eflatminor

Classical Liberal

- May 24, 2011

- 10,643

- 1,669

- 245

Actually, what I'm saying is this.

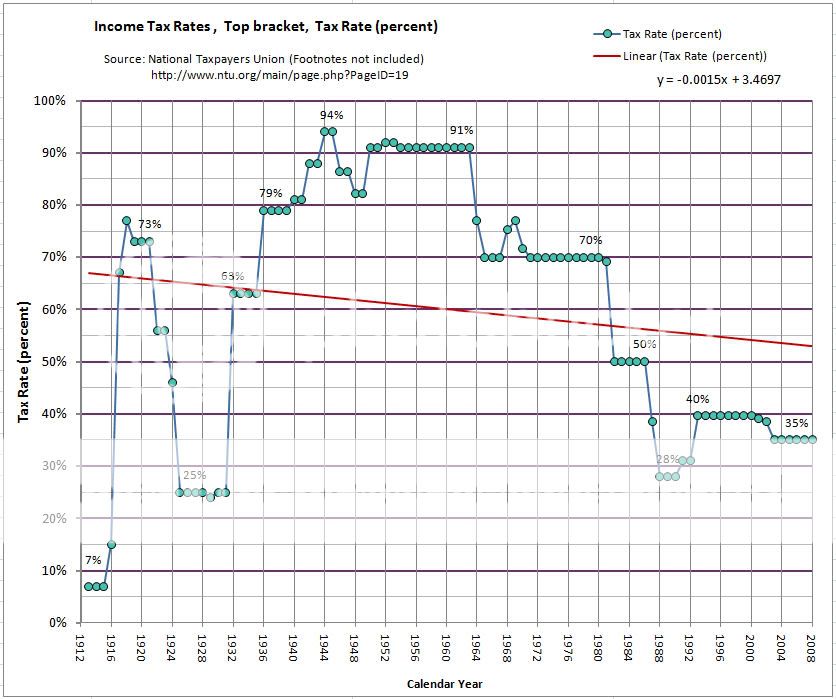

Raise taxes and funding to services - while using more progressive tax brackets.

We already have the most progressive tax structure in the world, meaning our rich pay a higher percentage of the overall tax burden than in any other country.

That's technically true, but misleading. When talking about redistributive taxation(simply, reducing inequality) we're nowhere near the top.

Good gawd, another one that thinks wealth is finite, a pie to be divided up...

Just because a fat man is standing next to a skinny man doesn't mean the fat man took the skinny man's food.