EdwardBaiamonte

Platinum Member

- Nov 23, 2011

- 34,612

- 2,153

- 1,100

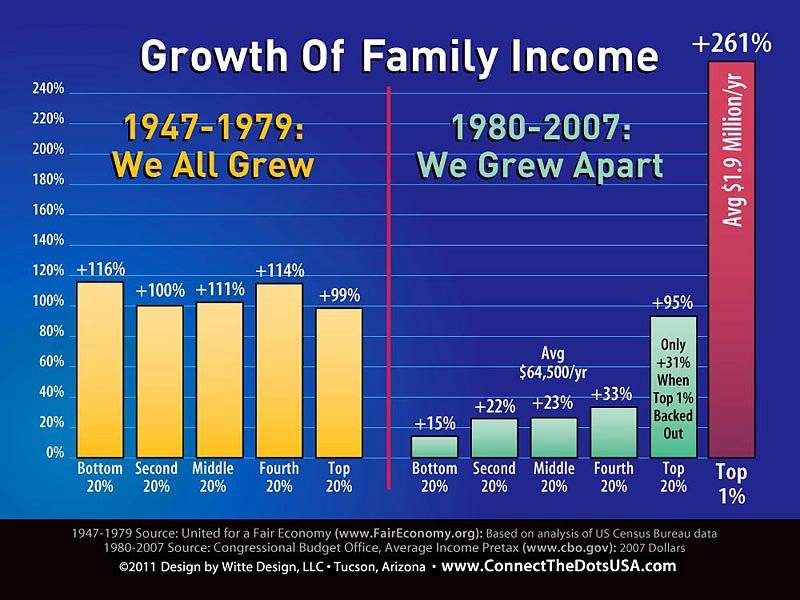

I have asked dumbto3 if he is a communist 9 times but he won't answer. I wonder why??Despite, or because of, the fallout from the 2007 Great Recession, annual earnings between the richest Americans and everybody else have exploded to record levels. Meanwhile middle- and lower-class wealth growth remains stagnant.

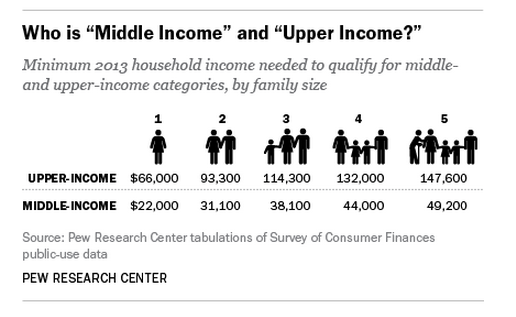

The median wealth for high-income families hit $639,400 last year, a whopping 7 percent jump from three years earlier and seven times greater than middle-class incomes, which stood at $96,500 according to Pew Research Center, citing data from the Federal Reserve.

Middle-class median wealth, which Pew defines as the difference between the value of a household’s total assets and debts, has not advanced since 2010.

The financial chasm now separating the rich and everybody else is the widest since the Fed began tracking earnings 30 years ago, which became even more pronounced following the 2008 global financial crisis.

America 8217 s wealth gap between middle-income and upper-income families is widest on record Pew Research Center

Wealth Gap between America s Rich and Middle-Class Families Widest on Record - Real Time Economics - WSJ

IMO The American Dream was always a myth, but now it has turned into a nightmare for 47% of Americans. This robbing of the poor half of the population has been quite deliberate, by allowing unchecked immigration to obtain cheap labor and by off shoring of jobs to India and China. The Federal minimum wage has remained at $7.25 per hour since Obama took office, while the cost of living has increased substantially. There is no justification for this, since corporate profits have never been higher.

Zzz. Oh good. More mindless and basically dishonest class warfare divide and conquer rhetoric from the left.

Shout out a healthy "1%!"

Tell us something about "workers of the World, UNITE!"

Then consume an enormous mug of stfu already. Your stale shit is stale. And shit.

Perhaps because you are a low info troll? Just saying

I have asked dumbto3 if he is a communist 10 times but he won't answer. I wonder why??I have asked dumbto3 if he is a communist 9 times but he won't answer. I wonder why??Despite, or because of, the fallout from the 2007 Great Recession, annual earnings between the richest Americans and everybody else have exploded to record levels. Meanwhile middle- and lower-class wealth growth remains stagnant.

The median wealth for high-income families hit $639,400 last year, a whopping 7 percent jump from three years earlier and seven times greater than middle-class incomes, which stood at $96,500 according to Pew Research Center, citing data from the Federal Reserve.

Middle-class median wealth, which Pew defines as the difference between the value of a household’s total assets and debts, has not advanced since 2010.

The financial chasm now separating the rich and everybody else is the widest since the Fed began tracking earnings 30 years ago, which became even more pronounced following the 2008 global financial crisis.

America 8217 s wealth gap between middle-income and upper-income families is widest on record Pew Research Center

Wealth Gap between America s Rich and Middle-Class Families Widest on Record - Real Time Economics - WSJ

IMO The American Dream was always a myth, but now it has turned into a nightmare for 47% of Americans. This robbing of the poor half of the population has been quite deliberate, by allowing unchecked immigration to obtain cheap labor and by off shoring of jobs to India and China. The Federal minimum wage has remained at $7.25 per hour since Obama took office, while the cost of living has increased substantially. There is no justification for this, since corporate profits have never been higher.

Zzz. Oh good. More mindless and basically dishonest class warfare divide and conquer rhetoric from the left.

Shout out a healthy "1%!"

Tell us something about "workers of the World, UNITE!"

Then consume an enormous mug of stfu already. Your stale shit is stale. And shit.

Perhaps because you are a low info troll? Just saying