Roadrunner

Roadrunner

The "pay no tax" theme only applies to personal income tax on the federal level, or, in some cases the state level.It is time for a head tax, payable in cash or labor.Middle America is being squeezed out of existence. WE pay for the tax shelters for the wealthy. WE pay for corporate bailouts. WE pay for bailouts to save Wallstreet, who turns their back on middle America when their profits are huge.

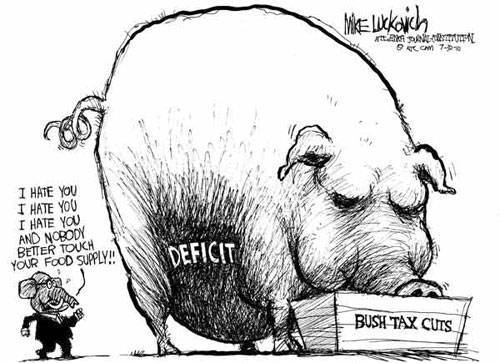

All the while the GOP defends the wealthy in their shafting of the tax system and the GOP defends multinational corporations as they shirk paying their fair share of taxes. The Repub party is in business for the rich guys and the low information poor, many of whom are in the south.

The middle class bears the highest tax burden no doubt. But taxing the rich isnt going to help matters just as taxing business doesnt help since they just pass the increased cost on to the consumer.

All able bodied persons should have skin in the game, or, forfeit all voting rights and all welfare.

Yep..when life costs you nothing it's easy to become complacent and your view of right and wrong becomes skewed.

Soaking the Poor, State by State

You have heard, perhaps, that rich people in America are egregiously overtaxed. And the poor? They're the lucky duckies! Why, 47 percent of Americans pay no taxes at all!

(This is not true, of course. Many poor and elderly Americans pay no federal income tax, but they pay plenty of other taxes.)

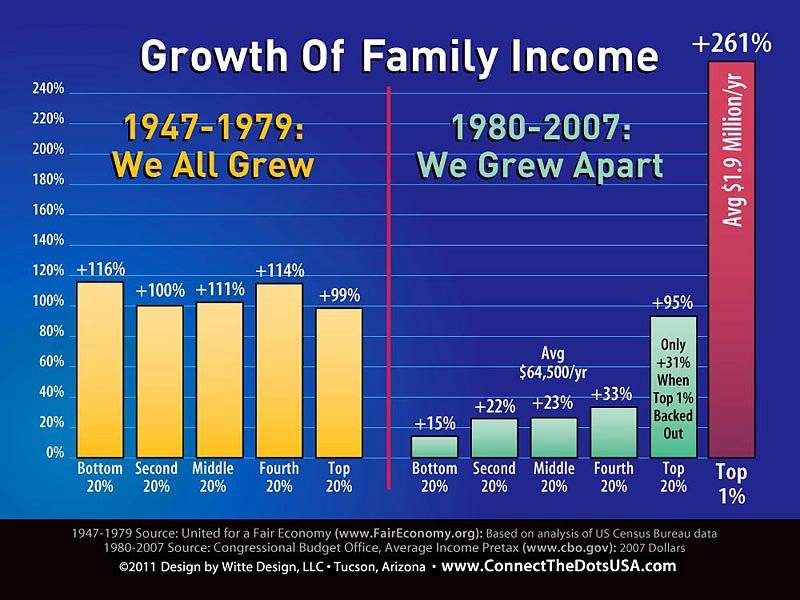

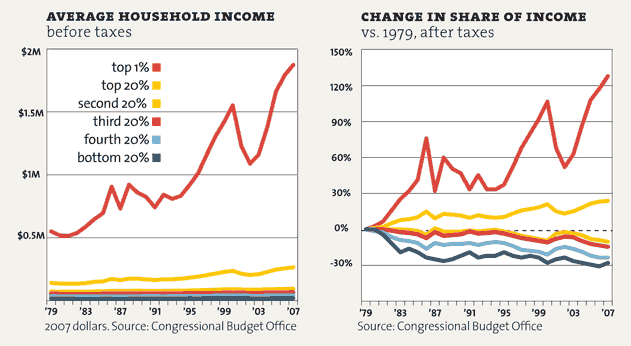

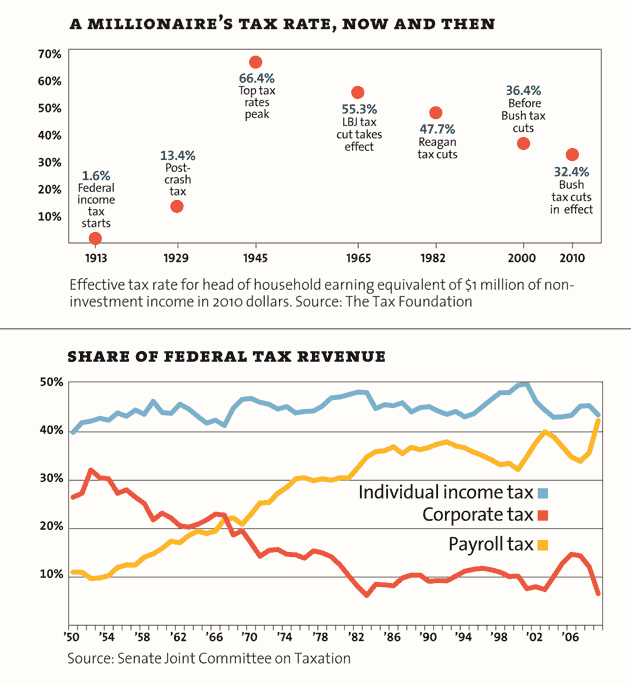

Still and all, it's true that the federal income tax is indeed progressive. Conservatives are right about that—though it's not as progressive as it used to be, back before top marginal rates were lowered and capital gains taxes were slashed in half. But conservatives are a little less excited to talk about other kinds of taxes. Payroll taxes aren't progressive, for example. In fact, they're actively regressive, with the poor and middle classes paying higher rates than the rich.

And then there are state taxes. Those include state income taxes, property taxes, sales taxes, and fees of various kinds. How progressive are state taxes?

Answer: They aren't. The Corporation for Enterprise Development recently released a scorecard for all 50 states, and it has boatloads of useful information. That includes overall tax rates, where data from the Institute on Taxation and Economic Policy shows that in the median state (Mississippi, as it turns out) the poorest 20 percent pay twice the tax rate of the top 1 percent. In the worst states, the poorest 20 percent pay five to six times the rate of the richest 1 percent. Lucky duckies indeed. There's not one single state with a tax system that's progressive. Check the table below to see how your state scores.

Soaking the Poor State by State Mother Jones

Poor Families Pay Double The State And Local Tax Rate As The Rich

Poor Families Pay Double The State And Local Tax Rate As The Rich Study

Everyone should have some skin in the game, even the poor.

Why do you think we have the "stupidity tax" known as the lottery?