Euro

Senior Member

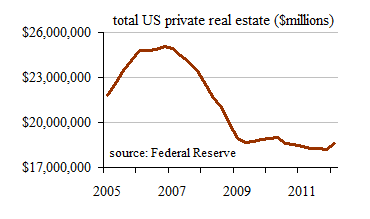

How was the mood before the housing bubble in 2008? Did Bush see it coming?

Did people complain about high housing prices?

Did people complain about high building costs?

Did you see the bubble coming?

Did you see it coming and did you get affected.? Did people have to much debt?

Did people complain about high housing prices?

Did people complain about high building costs?

Did you see the bubble coming?

Did you see it coming and did you get affected.? Did people have to much debt?