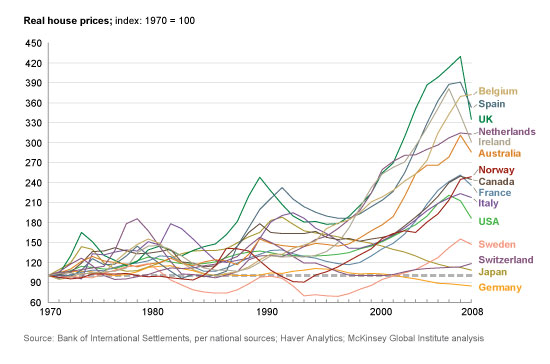

The boom and bust was global. Proponents of the Big Lie ignore the worldwide nature of the housing boom and bust.

A McKinsey Global Institute report noted “from 2000 through 2007, a remarkable run-up in global home prices occurred.” It is highly unlikely that a simultaneous boom and bust everywhere else in the world was caused by one set of factors (ultra-low rates, securitized AAA-rated subprime, derivatives) but had a different set of causes in the United States. Indeed, this might be the biggest obstacle to pushing the false narrative.

•Nonbank mortgage underwriting exploded from 2001 to 2007, along with the private label securitization market, which eclipsed Fannie and Freddie during the boom.

•Private lenders not subject to congressional regulations collapsed lending standards.

Examining the big lie How the facts of the economic crisis stack up The Big Picture

Contumacious

Radical Freedom

Here is a transcript of how the Democrats handled oversight of Fannie and Freddie, and their efforts to stonewall any investigation into the two giants. Where WAS the concern over mortgage loans and it's impact on the economy by Democrats? Was their any effort made to conduct an investigation, or would Democrats simply blow it off by saying "there is no financial crisis to be found"?

The Presidents Working Groups March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

A Two reasons, greed and Bush's regulators let them

Bushs documented policies and statements in timeframe leading up to the start of the Bush Mortgage Bubble include (but not limited to)

Wanting 5.5 million more minority homeowners

Tells congress there is nothing wrong with GSEs

Pledging to use federal policy to increase home ownership

Routinely taking credit for the housing market

Forcing GSEs to buy more low income home loans by raising their Housing Goals

Lowering Invesntment banks capital requirements, Net Capital rule

Reversing the Clinton rule that restricted GSEs purchases of subprime loans

Lowering down payment requirements to 0%

Forcing GSEs to spend an additional $440 billion in the secondary markets

Giving away 40,000 free down payments

PREEMPTING ALL STATE LAWS AGAINST PREDATORY LENDING

But the biggest policy was regulators not enforcing lending standards.

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

BARNEY? lol

Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?

Please tell me you have enough basic common sense to know that banks are in the business of supplying loans that are paid back through interest, and not simply throwing it all away on those who have no way or intention of paying them back. That's the reason why individuals carry things like "credit scores" and a "credit history" for banks to research and use to determine the difference between a secure loan and a bad investment.

These really SHOULD already be just very basic knowledge tools for anyone who has ever inquired about a loan before.

You do know (let's say) the difference between a fixed loan and an arm? I really begin to wonder about you when you give a reply like this.

"Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?"

LOL

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

Yes, you have given that propaganda line once before and I answered it already. Are you just slow, or are you only capable of throwing out the same 3 or 4 responses?

As I said earlier and do please try to follow as you are beginning to bore me with our lack of knowledge.

The Community Reinvestment Act (CRA) forces banks to make loans in poor communities, loans that banks may otherwise reject as financially unsound. Under the CRA, banks must convince a set of bureaucracies that they are not engaging in discrimination, a charge that the act encourages any CRA-recognized community group to bring forward. Otherwise, any merger or expansion the banks attempt will likely be denied. But what counts as discrimination?

According to one enforcement agency, "discrimination exists when a lender's underwriting policies contain arbitrary or outdated criteria that effectively disqualify many urban or lower-income minority applicants." Note that these "arbitrary or outdated criteria" include most of the essentials of responsible lending: income level, income verification, credit history and savings history--the very factors lenders are now being criticized for ignoring.

Now let's see if you can follow the discussion and bring out a response with your own words instead of the usual cut and paste of 3 or 4 responses. You are only proving my argument going in circles and you really do bore me. I'd rather engage in a more intellectual discussions that moves the conversation forward. You just want to talk in circles with the same crap over and over and over and over again.

I'LL MAKE IT EASY EVEN FOR A DOPE LIKE YOU BUBBA

THE BANKSTERS CREATED A WORLD WIDE CREDIT BUBBLE AND BUST. That's why they lobbied for 30+ years to deregulate.

The historical "originate and hold" mortgage model was replaced with the "originate and distribute" model. Incentives were such that you could get paid just to originate and sell the mortgages down the pipeline, passing the risk along. The big investment banks simply connected the investors to the originators, helped by the AAA ratings.

NO THINKING PERSON THINKS FANNIE/FREDDIE AROUND FOR 70 YEARS OR THE CRA AROUND FOR 30+ YEARS CAUSED THE MORTGAGE CRISIS, BUT IT WAS DUBYA/GOP WHO LOOKED THE OTHER WAY AS THEY CHEERED ON THE BANKSTERS

It is clear to anyone who has studied the financial crisis of 2008 that the private sector’s drive for short-term profit was behind it.

More than 84 percent of the sub-prime mortgages in 2006 were issued by private lending. These private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year. Out of the top 25 subprime lenders in 2006, only one was subject to the usual mortgage laws and regulations.

The nonbank underwriters made more than 12 million subprime mortgages with a value of nearly $2 trillion. The lenders who made these were exempt from federal regulations.

Lest We Forget Why We Had A Financial Crisis - Forbes

Either you are massively retarded or simply toeing the socialist party line.Here is a transcript of how the Democrats handled oversight of Fannie and Freddie, and their efforts to stonewall any investigation into the two giants. Where WAS the concern over mortgage loans and it's impact on the economy by Democrats? Was their any effort made to conduct an investigation, or would Democrats simply blow it off by saying "there is no financial crisis to be found"?

The Presidents Working Groups March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

A Two reasons, greed and Bush's regulators let them

Bushs documented policies and statements in timeframe leading up to the start of the Bush Mortgage Bubble include (but not limited to)

Wanting 5.5 million more minority homeowners

Tells congress there is nothing wrong with GSEs

Pledging to use federal policy to increase home ownership

Routinely taking credit for the housing market

Forcing GSEs to buy more low income home loans by raising their Housing Goals

Lowering Invesntment banks capital requirements, Net Capital rule

Reversing the Clinton rule that restricted GSEs purchases of subprime loans

Lowering down payment requirements to 0%

Forcing GSEs to spend an additional $440 billion in the secondary markets

Giving away 40,000 free down payments

PREEMPTING ALL STATE LAWS AGAINST PREDATORY LENDING

But the biggest policy was regulators not enforcing lending standards.

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

BARNEY? lol

Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?

Please tell me you have enough basic common sense to know that banks are in the business of supplying loans that are paid back through interest, and not simply throwing it all away on those who have no way or intention of paying them back. That's the reason why individuals carry things like "credit scores" and a "credit history" for banks to research and use to determine the difference between a secure loan and a bad investment.

These really SHOULD already be just very basic knowledge tools for anyone who has ever inquired about a loan before.

You do know (let's say) the difference between a fixed loan and an arm? I really begin to wonder about you when you give a reply like this.

"Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?"

LOL