New Agency Proposed to Oversee Freddie Mac and Fannie Mae - New York Timeshe was blocked 17 times by dems in congress when he tried to get oversight on Fannie Freddy ! hell the CDC even called him a racist !No one has ever shown that repeal of G/S led to anything.Well, the important parts of Glass-Steagall were repealed in 1999, so -15 years.

If it took 85 years, the Dims would still find a way to blame it on Republicans.

Absolutely true, it was a Dubya/EXECUTIVE BRANCH oversight failure as Dubya cheered on the Banksters in ANOTHER GOP raid on the working classes

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

Got it, you LIE

Name the 17 times the Demsd blocked him? GOP had the House 2001-2007 ANYTHING could pass the House, AND finally in 2005 A BI PARTISAN BILL, HR 1461 PASSED, GUESS WHAT? DUBYA OPPOSED IT, LOL

NAME the bills the Dems blocked in the GOP controlled Senate please? lol

STATEMENT OF ADMINISTRATION POLICY

The Administration strongly believes that the housing GSEs should be focused on their core housing mission, particularly with respect to low-income Americans and first-time homebuyers. Instead, provisions of H.R. 1461 that expand mortgage purchasing authority would lessen the housing GSEs' commitment to low-income homebuyers.

George W. Bush: Statement of Administration Policy: H.R. 1461 - Federal Housing Finance Reform Act of 2005

Yes, he said he was against it because it "would lessen the housing GSEs' commitment to low-income homebuyers". And here's what the House Republican Mike Oxley, Chairman of the House Financial Services committee said

“Instead, the Ohio Republican who headed the House financial services committee until his retirement after mid-term elections last year, blames the mess on ideologues within the White House as well as Alan Greenspan, former chairman of the Federal Reserve.

The critics have forgotten that the House passed a GSE reform bill in 2005 that could well have prevented the current crisis, says Mr Oxley, now vice-chairman of Nasdaq.”

“What did we get from the White House? We got a one-finger salute.”

Oxley was Chairman of the House Financial Services committee and sponsor of the only reform bill to pass any chamber of the republican controlled congress

WE KNOW HOW THE DEMS HATE REGULATIONS AND REGULATORS, AND THE GOP LOVE THEM RIGHT? lol

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

If GOP takes Senate, how long until 2nd Great Depression?

- Thread starter hazlnut

- Start date

- Nov 26, 2011

- 123,648

- 56,428

- 2,290

I will just quote the parts you chose to NOT highlight:

See those key words? "High profits could be made". That's what this was about. This was a battle for market share in a world of newly developed financial derivatives.

This confirms my earlier point I made that the GSEs were a smaller and smaller part of the secondary market as the bubble grew. Wall Street was a much, much, much bigger part of that market. Getting a larger share with every passing year. Record share.

You conclusion is completely erroneous. The GSEs could not even keep up with Wall Street in the issuance of toxic mortgages. Even though their numbers went up tenfold, they still fell farther and farther behind, dipshit!

Wall Street was leading the charge, not the government.

Quite a few leading figures in our government worked for, or made money from, the GSEs at one time or another. Both Republicans and Democrats. Newt Gingrich made millions. He hoped no one would notice when he later attacked the very GSEs he was drawing a paycheck from! Hypocrisy in the extreme.

As the derivatives bubble grew, those investors in the GSEs wanted to make the same big profits that Wall Street was making off the bubble. That is why there was pressure on the GSEs to increase their portfolios.

But Wall Street wanted as much market share of the secondary market as it could get. As your own link states, there were "high profits" to be made off the derivative profits which they believed were eliminating risk.

It was in Wall Street's interest to see the GSEs forced to shrink their portfolios, thus leaving more of the secondary market for them to take over. I believe this is why the Bush Administation began to try to get the GSEs to shrink their portfolios in 2005. Barney Frank and Chris Dodd put the kibosh on that plan.

But all sides were chasing the big profits.

Is it really surprising that politicians were hiding this chase for profits behind a patina of "gettin more folks inta houses, ya'll!"? That's what politicians do. They hide their true motives behind a "public good" bullshit photo op.

Wall Street was not subject to the CRA or government orders to give loans to negroes. And don't think any of you tards are fooling anybody that this isn't about trying to pin the blame on negroes.

Wall Street's business was exploding at a rate far higher than the GSEs. So this ridiculous idea that banks were being "forced" to make these toxic loans is utter bullshit.

This was a worldwide phenomena. It was all about the fees one gets for connecting an investor to a derivative package. And those derivatives would not exist without a lot of fuel which could only come from getting as many people to borrow as possible, and to borrow as much as possible.

For Wall Street, high profits could be made from securities backed by subprime loans. Fannie and Freddie targeted the least-risky loans. Still, their purchases provided more cash for a larger subprime market.

See those key words? "High profits could be made". That's what this was about. This was a battle for market share in a world of newly developed financial derivatives.

In 2003, the two bought $81 billion in subprime securities. In 2004, they purchased $175 billion — 44 percent of the market. In 2005, they bought $169 billion, or 33 percent. In 2006, they cut back to $90 billion, or 20 percent. Generally, Freddie purchased more than Fannie and relied more heavily on the securities to meet goals.

This confirms my earlier point I made that the GSEs were a smaller and smaller part of the secondary market as the bubble grew. Wall Street was a much, much, much bigger part of that market. Getting a larger share with every passing year. Record share.

Conclusion: President Bush had directed HUD to require the GSEs to meet the 56% low income housing requirement. This pressured the GSEs to buy massive MBS. This created a massive market for junk mortgages.

You conclusion is completely erroneous. The GSEs could not even keep up with Wall Street in the issuance of toxic mortgages. Even though their numbers went up tenfold, they still fell farther and farther behind, dipshit!

Wall Street was leading the charge, not the government.

Quite a few leading figures in our government worked for, or made money from, the GSEs at one time or another. Both Republicans and Democrats. Newt Gingrich made millions. He hoped no one would notice when he later attacked the very GSEs he was drawing a paycheck from! Hypocrisy in the extreme.

As the derivatives bubble grew, those investors in the GSEs wanted to make the same big profits that Wall Street was making off the bubble. That is why there was pressure on the GSEs to increase their portfolios.

But Wall Street wanted as much market share of the secondary market as it could get. As your own link states, there were "high profits" to be made off the derivative profits which they believed were eliminating risk.

It was in Wall Street's interest to see the GSEs forced to shrink their portfolios, thus leaving more of the secondary market for them to take over. I believe this is why the Bush Administation began to try to get the GSEs to shrink their portfolios in 2005. Barney Frank and Chris Dodd put the kibosh on that plan.

But all sides were chasing the big profits.

Is it really surprising that politicians were hiding this chase for profits behind a patina of "gettin more folks inta houses, ya'll!"? That's what politicians do. They hide their true motives behind a "public good" bullshit photo op.

Wall Street was not subject to the CRA or government orders to give loans to negroes. And don't think any of you tards are fooling anybody that this isn't about trying to pin the blame on negroes.

Wall Street's business was exploding at a rate far higher than the GSEs. So this ridiculous idea that banks were being "forced" to make these toxic loans is utter bullshit.

This was a worldwide phenomena. It was all about the fees one gets for connecting an investor to a derivative package. And those derivatives would not exist without a lot of fuel which could only come from getting as many people to borrow as possible, and to borrow as much as possible.

Last edited:

- Nov 26, 2011

- 123,648

- 56,428

- 2,290

$70 trillion.

There are not enough prime borrowers on five planet Earths to safely lend $70 trillion to.

If you can't lend someone money, you can't sell the paper to an investor for a fee. Therefore, you must find a way to lend all that money after you have run out of prime borrowers if you are greedy for more fees.

So at some point you throw the underwriting laws of the Universe which have been painstakingly written over centuries out the window. You ignore all the hard lessons learned over the past several centuries and chase after those fees so you can get your own private jet and all the hookers and blow you can handle.

You start loaning to anyone with a pulse. It takes lots and lots and lots and lots and lots and lots and lots of people to borrow money to whittle that $70 trillion down.

Corporate bond issues. Auto loans. Credit cards. Student loans. Mortgages. HELOCs.

You say this guy has always been a safe risk when he borrows money for a $200,000 house? Fuck that! Let's get this guy to buy a $450,000 house this time!

And that is how even a prime borrower is turned into a sub-prime borrower.

It wasn't the negroes. It was Biff, your white middle class neighbor, biting off more than he could chew. A middle class borrower can make a bigger dent in that $70 trillion dollars than some lower income black person can. Duh!

But even after you drag all the white people you can find into $450,000 houses, you still have a lot of that $70 trillion left to shell out. Now let's get them to take out HELOCs on all that instant equity. Buy an SUV with that cash! Buy a boat! Go to Disneyland!

You idiots going to tell me you didn't see all your white middle class neighbors doing this shit? If you didn't notice, then you are about as blind as bats.

But we still have quite a bit of that $70 trillion left. So what the hell, let's send some brokers into some black gospel churches to peddle our wares. These people are too uninformed to know up from down. We will completely bullshit them and get them to buy houses they can't afford, too.

You know who was lining up to buy all that paper? All those loans?

You were. Your 401k manager was buying that risk. So were your local college and university endowment funds. So were your city treasurers. So were your public employee retirement systems. So were your life, and auto, and health insurance companies (they don't make big profits off premiums, they make them off investing those premiums). Saudi princes. Old money families.

This was happening in banks and broker/dealers and money managers offices and every kind of financial services business there is all. Over. The. World.

Believing negroes are to blame for the gigantic global derivatives crash is in the seven-pounds-of-brain-damage category.

There are not enough prime borrowers on five planet Earths to safely lend $70 trillion to.

If you can't lend someone money, you can't sell the paper to an investor for a fee. Therefore, you must find a way to lend all that money after you have run out of prime borrowers if you are greedy for more fees.

So at some point you throw the underwriting laws of the Universe which have been painstakingly written over centuries out the window. You ignore all the hard lessons learned over the past several centuries and chase after those fees so you can get your own private jet and all the hookers and blow you can handle.

You start loaning to anyone with a pulse. It takes lots and lots and lots and lots and lots and lots and lots of people to borrow money to whittle that $70 trillion down.

Corporate bond issues. Auto loans. Credit cards. Student loans. Mortgages. HELOCs.

You say this guy has always been a safe risk when he borrows money for a $200,000 house? Fuck that! Let's get this guy to buy a $450,000 house this time!

And that is how even a prime borrower is turned into a sub-prime borrower.

It wasn't the negroes. It was Biff, your white middle class neighbor, biting off more than he could chew. A middle class borrower can make a bigger dent in that $70 trillion dollars than some lower income black person can. Duh!

But even after you drag all the white people you can find into $450,000 houses, you still have a lot of that $70 trillion left to shell out. Now let's get them to take out HELOCs on all that instant equity. Buy an SUV with that cash! Buy a boat! Go to Disneyland!

You idiots going to tell me you didn't see all your white middle class neighbors doing this shit? If you didn't notice, then you are about as blind as bats.

But we still have quite a bit of that $70 trillion left. So what the hell, let's send some brokers into some black gospel churches to peddle our wares. These people are too uninformed to know up from down. We will completely bullshit them and get them to buy houses they can't afford, too.

You know who was lining up to buy all that paper? All those loans?

You were. Your 401k manager was buying that risk. So were your local college and university endowment funds. So were your city treasurers. So were your public employee retirement systems. So were your life, and auto, and health insurance companies (they don't make big profits off premiums, they make them off investing those premiums). Saudi princes. Old money families.

This was happening in banks and broker/dealers and money managers offices and every kind of financial services business there is all. Over. The. World.

Believing negroes are to blame for the gigantic global derivatives crash is in the seven-pounds-of-brain-damage category.

Oh look... more mindless partisan bigotry from the Nut.If we should take a giant leap backwards and put the party of greed and excess back in charge cutting social programs while going hog wild on spending on corporate subsidies, tax breaks, defense contracts, and Federal Salaries and benefits -- the income gap will quickly grow to pre-Depression levels and when people have no money to spend in a Consumer Driven Economy -- the country will fall apart pretty fast.

And while the ship is sinking, the scumbags at Fox will blame Obama.

Lets assume for the minute that you're right and the GOP-controlled congress passes bills that do all of the things you mention, in spades.

How will they ever become law?

[See?

An answer to my question? No, you didn't answer it. What do Democrats disagree on? You said they do, so, where do they? You're a bunch of collectivist sheep who take instructions from the mother ship. You were told to say you aren't sheep, but they haven't given you an answer to the question of how you disagree, so you just flounder.

Dad2three

Gold Member

I will just quote the parts you chose to NOT highlight:

For Wall Street, high profits could be made from securities backed by subprime loans. Fannie and Freddie targeted the least-risky loans. Still, their purchases provided more cash for a larger subprime market.

See those key words? "High profits could be made". That's what this was about. This was a battle for market share in a world of newly developed financial derivatives.

In 2003, the two bought $81 billion in subprime securities. In 2004, they purchased $175 billion — 44 percent of the market. In 2005, they bought $169 billion, or 33 percent. In 2006, they cut back to $90 billion, or 20 percent. Generally, Freddie purchased more than Fannie and relied more heavily on the securities to meet goals.

This confirms my earlier point I made that the GSEs were a smaller and smaller part of the secondary market as the bubble grew. Wall Street was a much, much, much bigger part of that market. Getting a larger share with every passing year. Record share.

Conclusion: President Bush had directed HUD to require the GSEs to meet the 56% low income housing requirement. This pressured the GSEs to buy massive MBS. This created a massive market for junk mortgages.

You conclusion is completely erroneous. The GSEs could not even keep up with Wall Street in the issuance of toxic mortgages. Even though their numbers went up tenfold, they still fell farther and farther behind, dipshit!

Wall Street was leading the charge, not the government.

Quite a few leading figures in our government worked for, or made money from, the GSEs at one time or another. Both Republicans and Democrats. Newt Gingrich made millions. He hoped no one would notice when he later attacked the very GSEs he was drawing a paycheck from! Hypocrisy in the extreme.

As the derivatives bubble grew, those investors in the GSEs wanted to make the same big profits that Wall Street was making off the bubble. That is why there was pressure on the GSEs to increase their portfolios.

But Wall Street wanted as much market share of the secondary market as it could get. As your own link states, there were "high profits" to be made off the derivative profits which they believed were eliminating risk.

It was in Wall Street's interest to see the GSEs forced to shrink their portfolios, thus leaving more of the secondary market for them to take over. I believe this is why the Bush Administation began to try to get the GSEs to shrink their portfolios in 2005. Barney Frank and Chris Dodd put the kibosh on that plan.

But all sides were chasing the big profits.

Is it really surprising that politicians were hiding this chase for profits behind a patina of "gettin more folks inta houses, ya'll!"? That's what politicians do. They hide their true motives behind a "public good" bullshit photo op.

Wall Street was not subject to the CRA or government orders to give loans to negroes. And don't think any of you tards are fooling anybody that this isn't about trying to pin the blame on negroes.

Wall Street's business was exploding at a rate far higher than the GSEs. So this ridiculous idea that banks were being "forced" to make these toxic loans is utter bullshit.

This was a worldwide phenomena. It was all about the fees one gets for connecting an investor to a derivative package. And those derivatives would not exist without a lot of fuel which could only come from getting as many people to borrow as possible, and to borrow as much as possible.

Weird, what's that? THAT THE GSE'S WERE FORCED BY DUBYA TO BUY $440 BILLION AND THE PRIVATE MARKETS LED THIS RACE TO THE BOTTOM? YES!!! THAT DUBYA UPPED THE REQUIREMENT OF F/F TO BUY 56% INSTEAD OF ONLY 50% FOR THE 'AFFORDABLE HOUSING GOALS' OF DUBYA? LOL

HINT, DUBYA WAS THE REGULATORS WHO NOT ONLY FORCED F/F TO BUY $440 BILLION IN MBS'S AND UP THEIR GOALS HE ALSO ALLOWED THEM TO DROP THEIT UNDERWRITING STANDARDS ON THE LOANS THEY UNDERWROTE TO KEEP THE MARKET SHARE UP, THAT WAS IN 2005!!! LOL

YEAH,. DUBYA/GOP WANTED TO REFORM F/F? LOL

YOUR posit was F/F WERE BEING DEFENDED BY THE DEMS (OF COURSE THEY WERE, 2003-2004 BEFORE DUBYA'S SUBPRIME BUBBLE TOOK OFF!!!)

"I believe this is why the Bush Administation began to try to get the GSEs to shrink their portfolios in 2005. Barney Frank and Chris Dodd put the kibosh on that plan."

LOO, YOU CAN'T BE FUKKKING SERIOUS? DUBYA WANTED TO SHRINK THE GSE'S PORTFOLIO IN 2005? LOL

June 17, 2004

Home builders, realtors and others are preparing to fight a Bush administration plan that would require Fannie Mae and Freddie Mac to increase financing of homes for low-income people, a home builder group said Thursday.

Home builders fight Bush s low-income housing - Jun. 17 2004

WHAT THE FUKKK IS WITH YOU GUYS AND YOUR MYTHS THAT THE DEMS WERE AGAINST REGULATING F/F BUT THE GOP WERE FOR IT??? LOL

Dad2three

Gold Member

Cool a vid from 2003 BEFORE Dubya's subprime bubble? and?

The Presidents Working Groups March 2008 policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.

June 17, 2004

Builders to fight Bush's low-income plan

Groups ask HUD to rethink plan that would increase financing of homes to low-income people.

(CNN/Money) - Home builders, realtors and others are preparing to fight a Bush administration plan that would require Fannie Mae and Freddie Mac to increase financing of homes for low-income people, a home builder group said Thursday.

Home builders fight Bush s low-income housing - Jun. 17 2004

Dad2three

Gold Member

New Agency Proposed to Oversee Freddie Mac and Fannie Mae - New York Timeshe was blocked 17 times by dems in congress when he tried to get oversight on Fannie Freddy ! hell the CDC even called him a racist !No one has ever shown that repeal of G/S led to anything.If it took 85 years, the Dims would still find a way to blame it on Republicans.

Absolutely true, it was a Dubya/EXECUTIVE BRANCH oversight failure as Dubya cheered on the Banksters in ANOTHER GOP raid on the working classes

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

Got it, you LIE

Name the 17 times the Demsd blocked him? GOP had the House 2001-2007 ANYTHING could pass the House, AND finally in 2005 A BI PARTISAN BILL, HR 1461 PASSED, GUESS WHAT? DUBYA OPPOSED IT, LOL

NAME the bills the Dems blocked in the GOP controlled Senate please? lol

STATEMENT OF ADMINISTRATION POLICY

The Administration strongly believes that the housing GSEs should be focused on their core housing mission, particularly with respect to low-income Americans and first-time homebuyers. Instead, provisions of H.R. 1461 that expand mortgage purchasing authority would lessen the housing GSEs' commitment to low-income homebuyers.

George W. Bush: Statement of Administration Policy: H.R. 1461 - Federal Housing Finance Reform Act of 2005

Yes, he said he was against it because it "would lessen the housing GSEs' commitment to low-income homebuyers". And here's what the House Republican Mike Oxley, Chairman of the House Financial Services committee said

“Instead, the Ohio Republican who headed the House financial services committee until his retirement after mid-term elections last year, blames the mess on ideologues within the White House as well as Alan Greenspan, former chairman of the Federal Reserve.

The critics have forgotten that the House passed a GSE reform bill in 2005 that could well have prevented the current crisis, says Mr Oxley, now vice-chairman of Nasdaq.”

“What did we get from the White House? We got a one-finger salute.”

Oxley was Chairman of the House Financial Services committee and sponsor of the only reform bill to pass any chamber of the republican controlled congress

WE KNOW HOW THE DEMS HATE REGULATIONS AND REGULATORS, AND THE GOP LOVE THEM RIGHT? lol

Cool? AND? Dubya opposed the ONLY bill to make it through EITHER GOP House in Congress, the one in 2005 that had HUGE bi partisan support!!!

GROW A FUKKING BRAIN BUBBA!

Dad2three

Gold Member

The Presidents Working Groups March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

A Two reasons, greed and Bush's regulators let them

Bushs documented policies and statements in timeframe leading up to the start of the Bush Mortgage Bubble include (but not limited to)

Wanting 5.5 million more minority homeowners

Tells congress there is nothing wrong with GSEs

Pledging to use federal policy to increase home ownership

Routinely taking credit for the housing market

Forcing GSEs to buy more low income home loans by raising their Housing Goals

Lowering Invesntment banks capital requirements, Net Capital rule

Reversing the Clinton rule that restricted GSEs purchases of subprime loans

Lowering down payment requirements to 0%

Forcing GSEs to spend an additional $440 billion in the secondary markets

Giving away 40,000 free down payments

PREEMPTING ALL STATE LAWS AGAINST PREDATORY LENDING

But the biggest policy was regulators not enforcing lending standards.

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

BARNEY? lol

Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?

Please tell me you have enough basic common sense to know that banks are in the business of supplying loans that are paid back through interest, and not simply throwing it all away on those who have no way or intention of paying them back. That's the reason why individuals carry things like "credit scores" and a "credit history" for banks to research and use to determine the difference between a secure loan and a bad investment.

These really SHOULD already be just very basic knowledge tools for anyone who has ever inquired about a loan before.

You do know (let's say) the difference between a fixed loan and an arm? I really begin to wonder about you when you give a reply like this.

"Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?"

LOL

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

Yes, you have given that propaganda line once before and I answered it already. Are you just slow, or are you only capable of throwing out the same 3 or 4 responses?

As I said earlier and do please try to follow as you are beginning to bore me with our lack of knowledge.

The Community Reinvestment Act (CRA) forces banks to make loans in poor communities, loans that banks may otherwise reject as financially unsound. Under the CRA, banks must convince a set of bureaucracies that they are not engaging in discrimination, a charge that the act encourages any CRA-recognized community group to bring forward. Otherwise, any merger or expansion the banks attempt will likely be denied. But what counts as discrimination?

According to one enforcement agency, "discrimination exists when a lender's underwriting policies contain arbitrary or outdated criteria that effectively disqualify many urban or lower-income minority applicants." Note that these "arbitrary or outdated criteria" include most of the essentials of responsible lending: income level, income verification, credit history and savings history--the very factors lenders are now being criticized for ignoring.

Now let's see if you can follow the discussion and bring out a response with your own words instead of the usual cut and paste of 3 or 4 responses. You are only proving my argument going in circles and you really do bore me. I'd rather engage in a more intellectual discussions that moves the conversation forward. You just want to talk in circles with the same crap over and over and over and over again.

I'LL MAKE IT EASY EVEN FOR A DOPE LIKE YOU BUBBA

THE BANKSTERS CREATED A WORLD WIDE CREDIT BUBBLE AND BUST. That's why they lobbied for 30+ years to deregulate.

The historical "originate and hold" mortgage model was replaced with the "originate and distribute" model. Incentives were such that you could get paid just to originate and sell the mortgages down the pipeline, passing the risk along. The big investment banks simply connected the investors to the originators, helped by the AAA ratings.

NO THINKING PERSON THINKS FANNIE/FREDDIE AROUND FOR 70 YEARS OR THE CRA AROUND FOR 30+ YEARS CAUSED THE MORTGAGE CRISIS, BUT IT WAS DUBYA/GOP WHO LOOKED THE OTHER WAY AS THEY CHEERED ON THE BANKSTERS

It is clear to anyone who has studied the financial crisis of 2008 that the private sector’s drive for short-term profit was behind it.

More than 84 percent of the sub-prime mortgages in 2006 were issued by private lending. These private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year. Out of the top 25 subprime lenders in 2006, only one was subject to the usual mortgage laws and regulations.

The nonbank underwriters made more than 12 million subprime mortgages with a value of nearly $2 trillion. The lenders who made these were exempt from federal regulations.

Lest We Forget Why We Had A Financial Crisis - ForbesEither you are massively retarded or simply toeing the socialist party line.The Presidents Working Groups March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007.

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

A Two reasons, greed and Bush's regulators let them

Bushs documented policies and statements in timeframe leading up to the start of the Bush Mortgage Bubble include (but not limited to)

Wanting 5.5 million more minority homeowners

Tells congress there is nothing wrong with GSEs

Pledging to use federal policy to increase home ownership

Routinely taking credit for the housing market

Forcing GSEs to buy more low income home loans by raising their Housing Goals

Lowering Invesntment banks capital requirements, Net Capital rule

Reversing the Clinton rule that restricted GSEs purchases of subprime loans

Lowering down payment requirements to 0%

Forcing GSEs to spend an additional $440 billion in the secondary markets

Giving away 40,000 free down payments

PREEMPTING ALL STATE LAWS AGAINST PREDATORY LENDING

But the biggest policy was regulators not enforcing lending standards.

FACTS on Dubya s great recession US Message Board - Political Discussion Forum

BARNEY? lol

Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?

Please tell me you have enough basic common sense to know that banks are in the business of supplying loans that are paid back through interest, and not simply throwing it all away on those who have no way or intention of paying them back. That's the reason why individuals carry things like "credit scores" and a "credit history" for banks to research and use to determine the difference between a secure loan and a bad investment.

These really SHOULD already be just very basic knowledge tools for anyone who has ever inquired about a loan before.

You do know (let's say) the difference between a fixed loan and an arm? I really begin to wonder about you when you give a reply like this.

"Do you honestly believe banks just simply hand out loans to anyone off the street without FIRST seeing if such loans will be paid back or if they will end up losing money dealing with bankruptcy battles and the hassles of foreclosures?"

LOL

"Another form of easing facilitated the rapid rise of mortgages that didn't require borrowers to fully document their incomes. In 2006, these low- or no-doc loans comprised 81 percent of near-prime, 55 percent of jumbo, 50 percent of subprime and 36 percent of prime securitized mortgages."

Q HOLY JESUS! DID YOU JUST PROVE THAT OVER 50 % OF ALL MORTGAGES IN 2006 DIDNT REQUIRE BORROWERS TO DOCUMENT THEIR INCOME?!?!?!?

A Yes.

Q WHO THE HELL LOANS HUNDREDS OF THOUSANDS OF DOLLARS TO PEOPLE WITHOUT CHECKING THEIR INCOMES?!?!?

A Banks.

Q WHY??!?!!!?!

Yes, you have given that propaganda line once before and I answered it already. Are you just slow, or are you only capable of throwing out the same 3 or 4 responses?

As I said earlier and do please try to follow as you are beginning to bore me with our lack of knowledge.

The Community Reinvestment Act (CRA) forces banks to make loans in poor communities, loans that banks may otherwise reject as financially unsound. Under the CRA, banks must convince a set of bureaucracies that they are not engaging in discrimination, a charge that the act encourages any CRA-recognized community group to bring forward. Otherwise, any merger or expansion the banks attempt will likely be denied. But what counts as discrimination?

According to one enforcement agency, "discrimination exists when a lender's underwriting policies contain arbitrary or outdated criteria that effectively disqualify many urban or lower-income minority applicants." Note that these "arbitrary or outdated criteria" include most of the essentials of responsible lending: income level, income verification, credit history and savings history--the very factors lenders are now being criticized for ignoring.

Now let's see if you can follow the discussion and bring out a response with your own words instead of the usual cut and paste of 3 or 4 responses. You are only proving my argument going in circles and you really do bore me. I'd rather engage in a more intellectual discussions that moves the conversation forward. You just want to talk in circles with the same crap over and over and over and over again.

I'LL MAKE IT EASY EVEN FOR A DOPE LIKE YOU BUBBA

THE BANKSTERS CREATED A WORLD WIDE CREDIT BUBBLE AND BUST. That's why they lobbied for 30+ years to deregulate.

The historical "originate and hold" mortgage model was replaced with the "originate and distribute" model. Incentives were such that you could get paid just to originate and sell the mortgages down the pipeline, passing the risk along. The big investment banks simply connected the investors to the originators, helped by the AAA ratings.

NO THINKING PERSON THINKS FANNIE/FREDDIE AROUND FOR 70 YEARS OR THE CRA AROUND FOR 30+ YEARS CAUSED THE MORTGAGE CRISIS, BUT IT WAS DUBYA/GOP WHO LOOKED THE OTHER WAY AS THEY CHEERED ON THE BANKSTERS

It is clear to anyone who has studied the financial crisis of 2008 that the private sector’s drive for short-term profit was behind it.

More than 84 percent of the sub-prime mortgages in 2006 were issued by private lending. These private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year. Out of the top 25 subprime lenders in 2006, only one was subject to the usual mortgage laws and regulations.

The nonbank underwriters made more than 12 million subprime mortgages with a value of nearly $2 trillion. The lenders who made these were exempt from federal regulations.

Lest We Forget Why We Had A Financial Crisis - Forbes

You very well know what the truth is which has been proven to you a gazillion times.

.

.

Stop projecting dummy!

Dad2three

Gold Member

$70 trillion.

There are not enough prime borrowers on five planet Earths to safely lend $70 trillion to.

If you can't lend someone money, you can't sell the paper to an investor for a fee. Therefore, you must find a way to lend all that money after you have run out of prime borrowers if you are greedy for more fees.

So at some point you throw the underwriting laws of the Universe which have been painstakingly written over centuries out the window. You ignore all the hard lessons learned over the past several centuries and chase after those fees so you can get your own private jet and all the hookers and blow you can handle.

You start loaning to anyone with a pulse. It takes lots and lots and lots and lots and lots and lots and lots of people to borrow money to whittle that $70 trillion down.

Corporate bond issues. Auto loans. Credit cards. Student loans. Mortgages. HELOCs.

You say this guy has always been a safe risk when he borrows money for a $200,000 house? Fuck that! Let's get this guy to buy a $450,000 house this time!

And that is how even a prime borrower is turned into a sub-prime borrower.

It wasn't the negroes. It was Biff, your white middle class neighbor, biting off more than he could chew. A middle class borrower can make a bigger dent in that $70 trillion dollars than some lower income black person can. Duh!

But even after you drag all the white people you can find into $450,000 houses, you still have a lot of that $70 trillion left to shell out. Now let's get them to take out HELOCs on all that instant equity. Buy an SUV with that cash! Buy a boat! Go to Disneyland!

You idiots going to tell me you didn't see all your white middle class neighbors doing this shit? If you didn't notice, then you are about as blind as bats.

But we still have quite a bit of that $70 trillion left. So what the hell, let's send some brokers into some black gospel churches to peddle our wares. These people are too uninformed to know up from down. We will completely bullshit them and get them to buy houses they can't afford, too.

You know who was lining up to buy all that paper? All those loans?

You were. Your 401k manager was buying that risk. So were your local college and university endowment funds. So were your city treasurers. So were your public employee retirement systems. So were your life, and auto, and health insurance companies (they don't make big profits off premiums, they make them off investing those premiums). Saudi princes. Old money families.

This was happening in banks and broker/dealers and money managers offices and every kind of financial services business there is all. Over. The. World.

Believing negroes are to blame for the gigantic global derivatives crash is in the seven-pounds-of-brain-damage category.

LOL, ONLY the right wingers like you are blaming people of color or the poor!

IF only Dubya, like Reagan did with the S&L crisis, didn't ignore REGULATOR warnings that had predicted this right? REGULATIONS AND REGULATORS ON THE BEAT COULD'VE STOPPED DUBYA'S SUBPRIME CRISIS WHERE US HOUSEHOLD DEBT DOUBLED HIS FIRST 7 YEARS!

Truman123

Gold Member

- Oct 16, 2014

- 463

- 171

- 255

Whats with all the foul language?If we should take a giant leap backwards and put the party of greed and excess back in charge cutting social programs while going hog wild on spending on corporate subsidies, tax breaks, defense contracts, and Federal Salaries and benefits -- the income gap will quickly grow to pre-Depression levels and when people have no money to spend in a Consumer Driven Economy -- the country will fall apart pretty fast.

And while the ship is sinking, the scumbags at Fox will blame Obama.

While six years and counting you blame Bush. I find it amusing that when the House and the Senate were controlled by the Dems for two years before Obama came into the picture, you still blame Bush but if the same thing happen in the last two years of the Obama administration, you will blame Republicans. Shows what a hypocrite you are and how you are nothing but a partisan shithead with a fucking partisan agenda. You like other extreme partisans need to go fuck off, because it is stupid and ignorant people like you on both sides of the aisle that are screwing the nation over.

Dad2three

Gold Member

If we should take a giant leap backwards and put the party of greed and excess back in charge cutting social programs while going hog wild on spending on corporate subsidies, tax breaks, defense contracts, and Federal Salaries and benefits -- the income gap will quickly grow to pre-Depression levels and when people have no money to spend in a Consumer Driven Economy -- the country will fall apart pretty fast.

And while the ship is sinking, the scumbags at Fox will blame Obama.

While six years and counting you blame Bush. I find it amusing that when the House and the Senate were controlled by the Dems for two years before Obama came into the picture, you still blame Bush but if the same thing happen in the last two years of the Obama administration, you will blame Republicans. Shows what a hypocrite you are and how you are nothing but a partisan shithead with a fucking partisan agenda. You like other extreme partisans need to go fuck off, because it is stupid and ignorant people like you on both sides of the aisle that are screwing the nation over.

STILL waiting for the bills the Dems passed 2007-Jan 2009 that changed Dubya/GOP's policies? lol

Youch

Senior Member

- Aug 10, 2014

- 670

- 121

- 45

If we should take a giant leap backwards and put the party of greed and excess back in charge cutting social programs while going hog wild on spending on corporate subsidies, tax breaks, defense contracts, and Federal Salaries and benefits -- the income gap will quickly grow to pre-Depression levels and when people have no money to spend in a Consumer Driven Economy -- the country will fall apart pretty fast.

And while the ship is sinking, the scumbags at Fox will blame Obama.

Nutjob,

Are you aware that more corporate subsides and tax credits, and SPENDING, have happened Barry Obama?

Corporatism is not a party issue. It is a modern political issue that infects both sides.

Rather than mire yourself in the shallowness of party BS., why not instead embrace the movement that wants to end it all? Got a clue????

Please tell us how the "income gap" (a wedge issue born from jealously, envy and political leverage/fear-mongering) actually hurts anyone?

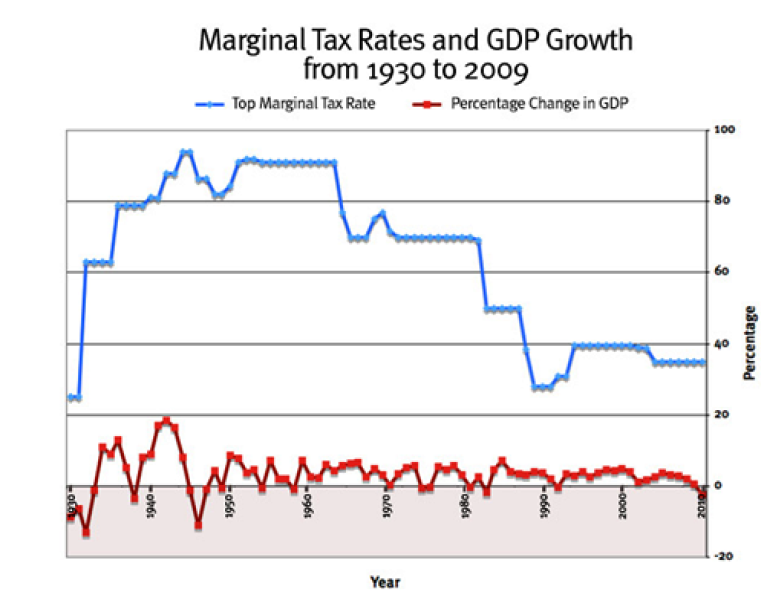

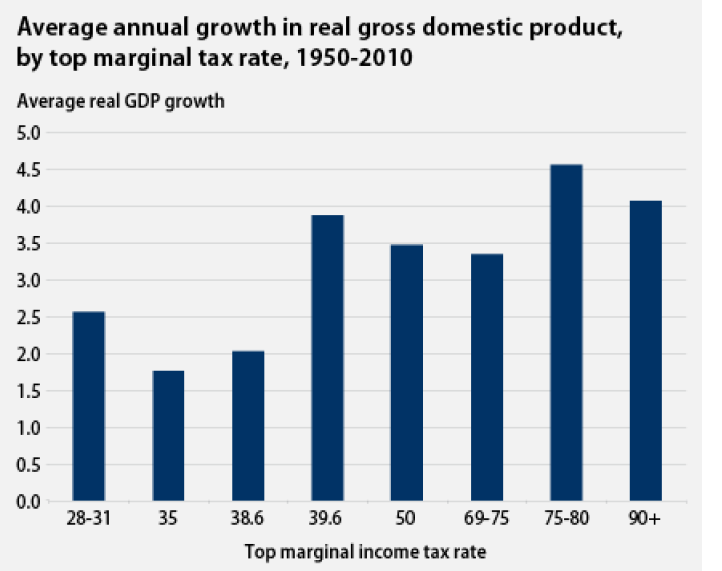

Non-Partisan Congressional Tax Report Debunks Core Conservative Economic Theory

The conclusion?

Lowering the tax rates on the wealthy and top earners in America do not appear to have any impact on the nation’s economic growth.

This paragraph from the report says it all—

“The reduction in the top tax rates appears to be uncorrelated with saving, investment and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.”

Non-Partisan Congressional Tax Report Debunks Core Conservative Economic Theory-GOP Suppresses Study - Forbes

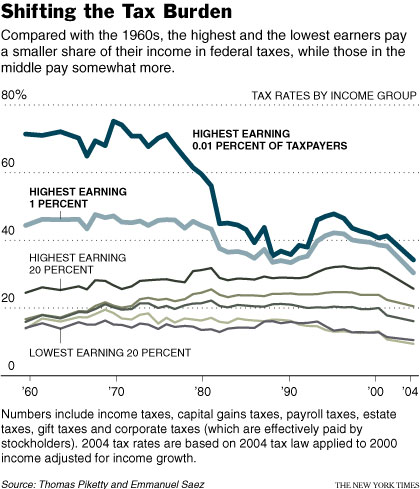

The share of total income going to the top 0.1 percent hovered around 4 percent during the 1950s, 1960s and 1970s, then rose to 12 percent by the mid-2000s. During this period, the average tax rate paid by the 0.1 percent fell from more than 40 percent to below 25 percent.

The study said that "as top tax rates are reduced, the share of income accruing to the top of the income distribution increases" and that "these relationships are statistically significant."

In other words, cutting taxes on the rich may not grow the economic pie. But the study found that those cuts can effect "how that economic pie is sliced."

Study: Tax Cuts for the Rich Don't Spur Growth

http://finance.yahoo.com/news/tax-cuts-rich-dont-spur-151649273.html

If I 'make' a million dollars, I accumulated money from other people. I'm not actually producing cash, I'm acquiring theirs. Therefore, others have collectively lost a million dollars of purchasing power to me.

These people can't go demand new money just because I have all of their money.

They go broke, I get rich, and income inequality is a thing.

LOL.

Having read just the first paragraphs, I find several problems in their assumptions, and critical omissions in their analysis. Not only does it avoid the most obvious thing, that just because top marginal rates were 90% in the '50, it fails to admit that nobody paid that rate, as many, many loopholes and havens were purposely in play. Also, the analysis seems to ignore the more recent proof that reducing tax rates does indeed promote economic growth!!!........care to discuss when that was, and how it worked?

But hey, you sure are good and cutting and pasting....

Youch

Senior Member

- Aug 10, 2014

- 670

- 121

- 45

If I 'make' a million dollars, I accumulated money from other people. I'm not actually producing cash, I'm acquiring theirs. Therefore, others have collectively lost a million dollars of purchasing power to me.

These people can't go demand new money just because I have all of their money.

They go broke, I get rich, and income inequality is a thing.

This is socialistic gibberish. Making a million dollars means you invested in or created something that benefitted many other people, which results in jobs, salaries, wages, inventions, opportunities, products, usually cheaper products, and commerce, all adding to the economy.... This notion that the pie is of a defined and static size only shows a lack of understanding of how an economy works. Just because I succeed does not mean anyone else fails......on the contrary, I succeed by way of increased economic activity, mine, theirs, ours or all of the above. The punk in Detroit has nothing to do with it. You think people go poor because Zuckerberg made billions? Is he, or Buffett or Gates or the Koch Brothers or the idiot Steyer all responsible for the abysmal economic failings of the Obama administration? Come on, your ability to cut and paste tells me you are smarter than that!!!

Mad Scientist

Feels Good!

- Sep 15, 2008

- 24,196

- 5,431

- 270

Democrat Election 2014 Talking Points courtesy of Robert Reich and Moveon.org. Nothing that rdean hasn't already been spewing for the last 2-4 years, but here it is:

(Comments disabled of course!)

(Comments disabled of course!)

Dad2three

Gold Member

If we should take a giant leap backwards and put the party of greed and excess back in charge cutting social programs while going hog wild on spending on corporate subsidies, tax breaks, defense contracts, and Federal Salaries and benefits -- the income gap will quickly grow to pre-Depression levels and when people have no money to spend in a Consumer Driven Economy -- the country will fall apart pretty fast.

And while the ship is sinking, the scumbags at Fox will blame Obama.

Nutjob,

Are you aware that more corporate subsides and tax credits, and SPENDING, have happened Barry Obama?

Corporatism is not a party issue. It is a modern political issue that infects both sides.

Rather than mire yourself in the shallowness of party BS., why not instead embrace the movement that wants to end it all? Got a clue????

Please tell us how the "income gap" (a wedge issue born from jealously, envy and political leverage/fear-mongering) actually hurts anyone?

Non-Partisan Congressional Tax Report Debunks Core Conservative Economic Theory

The conclusion?

Lowering the tax rates on the wealthy and top earners in America do not appear to have any impact on the nation’s economic growth.

This paragraph from the report says it all—

“The reduction in the top tax rates appears to be uncorrelated with saving, investment and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution.”

Non-Partisan Congressional Tax Report Debunks Core Conservative Economic Theory-GOP Suppresses Study - Forbes

The share of total income going to the top 0.1 percent hovered around 4 percent during the 1950s, 1960s and 1970s, then rose to 12 percent by the mid-2000s. During this period, the average tax rate paid by the 0.1 percent fell from more than 40 percent to below 25 percent.

The study said that "as top tax rates are reduced, the share of income accruing to the top of the income distribution increases" and that "these relationships are statistically significant."

In other words, cutting taxes on the rich may not grow the economic pie. But the study found that those cuts can effect "how that economic pie is sliced."

Study: Tax Cuts for the Rich Don't Spur Growth

http://finance.yahoo.com/news/tax-cuts-rich-dont-spur-151649273.html

If I 'make' a million dollars, I accumulated money from other people. I'm not actually producing cash, I'm acquiring theirs. Therefore, others have collectively lost a million dollars of purchasing power to me.

These people can't go demand new money just because I have all of their money.

They go broke, I get rich, and income inequality is a thing.

LOL.

Having read just the first paragraphs, I find several problems in their assumptions, and critical omissions in their analysis. Not only does it avoid the most obvious thing, that just because top marginal rates were 90% in the '50, it fails to admit that nobody paid that rate, as many, many loopholes and havens were purposely in play. Also, the analysis seems to ignore the more recent proof that reducing tax rates does indeed promote economic growth!!!........care to discuss when that was, and how it worked?

But hey, you sure are good and cutting and pasting....

Weird, you read the first couple paragraphs and refuted the study huh? lol

WHERE WAS THE ECONOMIC GROWTH WITH DUBYA'S TAX CUTS AGAIN?

The CRS report, by researcher Thomas Hungerford, concluded:

The results of the analysis suggest that changes over the past 65 years in the top marginal tax rate and the top capital gains tax rate do not appear correlated with economic growth. The reduction in the top tax rates appears to be uncorrelated with saving, investment, and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie.

However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution. As measured by IRS data, the share of income accruing to the top 0.1% of U.S. families increased from 4.2% in 1945 to 12.3% by 2007 before falling to 9.2% due to the 2007-2009 recession. At the same time, the average tax rate paid by the top 0.1% fell from over 50% in 1945 to about 25% in 2009.

Tax policy could have a relation to how the economic pie is sliced—lower top tax rates may be associated with greater income disparities.

Congressional Research Service Report On Tax Cuts For Wealthy Suppressed By GOP UPDATE

EFFECTIVE TAX RATES BUBBA

A 2011 study by the CBO found that the top earning 1 percent of households gained about 275% after federal taxes and income transfers over a period between 1979 and 2007

CBO finds that, between 1979 and 2007, income grew by:

275 percent for the top 1 percent of households,

65 percent for the next 19 percent,

Just under 40 percent for the next 60 percent, and

18 percent for the bottom 20 percent.

Trends in the Distribution of Household Income Between 1979 and 2007 Congressional Budget Office

STUDY: These Charts Show There's Almost No Correlation Between Tax Rates and GDP

These Charts Show There s Probably No Correlation Between Tax Rates and GDP - Business Insider

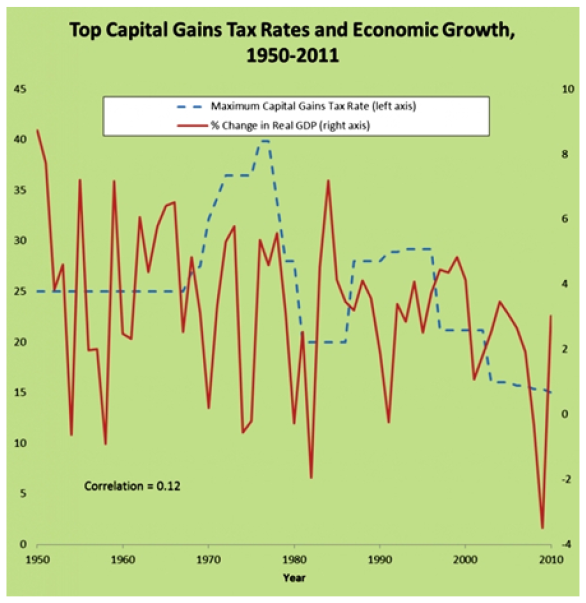

Capital Gains Tax Rates and Economic Growth (or not)

If you read the editorial page of the Wall Street Journal (or surf around the nether regions of Forbes.com), you may come to the conclusion that no aspect of tax policy is more important for economic growth than the way we tax capital gains. You’d be wrong

Capital Gains Tax Rates and Economic Growth or not - Forbes

Dad2three

Gold Member

If I 'make' a million dollars, I accumulated money from other people. I'm not actually producing cash, I'm acquiring theirs. Therefore, others have collectively lost a million dollars of purchasing power to me.

These people can't go demand new money just because I have all of their money.

They go broke, I get rich, and income inequality is a thing.

This is socialistic gibberish. Making a million dollars means you invested in or created something that benefitted many other people, which results in jobs, salaries, wages, inventions, opportunities, products, usually cheaper products, and commerce, all adding to the economy.... This notion that the pie is of a defined and static size only shows a lack of understanding of how an economy works. Just because I succeed does not mean anyone else fails......on the contrary, I succeed by way of increased economic activity, mine, theirs, ours or all of the above. The punk in Detroit has nothing to do with it. You think people go poor because Zuckerberg made billions? Is he, or Buffett or Gates or the Koch Brothers or the idiot Steyer all responsible for the abysmal economic failings of the Obama administration? Come on, your ability to cut and paste tells me you are smarter than that!!!

MORE right wing garbage from you, I'm shocked

Wealth is a Zero-Sum Game

Conservative damagogues like Limbaugh have been able to convince the public that the huge incomes of the wealthiest Americans are irrelevant to those who make moderate-to-low incomes. They even suggest that the more money the wealthiest Americans make, the more wealth will trickle down to the lower classes.

If you've swallowed this line of conservative garbage, get ready to vomit. As all conservative economists know, and deny to the public that they know, wealth is a zero-sum game. That is true at both the front end—when income is divided up, and the back end—when it is spent.

The Front End of Zero-Sum: Dividing the Loot

There is only so much corporate income in a given year. The more of that income that is used to pay workers, the less profit the corporation makes. The less profit, the less the stock goes up. The less the stock goes up, the less the CEO and the investors make. It’s as simple as that. Profit equals income minus expenses. No more, no less.

Subtract the right side of the equation from the left side and the answer is always zero. Hence the term, “zero-sum.”

So, to the extent a corporation can keep from sharing the wealth with workers—the ones who created the wealth to begin with—investors and executives get a bigger slice of the income pie and become richer.

The Zero-sum Nature of economics

I KNOW, YOU CAN'T REFUTE MY LINKS SO YOU'LL USE AD HOMS, AND I'LL BE IMPRESSED *SHAKING HEAD*

Wildman

Gold Member

If GOP takes Senate, how long until 2nd Great Depression?

NEVER HAPPEN !!

there will be a great recovery from this fucking mess we are currently in, all caused by a muslime mulatto commie socialist son-of-a-bitch !!

NEVER HAPPEN !!

there will be a great recovery from this fucking mess we are currently in, all caused by a muslime mulatto commie socialist son-of-a-bitch !!

Dad2three

Gold Member

If GOP takes Senate, how long until 2nd Great Depression?

NEVER HAPPEN !!

there will be a great recovery from this fucking mess we are currently in, all caused by a muslime mulatto commie socialist son-of-a-bitch !!

MoRoN

December 2007

The Economic Consequences of Mr. Bush

The next president will have to deal with yet another crippling legacy of George W. Bush: the economy. A Nobel laureate, Joseph E. Stiglitz, sees a generation-long struggle to recoup.

The Economic Consequences of Mr. Bush Vanity Fair

Bush Lead During Weakest Economy in Decades

President Bush has presided over the weakest eight-year span for the U.S. economy in decades, according to an analysis of key data, and economists across the ideological spectrum increasingly view his two terms as a time of little progress on the nation's thorniest fiscal challenges.

"The expansion was a continuation of the way the U.S. has grown for too long, which was a consumer-led expansion that was heavily concentrated in housing," said Douglas Holtz-Eakin, a onetime Bush White House staffer and one of Sen. John McCain's top economic advisers for his presidential campaign. "There was very little of the kind of saving and export-led growth that would be more sustainable."

"For a group that claims it wants to be judged by history, there is no evidence on the economic policy front that that was the view," Holtz-Eakin said. "It was all Band-Aids."

Bush Lead During Weakest Economy in Decades

BUSH LOST 1,000,000+ PRIVATE sector jobs in 8 years, Obama has almost 7,000,000 created under him in less than 6 years and Obama is the failure? lol

Bush Lead During Weakest Economy in Decades

Similar threads

- Replies

- 14

- Views

- 3K

- Replies

- 782

- Views

- 32K

- Replies

- 28

- Views

- 5K

Latest Discussions

- Replies

- 6

- Views

- 29

- Replies

- 490

- Views

- 3K

Forum List

-

-

-

-

-

Political Satire 8068

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 471

-

-

-

-

-

-

-

-

-

-