CONSUMERS CREATE JOBS.

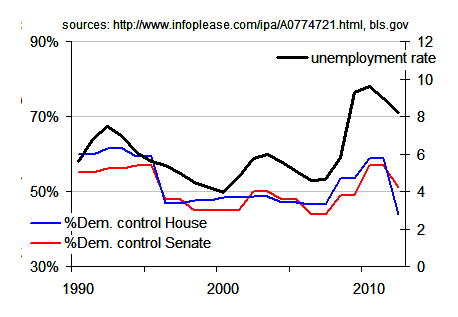

When President Bush took office in 2001, he inherited a $236 billion budget surplus, with a projected 10-year surplus of $5.6 trillion. Unemployment was at 4.0% in January 2001. Unemployment was at 7.85 when Obama took office in January 2009. Bushs Economic Growth and Tax Relief Reconciliation Act of 2001 cut taxes by $1.35 trillion over 10 years by making many changes. Did not create one job but cause Government $1.35 trillion in lost revenue, resulting in Government jobs lost. Especially in government that create jobs. If big and small businesses did not pay any taxes at all they still would not create any jobs. 11 years after Bushs tax cuts unemployment is at 8.2% down because of Obamas stimulus and because tax cuts do not create jobs. Like it or not, Radical Right Wing Extremists, government spending and government created jobs got us out of the great depression and will get us out of this recession. Stimulus money lowered unemployment down to 8.2%. If not for the stimulus ti would be well over 8.2%. But RRWE have cut government spending and cut Government jobs.

Government spending and government jobs will put people to work, create revenue and the employed will spend money on products and services and business will sell more products and services and will need to hire more people. Result. A growing economy out of the recession. A 5th grader figured this out.

Government can create jobs because Government do not have to make an immediate profit. Profit will come later in the form of taxes that will pay for the jobs Government create.

Consumers create jobs and not big or small businesses. Bush tax cut create this recession by cutting tax revenue by $1.35 trillion. It took money out of the hands of government and Government had to cut spending and cut government jobs, cutting more revenue and taking money out of the hands of consumers. Consumers having no money to buy big and small businesss products and services caused businesses to lay of employees and some went bankrupt. Results in no money in anyones hands. Resulting in a great recession.

Private sector cannot create jobs without consumers.

If RRWE know how to create jobs and healthcare for all, they had 10 years of Bush to do it and they didnt.

When President Bush took office in 2001, he inherited a $236 billion budget surplus, with a projected 10-year surplus of $5.6 trillion. Unemployment was at 4.0% in January 2001. Unemployment was at 7.85 when Obama took office in January 2009. Bushs Economic Growth and Tax Relief Reconciliation Act of 2001 cut taxes by $1.35 trillion over 10 years by making many changes. Did not create one job but cause Government $1.35 trillion in lost revenue, resulting in Government jobs lost. Especially in government that create jobs. If big and small businesses did not pay any taxes at all they still would not create any jobs. 11 years after Bushs tax cuts unemployment is at 8.2% down because of Obamas stimulus and because tax cuts do not create jobs. Like it or not, Radical Right Wing Extremists, government spending and government created jobs got us out of the great depression and will get us out of this recession. Stimulus money lowered unemployment down to 8.2%. If not for the stimulus ti would be well over 8.2%. But RRWE have cut government spending and cut Government jobs.

Government spending and government jobs will put people to work, create revenue and the employed will spend money on products and services and business will sell more products and services and will need to hire more people. Result. A growing economy out of the recession. A 5th grader figured this out.

Government can create jobs because Government do not have to make an immediate profit. Profit will come later in the form of taxes that will pay for the jobs Government create.

Consumers create jobs and not big or small businesses. Bush tax cut create this recession by cutting tax revenue by $1.35 trillion. It took money out of the hands of government and Government had to cut spending and cut government jobs, cutting more revenue and taking money out of the hands of consumers. Consumers having no money to buy big and small businesss products and services caused businesses to lay of employees and some went bankrupt. Results in no money in anyones hands. Resulting in a great recession.

Private sector cannot create jobs without consumers.

If RRWE know how to create jobs and healthcare for all, they had 10 years of Bush to do it and they didnt.